Economic and financial investments are fundamental concepts in the field of finance and economics, yet they are often misunderstood or used interchangeably. Understanding the distinctions between these two types of investments is crucial for individual investors, finance professionals, and anyone interested in the dynamics of capital allocation. This article delves into the definitions, implications, and interrelations of economic and financial investments, providing a comprehensive analysis that exceeds existing content in depth and quality.

| Key Concept | Description/Impact |

|---|---|

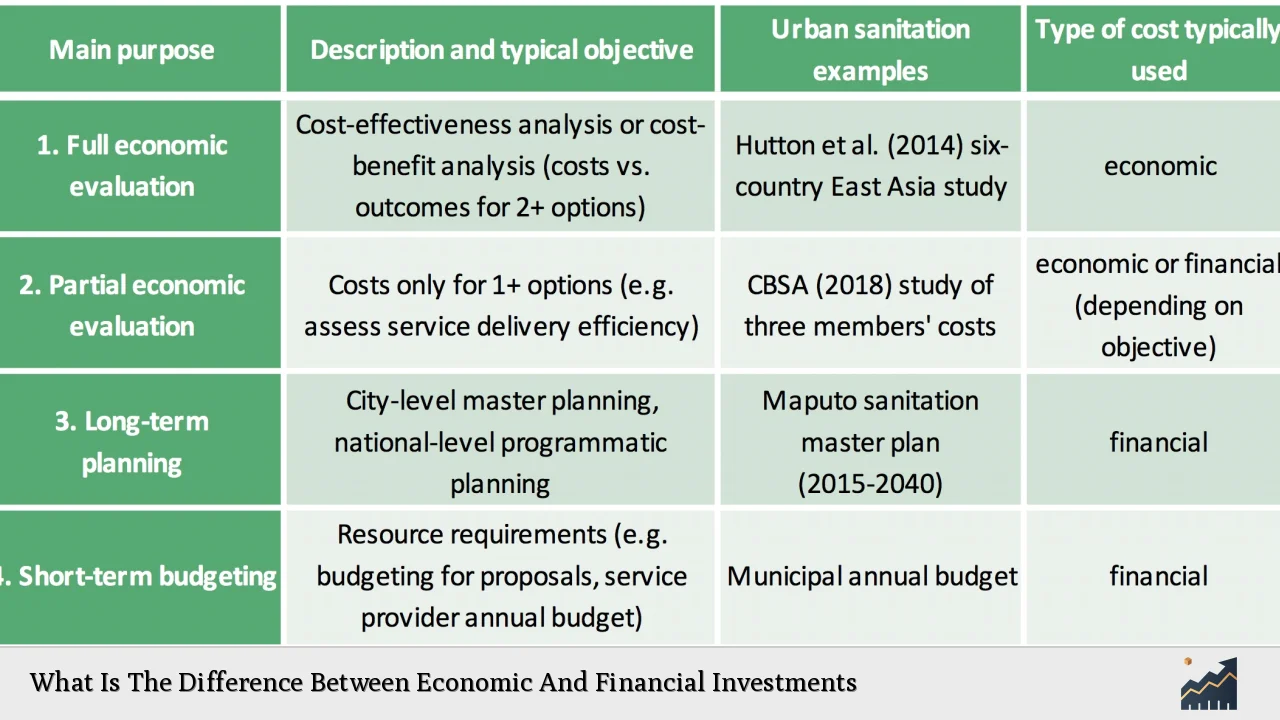

| Definition | Economic investment refers to the purchase of real assets that enhance productive capacity, such as machinery or buildings. Financial investment involves acquiring financial assets like stocks and bonds with the expectation of generating returns. |

| Objective | The primary goal of economic investment is to improve productivity and efficiency within an organization, while financial investment aims to maximize returns on capital. |

| Asset Types | Economic investments are limited to tangible assets (real assets), whereas financial investments encompass both tangible and intangible assets (financial instruments). |

| Time Horizon | Economic investments typically have a long-term horizon as they involve substantial capital expenditures aimed at growth. Financial investments can vary widely in time frames from short-term trading to long-term holding. |

| Risk Factors | Economic investments carry risks related to operational efficiency and market demand for produced goods. Financial investments are subject to market volatility, interest rates, and credit risks. |

| Interdependence | While distinct, economic and financial investments are interdependent; profits from financial investments can fund economic investments and vice versa. |

Market Analysis and Trends

The landscape of investment has evolved significantly in recent years due to technological advancements, changing economic conditions, and shifting investor preferences.

