Index funds have become increasingly popular among investors seeking a low-cost, diversified approach to building wealth. These passive investment vehicles track specific market indexes, offering broad exposure to various sectors and companies. When considering the best index fund to invest in, several factors come into play, including expense ratios, tracking accuracy, and the underlying index itself.

The “best” index fund can vary depending on an investor’s goals, risk tolerance, and investment horizon. However, some index funds consistently stand out due to their performance, low costs, and broad market coverage. Let’s explore some top contenders and key considerations for choosing the right index fund for your portfolio.

| Factor | Importance |

|---|---|

| Expense Ratio | Lower costs can significantly impact long-term returns |

| Tracking Error | Minimal deviation from the underlying index is ideal |

| Asset Under Management (AUM) | Larger funds tend to be more stable and liquid |

| Underlying Index | Determines the fund’s diversification and potential returns |

Top Index Funds to Consider

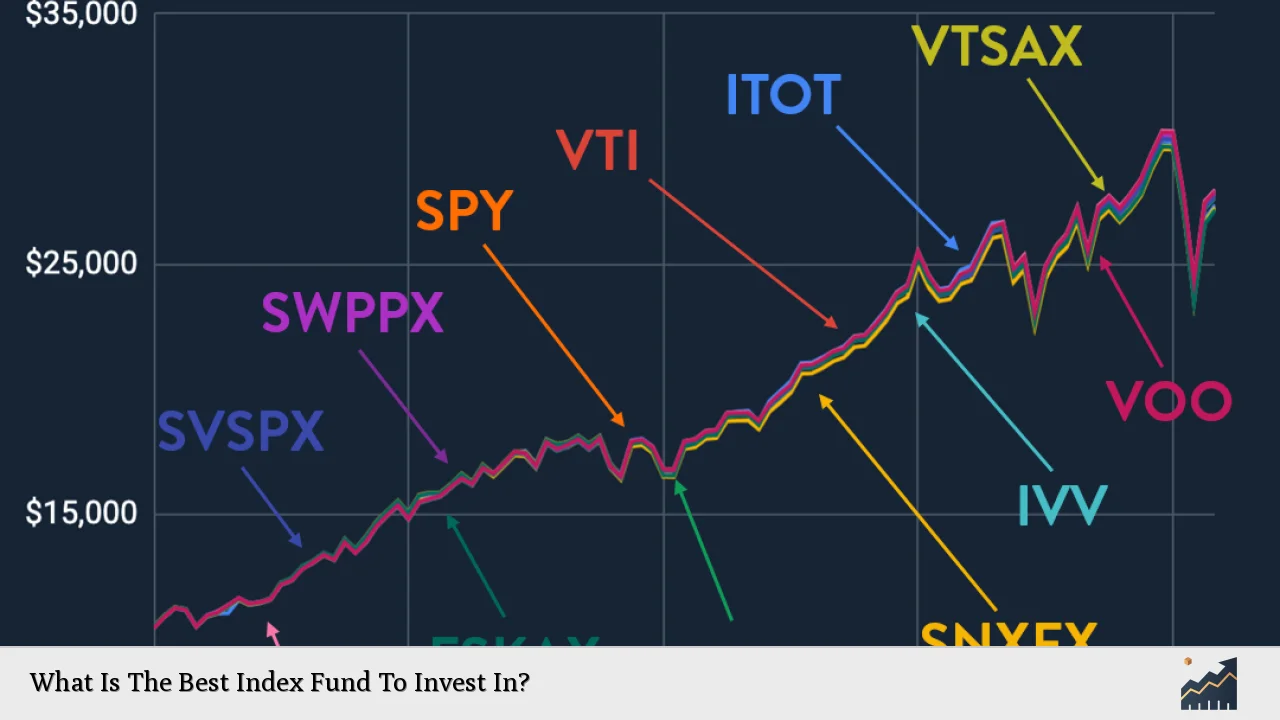

When evaluating the best index funds for 2025 and beyond, several options stand out based on their performance, cost-effectiveness, and broad market exposure. Here are some top contenders:

S&P 500 Index Funds

S&P 500 index funds remain a popular choice for many investors due to their broad exposure to large-cap U.S. stocks. These funds track the S&P 500 index, which includes 500 of the largest publicly traded companies in the United States. Some notable options include:

1. iShares Core S&P 500 ETF (IVV): This fund offers low-cost exposure to the S&P 500 with an expense ratio of just 0.03%. It has a strong track record of closely tracking the index and boasts significant assets under management, providing excellent liquidity.

2. Schwab S&P 500 Index Fund (SWPPX): With an even lower expense ratio of 0.02%, this mutual fund is an attractive option for investors looking for a cost-effective way to invest in the S&P 500. It has a solid performance history and is backed by Charles Schwab, a reputable name in the industry.

