Investing money for kids is a vital step in preparing them for a financially secure future. By starting early, parents can leverage the power of compound interest and teach their children essential financial skills. The goal is to instill good habits and provide them with the tools they need to manage their finances wisely as they grow. This article will explore various investment options, strategies, and tips to help you navigate the world of investing for children.

| Investment Option | Description |

|---|---|

| Custodial Accounts | Accounts managed by adults for minors until they reach adulthood. |

| 529 Plans | Tax-advantaged savings plans for education expenses. |

Understanding the Importance of Early Investing

Investing for kids is not just about accumulating wealth; it’s about teaching them the value of money and how it can work for them. Starting an investment fund early allows children to learn about compound returns, which can significantly increase their savings over time. The earlier you start investing, the more time your money has to grow, making it a powerful tool for long-term financial goals.

One of the primary benefits of investing is that it helps children understand financial literacy. By engaging them in discussions about investments, parents can equip their kids with essential skills such as budgeting, saving, and understanding risk versus reward. This foundational knowledge will serve them well into adulthood.

Moreover, investing can reduce future financial burdens, such as student loans or buying a first home. By setting aside funds in an investment account, you can help alleviate some of the financial stress associated with major life events.

Types of Investment Accounts for Kids

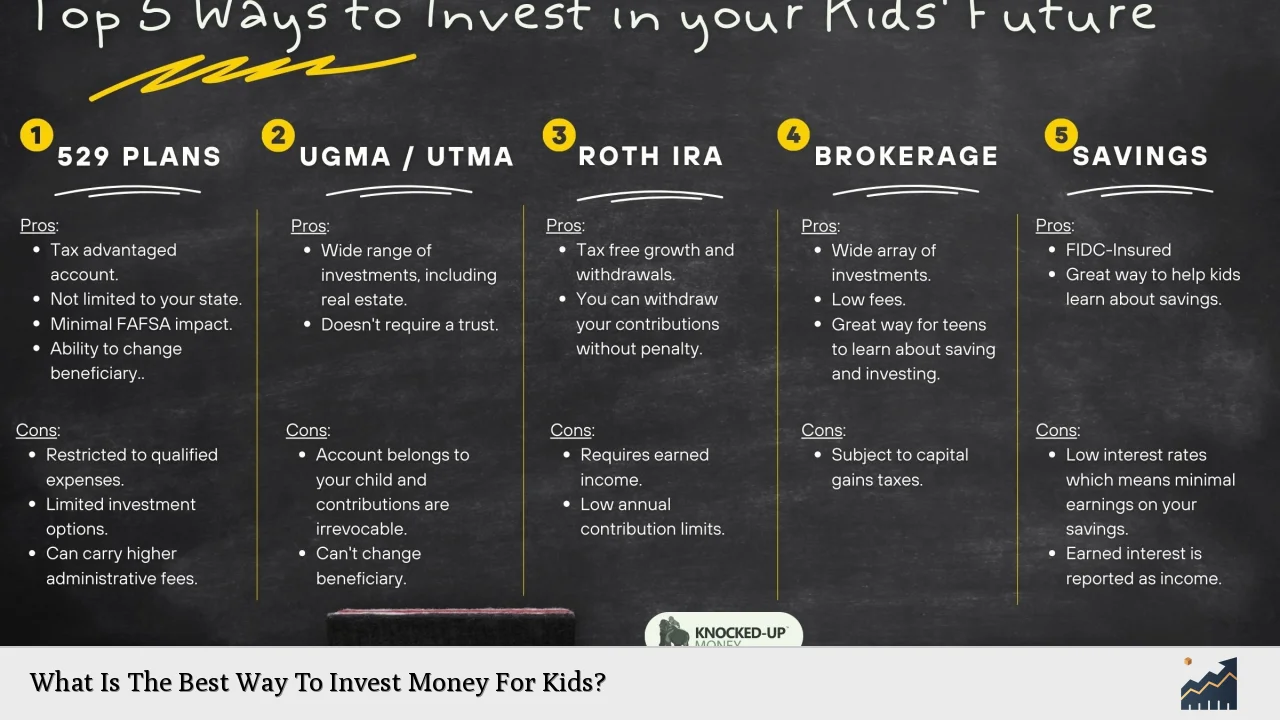

When considering how to invest money for kids, there are several types of accounts available. Each has its unique features and benefits that cater to different goals:

Custodial Accounts (UGMA/UTMA)

Custodial accounts are established under the Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA). These accounts allow adults to manage investments on behalf of minors until they reach a specified age, usually 18 or 21.

