Investing in energy stocks can be a lucrative opportunity, especially given the global shift towards renewable energy and the increasing demand for traditional energy sources. As we enter 2025, several companies stand out due to their performance, strategic initiatives, and market positioning. This article will explore some of the best energy stocks to consider for investment, focusing on their growth potential, financial health, and market trends.

| Company | Key Highlights |

|---|---|

| Constellation Energy (CEG) | Leading in carbon-free generation with significant growth in earnings. |

| TC Energy (TRP) | Strong dividend history and ongoing infrastructure projects boosting revenue. |

| Exxon Mobil (XOM) | Stable performance with attractive dividends and strong market presence. |

Constellation Energy: A Leader in Clean Energy

Constellation Energy (CEG) has emerged as a frontrunner in the clean energy sector. The company focuses on carbon-free electricity generation, leveraging its extensive portfolio of nuclear and renewable energy assets. Notably, Constellation has experienced remarkable stock performance, with a 91% increase in value over the past year. Its strategic initiatives include a significant partnership with Microsoft, aimed at enhancing its carbon-free electricity offerings.

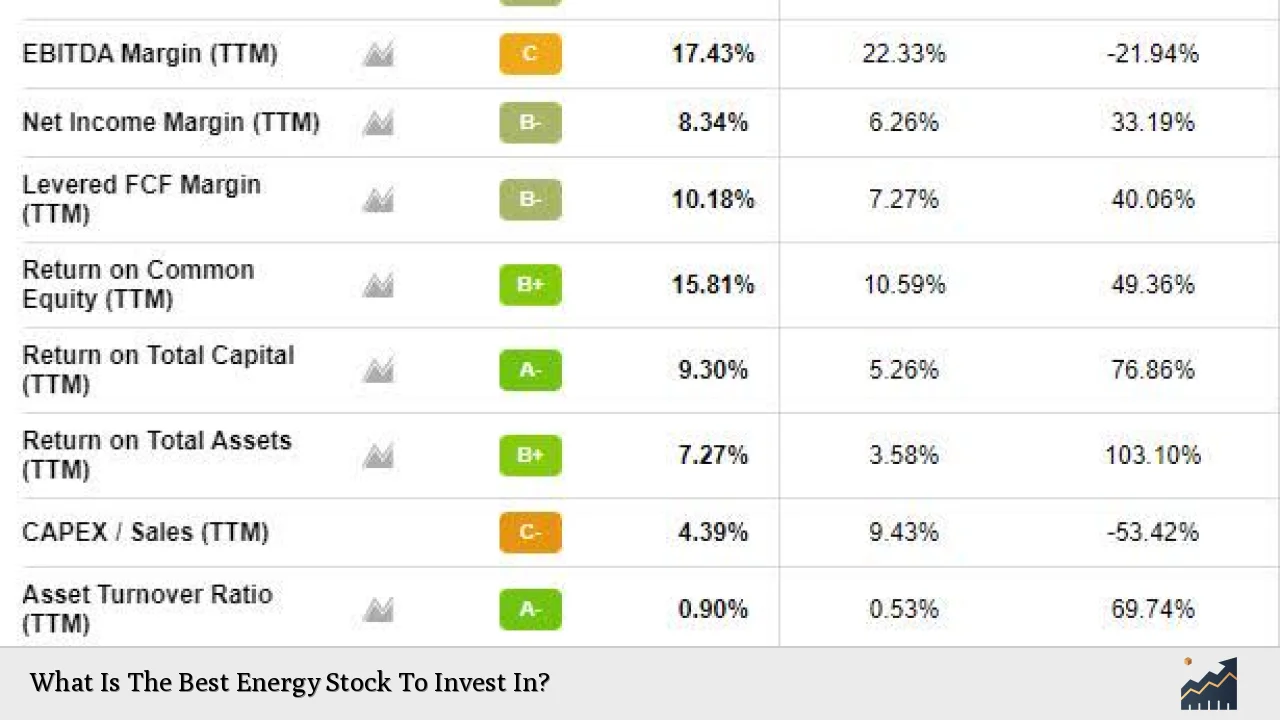

The company’s financial metrics are impressive, with analysts projecting an earnings per share (EPS) growth from $8.33 in the first fiscal year to $9.26 in the following year. Additionally, Constellation’s EBITDA is expected to rise from $4.025 billion in 2023 to $4.738 billion by 2026. This growth trajectory positions Constellation as an attractive option for investors seeking exposure to renewable energy.

