The rise of exchange-based tokens has transformed the cryptocurrency landscape, offering new opportunities for investment and innovation. However, this growth has also attracted significant regulatory scrutiny. Understanding the impact of regulation on these tokens is crucial for investors, financial professionals, and market participants. Regulations can influence token valuation, market stability, investor protection, and the broader adoption of cryptocurrencies. This article explores the multifaceted effects of regulation on exchange-based tokens, focusing on market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Market Integrity | Regulations aim to enhance market integrity by preventing fraud and manipulation in trading activities. This can lead to increased investor confidence and participation. |

| Investor Protection | Regulatory frameworks are designed to safeguard investors from scams and fraudulent schemes, ensuring better disclosure standards and transparency in token offerings. |

| Liquidity and Accessibility | Regulations can improve liquidity by establishing clear guidelines for trading practices, which can attract institutional investors and enhance market depth. |

| Compliance Costs | While regulations may enhance trust in the market, they can also impose significant compliance costs on token issuers and exchanges, potentially stifling innovation. |

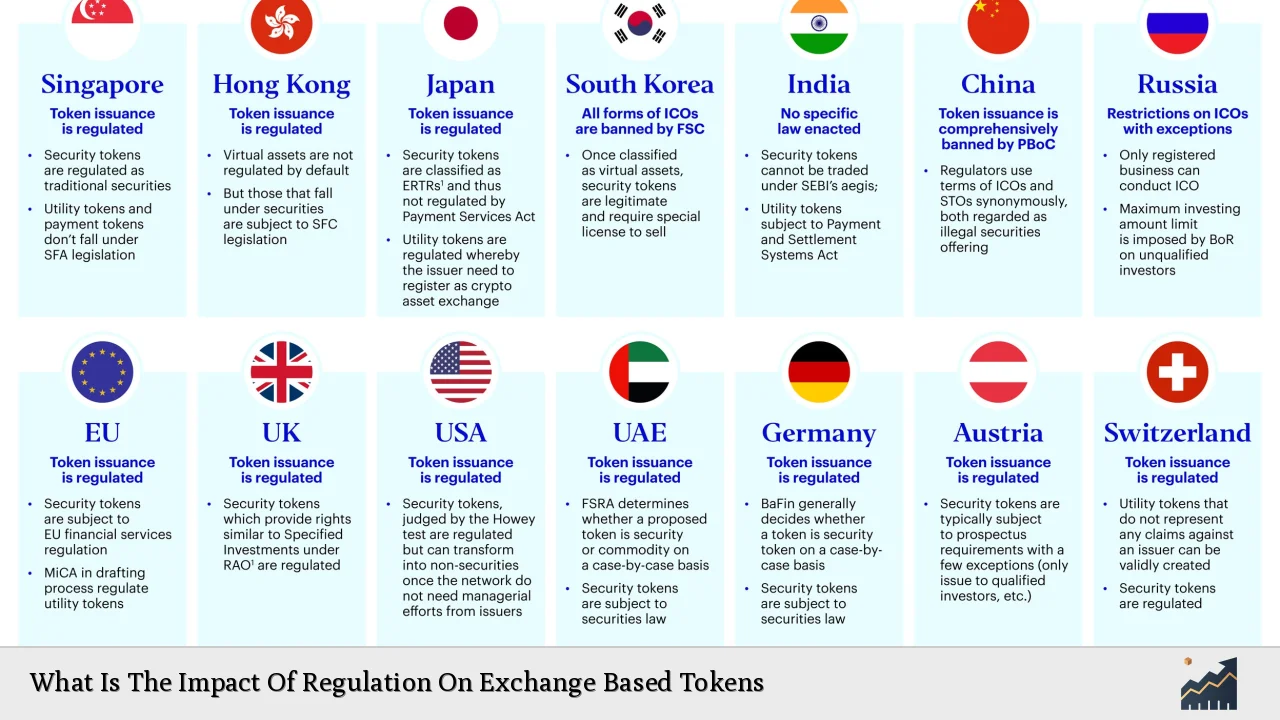

| Global Regulatory Landscape | The fragmented nature of global regulations creates challenges for exchange-based tokens operating across borders, leading to uncertainty and operational complexities. |

| Innovation vs. Regulation | The balance between fostering innovation in the crypto space and implementing effective regulations remains a contentious issue among stakeholders. |

Market Analysis and Trends

The cryptocurrency market has witnessed exponential growth over the past decade, with exchange-based tokens playing a pivotal role. As of December 2024, the total market capitalization of cryptocurrencies stands at approximately $3.44 trillion, with daily trading volumes exceeding $349 billion. Major exchanges like Binance and Coinbase dominate the landscape, facilitating a significant portion of these transactions.

Current Trends

- Increased Regulatory Scrutiny: Regulatory bodies worldwide are intensifying their focus on cryptocurrencies. The U.S. Securities and Exchange Commission (SEC) has initiated numerous enforcement actions against major exchanges for operating as unregistered entities.

- Emergence of Comprehensive Regulations: The European Union’s Markets in Crypto-Assets Regulation (MiCA), implemented in 2023, represents a landmark effort to create a unified regulatory framework for cryptocurrencies across member states.

