Investing is a crucial aspect of financial planning, enabling individuals to grow their wealth over time. As we enter 2025, the investment landscape is evolving rapidly due to technological advancements, changing consumer behaviors, and macroeconomic factors. Investors are faced with numerous options, each with its own set of risks and rewards. Understanding the current trends and potential investment opportunities is essential for making informed decisions.

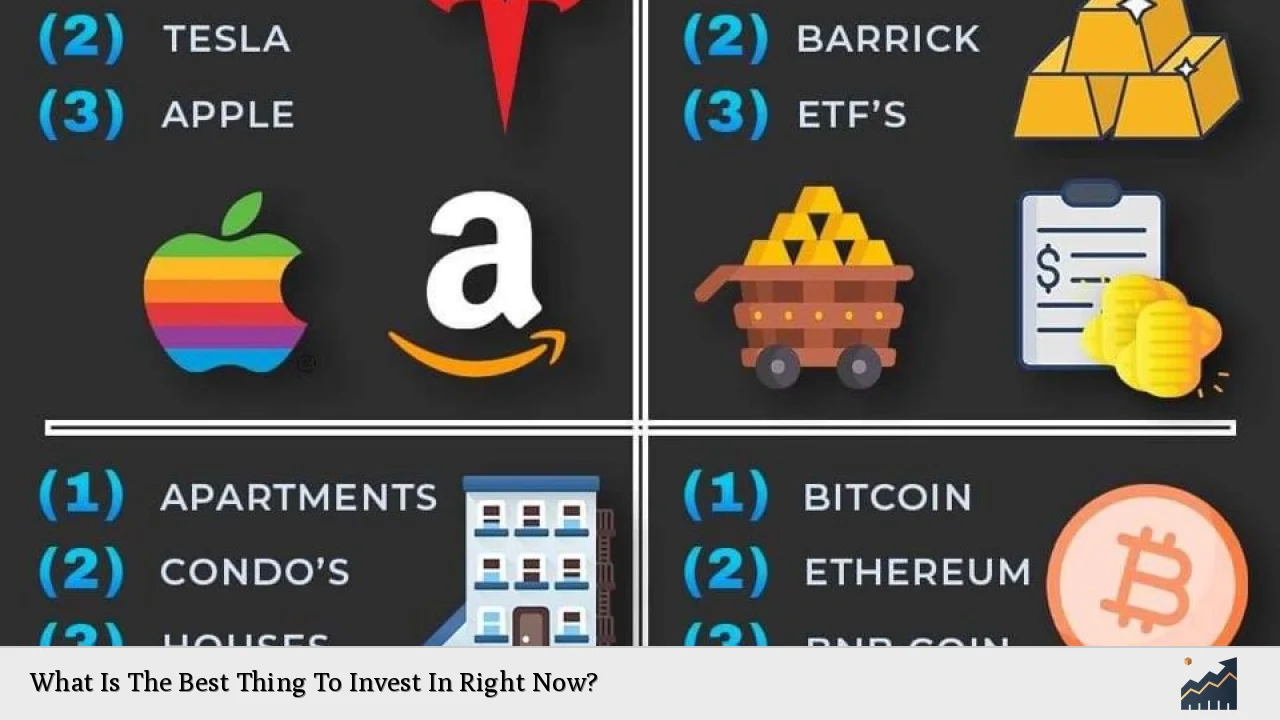

The best investments right now span various sectors, including technology, alternative assets, and sustainable investments. Each of these areas offers unique opportunities for growth and diversification. The key is to align investment choices with personal financial goals and risk tolerance.

| Investment Type | Key Characteristics |

|---|---|

| Technology | High growth potential; includes AI and biotech. |

| Alternative Assets | Less correlation with traditional markets; includes real estate and private equity. |

| Sustainable Investments | Focus on ESG factors; growing demand for impact investing. |

Emerging Technologies

Investing in emerging technologies is one of the most promising strategies for 2025. Sectors like artificial intelligence (AI), biotechnology, and renewable energy are expected to drive significant growth. AI, in particular, is transforming industries by enhancing efficiency and creating new business models. Companies involved in AI development are likely to see substantial returns as businesses increasingly adopt these technologies.

The biotechnology sector also presents compelling investment opportunities. Innovations in healthcare, such as gene editing and personalized medicine, are revolutionizing treatment options and improving patient outcomes. As the global population ages and healthcare needs increase, biotech companies are well-positioned for growth.

