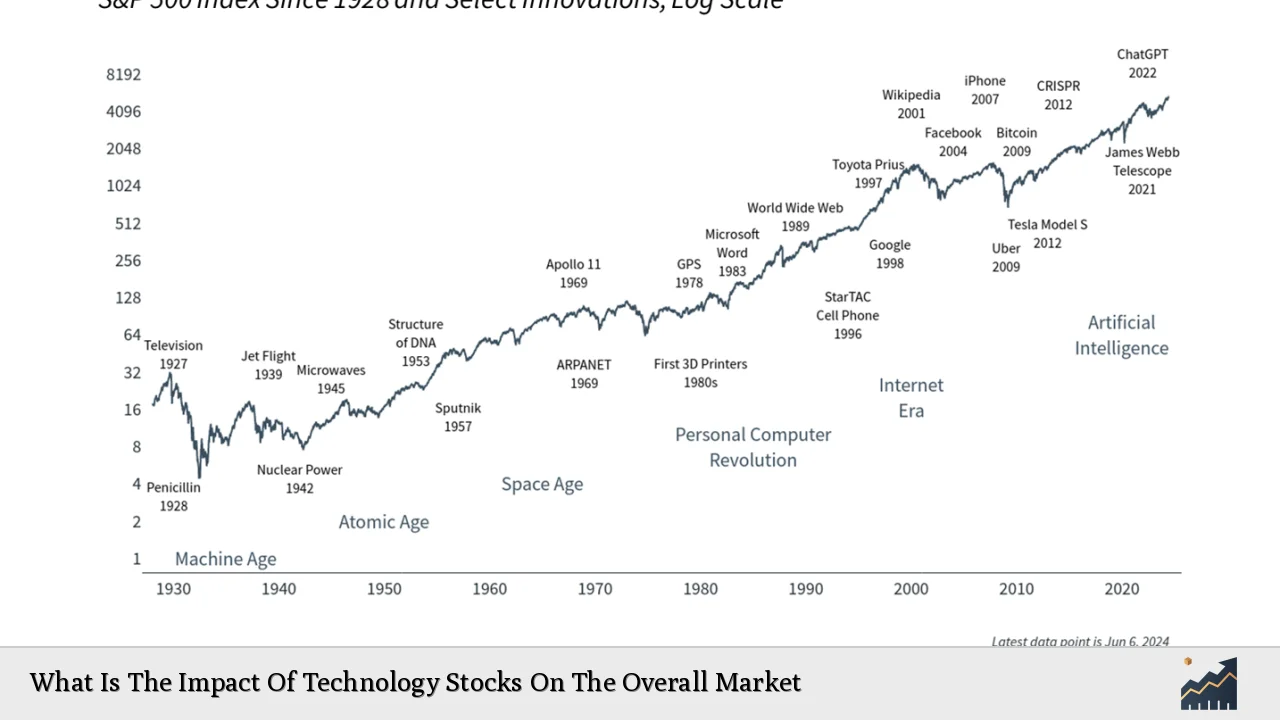

The influence of technology stocks on the overall market is profound and multifaceted, shaping investor sentiment, market trends, and economic indicators. As the technology sector has grown to dominate stock indices like the S&P 500 and NASDAQ, its performance has increasingly dictated the direction of the broader market. This article explores the current landscape of technology stocks, their impact on market dynamics, and future outlooks for investors.

| Key Concept | Description/Impact |

|---|---|

| Market Capitalization | The technology sector represents over 32% of the S&P 500, significantly influencing index performance. |

| Volatility | Technology stocks are more volatile than other sectors, leading to rapid market shifts during earnings reports or economic changes. |

| AI and Innovation | Advancements in AI and digital technologies drive growth in tech stocks, affecting overall market trends. |

| Investor Sentiment | The performance of major tech companies often dictates investor confidence across markets, impacting sectors beyond technology. |

| Wealth Effects | Rising tech stock valuations contribute to increased household wealth, influencing consumer spending and economic growth. |

| Regulatory Environment | The tech sector faces scrutiny from regulators, which can affect stock performance and market stability. |

| Global Influence | Tech companies’ performance impacts global markets, with significant repercussions in economies reliant on technology exports. |

Market Analysis and Trends

The technology sector has been a dominant force in financial markets for several years. Following the COVID-19 pandemic, there was an accelerated shift towards digitalization, which significantly benefited tech companies. As of late 2024, tech stocks have shown remarkable resilience and growth potential, largely driven by advancements in artificial intelligence (AI) and cloud computing.

