Investing in Exchange-Traded Funds (ETFs) has become increasingly popular due to their flexibility, lower costs, and diversified exposure to various asset classes. ETFs are investment funds that hold a collection of securities and trade on stock exchanges, similar to individual stocks. They can track indices, sectors, commodities, or even specific investment strategies. This article will explore some of the best ETFs to consider for investment in 2025, focusing on their performance, expense ratios, and investment strategies.

| ETF Name | Key Features |

|---|---|

| Vanguard S&P 500 ETF (VOO) | Tracks the S&P 500 Index with low expense ratio of 0.03% |

| Invesco QQQ Trust (QQQ) | Focuses on the Nasdaq-100 Index with a 0.20% expense ratio |

Understanding ETFs

ETFs offer a unique way to invest in a variety of assets without the need to purchase each security individually. They provide diversification, which can help reduce risk while maintaining potential returns. Investors can choose from various types of ETFs, including equity, bond, commodity, and sector-specific funds.

The primary advantages of investing in ETFs include:

- Cost Efficiency: Many ETFs have lower expense ratios compared to mutual funds.

- Liquidity: ETFs can be bought and sold throughout the trading day at market prices.

- Transparency: Most ETFs disclose their holdings daily, allowing investors to see exactly what they own.

With these benefits in mind, it is essential to evaluate which ETFs align with your investment goals and risk tolerance.

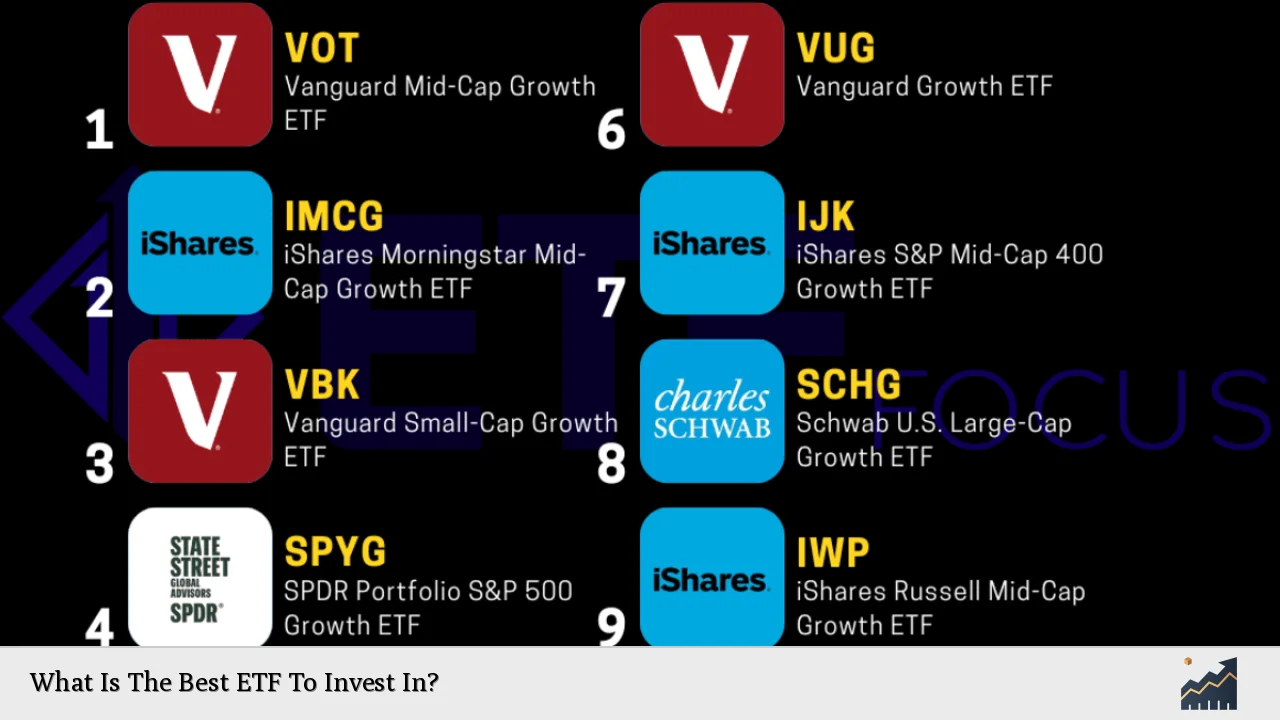

Top ETFs for 2025

When considering the best ETFs for investment in 2025, several factors come into play, including past performance, expense ratios, and market trends. Here are some top contenders:

Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF is one of the most popular ETFs available today. It aims to replicate the performance of the S&P 500 Index, which includes 500 of the largest U.S. companies.

