Wise, formerly known as TransferWise, is a financial technology company that has revolutionized how individuals and businesses manage their money across borders. The Wise Account is a multi-currency account that allows users to hold, convert, and transfer money in over 40 currencies at the real exchange rate, making it an attractive option for frequent travelers, expatriates, and international businesses. This comprehensive overview delves into the features, market trends, risk considerations, regulatory aspects, and future outlook of the Wise Account.

| Key Concept | Description/Impact |

|---|---|

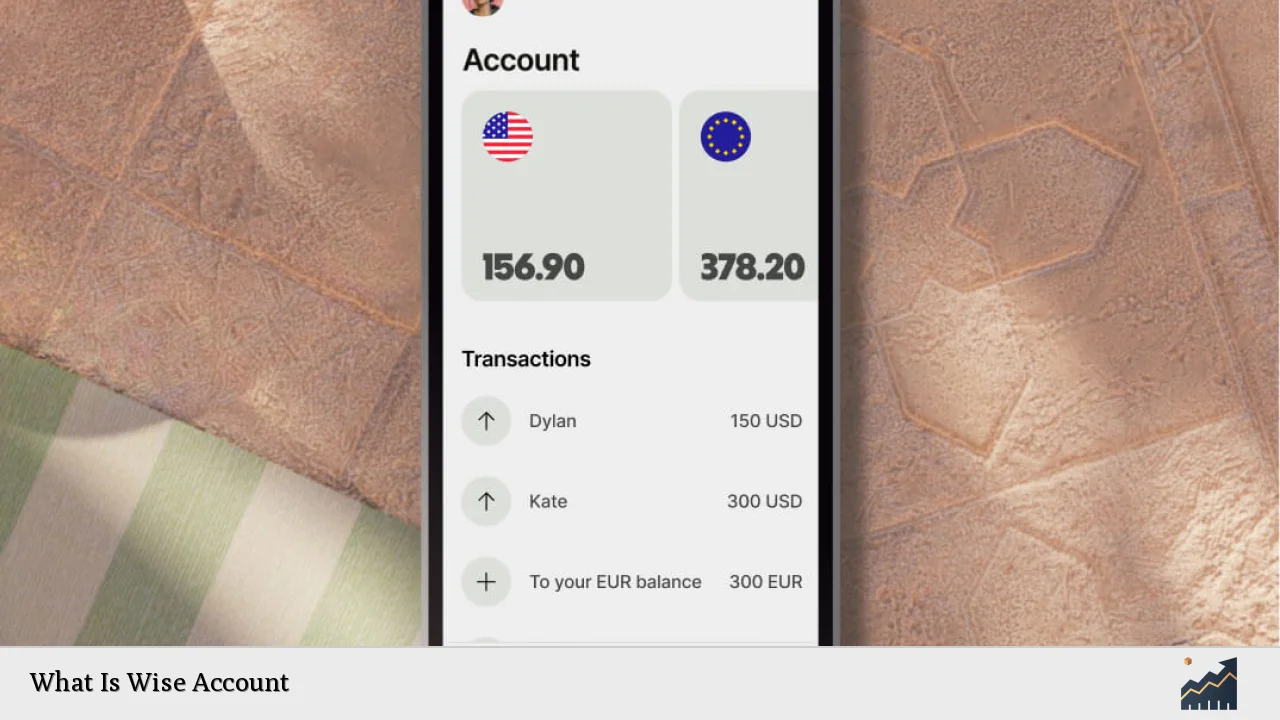

| Multi-Currency Holding | Users can hold balances in over 40 currencies, facilitating seamless international transactions without the need for multiple accounts. |

| Real Exchange Rate | Wise uses the mid-market exchange rate for currency conversions, ensuring transparency and cost-effectiveness compared to traditional banks. |

| International Transfers | Send money to over 160 countries with low fees and fast processing times, enhancing global financial connectivity. |

| Local Bank Details | Receive payments like a local in various currencies by providing local bank details for USD, EUR, GBP, AUD, and others. |

| Wise Debit Card | A debit card linked to the Wise Account allows users to spend in different currencies globally with minimal conversion fees. |

| Investment Options | Wise offers interest-earning opportunities on certain currencies through partnerships with investment firms. |

| Regulatory Compliance | Wise is regulated in multiple jurisdictions, providing users with a sense of security and trust in their financial transactions. |

Market Analysis and Trends

The global fintech landscape has seen significant growth in recent years, with Wise emerging as a leader in the international money transfer sector. As of 2024, Wise reported processing £118.5 billion in transactions for 12.8 million customers—a 29% increase year-on-year. This growth is attributed to the increasing adoption of the Wise Account among both personal (48%) and business (60%) customers.