Recent statistics indicate that from October 2022 to July 2024, tech stocks surged by approximately 109.5%, contributing significantly to overall market gains. However, following a peak in July 2024, technology stocks experienced a decline of about 8.5%, while the broader market only fell by 1.6% during this period. This disparity highlights how fluctuations in tech stocks can lead to pronounced impacts on overall market performance.

The concentration of tech stocks within major indices means that their performance is closely watched by investors. Currently, tech firms represent over 40% of the S&P 500 when including communications services stocks. This significant weighting means that any downturn in tech can lead to broader market declines.

Implementation Strategies

Investors looking to capitalize on technology stock trends should consider several strategies:

- Diversification: While technology stocks can offer high returns, they also come with risks due to volatility. Investors should diversify their portfolios across various sectors to mitigate potential losses.

- Focus on Fundamentals: Evaluating companies based on their earnings growth potential rather than just stock price movements is crucial. For instance, firms like Nvidia have shown robust earnings growth backed by AI advancements.

- Monitoring Economic Indicators: Keeping an eye on macroeconomic factors such as interest rates and inflation can help investors anticipate shifts in technology stock performance.

- Utilizing ETFs and Mutual Funds: For those hesitant to pick individual stocks, investing in ETFs or mutual funds that focus on technology can provide exposure while spreading risk.

Risk Considerations

Investing in technology stocks carries inherent risks:

- Market Volatility: Technology stocks are often subject to rapid price swings based on earnings reports or changes in investor sentiment. For example, major tech firms like Microsoft and Apple have seen significant fluctuations based on quarterly earnings announcements.

- High Valuations: Many tech companies are trading at high price-to-earnings ratios based on future growth expectations. If these expectations are not met, it could lead to sharp declines in stock prices.

- Regulatory Risks: Increasing scrutiny from regulators regarding privacy issues and antitrust concerns can impact stock valuations negatively.

- Global Economic Factors: Technology firms often operate globally; thus, geopolitical tensions or economic downturns in key markets can affect their performance.

Regulatory Aspects

The regulatory environment for technology companies is evolving rapidly. Governments worldwide are increasingly concerned about data privacy, monopolistic practices, and cybersecurity threats. These concerns have led to various legislative proposals aimed at regulating big tech companies more closely.

For instance, recent discussions around antitrust laws in the U.S. could reshape how major players like Google and Amazon operate. Such regulatory changes could impact their profitability and operational strategies significantly. Investors must stay informed about these developments as they could influence stock prices dramatically.

Future Outlook

Looking ahead, the future for technology stocks appears promising but fraught with uncertainty:

- Continued Growth Potential: The ongoing adoption of AI technologies is expected to drive long-term growth in the sector. Companies that effectively leverage AI for operational efficiency are likely to outperform their peers.

- Market Corrections: Given the high valuations currently seen in many tech stocks, corrections may occur if earnings do not meet inflated expectations. Investors should be prepared for potential volatility as market conditions shift.

- Global Investment Opportunities: As technology continues to integrate into various sectors globally, opportunities will arise not just within established markets but also emerging economies looking to enhance their digital infrastructure.

In conclusion, while technology stocks have a significant impact on overall market trends and investor sentiment, they also present unique risks that require careful consideration by investors.

Frequently Asked Questions About Technology Stocks’ Impact on the Overall Market

- How do technology stocks influence overall market trends?

Technology stocks significantly impact overall market trends due to their large representation in major indices like the S&P 500 and NASDAQ. Their performance often dictates investor sentiment across all sectors. - What are the risks associated with investing in technology stocks?

Risks include high volatility, potential regulatory scrutiny, elevated valuations based on future growth expectations, and global economic factors that could affect international operations. - Why are tech stocks considered volatile?

Tech stocks are considered volatile due to rapid changes in investor sentiment influenced by quarterly earnings reports and macroeconomic factors that can lead to swift price fluctuations. - What role does AI play in the performance of tech stocks?

AI advancements are driving significant growth within the tech sector as companies leverage these technologies for innovation and efficiency improvements. - How should investors approach investing in tech stocks?

Investors should diversify their portfolios, focus on fundamental analysis rather than just price movements, monitor economic indicators closely, and consider ETFs for broader exposure. - What is the current outlook for technology stocks?

The outlook remains positive due to ongoing innovations; however, investors should remain cautious of high valuations that may not be supported by actual earnings growth. - How does regulatory scrutiny affect tech companies?

Regulatory scrutiny can impact profitability through potential fines or operational changes required to comply with new laws aimed at protecting consumer data and promoting fair competition. - What are some key indicators of a healthy tech sector?

Indicators include consistent earnings growth among major firms, innovation rates within emerging technologies like AI or cloud computing, and stable consumer demand for tech products.