Renewable energy is another critical area of focus. With the world moving towards sustainability, investments in solar, wind, and other renewable sources are gaining traction. Companies that provide solutions for energy efficiency and carbon reduction will likely benefit from government incentives and consumer demand.

Alternative Investments

Alternative investments have gained popularity among younger investors who seek diversification beyond traditional stocks and bonds. These include private equity, hedge funds, real estate, and cryptocurrencies.

Private equity offers the potential for high returns but comes with higher risks due to illiquidity. Investors can access this asset class through specialized funds that pool capital from multiple investors. Hedge funds provide strategies that can profit in both rising and falling markets, appealing to those looking to hedge against market volatility.

Real estate remains a solid investment choice as it typically appreciates over time and provides rental income. With rising interest rates impacting mortgage costs, investors should carefully assess market conditions before entering this sector.

Cryptocurrencies continue to attract attention due to their potential for high returns despite their volatility. Investors should approach crypto with caution, ensuring they understand the underlying technology and market dynamics.

Sustainable Investments

The shift towards sustainable investments reflects a growing awareness of environmental, social, and governance (ESG) issues among investors. This trend is not just a passing phase; it represents a fundamental change in how people view investing.

Investors are increasingly seeking out companies that prioritize sustainability alongside profitability. This includes businesses focused on reducing carbon footprints, promoting social equity, and maintaining transparent governance practices.

Impact investing allows individuals to support causes they care about while still seeking financial returns. Funds that focus on renewable energy projects or companies with strong ESG ratings are likely to attract more capital as awareness increases.

Stock Market Trends

As we look at the stock market for 2025, several key themes emerge that investors should consider:

- Technology Stocks: Companies involved in AI, cloud computing, and cybersecurity are projected to perform well as demand for digital solutions continues to rise.

- Healthcare Stocks: With ongoing innovations in pharmaceuticals and medical technology, healthcare remains a resilient sector for investment.

- Consumer Discretionary Stocks: As consumer confidence grows post-pandemic, companies in retail and travel may see increased revenues.

Investors should also be aware of macroeconomic factors such as interest rates and inflation when making stock market decisions. A balanced portfolio that includes a mix of growth stocks and defensive positions can help mitigate risks associated with market fluctuations.

Real Estate Investment Trusts (REITs)

For those interested in real estate without the complexities of direct ownership, Real Estate Investment Trusts (REITs) offer an attractive alternative. REITs allow investors to pool their money into real estate portfolios that generate income through property leasing or sales.

Investing in REITs provides several advantages:

- Liquidity: Unlike traditional real estate investments, REITs can be bought or sold on stock exchanges.

- Diversification: REITs often invest in various types of properties across different geographical locations.

- Income Generation: Many REITs pay dividends based on rental income received from properties they manage.

Investors should research different types of REITs—such as those focused on residential properties versus commercial spaces—to find opportunities that align with their investment goals.

Fixed Income Investments

While equities capture much attention, fixed income investments remain a critical component of a well-rounded portfolio. Bonds can provide stability during volatile market conditions while generating income through interest payments.

With interest rates expected to stabilize or decline slightly in 2025, bond prices may rise as yields fall. Investors should consider diversifying their fixed income holdings across government bonds, corporate bonds, and municipal bonds to manage risk effectively.

Key Considerations for Fixed Income Investments

- Credit Quality: Higher-rated bonds generally carry lower risk but also offer lower yields.

- Duration Risk: Longer-term bonds are more sensitive to interest rate changes than shorter-term bonds.

- Inflation Protection: Consider inflation-linked bonds if concerns about rising prices persist.

FAQs About What Is The Best Thing To Invest In Right Now

- What sectors should I invest in for 2025?

Focus on technology, renewable energy, healthcare, and alternative assets. - Are alternative investments worth it?

Yes, they offer diversification but come with higher risks. - How important is ESG investing?

ESG investing aligns financial goals with ethical considerations; its importance is growing. - What role do REITs play in a portfolio?

REITs provide exposure to real estate without direct ownership while generating income. - Should I consider fixed income investments?

Yes, they add stability to your portfolio amid equity market volatility.

In conclusion, the best investments right now encompass a variety of sectors tailored to individual financial goals and risk tolerance levels. By staying informed about market trends and diversifying portfolios across emerging technologies, alternative assets, sustainable investments, stocks, real estate trusts, and fixed income options, investors can position themselves for success in 2025 and beyond.