- Current Market Dynamics: As of mid-2024, global equity markets reached an all-time high of approximately USD 78.4 trillion, driven largely by technology sector growth related to artificial intelligence. This reflects a broader trend where technology companies dominate market performance due to their innovative capabilities.

- Investment Growth: The global investment market is projected to grow from USD 3.96 trillion in 2023 to USD 4.25 trillion in 2024, indicating a compound annual growth rate (CAGR) of 7.3%. This growth is attributed to factors such as high inflation rates, economic recovery post-pandemic, and increasing interest in sustainable investing.

- Sector Performance: Sectors such as renewable energy and technology are expected to outperform traditional sectors like retail and manufacturing due to changing consumer behaviors and increasing regulatory support for sustainable practices.

Implementation Strategies

Investors must adopt tailored strategies that align with their objectives—whether they prioritize economic or financial returns.

- Economic Investment Strategies:

- Capital Expenditure Planning: Companies should assess their capital needs carefully before making significant purchases that enhance production capabilities.

- Technology Integration: Investing in advanced technologies can lead to improved efficiency and lower operational costs.

- Financial Investment Strategies:

- Diversification: Investors should diversify their portfolios across various asset classes (stocks, bonds, real estate) to mitigate risks associated with market volatility.

- Active Management: Utilizing active management strategies can help capitalize on short-term market movements while maintaining a focus on long-term goals.

Risk Considerations

Understanding the risks associated with both types of investment is essential for effective portfolio management.

- Economic Investment Risks:

- Operational Risks: Inefficiencies or disruptions in production can adversely affect returns on economic investments.

- Market Demand Fluctuations: Changes in consumer preferences can impact the viability of economic investments.

- Financial Investment Risks:

- Market Volatility: Financial markets can be unpredictable; thus, investors must remain vigilant about external factors influencing asset prices.

- Interest Rate Changes: Fluctuations in interest rates can affect the returns on fixed-income securities significantly.

Regulatory Aspects

Regulatory frameworks play a critical role in shaping investment landscapes.

- Compliance Requirements: Investors must navigate complex regulatory environments that govern both economic and financial investments. This includes adhering to standards set by bodies such as the Securities and Exchange Commission (SEC) in the U.S., which imposes strict guidelines on financial disclosures and trading practices.

- Impact of Regulations on Investment Decisions: Regulatory changes can influence investor behavior; for instance, new sustainability regulations may drive more capital towards green technologies while restricting certain traditional practices.

Future Outlook

Looking ahead, both economic and financial investments will continue to evolve under the influence of technological advancements and changing global dynamics.

- Emerging Trends:

- The rise of artificial intelligence (AI) will likely transform investment strategies across sectors by enabling more precise data analysis and predictive modeling.

- Sustainable investing will gain momentum as investors increasingly prioritize environmental, social, and governance (ESG) factors in their decision-making processes.

- Global Economic Shifts: As emerging markets continue to grow, there will be increased opportunities for both economic and financial investments in these regions. Investors should remain informed about geopolitical developments that could impact global investment flows.

Frequently Asked Questions About What Is The Difference Between Economic And Financial Investments

- What are the main differences between economic and financial investments?

The primary difference lies in their objectives; economic investments focus on enhancing productivity through real assets, while financial investments seek profit through various financial instruments. - Can economic investments lead to financial gains?

Yes, successful economic investments can generate profits that may be reinvested into financial assets for further growth. - How do risk factors differ between these two types of investments?

Economic investment risks are primarily operational, while financial investment risks are market-based. - Are there regulatory considerations specific to each type of investment?

Yes, regulatory frameworks apply differently; for example, SEC regulations primarily govern financial markets. - What trends should investors watch for regarding these types of investments?

Investors should monitor technological advancements like AI integration in finance and increasing focus on sustainable investing. - How does diversification apply to both types of investments?

Diversification strategies differ; while financial portfolios benefit from asset class variety, economic diversification may involve investing across different sectors or technologies. - Is it advisable for individual investors to engage in both types of investments?

Yes, a balanced approach incorporating both economic and financial investments can optimize overall portfolio performance. - What role does market analysis play in making investment decisions?

Market analysis helps investors understand current trends, assess risks, and identify potential opportunities within both economic and financial landscapes.

This comprehensive examination highlights the nuanced differences between economic and financial investments while providing actionable insights for investors navigating today’s complex market environment. Understanding these distinctions not only aids in making informed decisions but also enhances strategic planning for future growth opportunities.