Total Market Index Funds

For investors seeking even broader market exposure, total market index funds can be an excellent choice. These funds typically track indexes that include small and mid-cap stocks in addition to large-cap companies. Some top options include:

1. Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX): This fund tracks the CRSP US Total Market Index, offering exposure to the entire U.S. stock market. With a low expense ratio and a long-standing reputation, it’s a favorite among long-term investors.

2. Fidelity ZERO Total Market Index Fund (FZROX): This fund stands out for its zero expense ratio, making it an incredibly cost-effective option for investors. It tracks the Fidelity U.S. Total Investable Market Index, providing broad market exposure.

International Index Funds

Diversifying beyond the U.S. market can be crucial for a well-rounded portfolio. International index funds offer exposure to global markets, potentially reducing overall portfolio risk. Consider these options:

1. Vanguard Total International Stock Index Fund (VTIAX): This fund tracks the FTSE Global All Cap ex US Index, providing exposure to both developed and emerging markets outside the United States. It offers a low expense ratio and broad international diversification.

2. iShares Core MSCI EAFE ETF (IEFA): Focusing on developed markets outside North America, this ETF tracks the MSCI EAFE Index. It offers a cost-effective way to gain exposure to established international economies.

Sector-Specific Index Funds

For investors looking to target specific industries or sectors, sector-specific index funds can be valuable tools. These funds allow for more focused investments in areas like technology, healthcare, or energy. Some popular options include:

1. Technology Select Sector SPDR Fund (XLK): This ETF tracks the Technology Select Sector Index, offering exposure to major tech companies in the S&P 500.

2. Vanguard Health Care Index Fund Admiral Shares (VHCIX): This fund tracks the MSCI US Investable Market Health Care 25/50 Index, providing broad exposure to the healthcare sector.

Choosing the Right Index Fund

When selecting the best index fund for your portfolio, consider the following factors:

- Investment goals: Determine whether you’re seeking growth, income, or a balance of both.

- Risk tolerance: Assess your comfort level with market fluctuations and adjust your fund selection accordingly.

- Time horizon: Consider how long you plan to hold the investment, as this can impact your choice of index and fund type.

- Costs: Pay close attention to expense ratios, as even small differences can significantly impact long-term returns.

- Tax considerations: For taxable accounts, consider the tax efficiency of ETFs versus mutual funds.

- Diversification: Ensure your chosen fund aligns with your overall portfolio diversification strategy.

Benefits of Index Fund Investing

Investing in index funds offers several advantages:

- Low costs: Index funds typically have lower expense ratios compared to actively managed funds.

- Diversification: A single index fund can provide exposure to hundreds or thousands of stocks.

- Simplicity: Index funds offer a straightforward investment approach, requiring less research and monitoring.

- Tax efficiency: Many index funds, especially ETFs, tend to be more tax-efficient due to lower turnover.

- Consistent performance: While not guaranteed, index funds often outperform actively managed funds over the long term.

Potential Drawbacks

While index funds offer many benefits, it’s important to consider potential drawbacks:

- Limited upside: Index funds won’t outperform their benchmark, potentially missing out on exceptional returns from individual stocks.

- Lack of downside protection: During market downturns, index funds will follow the market’s decline without any active management to mitigate losses.

- Tracking error: Some index funds may not perfectly replicate their benchmark’s performance due to various factors.

- Concentration risk: Certain indexes may be heavily weighted towards specific sectors or companies, potentially increasing risk.

Conclusion

Choosing the best index fund depends on your individual financial situation, goals, and risk tolerance. S&P 500 index funds like IVV or SWPPX offer excellent core holdings for many investors, providing broad exposure to large-cap U.S. stocks at very low costs. For those seeking even broader diversification, total market funds like VTSAX or FZROX can be attractive options.

International index funds such as VTIAX or IEFA can complement domestic holdings, while sector-specific funds allow for more targeted investments. Regardless of your choice, the key is to align your index fund selection with your overall investment strategy and to regularly review and rebalance your portfolio as needed.

Remember that while past performance can be indicative, it doesn’t guarantee future results. Always conduct thorough research or consult with a financial advisor before making investment decisions. By carefully selecting index funds that align with your goals and risk tolerance, you can build a robust, diversified portfolio designed for long-term success.

FAQs About What Is The Best Index Fund To Invest In

- Are index funds suitable for beginner investors?

Yes, index funds are often recommended for beginners due to their simplicity, low costs, and broad market exposure. - How often should I rebalance my index fund portfolio?

Most experts recommend rebalancing annually or when your asset allocation drifts significantly from your target. - Can index funds outperform actively managed funds?

Over long periods, many index funds have outperformed actively managed funds, primarily due to lower fees. - What’s the difference between an index mutual fund and an index ETF?

The main differences are in how they’re traded, their minimum investment requirements, and potential tax efficiency. - Should I invest in multiple index funds or stick to one?

Investing in multiple index funds can provide additional diversification, but it depends on your individual goals and risk tolerance.