Pocket Network is emerging as a pivotal player in the decentralized infrastructure space, providing a unique solution for Web3 applications by facilitating seamless interactions between blockchains and applications. As it transitions into its next phase, the roadmap for Pocket Network outlines significant upgrades and strategies aimed at enhancing its scalability, efficiency, and overall market presence. This article delves into the future roadmap of Pocket Network, examining market trends, implementation strategies, risk considerations, regulatory aspects, and the overall outlook.

| Key Concept | Description/Impact |

|---|---|

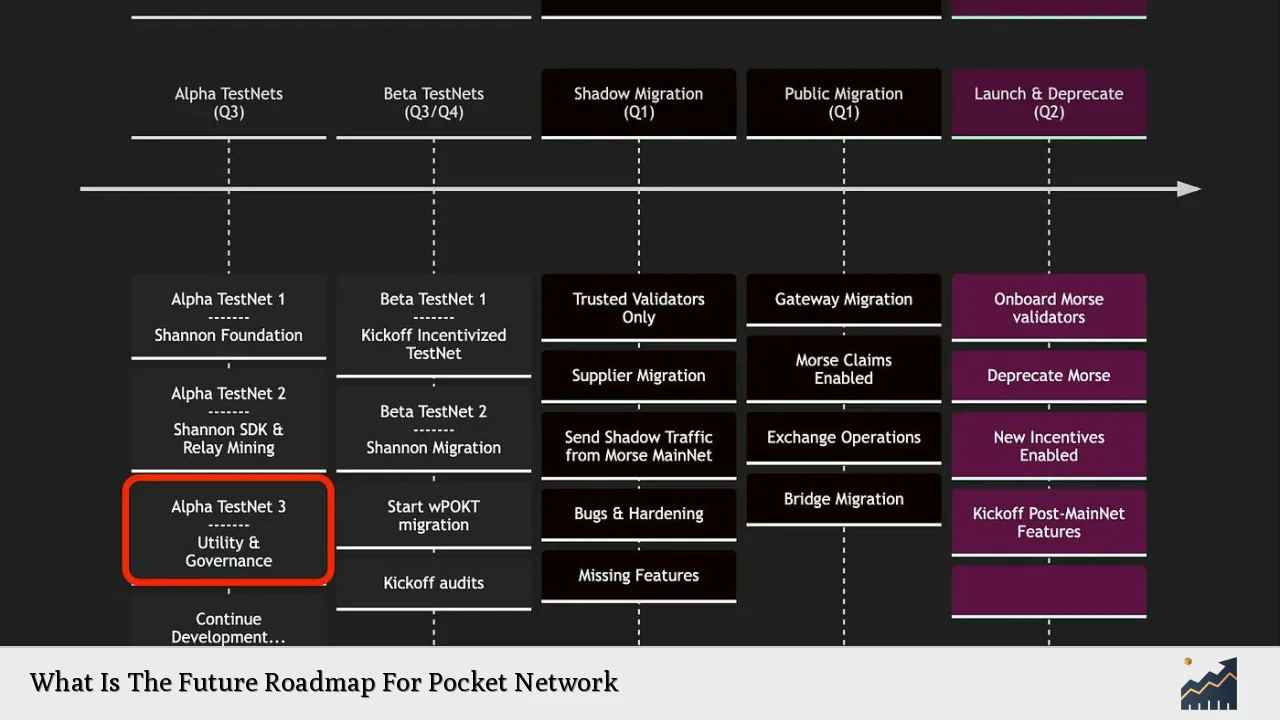

| Upgrade to Pocket v1 | This upgrade focuses on improving scalability and quality of service through a new consensus mechanism (HotStuff BFT) and structured communication in the P2P module. |

| Shannon Protocol | Aimed at attracting high-quality data service providers and enhancing the network’s capabilities through integration with existing frameworks. |

| Market Expansion | Plans to onboard more applications and increase node participation to bolster its decentralized infrastructure model. |

| Tokenomics Evolution | The transition from a Node as a Service (NaaS) model to a Software as a Service (SaaS) model while implementing burn mechanics for token sustainability. |

| Regulatory Compliance | Ensuring adherence to evolving regulations in the cryptocurrency space to maintain operational legitimacy and attract institutional investors. |

Market Analysis and Trends

The demand for decentralized infrastructure is steadily increasing as more developers seek alternatives to traditional centralized services. The rise of Web3 applications necessitates robust, reliable, and cost-effective solutions that can handle vast amounts of data with minimal downtime.

Current Market Landscape

- Growth of Decentralized Applications (dApps): The total number of dApps has surged, with over 6,000 active dApps across various blockchains as of late 2023. This growth underscores the need for scalable infrastructure solutions like Pocket Network.

- Market Size: The blockchain infrastructure market is projected to reach $69.04 billion by 2027, growing at a CAGR of 56.1% from 2020. This presents significant opportunities for Pocket Network to capture market share.