Current Market Statistics

- Customer Growth: Wise has expanded its customer base significantly, reaching 12.8 million active users by March 2024.

- Transaction Volume: The company processed £118.5 billion in cross-border transactions during FY2024.

- Revenue Growth: Underlying income increased by 31% year-on-year to £1.2 billion.

- Regional Revenue: Europe remains Wise’s primary market, contributing over 30% of its revenue.

Trends Influencing Growth

- Increased Global Mobility: As more individuals work remotely or travel internationally, demand for multi-currency accounts has surged.

- Technological Advancements: The rise of mobile banking apps has made it easier for consumers to manage their finances on-the-go.

- Consumer Preference for Transparency: Customers are increasingly seeking financial services that offer transparent pricing structures and real-time exchange rates.

Implementation Strategies

To effectively utilize a Wise Account, individuals and businesses should consider several strategies:

- Open a Multi-Currency Account: Users can sign up for free and begin holding multiple currencies immediately.

- Leverage Local Bank Details: By using local account details provided by Wise, users can receive payments without incurring international transfer fees.

- Utilize the Wise Debit Card: This card allows users to spend directly from their Wise balance while minimizing conversion costs.

- Monitor Currency Fluctuations: Users should stay informed about currency trends to make timely conversions that maximize their funds.

Risk Considerations

While the Wise Account offers numerous benefits, potential risks include:

- Currency Volatility: Holding funds in foreign currencies exposes users to exchange rate fluctuations that can impact their balances.

- Regulatory Risks: Compliance with varying regulations across different countries can affect service availability and operational stability.

- Security Concerns: Although Wise employs robust security measures like two-step authentication, users must remain vigilant against phishing attacks and other cyber threats.

Regulatory Aspects

Wise operates under strict regulatory frameworks across various jurisdictions:

- In the UK, it is authorized by the Financial Conduct Authority (FCA) under Electronic Money Regulations.

- In Australia, Wise is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence.

- In the United States, Wise is registered with FinCEN as a money transmitter and complies with state-level regulations.

These regulatory measures enhance consumer trust and ensure compliance with international financial standards.

Future Outlook

The future of the Wise Account appears promising due to several factors:

- Continued Customer Growth: With an increasing number of individuals engaging in cross-border transactions, Wise is likely to see sustained growth in its user base.

- Expansion of Services: The introduction of new features such as investment options may attract more customers seeking comprehensive financial solutions.

- Technological Innovations: Ongoing investments in technology will enhance user experience and operational efficiency.

Overall, as global commerce continues to evolve towards a more interconnected model, platforms like Wise will play a crucial role in facilitating seamless financial transactions across borders.

Frequently Asked Questions About Wise Account

- What is a Wise Account?

A Wise Account is a multi-currency account that allows users to hold money in over 40 currencies, convert between them at real exchange rates, and send money internationally with low fees. - How do I open a Wise Account?

You can open a Wise Account online or through the mobile app for free. Simply provide your email address and follow the verification steps. - Are there any fees associated with using a Wise Account?

While opening an account is free, there are fees for currency conversions and sending money internationally. However, these fees are generally lower than traditional banks. - Can I earn interest on my funds held in a Wise Account?

Yes, certain currencies held in your Wise Account may earn interest through investment partnerships offered by Wise. - Is my money safe with Wise?

Wise employs robust security measures including two-step authentication and keeps customer funds with reputable financial institutions. It is also regulated by various financial authorities worldwide. - Can I use my Wise Account for business transactions?

Yes, businesses can open a separate Wise Business account that offers additional features tailored for commercial use. - What happens if I need customer support?

Wise provides customer support primarily through online channels. While some users have reported challenges accessing immediate human assistance, resources are available via their help center. - Can I hold multiple currencies at once?

Absolutely! The Wise Account allows you to hold balances in over 40 different currencies simultaneously.

In conclusion, the Wise Account represents a significant advancement in how individuals and businesses manage their finances globally. With its user-friendly interface and competitive pricing structure, it stands out as an essential tool for anyone engaged in international transactions or living an expatriate lifestyle.