Investing money wisely is crucial for building wealth and achieving financial goals. In the United States, there are various investment options available, each with its own risk and return profile. Understanding these options can help individuals make informed decisions that align with their financial objectives.

Investing can take many forms, including stocks, bonds, mutual funds, real estate, and more. The best investment strategy often depends on individual factors such as risk tolerance, investment timeline, and financial goals. Diversification is a key principle in investing, as it helps mitigate risks by spreading investments across different asset classes. This article will explore various investment options and strategies suitable for different types of investors.

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company with potential for high returns. |

| Bonds | Loans to governments or corporations with fixed interest payments. |

| Mutual Funds | Pooled funds investing in a diversified portfolio of assets. |

| Real Estate | Investing in property for rental income or appreciation. |

| ETFs | Funds traded on stock exchanges that track indices. |

Understanding Investment Options

When considering how to invest money in the USA, it is essential to understand the various options available. Each investment type has its characteristics, benefits, and risks.

- Stocks: Investing in stocks means buying shares of publicly traded companies. Stocks have the potential for high returns but come with increased volatility. Investors can choose between individual stocks or diversified options like mutual funds and ETFs.

- Bonds: Bonds are considered safer than stocks. When you buy a bond, you are essentially lending money to a government or corporation in exchange for periodic interest payments plus the return of the bond’s face value at maturity. Government bonds are generally viewed as low-risk investments.

- Mutual Funds: These are professionally managed investment funds that pool money from multiple investors to purchase securities. They offer diversification and are suitable for those who prefer a hands-off approach to investing.

- Real Estate: Investing in real estate involves purchasing properties to generate rental income or capital appreciation. Real estate can provide a hedge against inflation and is often considered a stable long-term investment.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer liquidity and diversification at lower costs than traditional mutual funds.

Understanding these options allows investors to create a balanced portfolio that aligns with their financial goals and risk tolerance.

Risk Tolerance and Investment Strategy

Before investing, individuals should assess their risk tolerance, which refers to their ability and willingness to endure fluctuations in the value of their investments. This assessment is critical for determining the appropriate investment strategy.

- Conservative Investors: Those who prefer stability may opt for safer investments like bonds, high-yield savings accounts, or certificates of deposit (CDs). These options typically offer lower returns but come with reduced risk.

- Moderate Investors: Individuals willing to accept some risk for potential higher returns might consider a balanced mix of stocks and bonds. This approach can provide growth while still offering some level of protection against market volatility.

- Aggressive Investors: Those with a high-risk tolerance may focus on growth-oriented investments such as individual stocks or sector-specific ETFs. While these investments can yield substantial returns, they also come with increased volatility.

Creating an investment strategy based on risk tolerance ensures that investors remain comfortable during market fluctuations and are more likely to stick to their plans over time.

Diversification: A Key Principle

One of the most important strategies in investing is diversification. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the overall risk of their portfolios.

- Asset Classes: Diversifying among asset classes such as stocks, bonds, real estate, and cash can help mitigate risks associated with any single investment type.

- Sectors: Within the stock market, investors can diversify by investing in various sectors such as technology, healthcare, consumer goods, and energy. This approach reduces exposure to sector-specific downturns.

- Geographic Regions: Investing in international markets can provide additional diversification benefits. Global exposure allows investors to capitalize on growth opportunities outside their home country while reducing reliance on domestic economic conditions.

Diversification does not guarantee profits or protect against losses but can significantly reduce the impact of poor-performing investments on an overall portfolio.