- Expense Ratio: 0.03%

- Performance: Historically strong returns with a long-term growth outlook.

- Investment Strategy: Passive management that tracks a broad market index.

This ETF is an excellent choice for investors seeking exposure to large-cap U.S. equities with minimal fees.

Invesco QQQ Trust (QQQ)

The Invesco QQQ Trust focuses on the Nasdaq-100 Index, which consists of 100 of the largest non-financial companies listed on the Nasdaq Stock Market.

- Expense Ratio: 0.20%

- Performance: Has outperformed many other indices over the past decade.

- Investment Strategy: Targets growth-oriented sectors such as technology.

Investors looking for exposure to high-growth companies may find QQQ particularly appealing.

iShares Core S&P Small-Cap ETF (IJR)

For those interested in small-cap stocks, the iShares Core S&P Small-Cap ETF provides access to smaller U.S. companies that have significant growth potential.

- Expense Ratio: 0.07%

- Performance: Historically strong performance during economic recoveries.

- Investment Strategy: Tracks small-cap stocks across various sectors.

This ETF is suitable for investors seeking diversification through small-cap equities.

VanEck Semiconductor ETF (SMH)

The VanEck Semiconductor ETF targets companies involved in semiconductor production and design, an industry poised for growth due to increasing demand for technology.

- Expense Ratio: 0.35%

- Performance: Strong historical returns driven by technological advancements.

- Investment Strategy: Focuses on a specific sector with high growth potential.

Investors interested in technology and innovation may consider this ETF as part of their portfolio.

Global X Robotics & Artificial Intelligence UCITS ETF (BOTZ)

As technology continues to evolve, investing in robotics and AI has become increasingly attractive. The Global X Robotics & Artificial Intelligence UCITS ETF focuses on companies involved in these sectors.

- Expense Ratio: Approximately 0.68%

- Performance: Benefiting from trends towards automation and AI integration.

- Investment Strategy: Invests in companies leading advancements in robotics and AI technologies.

This ETF is ideal for investors looking to capitalize on future technological trends.

Evaluating ETF Performance

When choosing an ETF, it's crucial to evaluate its performance metrics over various time frames. Key indicators include:

- Annual Returns: Look at both short-term (1-year) and long-term (5-year) performance.

- Expense Ratios: Lower fees can significantly impact overall returns over time.

- Holdings Diversification: A well-diversified portfolio within the ETF can reduce risk.

Investors should also consider market conditions and economic forecasts when evaluating potential investments.

Risks Associated with ETFs

While ETFs offer numerous advantages, they are not without risks:

- Market Risk: Like all investments tied to market performance, ETFs can lose value based on market fluctuations.

- Sector Risk: Investing heavily in a specific sector or industry may expose investors to higher volatility.

- Tracking Error: Some ETFs may not perfectly replicate their underlying index due to management fees or other factors.

Understanding these risks is essential for making informed investment decisions.

FAQs About Best ETFs To Invest In

- What is an ETF?

An Exchange-Traded Fund (ETF) is an investment fund that holds multiple underlying assets and trades on stock exchanges like individual stocks. - How do I choose an ETF?

Consider factors such as performance history, expense ratios, diversification, and alignment with your investment goals. - Are there any risks associated with investing in ETFs?

Yes, risks include market risk, sector risk, and tracking error. - What are some popular ETFs?

Popular options include Vanguard S&P 500 ETF (VOO), Invesco QQQ Trust (QQQ), and VanEck Semiconductor ETF (SMH). - How do I buy an ETF?

You can buy an ETF through a brokerage account just like you would purchase individual stocks.

Investing in ETFs can be a strategic way to build wealth over time while managing risk through diversification. By understanding your investment goals and evaluating various options available in the market today, you can make informed decisions that align with your financial objectives. Whether you are looking for growth through technology or stability through large-cap stocks, there are numerous ETFs tailored to meet diverse investor needs in 2025.