Investing money safely is a priority for many individuals, particularly those who are risk-averse or new to the world of finance. The goal is to find investment options that minimize risk while still providing some level of return. Safe investments typically involve lower volatility and a higher degree of capital protection, making them appealing to conservative investors. Understanding the different types of safe investments and their characteristics is essential for anyone looking to secure their financial future.

When considering safe investments, it’s important to recognize that while they generally offer lower returns compared to higher-risk options, they also come with a significantly reduced risk of losing your principal. This balance between risk and return is crucial for maintaining financial stability. Below is a table summarizing some common safe investment options.

| Investment Type | Risk Level |

|---|---|

| High-Yield Savings Accounts | Low |

| Money Market Accounts | Low |

| Treasury Securities | Very Low |

| Certificates of Deposit (CDs) | Low |

| Bonds (Municipal & Corporate) | Moderate |

Understanding Safe Investments

Safe investments are typically characterized by their ability to preserve capital while providing modest returns. They are ideal for individuals who prioritize security over high returns. The most common types of safe investments include:

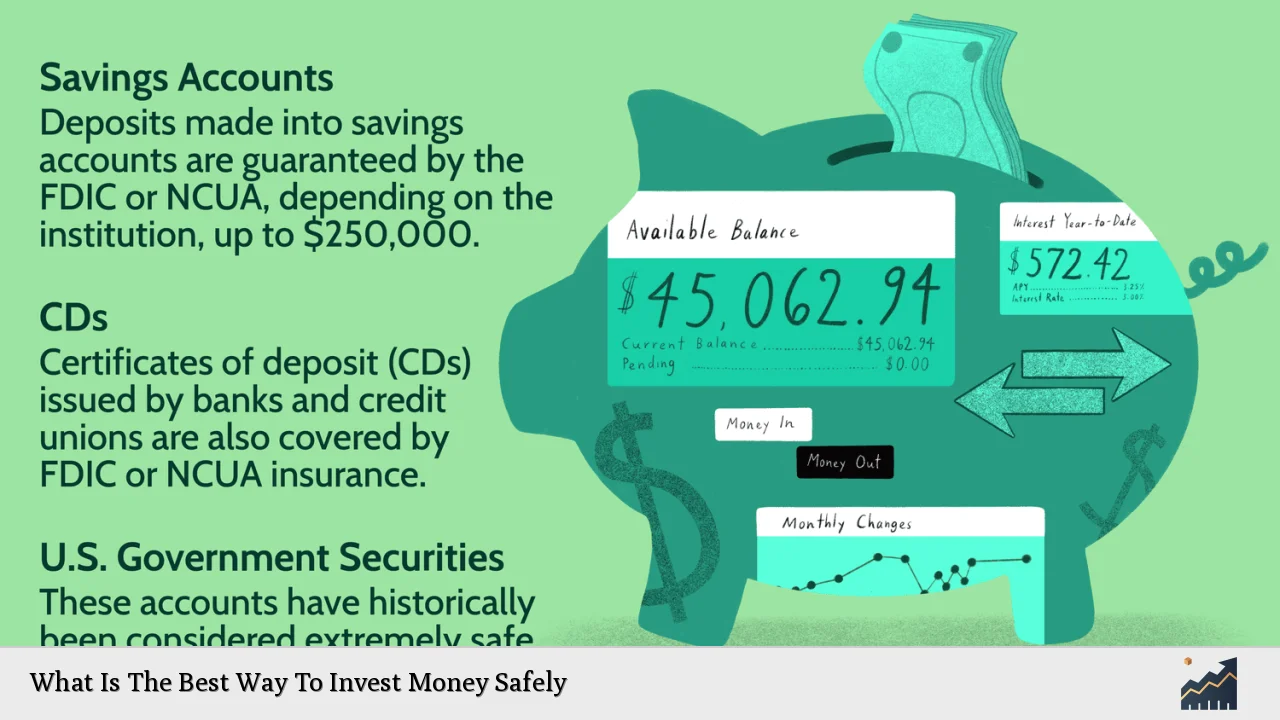

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts while still being FDIC-insured up to $250,000 per depositor. They provide liquidity and easy access to funds.

- Money Market Accounts: Similar to high-yield savings accounts, money market accounts typically offer higher interest rates and are also FDIC-insured. They allow limited check-writing capabilities, making them a flexible option for savings.

- Treasury Securities: U.S. Treasury bills, notes, and bonds are backed by the federal government, making them one of the safest investment options available. They provide fixed interest payments and are highly liquid.

- Certificates of Deposit (CDs): CDs are time deposits offered by banks with fixed interest rates over specified terms. They are FDIC-insured and generally offer higher rates than savings accounts but require funds to be locked in for a set period.

