Investing in bond ETFs has become increasingly popular as a way to diversify portfolios and manage risk. With over 3,900 exchange-traded funds (ETFs) available in the U.S., approximately 780 focus exclusively on bonds. This variety allows investors to choose from a range of options tailored to their specific needs, whether they seek income, safety, or growth potential.

Bond ETFs can be categorized into several types, including government bonds, corporate bonds, and municipal bonds. Each type carries its own risk and return profile. For example, government bond ETFs are generally considered safer but may offer lower yields, while high-yield corporate bond ETFs can provide higher returns at the cost of increased risk.

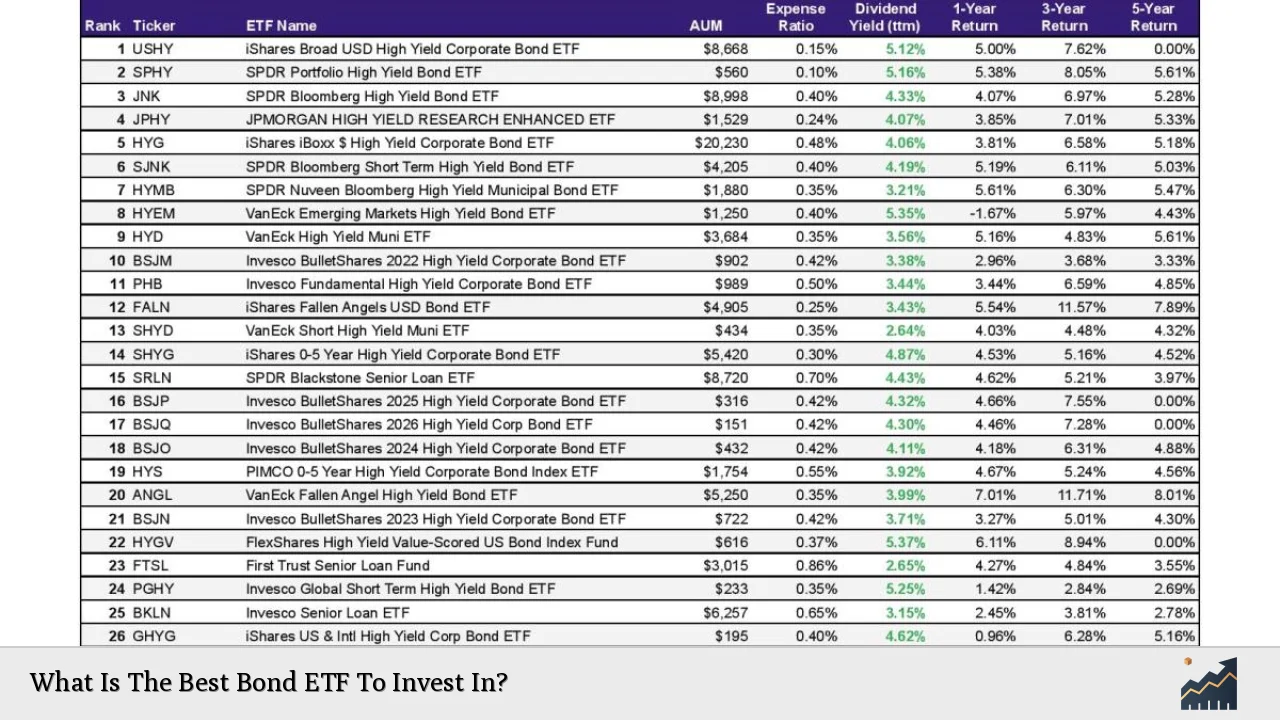

When selecting a bond ETF, it’s crucial to consider factors such as the expense ratio, yield, and the underlying assets held by the ETF. This article will explore some of the best bond ETFs available for investment in 2025, highlighting their features and potential benefits.

| ETF Name | Expense Ratio |

|---|---|

| Vanguard Total Bond Market ETF (BND) | 0.03% |

| Vanguard Ultra-Short Bond ETF (VUSB) | 0.10% |

| Amplify Samsung SOFR ETF (SOFR) | 0.20% |

| iShares 0-3 Month Treasury Bond ETF (SGOV) | 0.09% |

| Schwab Short-Term U.S. Treasury ETF (SCHO) | 0.03% |

Key Considerations When Choosing Bond ETFs

When selecting a bond ETF, investors should consider several critical factors to align their investments with financial goals and risk tolerance.

Expense Ratio: The expense ratio indicates how much of your investment will go toward fund management fees. Lower expense ratios can significantly enhance long-term returns, especially in a low-yield environment.

