The relationship between cryptocurrencies and traditional currencies has become a focal point for investors, economists, and financial analysts in recent years. As digital assets continue to gain prominence in the global financial landscape, understanding their correlation with fiat currencies is crucial for making informed investment decisions and assessing potential economic impacts. This comprehensive analysis delves into the intricate dynamics between these two asset classes, exploring market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Correlation | Measures the degree to which cryptocurrency and traditional currency prices move in relation to each other |

| Volatility | Cryptocurrencies typically exhibit higher price volatility compared to traditional currencies |

| Market Capitalization | Total value of cryptocurrencies ($2.66 trillion) vs. global forex market ($6.6 trillion daily volume) |

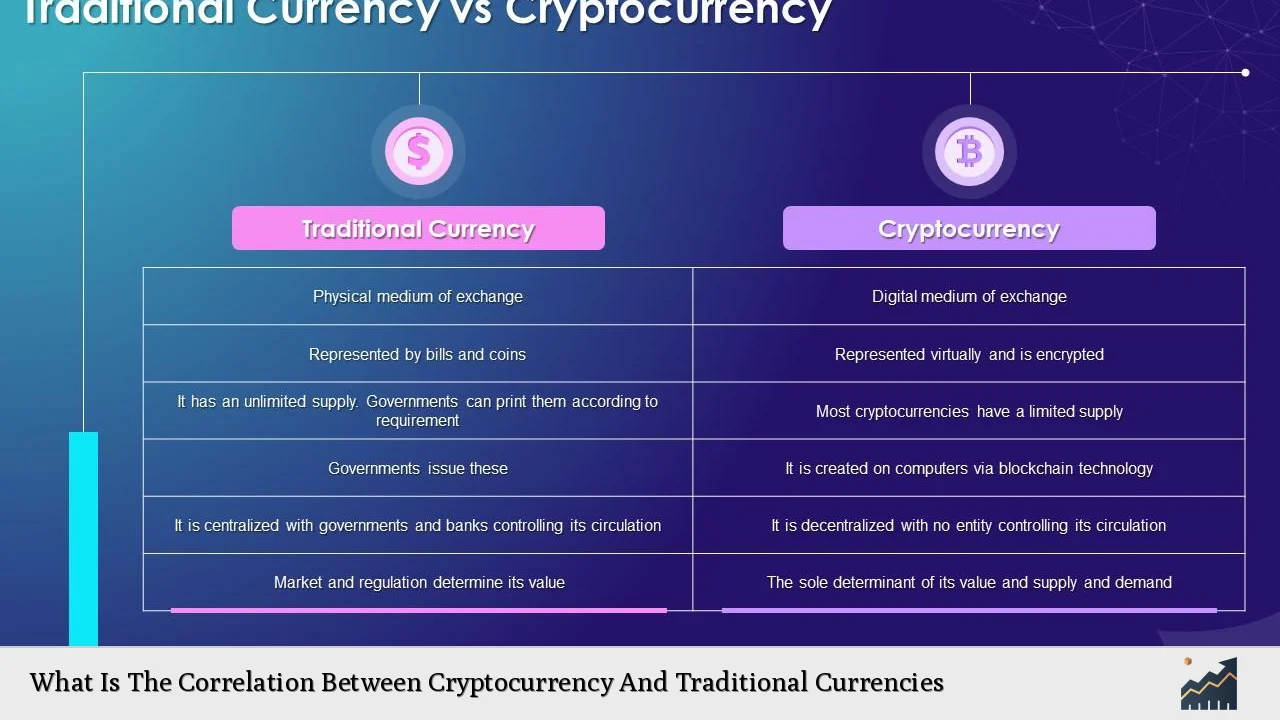

| Decentralization | Cryptocurrencies operate on decentralized networks, while traditional currencies are centrally controlled |

| Regulatory Environment | Traditional currencies are heavily regulated; cryptocurrency regulations vary globally and are evolving |

Market Analysis and Trends

The cryptocurrency market has experienced significant growth and volatility in recent years, with its total market capitalization reaching $2.66 trillion in 2024. This surge in value has prompted increased scrutiny of the relationship between digital assets and traditional currencies.

Historically, cryptocurrencies and traditional currencies have exhibited a moderate negative correlation. This means that as the value of traditional currencies increases, cryptocurrency prices tend to decrease, and vice versa. However, this relationship is not fixed and can vary depending on market conditions and external factors.

Recent trends indicate a shift in this correlation. As institutional adoption of cryptocurrencies grows and more traditional financial institutions enter the space, the negative correlation has begun to weaken. This change suggests that cryptocurrencies are increasingly being viewed as a legitimate asset class rather than merely a speculative investment.

The US dollar remains the dominant fiat currency in crypto markets, accounting for a significant portion of trading volume. However, other currencies like the South Korean won have gained prominence, reflecting the global nature of cryptocurrency adoption. Interestingly, the euro plays a relatively minor role in crypto transactions, despite the European Union’s efforts to regulate the market through initiatives like the Markets in Crypto-Assets (MiCA) regulation.

Implementation Strategies

For investors and financial institutions looking to leverage the relationship between cryptocurrencies and traditional currencies, several implementation strategies have emerged:

Portfolio Diversification

Many investors are incorporating cryptocurrencies into their portfolios as a means of diversification. The historically negative correlation between crypto and traditional assets can potentially help balance overall portfolio risk. However, as correlations shift, investors must regularly reassess their allocation strategies.

Currency Hedging

Some businesses and investors use cryptocurrencies as a hedge against currency fluctuations. For example, in countries with unstable fiat currencies, individuals and companies may hold cryptocurrencies to protect against local currency devaluation.

