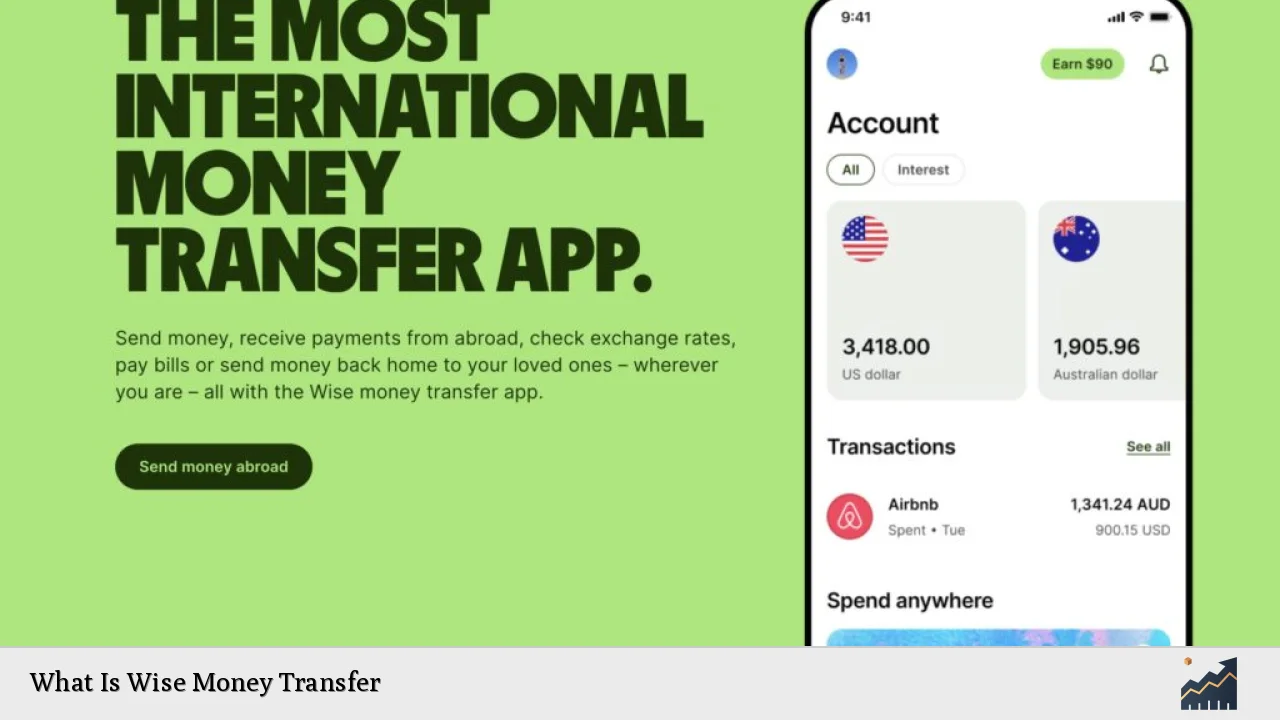

Wise, formerly known as TransferWise, is a leading financial technology company that specializes in international money transfers and multi-currency accounts. Founded in 2011 by Kristo Käärmann and Taavet Hinrikus, Wise has revolutionized the way people and businesses move money across borders by offering fast, low-cost, and transparent services. The company’s innovative approach to currency exchange and international transfers has disrupted traditional banking systems and gained popularity among millions of customers worldwide.

| Key Concept | Description/Impact |

|---|---|

| Mid-Market Exchange Rate | Wise uses the real exchange rate without markup, saving customers up to 8x compared to banks |

| Local Transfer Network | Utilizes a network of local bank accounts to minimize international transfer fees |

| Multi-Currency Account | Allows users to hold and manage 40+ currencies in one account |

| Transparent Pricing | Clear fee structure with no hidden charges, enhancing trust and customer satisfaction |

Market Analysis and Trends

The global remittance and money transfer market has experienced significant growth in recent years, driven by increasing international migration, globalization of businesses, and advancements in financial technology. According to recent data, the money transfer services market size is projected to grow from $31.41 billion in 2023 to $66.75 billion by 2028, at a compound annual growth rate (CAGR) of 16.3%.

Wise has positioned itself as a key player in this expanding market, leveraging its innovative technology and customer-centric approach. In the financial year 2024, Wise reported serving 12.8 million active customers, a 29% increase from the previous year. The company processed £118.5 billion in cross-border transactions, representing a 13% year-on-year growth.

Several trends are shaping the money transfer industry:

- Digital Transformation: The shift towards digital transactions has accelerated, with mobile and online platforms becoming the preferred channels for international transfers.

- Blockchain and Cryptocurrency Integration: Companies are exploring blockchain technology and cryptocurrencies to enhance the speed and reduce the cost of cross-border transactions.

- Regulatory Technology (RegTech): The adoption of RegTech solutions is increasing to ensure compliance with evolving international financial regulations.

- Focus on Customer Experience: Providers are prioritizing user-friendly interfaces, instant transfers, and personalized services to enhance customer satisfaction.

- Emerging Market Expansion: There’s a growing focus on tapping into underserved markets in developing countries, where remittance flows are significant.

Implementation Strategies

Wise’s success in the money transfer market can be attributed to several key strategies:

Innovative Pricing Model

Wise disrupted the traditional forex market by offering the mid-market exchange rate to customers, a rate typically reserved for large financial institutions. This transparent pricing model, coupled with low, upfront fees, has been a cornerstone of Wise’s appeal to cost-conscious consumers and businesses.