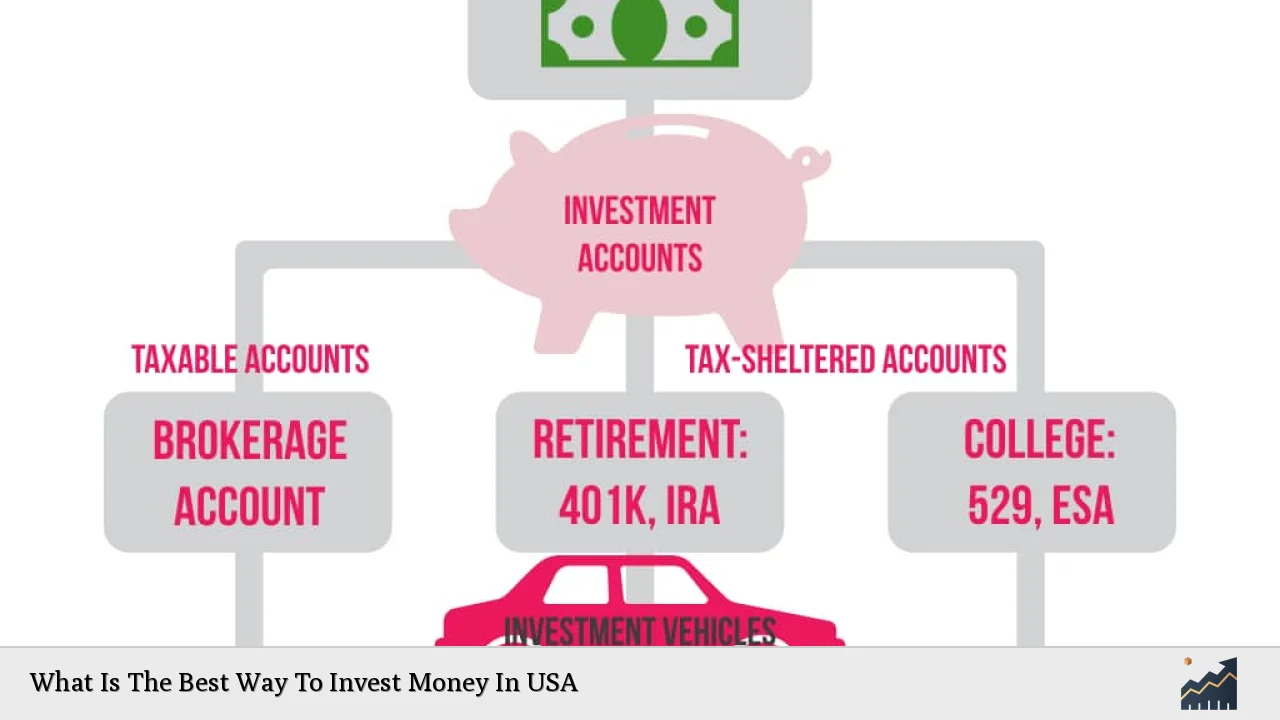

Investment Accounts: Choosing the Right Type

Selecting the right type of investment account is crucial for maximizing returns while minimizing tax liabilities. Here are some common account types available in the USA:

- Brokerage Accounts: These accounts allow investors to buy and sell various securities like stocks and bonds without tax advantages. They offer flexibility but may incur capital gains taxes on profitable trades.

- Retirement Accounts: Accounts like 401(k)s and IRAs provide tax advantages for retirement savings. Contributions may be tax-deductible, and investments grow tax-deferred until withdrawal.

- Robo-Advisors: Automated platforms that create diversified portfolios based on individual risk tolerance and financial goals. They typically charge lower fees than traditional financial advisors.

Choosing the right account depends on individual financial situations and long-term objectives. Investors should consider factors such as tax implications, fees, and access to different investment vehicles when making their decision.

The Importance of Research

Conducting thorough research before making investment decisions is essential for success. Investors should stay informed about market trends, economic indicators, and specific companies or sectors they are interested in investing in.

- Market Trends: Understanding broader market trends helps investors identify potential opportunities or risks within specific sectors or asset classes.

- Company Analysis: For those investing in individual stocks, analyzing company fundamentals such as earnings reports, management performance, and competitive positioning is crucial for making informed decisions.

- Economic Indicators: Monitoring economic indicators like interest rates, inflation rates, and unemployment figures provides insight into overall economic health and can influence investment choices.

By staying informed through research and analysis, investors can make better decisions aligned with their financial goals while adapting their strategies as market conditions change.

FAQs About Investing Money In USA

FAQs About What Is The Best Way To Invest Money In USA

- What is the safest way to invest money?

The safest ways include high-yield savings accounts, CDs, and government bonds. - How much money do I need to start investing?

You can start investing with as little as $100 through ETFs or mutual funds. - What is diversification?

Diversification involves spreading investments across various asset classes to reduce risk. - Should I hire a financial advisor?

A financial advisor can help tailor an investment strategy based on your goals and risk tolerance. - What are index funds?

Index funds are mutual funds or ETFs designed to track specific market indices like the S&P 500.

Investing money wisely requires careful consideration of various factors including risk tolerance, investment options, diversification strategies, account types, and ongoing research. By understanding these elements and creating a well-rounded investment plan tailored to individual needs, investors can work towards achieving their financial goals effectively.