Equity investment is a significant component of the financial landscape, allowing individuals and institutions to invest in companies by purchasing shares. This type of investment enables investors to gain partial ownership of a company, which can lead to various financial benefits. Equity investments are generally categorized into public and private equity, each with distinct characteristics and implications for investors. Understanding the nature of equity investments, their types, benefits, and risks is essential for anyone looking to enhance their financial portfolio.

Equity investments provide the potential for capital appreciation and dividend income, making them attractive options for investors seeking growth. The value of equity investments can fluctuate based on market conditions, the performance of the underlying companies, and broader economic factors. Investors must be aware of these dynamics to make informed decisions about their equity holdings.

| Type of Equity Investment | Description |

|---|---|

| Public Equity | Investing in shares of publicly traded companies on stock exchanges. |

| Private Equity | Investing in privately held companies not listed on public stock exchanges. |

Understanding Equity Investment Accounts

Equity investment accounts are financial accounts that facilitate the buying and selling of equity securities such as stocks. These accounts can be opened through brokerage firms or financial institutions, allowing investors to trade shares in various companies. The primary purpose of these accounts is to enable investors to manage their equity investments efficiently.

Investors can choose between different types of equity investment accounts based on their investment strategies and objectives. Common account types include individual brokerage accounts, retirement accounts (like IRAs), and managed account services. Each type has its own features, benefits, and tax implications.

Individual brokerage accounts are the most flexible option for retail investors. They allow for direct trading of stocks and other securities without restrictions on withdrawals or contributions. Retirement accounts, on the other hand, offer tax advantages but come with specific regulations regarding withdrawals and contributions.

Managed accounts involve professional management of an investor’s portfolio by financial advisors or firms. These accounts are suitable for those who prefer a hands-off approach to investing but may come with higher fees due to management services.

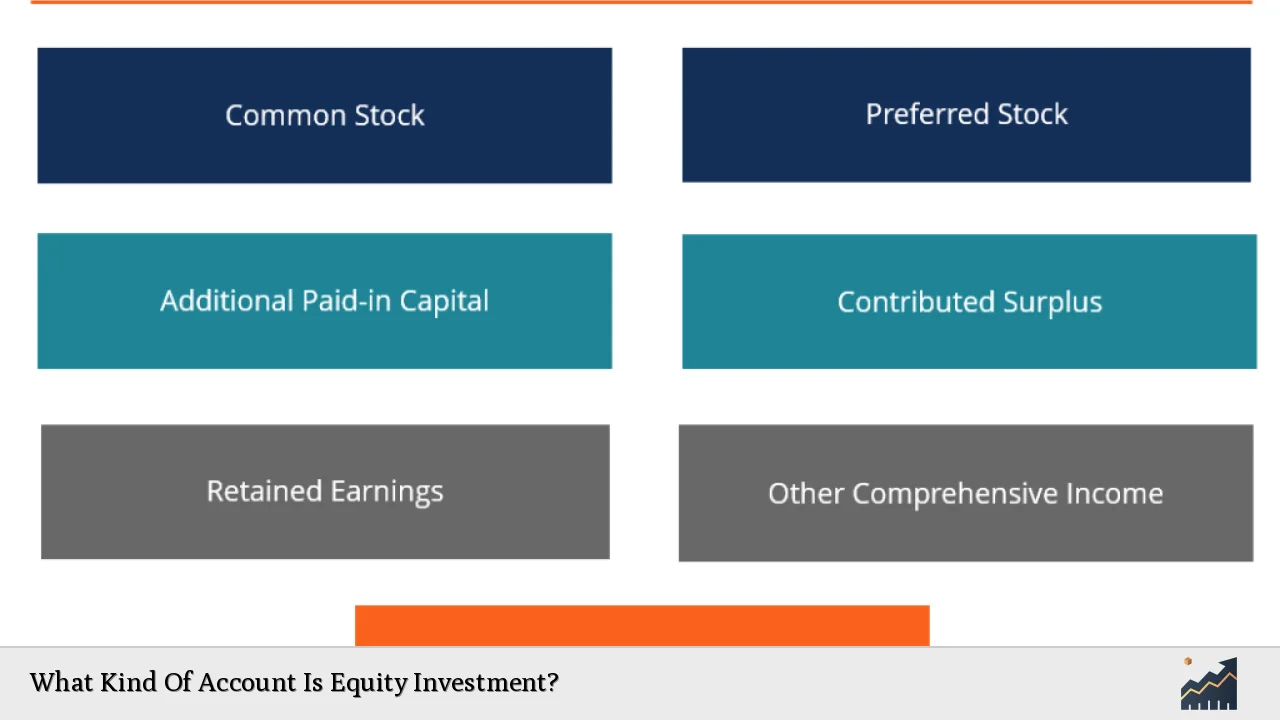

Types of Equity Investments

There are several types of equity investments that cater to different investor preferences and risk tolerances. Understanding these types can help investors choose the most suitable options for their portfolios.