Arbitrage Opportunities

The price discrepancies between cryptocurrencies and traditional currencies across different markets create arbitrage opportunities for savvy traders. These strategies involve buying assets in one market and selling them in another to profit from price differences.

Stablecoin Integration

Stablecoins, which are cryptocurrencies pegged to traditional currencies (often the US dollar), serve as a bridge between the crypto and fiat worlds. They offer the benefits of cryptocurrency technology while maintaining price stability relative to fiat currencies.

Risk Considerations

While the correlation between cryptocurrencies and traditional currencies presents opportunities, it also comes with significant risks:

Volatility: Cryptocurrencies are known for their price volatility, which can lead to substantial gains or losses in short periods. This volatility can impact their correlation with traditional currencies and make risk management challenging.

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, with different countries adopting varying approaches. Changes in regulations can significantly impact the relationship between crypto and traditional currencies.

Liquidity Risk: Some cryptocurrencies may have lower liquidity compared to major fiat currencies, potentially leading to slippage and execution issues during large trades.

Technological Risks: Cryptocurrencies rely on complex technological infrastructure. Issues such as network congestion, smart contract vulnerabilities, or cyber attacks can disrupt the market and affect correlations.

Market Manipulation: The cryptocurrency market is more susceptible to manipulation due to its smaller size and lower regulation compared to traditional currency markets.

Regulatory Aspects

The regulatory environment plays a crucial role in shaping the relationship between cryptocurrencies and traditional currencies:

Global Regulatory Landscape

Different countries have adopted varying approaches to cryptocurrency regulation. Some, like Japan and Switzerland, have embraced crypto with clear regulatory frameworks, while others have imposed strict restrictions or outright bans.

Central Bank Digital Currencies (CBDCs)

Many central banks are exploring or developing their own digital currencies. CBDCs could significantly impact the correlation between cryptocurrencies and traditional currencies by offering a government-backed digital alternative.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

Increasing AML and KYC regulations in the crypto space are bringing digital asset practices more in line with traditional financial systems, potentially affecting their correlation.

Tax Implications

The tax treatment of cryptocurrencies varies by jurisdiction and can influence their relationship with traditional currencies. Clear tax guidelines may increase institutional adoption and affect correlations.

Future Outlook

The future relationship between cryptocurrencies and traditional currencies is likely to be shaped by several key factors:

Institutional Adoption: Continued entry of institutional investors into the crypto market could lead to increased correlation with traditional financial markets.

Technological Advancements: Improvements in blockchain technology, such as increased scalability and interoperability, may enhance the utility of cryptocurrencies and affect their relationship with fiat currencies.

Regulatory Developments: The evolution of global cryptocurrency regulations will play a crucial role in determining the long-term correlation between digital and traditional assets.

Economic Factors: Global economic conditions, inflation rates, and monetary policies will continue to influence the relationship between cryptocurrencies and traditional currencies.

Market Maturation: As the cryptocurrency market matures, it may develop more stable correlations with traditional financial assets, including fiat currencies.

In conclusion, the correlation between cryptocurrencies and traditional currencies is a complex and dynamic relationship that continues to evolve. As the digital asset space matures and becomes more integrated with the global financial system, understanding this correlation will be crucial for investors, policymakers, and financial institutions alike. While challenges and risks remain, the potential for cryptocurrencies to complement and even transform traditional currency systems presents exciting opportunities for innovation in the financial sector.

Frequently Asked Questions About What Is The Correlation Between Cryptocurrency And Traditional Currencies

- How does Bitcoin’s correlation with traditional currencies compare to other cryptocurrencies?

Bitcoin, as the largest cryptocurrency by market capitalization, often shows a stronger correlation with traditional currencies compared to smaller altcoins. However, this correlation can vary significantly during periods of market stress or major economic events. - Can cryptocurrencies serve as a hedge against inflation in traditional currencies?

Some investors view cryptocurrencies, particularly Bitcoin, as a potential hedge against inflation in traditional currencies. However, the effectiveness of this strategy is debated, and cryptocurrencies’ high volatility can offset potential inflation-hedging benefits. - How do geopolitical events affect the correlation between cryptocurrencies and traditional currencies?

Geopolitical events can significantly impact the correlation between cryptocurrencies and traditional currencies. During times of political uncertainty or economic instability, cryptocurrencies may see increased demand as a potential safe haven, potentially strengthening their negative correlation with affected fiat currencies. - What role do stablecoins play in the relationship between cryptocurrencies and traditional currencies?

Stablecoins act as a bridge between the cryptocurrency and traditional currency markets. They can provide a more stable entry point for investors and facilitate easier conversion between crypto and fiat, potentially influencing the overall correlation between these asset classes. - How might the introduction of Central Bank Digital Currencies (CBDCs) affect the correlation between cryptocurrencies and traditional currencies?

The introduction of CBDCs could significantly impact the crypto-fiat correlation. CBDCs may compete with existing cryptocurrencies for market share while also potentially increasing overall digital currency adoption, leading to complex shifts in market dynamics and correlations. - Are there any cryptocurrencies that consistently show a positive correlation with traditional currencies?

While most cryptocurrencies tend to have a negative or low correlation with traditional currencies, some stablecoins are designed to maintain a consistent 1:1 ratio with specific fiat currencies, effectively showing a perfect positive correlation. - How does the correlation between cryptocurrencies and traditional currencies affect institutional investment strategies?

The evolving correlation between cryptocurrencies and traditional currencies is prompting institutions to reassess their investment strategies. Many are exploring ways to incorporate cryptocurrencies into their portfolios for diversification benefits, while also developing new risk management approaches to account for the unique characteristics of digital assets.