Wise, formerly known as TransferWise, is a financial technology company that has transformed the landscape of international money transfers and multi-currency banking. Founded in 2011, Wise aims to provide a more cost-effective and transparent alternative to traditional banks for sending money across borders. With its innovative approach, Wise has gained significant traction among individual users and businesses alike, boasting millions of active customers worldwide.

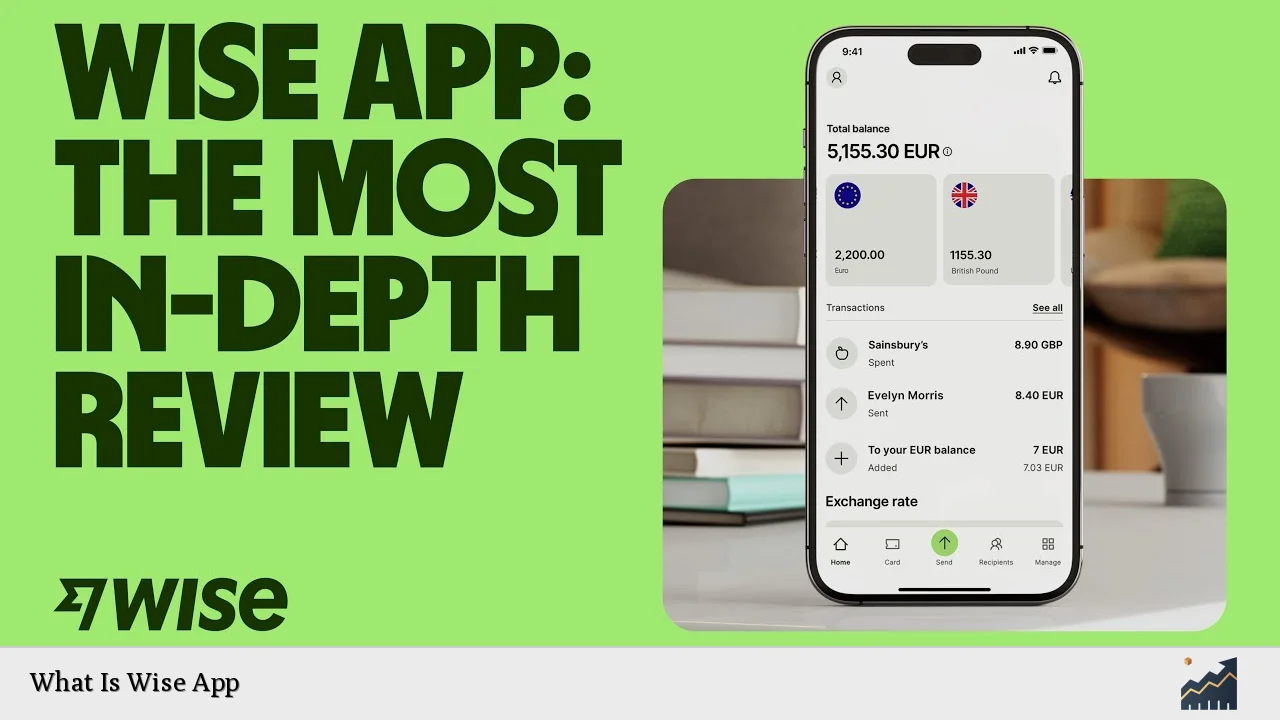

Wise operates on a peer-to-peer model, allowing users to send money internationally at the mid-market exchange rate with low, transparent fees. This model not only reduces costs but also enhances the speed of transactions, making it an attractive option for those needing to manage finances across different currencies. The app offers features such as multi-currency accounts, local bank details for receiving payments, and a debit card for spending globally. As of 2024, Wise has reported substantial growth in user adoption and transaction volume, reflecting its increasing relevance in the global financial ecosystem.

| Key Concept | Description/Impact |

|---|---|

| Peer-to-Peer Model | Wise uses a peer-to-peer system to match users sending money in one currency with those receiving it in another, minimizing transfer costs. |

| Multi-Currency Accounts | Users can hold balances in over 40 currencies, facilitating easy exchange and management of funds without high fees. |

| Transparent Fees | Wise provides a clear breakdown of fees before transactions, ensuring users know exactly what they will pay. |

| Global Reach | The app supports transfers to over 160 countries, making it a versatile tool for international transactions. |

| Regulatory Compliance | Wise is regulated by financial authorities like the FCA in the UK, ensuring adherence to strict security and operational standards. |

| Innovative Features | Includes options like Interest Jars and Stock Jars for investment, allowing users to earn returns on their balances. |

| User Growth | As of 2024, Wise reported a 29% increase in active users year-over-year, indicating strong market demand. |

| Market Positioning | Wise is positioned as a leading player in the digital remittance market, which is projected to grow significantly over the coming years. |

Market Analysis and Trends

The digital remittance market is experiencing rapid growth, driven by increasing globalization and the need for efficient cross-border payment solutions. As of 2021, the global digital remittance market was valued at approximately $15.27 billion and is projected to reach $36.54 billion by 2028. This growth reflects a shift away from traditional banking methods towards more agile fintech solutions like Wise.