- Common Stocks: These represent ownership in a company and entitle shareholders to vote on corporate matters and receive dividends if declared.

- Preferred Stocks: These provide a fixed dividend before common stockholders receive any payments but typically do not carry voting rights.

- Equity Funds: These are mutual funds or exchange-traded funds (ETFs) that pool money from multiple investors to buy shares in various companies, offering diversification.

- Venture Capital: This involves investing in early-stage companies with high growth potential in exchange for equity stakes.

- Private Equity: Investments made directly into private companies or buyouts of public companies that result in delisting from stock exchanges.

Each type has its own risk-return profile, making it crucial for investors to assess their financial goals before committing capital.

Benefits of Equity Investments

Investing in equities offers numerous benefits that can significantly contribute to wealth accumulation over time. Here are some key advantages:

- Potential for Capital Appreciation: As companies grow and become more profitable, the value of their shares can increase significantly, allowing investors to realize gains when they sell their shares.

- Dividend Income: Many established companies distribute a portion of their profits as dividends to shareholders. This provides a regular income stream that can supplement overall returns.

- Ownership Rights: Equity investors gain partial ownership in the company, which often includes voting rights on important corporate matters such as board elections and mergers.

- Liquidity: Publicly traded equities are generally liquid assets, meaning they can be easily bought or sold on stock exchanges without significant delays or price impacts.

- Inflation Hedge: Historically, equities have outpaced inflation over long periods, helping preserve purchasing power and grow wealth.

These benefits make equity investments an attractive option for both individual and institutional investors looking to build a diversified portfolio.

Risks Associated with Equity Investments

While equity investments offer substantial potential rewards, they also come with inherent risks that investors must consider:

- Market Volatility: Stock prices can fluctuate widely due to market conditions, economic changes, or company-specific news. This volatility can lead to significant losses if shares are sold during downturns.

- Company Performance Risk: The success of an equity investment is closely tied to the performance of the underlying company. Poor management decisions or adverse market conditions can negatively impact share prices.

- Liquidity Risk: While publicly traded stocks are generally liquid, some stocks may be thinly traded, making it difficult to sell shares without affecting the price significantly.

- Regulatory Risks: Changes in regulations or government policies can impact specific industries or sectors, affecting stock performance.

Investors should conduct thorough research and consider these risks when making equity investment decisions to mitigate potential losses.

How to Start Investing in Equities

Starting an equity investment journey requires careful planning and execution. Here are steps to guide new investors:

1. Educate Yourself: Understand the basics of stock markets, types of equities, and investment strategies before diving into investing.

2. Set Financial Goals: Determine your investment objectives—whether it’s long-term growth, income generation through dividends, or short-term trading gains.

3. Choose an Investment Account: Open an appropriate account based on your goals—individual brokerage accounts offer flexibility while retirement accounts provide tax advantages.

4. Research Stocks and Funds: Analyze potential investments by reviewing company performance metrics like earnings reports, market trends, and industry competition.

5. Diversify Your Portfolio: Spread your investments across various sectors and asset classes to reduce risk exposure while aiming for optimal returns.

6. Monitor Your Investments: Regularly review your portfolio’s performance against your goals and make adjustments as necessary based on market conditions or personal circumstances.

By following these steps diligently, individuals can navigate the complexities of equity investing effectively while working toward achieving their financial objectives.

FAQs About Equity Investment

- What is an equity investment account?

An equity investment account is a financial account used for buying and selling stocks or shares in companies. - What types of equities can I invest in?

You can invest in common stocks, preferred stocks, equity funds, venture capital opportunities, and private equity. - What are the main benefits of investing in equities?

The main benefits include potential capital appreciation, dividend income, ownership rights, liquidity, and serving as an inflation hedge. - What risks should I consider when investing in equities?

Key risks include market volatility, company performance risk, liquidity risk, and regulatory risks. - How do I start investing in equities?

Begin by educating yourself about equities, setting financial goals, choosing an appropriate investment account, researching stocks or funds, diversifying your portfolio, and monitoring your investments regularly.