- Bonds: Municipal and corporate bonds can provide steady income through interest payments. While they carry some risk, investing in high-quality bonds can mitigate potential losses.

Investors should evaluate these options based on their individual financial goals, time horizon, and risk tolerance.

Evaluating Your Risk Tolerance

Before investing, it’s crucial to assess your risk tolerance, which refers to your ability and willingness to endure fluctuations in the value of your investments. Understanding your risk tolerance helps you choose investments that align with your comfort level.

Factors influencing risk tolerance include:

- Time Horizon: If you plan to invest for a short period, you may prefer safer options like savings accounts or CDs. For longer-term goals, you might consider bonds or dividend-paying stocks.

- Financial Goals: Define what you want to achieve with your investments. Are you saving for retirement, a home purchase, or education? Your goals will dictate the level of risk you can take.

- Personal Comfort: Some individuals may feel uneasy with any level of risk, while others may be more comfortable with moderate risks in exchange for higher potential returns.

By understanding these factors, you can make informed decisions about where to allocate your funds safely.

Diversification: A Key Strategy

Diversification is an essential strategy for reducing investment risk. By spreading your investments across various asset classes—such as stocks, bonds, and cash equivalents—you can mitigate the impact of poor performance in any single investment.

Benefits of diversification include:

- Risk Reduction: Different assets react differently to market conditions. When one investment underperforms, others may perform well, balancing out overall portfolio performance.

- Stability: A diversified portfolio tends to be less volatile than one concentrated in a single asset class. This stability is particularly important for conservative investors seeking safety.

- Potential for Returns: While safe investments typically yield lower returns, diversifying into slightly higher-risk assets can enhance overall portfolio performance without significantly increasing risk.

To effectively diversify, consider including a mix of safe investments along with moderate-risk options tailored to your financial goals.

Safe Investment Options Overview

Here’s an overview of some popular safe investment options:

| Investment Type | Description |

|---|---|

| High-Yield Savings Accounts | FDIC-insured accounts offering higher interest rates than traditional savings. |

| Money Market Accounts | Similar to savings accounts but often with check-writing capabilities. |

| Treasury Bills/Notes/Bonds | Government-backed securities providing fixed interest payments. |

| Certificates of Deposit (CDs) | Time deposits with fixed interest rates; FDIC-insured. |

| Bonds (Municipal & Corporate) | Debt securities providing regular interest payments; varying degrees of risk. |

Each option has its own advantages and disadvantages; therefore, it’s essential to consider how they fit into your overall investment strategy.

Importance of Liquidity

Liquidity refers to how quickly an asset can be converted into cash without significantly affecting its price. When investing safely, understanding liquidity is crucial because it affects how easily you can access your funds when needed.

Some key points about liquidity include:

- Immediate Access: Investments like high-yield savings accounts and money market accounts offer immediate access to funds without penalties.

- Fixed Terms: CDs have fixed terms during which your money is locked in; early withdrawal may incur penalties. Consider this when planning your cash flow needs.

- Market Conditions: Some bonds may take longer to sell depending on market conditions. Always evaluate how quickly you might need access to your cash before investing in less liquid assets.

Balancing liquidity needs with safety is vital for effective financial planning.

Tax Considerations

When investing safely, it’s important to understand the tax implications associated with different investment types. Some safe investments offer tax advantages that can enhance overall returns:

- Tax-Free Bonds: Municipal bonds often provide tax-free interest income at the federal level and sometimes at the state level as well.

- Tax-Deferred Accounts: Investing through retirement accounts like IRAs allows you to defer taxes on earnings until withdrawal during retirement.

- Interest Income Taxation: Interest earned from savings accounts and CDs is typically subject to federal income tax. Be mindful of how this impacts your overall returns.

Understanding these tax considerations can help you optimize your investment strategy while maintaining safety.

FAQs About Safe Investments

- What are safe investment options?

Safe investment options include high-yield savings accounts, money market accounts, treasury securities, CDs, and certain types of bonds. - How do I determine my risk tolerance?

Your risk tolerance can be determined by evaluating your financial goals, time horizon, and personal comfort with market fluctuations. - Is diversification necessary for safe investing?

Diversification helps reduce risk by spreading investments across different asset classes; it is advisable even for conservative investors. - What is liquidity in investing?

Liquidity refers to how quickly an asset can be converted into cash without affecting its price; it is important for accessing funds when needed. - Are there tax benefits associated with safe investments?

Yes, some safe investments like municipal bonds offer tax-free interest income while others allow tax deferral through retirement accounts.

Investing money safely requires careful consideration of various factors including risk tolerance, diversification strategies, liquidity needs, and tax implications. By understanding these elements and choosing appropriate investment vehicles, individuals can effectively preserve their capital while still achieving modest growth over time.