Current Market Statistics

- User Base: Wise reported having around 12.8 million active customers as of March 2024.

- Transaction Volume: The company moved £118.5 billion globally during FY24.

- Customer Growth: Active customer growth was noted at 29% year-over-year.

- Revenue Growth: Underlying income increased by 31% to £1.2 billion in FY24.

These statistics highlight Wise’s robust performance amidst increasing competition in the fintech space.

Implementation Strategies

For individuals and businesses looking to leverage Wise for their financial needs, several strategies can enhance their experience:

- Utilize Multi-Currency Accounts: Open a multi-currency account to hold various currencies and avoid conversion fees when making international purchases or transfers.

- Set Up Regular Payments: Use Wise for recurring payments or subscriptions in different currencies to streamline budgeting and reduce costs.

- Take Advantage of Local Bank Details: By obtaining local account details in multiple currencies, users can receive payments like a local resident without incurring high fees.

- Invest with Wise: Explore investment options such as Interest Jars or Stock Jars to earn returns on idle funds while maintaining liquidity.

Risk Considerations

While Wise offers numerous benefits, potential users should be aware of certain risks:

- Exchange Rate Fluctuations: Although Wise uses mid-market rates, fluctuations can impact the final amount received or sent during transactions.

- Regulatory Changes: As a fintech company operating globally, changes in regulatory environments could affect service availability or fees.

- Service Reliability: Users have reported mixed experiences regarding transfer times; while many transactions are instant, some may take longer than expected.

- Security Risks: As with any digital platform, there is always a risk of cyber threats. Wise employs robust security measures but remains vigilant against potential breaches.

Regulatory Aspects

Wise operates under stringent regulatory frameworks across various jurisdictions. In the UK, it is regulated by the Financial Conduct Authority (FCA), which ensures compliance with laws designed to protect consumers and maintain market integrity. Additionally:

- Licenses: Wise holds licenses from financial authorities in multiple countries where it operates.

- Compliance Measures: The company implements comprehensive anti-money laundering (AML) policies and Know Your Customer (KYC) protocols to ensure secure transactions.

This regulatory compliance not only builds trust with customers but also positions Wise as a reliable player in the financial services industry.

Future Outlook

Looking ahead, Wise is well-positioned for continued growth. Key factors influencing its future include:

- Expansion into New Markets: With ongoing efforts to enter new geographical markets and expand services like Wise Platform for businesses, potential growth avenues are significant.

- Product Innovation: The introduction of new features such as investment options through Stock Jars indicates Wise’s commitment to enhancing user experience and engagement.

- Increased User Adoption: As more individuals and businesses seek efficient payment solutions amidst rising global mobility, Wise’s user base is expected to grow further.

Overall, the future appears bright for Wise as it continues to innovate and adapt within an evolving financial landscape.

Frequently Asked Questions About What Is Wise App

- What services does Wise offer?

Wise provides international money transfers at mid-market rates, multi-currency accounts for holding various currencies, local bank details for receiving payments globally, and a debit card for spending internationally. - How does Wise ensure low fees?

Wise employs a peer-to-peer model that matches senders with recipients directly, minimizing costs associated with traditional banking methods. - Is my money safe with Wise?

Yes, Wise is regulated by financial authorities such as the FCA in the UK and implements robust security measures including two-factor authentication. - Can I invest using Wise?

Yes, users can invest through features like Interest Jars that offer returns on cash balances or Stock Jars that invest in index funds. - How quickly can I send money using Wise?

Many transactions are completed instantly; however, some may take longer depending on various factors including currency pairings and banking processes. - Is there a limit on how much I can transfer?

While there are limits based on regulatory requirements and user verification levels, most personal users can transfer significant amounts without issues. - What currencies can I hold in my Wise account?

Users can hold balances in over 40 currencies within their Wise accounts. - How does Wise compare to traditional banks?

Wise typically offers lower fees and better exchange rates compared to traditional banks for international transfers.

In conclusion, the Wise app represents a significant advancement in how individuals and businesses manage their international finances. With its transparent fee structure, innovative features, and commitment to security and compliance, it stands out as a leading choice among fintech solutions available today.