Moreover, Constellation’s commitment to expanding its nuclear capacity further solidifies its market position. The company is investing approximately $800 million to enhance output at its facilities by 2029. This focus on growth and sustainability aligns well with global trends towards cleaner energy solutions.

TC Energy: A Strong Dividend Play

TC Energy (TRP) stands out as a solid choice for income-focused investors. With a dividend yield of 4.9%, TC Energy has consistently increased its dividends over the past 24 years, making it a reliable option for those seeking regular income from their investments.

The company has recently completed significant projects, including the Coastal GasLink pipeline, which is expected to drive revenue growth starting in 2025. Despite facing challenges such as rising costs and debt management, TC Energy’s management has effectively monetized non-core assets to strengthen its balance sheet.

Analysts have mixed views on TC Energy’s valuation; some suggest it is currently overvalued by about 23%, while others see potential for growth as new projects come online. The average price target for TC Energy is around $71.33 CAD, indicating room for appreciation if the company can maintain its dividend growth and execute its expansion plans effectively.

Exxon Mobil: Stability Amidst Volatility

Exxon Mobil (XOM) remains a stalwart in the energy sector, known for its robust financials and consistent dividend payouts. With a current dividend yield of approximately 3.68%, Exxon is appealing to investors looking for stability alongside capital appreciation.

In 2024, Exxon Mobil’s stock price increased by about 18%, reflecting its ability to navigate market fluctuations successfully. The company’s diversified portfolio includes upstream exploration and production as well as downstream refining operations, which provide a buffer against volatility in oil prices.

Exxon’s market capitalization stands at around $472.78 billion, making it one of the largest players in the industry. Analysts project that Exxon will continue to benefit from strong demand for fossil fuels while also investing in renewable technologies to adapt to changing market dynamics.

Gevo: Innovating Renewable Fuels

Gevo (GEVO) is another intriguing investment opportunity within the renewable energy sector. The company focuses on producing sustainable aviation fuel (SAF) and other biofuels through innovative processes that convert biomass into high-quality fuels.

Gevo’s stock has shown significant growth potential, with projections indicating a remarkable 101.5% increase in sales by 2025 compared to previous years. The company’s ambitious Net-Zero 1 project aims to revolutionize fuel production while minimizing environmental impact.

Investors should note that while Gevo presents exciting opportunities, it also carries risks associated with emerging technologies and market competition. However, for those willing to embrace these risks, Gevo could offer substantial rewards as global demand for sustainable fuels rises.

Shell: A Diversified Energy Giant

Shell (SHEL) continues to be a major player in both traditional and renewable energy markets. The company has made significant strides in transitioning towards cleaner energy solutions while maintaining strong cash flows from its oil and gas operations.

Shell’s financial strength is underscored by its ability to manage costs effectively while pursuing capital discipline across its operations. Analysts have noted that Shell’s valuation remains attractive compared to peers, with forecasts indicating a potential 7% increase in dividends for the upcoming quarter.

Investors should consider Shell’s diversified portfolio as it navigates the complexities of transitioning towards renewable energy while still capitalizing on its legacy fossil fuel business.

Conclusion: Choosing the Right Investment

When considering which energy stock to invest in, it’s essential to evaluate each company’s strengths, weaknesses, and market positioning.

- Constellation Energy offers robust growth prospects in clean energy.

- TC Energy provides stability through consistent dividends.

- Exxon Mobil remains a reliable choice amidst market volatility.

- Gevo presents innovative opportunities within renewable fuels.

- Shell balances traditional energy strengths with renewable initiatives.

Investors should align their choices with their risk tolerance and investment goals while keeping an eye on broader market trends affecting the energy sector.

FAQs About Best Energy Stock To Invest In

- What factors should I consider when investing in energy stocks?

Consider financial health, growth potential, dividend yield, and market trends. - Is investing in renewable energy stocks risky?

Yes, but they also offer significant growth potential as demand increases. - How do dividends affect my investment choice?

Dividends provide regular income and indicate a company’s financial stability. - Which energy stock has performed best recently?

Constellation Energy has shown remarkable performance with a 91% increase last year. - Should I diversify my investments within the energy sector?

Diversification can help mitigate risks associated with specific companies or technologies.