The nominal rate of return is a fundamental concept in finance that represents the percentage increase or decrease in the value of an investment over a specific period, without adjusting for external factors such as inflation, taxes, or fees. This metric provides investors with a straightforward way to assess the performance of their investments, making it easier to compare different assets. However, while nominal returns can give a high-level overview of investment performance, they may not accurately reflect the real economic gains due to the effects of inflation and other costs.

Understanding the nominal rate of return is essential for both individual investors and finance professionals as it forms the basis for more complex calculations, such as the real rate of return, which accounts for inflation.

| Key Concept | Description/Impact |

|---|---|

| Definition | The nominal rate of return indicates the total percentage increase or decrease in an investment’s value without adjusting for inflation or other costs. |

| Calculation | Calculated by subtracting the original investment value from the current market value and dividing by the original investment value. |

| Example | An investment of $100,000 grows to $110,000 over one year; the nominal rate of return is 10%. |

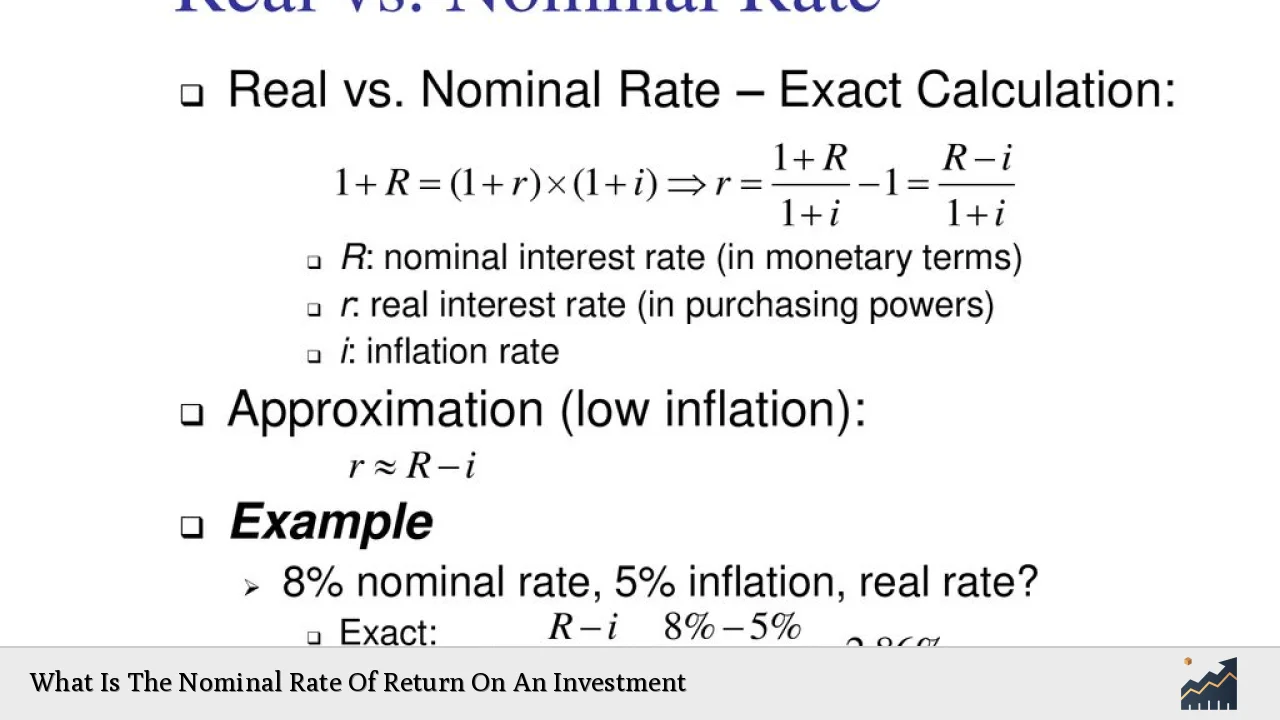

| Comparison with Real Return | The real rate of return adjusts the nominal rate for inflation, providing a clearer picture of purchasing power growth. |

| Importance | Useful for comparing different investments and assessing portfolio performance over time. |

| Limitations | Does not account for inflation or taxes, which can significantly impact actual investment gains. |

Market Analysis and Trends

Recent market conditions have influenced expectations regarding nominal rates of return across various asset classes. As interest rates have risen globally, particularly in response to inflationary pressures, nominal return forecasts have adjusted accordingly. For example:

- U.S. Large-Cap Equities: Expected nominal returns are projected at approximately 5.2% over the next decade.