- Competitive Analysis: While centralized providers like Infura dominate the current landscape, there is a growing sentiment against centralization due to concerns over downtime and censorship. Pocket Network’s decentralized model positions it favorably against these incumbents.

Key Trends Influencing Pocket Network

- Increased Demand for Decentralization: As users become more aware of privacy issues and data ownership, demand for decentralized solutions is expected to rise.

- Technological Advancements: Innovations in blockchain technology and consensus mechanisms (like HotStuff BFT) are crucial for enhancing transaction speeds and network efficiency.

- Investment in Infrastructure: Significant capital is flowing into blockchain infrastructure projects, with venture capital firms increasingly backing decentralized solutions.

Implementation Strategies

To capitalize on these trends, Pocket Network has outlined several strategic initiatives:

Upgrade Path

- Pocket v1 Launch: Transitioning from Tendermint to HotStuff BFT will enhance transaction throughput and reliability. This change aims to reduce latency and improve user experience across applications.

- Shannon Protocol Development: By incentivizing high-quality service providers through the Shannon upgrade, Pocket aims to enrich its data offerings while ensuring that developers have access to reliable data sources.

- Node Expansion Initiatives: Increasing the number of nodes is vital for scaling operations. Pocket plans to simplify the process for new node operators, reducing barriers to entry.

- Freemium Model Implementation: The introduction of a freemium model allows new applications to utilize basic services without upfront costs while offering premium features through staking $POKT tokens.

Community Engagement

Building a strong community around Pocket Network is essential for its growth. Initiatives include:

- Governance Participation: Encouraging token holders to engage in governance decisions will create a more robust ecosystem aligned with user needs.

- Educational Outreach: Providing resources and support for developers looking to build on Pocket Network will drive adoption.

Risk Considerations

While the future looks promising for Pocket Network, several risks must be managed:

Market Risks

- Volatility in Crypto Markets: The cryptocurrency market is known for its volatility. Price fluctuations can impact investor sentiment and participation rates.

- Competition from Centralized Providers: Established players may respond aggressively to maintain their market share, potentially leading to price wars or service enhancements that could overshadow decentralized offerings.

Technical Risks

- Implementation Challenges: Transitioning to new consensus mechanisms and protocols may encounter unforeseen technical hurdles that could delay progress or affect network performance.

- Security Vulnerabilities: As with any blockchain project, vulnerabilities can arise that may expose users or nodes to risks if not adequately addressed.

Regulatory Aspects

The regulatory landscape surrounding cryptocurrencies remains fluid. Pocket Network must navigate these changes carefully:

- Compliance with SEC Regulations: Ensuring that all token offerings comply with securities regulations will be critical in maintaining investor confidence and avoiding legal pitfalls.

- Adapting to Global Regulations: As different countries adopt varying stances on cryptocurrency regulation, Pocket must remain agile in its compliance strategies to operate globally without hindrance.

Future Outlook

The roadmap ahead for Pocket Network is filled with potential:

- Projected Growth Rates: Analysts predict that by 2025, the price of $POKT could reach approximately $0.1010, reflecting a significant recovery from current levels. By 2030, projections suggest it could hit $0.1967 as adoption increases.

- Expansion into New Markets: With plans to onboard additional layer 1 blockchains and applications, Pocket Network aims to broaden its reach significantly over the next few years.

- Sustainable Tokenomics: The shift towards a SaaS model combined with burn mechanics will help stabilize $POKT’s value over time while incentivizing long-term holding among investors.

In summary, Pocket Network stands at a pivotal moment in its development journey. By focusing on strategic upgrades, community engagement, risk management, and regulatory compliance, it is well-positioned to lead the charge toward a more decentralized future in blockchain infrastructure.

Frequently Asked Questions About What Is The Future Roadmap For Pocket Network

- What is the significance of the Pocket v1 upgrade?

The upgrade aims to enhance scalability and efficiency by transitioning from Tendermint consensus to HotStuff BFT. - How does the Shannon Protocol benefit users?

The Shannon Protocol incentivizes high-quality data service providers, ensuring developers have access to reliable data sources. - What are the projected price trends for $POKT?

Analysts predict $POKT could reach approximately $0.1010 by 2025 and $0.1967 by 2030. - What risks does Pocket Network face?

The main risks include market volatility, competition from centralized providers, implementation challenges, and security vulnerabilities. - How does regulatory compliance affect Pocket Network?

Compliance ensures operational legitimacy and attracts institutional investors while navigating evolving cryptocurrency regulations. - What role does community engagement play in Pocket’s success?

A strong community fosters governance participation and drives adoption through educational outreach. - What are the long-term goals for Pocket Network?

Pocket aims for sustainable growth through strategic partnerships, expanding its node network, and enhancing user experience. - How will changes in tokenomics impact investors?

The shift towards a SaaS model with burn mechanics will stabilize token value while promoting long-term holding among investors.