Investing in exchange-traded funds (ETFs) has become increasingly popular due to their flexibility, diversification, and lower fees compared to mutual funds. As we move into 2024, selecting the best ETFs can be crucial for achieving investment goals. This article will explore the top-performing ETFs of 2024, providing insights into their performance, sectors, and investment strategies.

The ETF market is vast, with thousands of options available across various sectors and asset classes. Investors often seek ETFs that align with their financial objectives, risk tolerance, and market outlook. In 2024, several key trends are emerging that investors should consider when selecting an ETF.

| Key Factors | Details |

|---|---|

| Performance | Top ETFs have shown significant returns in 2024. |

| Sectors | Technology, cryptocurrency, and healthcare are leading sectors. |

Top Performing ETFs of 2024

In 2024, several ETFs have outperformed others based on their returns and market trends. Here are some of the best options to consider:

- ProShares Bitcoin Strategy ETF (BITO): This ETF focuses on Bitcoin futures and has delivered an impressive return of 104.5% in 2024. With the growing interest in cryptocurrencies, BITO offers exposure to Bitcoin without the need for direct ownership.

- Roundhill Magnificent Seven ETF (MAGS): This fund targets seven major tech companies including Nvidia and Tesla, achieving a return of 63.9%. It is an excellent choice for investors looking to capitalize on leading tech stocks.

- Global X MSCI Argentina ETF (ARGT): This ETF has shown a remarkable performance with a 63.4% return. It provides exposure to the Argentine market, which has been buoyed by economic recovery efforts.

- Defiance Quantum ETF (QTUM): Focusing on quantum computing technologies, QTUM has achieved a return of 50.5%, making it a compelling option for investors interested in cutting-edge technology.

- Bitwise Crypto Industry Innovators ETF (BITQ): This fund invests in companies involved in the cryptocurrency sector and has returned 45.7% in 2024.

These ETFs represent a mix of traditional sectors and emerging technologies, showcasing the diverse opportunities available to investors.

Sector Analysis

Understanding which sectors are performing well can guide investment decisions. In 2024, certain sectors have outperformed others significantly:

Technology Sector

The technology sector continues to dominate the market with high growth potential. Key ETFs include:

- Invesco QQQ Trust (QQQ): Tracking the Nasdaq-100 Index, QQQ has returned approximately 25.6% in 2024.

- Vanguard Information Technology ETF (VGT): This fund focuses on technology companies and has delivered a return of around 29.3%.

Cryptocurrency Sector

Cryptocurrencies have gained traction as a viable investment option:

- ProShares Bitcoin Strategy ETF (BITO): As mentioned earlier, BITO leads with its substantial returns driven by Bitcoin’s price surge.

- Grayscale Bitcoin Trust (GBTC): Another popular choice among crypto investors that has also performed well this year.

Healthcare Sector

Healthcare remains a stable investment sector:

- iShares Nasdaq Biotechnology ETF (IBB): This fund focuses on biotech firms and has shown resilience with solid returns.

Investing across these sectors can provide diversification and help mitigate risks associated with market volatility.

Investment Strategies for 2024

When investing in ETFs for 2024, consider these strategies:

- Diversification: Spread investments across various sectors to reduce risk exposure.

- Focus on Trends: Identify sectors with strong growth potential such as technology and renewable energy.