- European Equities: Anticipated returns are around 9.9%, reflecting different economic conditions and growth prospects compared to U.S. markets.

- Bonds: The outlook for U.S. aggregate bonds has improved significantly, with expected nominal returns rising to between 4.8% and 5.8% due to higher yields resulting from recent interest rate hikes.

These trends indicate a shift towards higher expected returns across many asset classes, making it crucial for investors to reassess their portfolios and strategies in light of these changes.

Implementation Strategies

Investors can utilize the nominal rate of return in various ways to enhance their portfolios:

- Portfolio Comparison: Use nominal rates to compare performance across different asset classes (stocks vs. bonds) without considering external factors like taxes or inflation.

- Investment Selection: Identify investments with higher nominal rates that align with personal risk tolerance and financial goals.

- Performance Tracking: Regularly monitor nominal returns to gauge how well investments are performing relative to initial expectations.

To maximize investment outcomes, investors should also consider adjusting their strategies based on real returns and market conditions. This dual approach ensures that they not only seek high nominal returns but also protect against inflationary erosion.

Risk Considerations

While focusing on nominal returns can simplify investment decisions, it is essential to recognize associated risks:

- Inflation Risk: A significant risk that can erode purchasing power if nominal returns do not exceed inflation rates.

- Market Volatility: Nominal returns can fluctuate widely due to market conditions; understanding this volatility is crucial for long-term planning.

- Tax Implications: Different investments may be subject to varying tax treatments that can affect net returns; investors should factor these into their calculations.

Investors should conduct thorough due diligence and consider consulting with financial advisors to navigate these risks effectively.

Regulatory Aspects

Understanding regulatory implications is vital when evaluating investments based on nominal rates of return:

- Disclosure Requirements: Regulatory bodies mandate that financial institutions disclose expected returns clearly, allowing investors to make informed decisions.

- Investment Products: Certain products may have specific regulatory considerations affecting their reported nominal returns (e.g., mutual funds vs. ETFs).

- Tax Regulations: Awareness of tax laws governing capital gains can influence how investors perceive nominal versus real returns.

Staying informed about regulatory changes can help investors adapt their strategies accordingly and optimize their portfolios.

Future Outlook

The outlook for nominal rates of return remains dynamic as economic conditions evolve:

- Interest Rates: Continued adjustments in monetary policy will likely influence future expectations for both equities and fixed-income securities.

- Inflation Trends: Persistent inflation could lead to higher required nominal returns on investments as investors seek compensation for lost purchasing power.

- Global Market Conditions: Economic recovery patterns post-pandemic will vary by region, impacting expected returns across international markets differently.

Investors should remain vigilant about these trends and adjust their strategies proactively to capitalize on emerging opportunities while mitigating risks associated with changing market conditions.

Frequently Asked Questions About Nominal Rate Of Return On An Investment

- What is the difference between nominal and real rates of return?

The nominal rate does not account for inflation or taxes, while the real rate adjusts for these factors, providing a more accurate measure of purchasing power growth. - How do I calculate my investment’s nominal rate of return?

Subtract your initial investment from its current value, divide by the initial investment, and multiply by 100 to get a percentage. - Why is understanding the nominal rate important?

It helps investors assess performance across different investments and make informed decisions based on expected gains. - Can high nominal returns be misleading?

Yes, if inflation is high or taxes are significant, actual gains may be much lower than indicated by nominal returns. - How often should I review my investments’ nominal rates?

Regular reviews are recommended—at least annually—to ensure alignment with financial goals and market conditions. - What role do fees play in calculating nominal returns?

Nominal returns are calculated before accounting for fees; thus, it’s essential to consider them when assessing net profitability. - Are there specific sectors with higher expected nominal returns?

Certain sectors like technology or emerging markets may offer higher potential returns but typically come with increased risk. - How do economic indicators affect expected nominal returns?

Evolving economic indicators such as GDP growth rates, employment data, and consumer spending influence investor sentiment and future return expectations.

In conclusion, while the nominal rate of return serves as a critical measure for evaluating investment performance, it is essential for investors to consider broader economic factors and adjust their strategies accordingly. Understanding both nominal and real rates enables better decision-making in an increasingly complex financial landscape.