Technology-Driven Operations

The company has built a sophisticated network of local bank accounts around the world. When a customer initiates a transfer, Wise routes the money through this network, effectively turning international transfers into a series of local ones. This approach significantly reduces transfer times and costs.

Multi-Currency Account Offering

Wise’s multi-currency account allows users to hold balances in multiple currencies, obtain local bank details in several countries, and spend internationally using a linked debit card. This feature caters to expatriates, frequent travelers, and businesses operating across borders.

Strategic Partnerships

Wise has formed partnerships with banks and financial institutions through its Wise Platform. This B2B service allows partners to integrate Wise’s low-cost, fast transfer capabilities into their own offerings, expanding Wise’s reach and transaction volume.

Continuous Product Innovation

The company regularly introduces new features and expands its services. For instance, in FY2024, Wise launched ‘Wise Assets’ in additional European countries, allowing customers to earn returns on their balances through low-risk investment funds.

Risk Considerations

While Wise has demonstrated strong growth and innovation, investors and users should be aware of several risk factors:

Regulatory Compliance

As a financial services provider operating globally, Wise must navigate complex and evolving regulatory landscapes across multiple jurisdictions. Changes in regulations or failure to comply could impact the company’s operations and reputation.

Competition

The fintech sector is highly competitive, with both established banks and new startups vying for market share. Wise must continually innovate to maintain its competitive edge and market position.

Currency Fluctuations

Wise’s business model is sensitive to currency exchange rate fluctuations. While the company uses hedging strategies to mitigate this risk, significant market volatility could affect its financial performance.

Cybersecurity Threats

As a digital-first company handling sensitive financial data, Wise faces ongoing cybersecurity risks. Any breach could have severe consequences for customer trust and regulatory compliance.

Dependency on Banking Partners

Wise’s operations rely on partnerships with traditional banks for local transfers. Changes in these relationships or banking regulations could potentially disrupt Wise’s service delivery.

Regulatory Aspects

Wise operates under strict regulatory oversight in multiple countries to ensure the security of customer funds and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Global Regulatory Landscape

Wise holds licenses and authorizations from regulatory bodies worldwide, including:

- United Kingdom: Authorized by the Financial Conduct Authority (FCA) as an Electronic Money Institution

- United States: Registered with FinCEN and licensed as a money transmitter in multiple states

- European Union: Licensed as a payment institution

- Australia: Holds an Australian Financial Services License and is regulated by ASIC

- Singapore: Licensed by the Monetary Authority of Singapore as a Major Payment Institution

These regulatory approvals ensure that Wise adheres to strict financial standards and consumer protection measures across its global operations.

Compliance Measures

To maintain regulatory compliance, Wise implements robust AML and KYC procedures, including:

- Identity verification for all customers

- Transaction monitoring to detect suspicious activities

- Regular reporting to relevant authorities

- Ongoing staff training on compliance matters

Future Outlook

The future of Wise and the money transfer industry looks promising, driven by several factors:

Market Expansion

Wise continues to expand its geographical reach and service offerings. The company’s focus on emerging markets and underserved corridors presents significant growth opportunities.

Technological Advancements

Ongoing investments in technology are likely to further improve transfer speeds and reduce costs. Wise reported that 62% of its transfers were instant in Q4 FY2024, with plans to increase this percentage.

Business Services Growth

The Wise Business account and Wise Platform are expected to be key drivers of future growth, as more companies seek efficient cross-border payment solutions.

Product Diversification

Wise is expanding beyond pure money transfers, with services like Wise Assets offering investment opportunities to customers. This diversification could open new revenue streams and increase customer retention.

Regulatory Evolution

As governments and regulatory bodies adapt to the changing financial landscape, Wise is well-positioned to benefit from potential reforms that could further streamline cross-border transactions.

In conclusion, Wise Money Transfer represents a significant innovation in the international money transfer market. By leveraging technology to offer transparent, low-cost services, Wise has disrupted traditional banking models and gained a substantial market share. As the global economy becomes increasingly interconnected, the demand for efficient cross-border money transfer solutions is likely to grow, presenting continued opportunities for Wise and its competitors in this dynamic sector.

Frequently Asked Questions About What Is Wise Money Transfer

- How does Wise keep its fees lower than traditional banks?

Wise uses a network of local bank accounts and the mid-market exchange rate, eliminating intermediary banks and avoiding currency markup fees typically charged by traditional banks. - Is Wise safe to use for international money transfers?

Yes, Wise is regulated by financial authorities in multiple countries and employs strong security measures to protect customer funds and data. - How long do Wise transfers typically take?

Transfer times vary depending on the currencies and countries involved, but as of Q4 FY2024, 62% of Wise transfers were instant, 83% were completed within an hour, and 95% within 24 hours. - Can businesses use Wise for international payments?

Yes, Wise offers a Business account tailored for companies needing to make international payments, receive funds in multiple currencies, and manage multi-currency operations. - How does Wise compare to traditional bank transfers for large amounts?

Wise can be more cost-effective for large transfers due to its use of the mid-market rate and transparent fee structure. However, for very large amounts, it’s advisable to compare rates and consider factors like transfer limits and additional verification requirements. - Does Wise offer any additional financial services beyond money transfers?

Yes, Wise provides multi-currency accounts, debit cards for international spending, and the Wise Assets feature for earning returns on account balances in some regions.