- Institutional Adoption: There is a growing trend of institutional investors entering the crypto space, driven by regulatory clarity that enhances confidence in digital assets.

- Focus on Consumer Protection: Regulators are emphasizing consumer protection measures to prevent fraud and ensure transparency in token offerings.

Implementation Strategies

For companies involved in exchange-based tokens, developing effective compliance strategies is essential to navigate regulatory landscapes successfully. Here are key strategies:

- Establish Robust Compliance Frameworks: Companies should implement comprehensive compliance programs that address anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Engage with Regulators: Proactive engagement with regulatory authorities can facilitate smoother compliance processes and help shape favorable regulatory outcomes.

- Adopt Best Practices for Transparency: Providing clear information about token utility, risks, and financial health can build trust with regulators and investors alike.

- Leverage Technology for Compliance: Utilizing blockchain analytics tools can assist companies in meeting regulatory requirements effectively while ensuring data integrity.

Risk Considerations

The intersection of regulation and exchange-based tokens introduces various risks that stakeholders must consider:

- Regulatory Risks: Changes in regulations can significantly impact token valuations and operational capabilities. Companies must stay informed about evolving regulations to mitigate these risks.

- Market Volatility: Regulatory announcements often lead to immediate market reactions. Investors should be prepared for volatility surrounding news related to compliance or enforcement actions.

- Compliance Costs: The financial burden associated with compliance can strain smaller firms or startups within the crypto space, potentially leading to reduced competition.

- Legal Risks: Non-compliance with regulations may result in legal actions against companies or individuals involved in token offerings or trading activities.

Regulatory Aspects

Key Regulatory Developments

- U.S. Regulations: The SEC has classified many cryptocurrencies as securities under the Howey Test. This classification requires issuers to register their tokens unless an exemption applies.

- European Union’s MiCA: MiCA aims to establish a comprehensive legal framework for crypto assets across Europe, addressing issues related to consumer protection, market integrity, and financial stability.

- Global Coordination Efforts: International bodies like the Financial Stability Board (FSB) are working towards harmonizing regulations across jurisdictions to address cross-border challenges posed by cryptocurrencies.

Implications of Regulation

- Increased Legitimacy: Regulatory oversight can enhance the legitimacy of exchange-based tokens, attracting more traditional investors who may have previously been hesitant due to perceived risks.

- Standardization of Practices: Regulations can lead to standardized practices across exchanges and token issuers, promoting fair competition and reducing information asymmetry among investors.

- Potential for Innovation Stifling: Overly stringent regulations may hinder innovation by imposing barriers that limit new entrants into the market or restrict existing players from exploring new business models.

Future Outlook

The future of exchange-based tokens will be shaped by ongoing regulatory developments and market dynamics:

- Evolving Regulatory Frameworks: As governments adapt to the rapidly changing crypto landscape, we can expect more nuanced regulations that balance innovation with consumer protection.

- Integration with Traditional Finance: The convergence of cryptocurrencies with traditional financial systems will likely accelerate as regulatory clarity improves, allowing for greater interoperability between asset classes.

- Focus on Sustainability: Environmental concerns related to cryptocurrency mining are prompting regulators to consider sustainability measures that could impact how tokens are created and traded.

- Increased Investor Education: As regulations evolve, there will be a greater emphasis on educating investors about the risks associated with exchange-based tokens and how to navigate them effectively.

Frequently Asked Questions About What Is The Impact Of Regulation On Exchange Based Tokens

- How do regulations affect the value of exchange-based tokens?

Regulations can influence token values through increased legitimacy and investor confidence but may also lead to volatility during enforcement actions or compliance announcements. - What are the main regulatory bodies overseeing exchange-based tokens?

The SEC in the U.S., the European Securities and Markets Authority (ESMA) in Europe, and various national regulators globally play key roles in overseeing these assets. - How does MiCA impact cryptocurrency exchanges?

MiCA requires exchanges operating within the EU to obtain licenses and comply with strict operational standards aimed at protecting consumers and ensuring market integrity. - What risks do investors face due to regulation?

Investors may face risks such as increased volatility due to regulatory news, potential legal repercussions from non-compliant exchanges, or higher costs associated with compliance affecting token prices. - Can regulation stifle innovation in cryptocurrency?

Excessive regulation may hinder innovation by creating barriers for new entrants or limiting existing companies’ ability to explore novel business models. - What role does investor education play in a regulated environment?

Investor education is crucial as it helps individuals understand their rights under new regulations while enabling them to make informed investment decisions. - How do global regulatory differences affect exchange-based tokens?

Diverse regulatory environments create challenges for cross-border operations of exchange-based tokens, leading to uncertainty for companies navigating multiple jurisdictions. - What is the future outlook for regulation on exchange-based tokens?

The future will likely see evolving frameworks that balance innovation with consumer protection while addressing sustainability concerns related to cryptocurrency operations.

In conclusion, while regulation poses challenges for exchange-based tokens—such as increased compliance costs and potential barriers to entry—it also offers significant benefits including enhanced market integrity, investor protection, and legitimacy within traditional finance. As the landscape continues to evolve globally, stakeholders must remain agile in adapting their strategies to align with regulatory changes while pursuing opportunities within this dynamic sector.