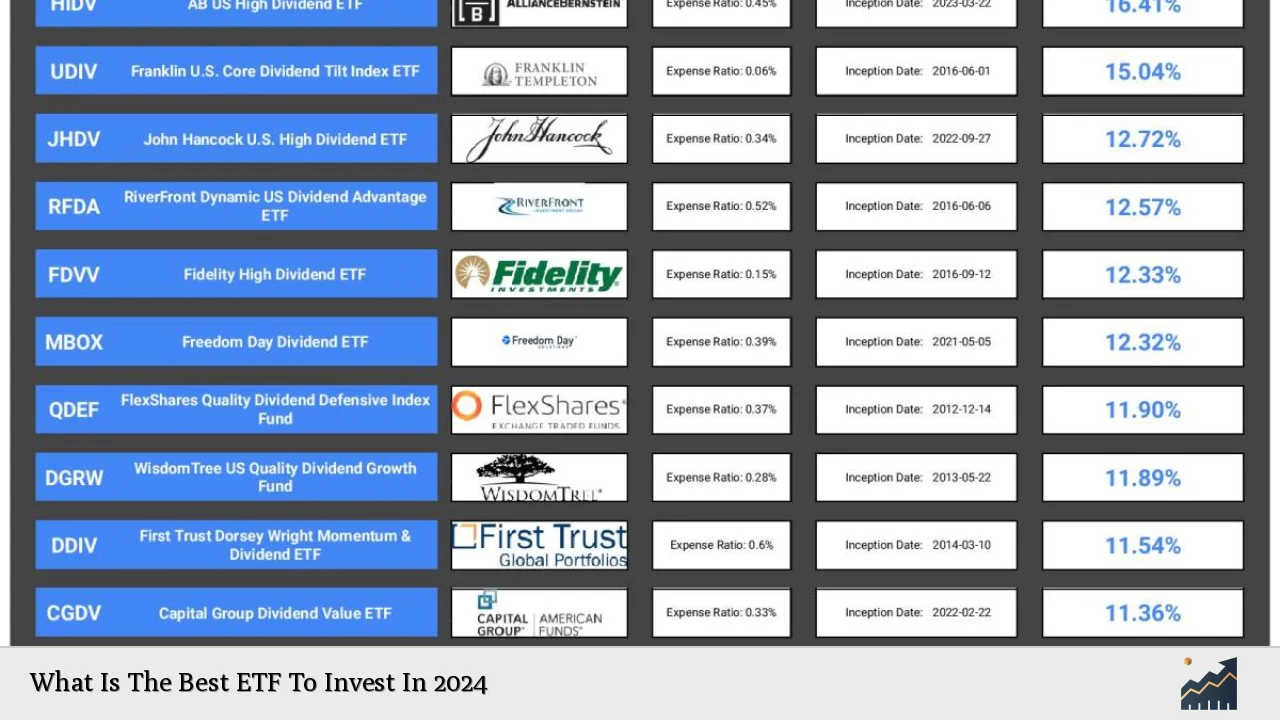

- Monitor Fees: Choose ETFs with low expense ratios to maximize returns over time.

- Stay Informed: Keep abreast of market trends and economic indicators that may affect your investments.

By employing these strategies, investors can enhance their chances of achieving favorable returns in 2024.

Risks Involved in ETF Investments

While ETFs offer many advantages, there are also risks to consider:

- Market Risk: Like any investment tied to market performance, ETFs can lose value during downturns.

- Liquidity Risk: Some niche ETFs may have lower trading volumes, affecting their liquidity during market fluctuations.

- Management Risk: The performance of actively managed ETFs depends on the manager’s decisions and expertise.

Investors should assess these risks against their financial goals before committing capital to any ETF.

FAQs About Best ETF To Invest In 2024

- What are the best-performing ETFs for 2024?

The best-performing ETFs include ProShares Bitcoin Strategy ETF (BITO) with a return of 104.5%, Roundhill Magnificent Seven ETF (MAGS) at 63.9%, and Global X MSCI Argentina ETF (ARGT) at 63.4%. - How do I choose an ETF?

Consider factors such as performance history, expense ratios, sector focus, and alignment with your investment goals. - Are there risks associated with investing in ETFs?

Yes, risks include market risk, liquidity risk, and management risk that can affect overall performance. - What sectors are trending in 2024?

The technology sector is leading along with cryptocurrency and healthcare as key areas for investment. - Is it better to invest in active or passive ETFs?

This depends on your investment strategy; active ETFs may offer higher potential returns but come with higher fees compared to passive options.

Investing wisely requires understanding both opportunities and risks associated with different funds. As you consider your options for 2024, keep these insights in mind to make informed decisions that align with your financial goals.