- Pros: Flexible investment options; funds can be used for any purpose.

- Cons: Limited parental control once the child reaches adulthood; potential tax implications on earnings.

529 College Savings Plans

These plans are designed specifically for saving for educational expenses. Contributions grow tax-free, and withdrawals are tax-free when used for qualified education costs.

- Pros: Tax advantages; high contribution limits.

- Cons: Limited to educational expenses; penalties for non-qualified withdrawals.

Coverdell Education Savings Accounts (ESAs)

Coverdell ESAs allow contributions up to $2,000 per year and provide tax-free growth for educational expenses at any level.

- Pros: Flexibility in using funds; broader range of qualified expenses.

- Cons: Contribution limits; income restrictions may apply.

Custodial Roth IRA

If your child has earned income from part-time work, they can contribute to a custodial Roth IRA. This account allows tax-free growth and withdrawals when used for qualified expenses.

- Pros: Tax-free growth; teaches retirement planning early.

- Cons: Contributions limited to earned income; penalties for non-qualified withdrawals.

Brokerage Accounts

Some brokerage firms offer youth accounts that allow minors aged 13 and older to invest with parental supervision. These accounts enable children to buy stocks or ETFs directly.

- Pros: Hands-on experience with investing; ownership of investments.

- Cons: Taxable income on earnings; potential fees depending on the brokerage.

Investment Strategies for Kids

Once you’ve chosen an account type, it’s essential to develop a strategy that aligns with your child’s interests and financial goals. Here are some effective strategies:

Start Small with Fractional Shares

Many platforms now offer fractional shares, allowing kids to invest in expensive stocks without needing large sums of money. This approach makes investing accessible and encourages children to diversify their portfolios without significant risk.

Focus on Familiar Brands

Encourage your child to invest in companies they know and love. Whether it’s a favorite toy manufacturer or a popular streaming service, investing in familiar brands can make the experience more engaging and relatable.

Teach Diversification

Explain the importance of spreading investments across various asset classes to reduce risk. A diversified portfolio could include a mix of stocks, bonds, and index funds that align with their interests.

Use Educational Tools

Leverage online resources and apps designed for young investors. Many platforms offer simulations or educational content that teaches kids about market trends and investment strategies in an interactive way.

Keeping Kids Engaged in Investing

To foster a lasting interest in investing, parents should actively involve their children in discussions about their investments. Here are some tips:

Regular Check-ins

Schedule regular meetings with your child to review their investment performance. Discuss any gains or losses and what factors influenced those changes. This ongoing dialogue reinforces learning and keeps them engaged.

Set Financial Goals

Help your child set achievable financial goals related to their investments. Whether it’s saving for a new gadget or planning for college expenses, having clear objectives can motivate them to contribute regularly.

Make It Fun

Incorporate games or challenges related to investing. For instance, you could create a friendly competition where each family member picks stocks and tracks performance over time.

FAQs About Investing Money For Kids

- What is the best age to start investing for my child?

The earlier you start investing, the better; even newborns can have accounts set up. - Can my child have their own brokerage account?

Minors typically cannot open accounts independently but can have custodial accounts managed by adults. - What types of investments should I consider?

Consider stocks, ETFs, mutual funds, or bonds based on your child’s interests and risk tolerance. - Are there tax implications when investing for kids?

Yes, earnings may be subject to taxes depending on the account type and amount earned. - How can I teach my child about risk management?

Discuss different investment risks and rewards while encouraging diversification in their portfolio.

Investing money for kids is an invaluable gift that sets them on a path toward financial independence. By understanding various investment options and strategies, parents can help cultivate responsible financial habits that last a lifetime. Starting early not only maximizes growth potential but also empowers children with essential knowledge about managing their finances effectively as they transition into adulthood.