Yield: The yield is a crucial metric that reflects the income generated by the ETF relative to its price. Higher yields may indicate higher risks, so it’s essential to balance yield expectations with risk tolerance.

Duration and Maturity: The duration of the bonds within the ETF affects sensitivity to interest rate changes. Longer durations typically carry higher interest rate risk but can also offer greater rewards when rates fall.

Credit Quality: Understanding the credit quality of the bonds held within the ETF is vital. Higher-rated bonds are generally safer but may offer lower yields compared to lower-rated “junk” bonds.

Liquidity: The liquidity of an ETF is important for investors who may need to buy or sell shares quickly. ETFs with high trading volumes tend to have tighter bid-ask spreads, reducing transaction costs.

By considering these factors, investors can make informed decisions when selecting bond ETFs that suit their financial objectives.

Top Bond ETFs for 2025

Several bond ETFs stand out for their performance and features in 2025. Below are some of the most recommended options based on expert analyses and market trends.

Vanguard Total Bond Market ETF (BND)

The Vanguard Total Bond Market ETF (BND) is one of the most popular choices among investors due to its broad exposure and low expense ratio of 0.03%. It holds over 11,300 different bonds, including U.S. Treasuries, mortgage-backed securities, and corporate bonds. With a 30-day SEC yield of 4.5%, BND provides a balance between safety and income generation.

Vanguard Ultra-Short Bond ETF (VUSB)

For those seeking capital preservation with slightly higher yields than cash equivalents, the Vanguard Ultra-Short Bond ETF (VUSB) is an excellent option. This actively managed fund focuses on high-quality short-maturity bonds, offering a yield of 3.8% with an expense ratio of 0.10%. It is ideal for conservative investors looking for stability without sacrificing too much yield.

Amplify Samsung SOFR ETF (SOFR)

The Amplify Samsung SOFR ETF (SOFR) stands out as a unique product designed to track the secured overnight financing rate (SOFR). With an expense ratio of 0.20% and a yield of 4.6%, it offers minimal interest rate risk while providing monthly income, making it suitable for risk-averse investors looking for alternatives to traditional cash investments.

iShares 0-3 Month Treasury Bond ETF (SGOV)

The iShares 0-3 Month Treasury Bond ETF (SGOV) focuses exclusively on short-term U.S. Treasury bills with maturities ranging from zero to three months. It boasts an impressive liquidity profile with a very low expense ratio of 0.09% and a yield of 4.4%. This makes SGOV an attractive option for investors prioritizing safety and liquidity.

Schwab Short-Term U.S. Treasury ETF (SCHO)

The Schwab Short-Term U.S. Treasury ETF (SCHO) is another solid choice for conservative investors seeking exposure to government debt without taking on significant duration risk. With an expense ratio of just 0.03%, SCHO offers competitive yields while focusing on short-term Treasuries.

Specialized Bond ETFs

In addition to core bond ETFs, specialized bond ETFs cater to specific investment strategies or sectors within the bond market.

iShares Core U.S. Aggregate Bond ETF (AGG)

The iShares Core U.S. Aggregate Bond ETF (AGG) is designed for investors looking for comprehensive exposure to the total U.S. bond market while maintaining a low expense ratio of 0.04%. It includes government bonds, corporate debt, and mortgage-backed securities, making it an excellent choice for diversified fixed-income exposure.

Trowe Price Floating Rate ETF (TFLR)

For those concerned about rising interest rates impacting fixed-income investments, the Trowe Price Floating Rate ETF (TFLR) provides exposure to floating-rate loans that adjust with interest rate changes. This can help mitigate interest rate risk while offering attractive yields in a rising rate environment.

Vanguard Intermediate-Term Corporate Bond ETF (VCIT)

The Vanguard Intermediate-Term Corporate Bond ETF (VCIT) focuses on corporate bonds with intermediate maturities, providing a balance between yield and credit quality at an expense ratio of 0.05%. This fund can be an excellent choice for investors seeking higher yields than government bonds without venturing into high-yield territory.

Risks Associated with Bond ETFs

While bond ETFs offer various benefits, they are not without risks that investors should carefully consider before investing:

- Interest Rate Risk: As interest rates rise, bond prices typically fall, which can negatively impact the value of bond ETFs.

- Credit Risk: Investing in corporate or high-yield bonds increases exposure to credit risk; if issuers default on payments, it can lead to losses.

- Liquidity Risk: Some specialized or less popular bond ETFs may have lower trading volumes, leading to wider bid-ask spreads and potential difficulties in executing trades.

- Inflation Risk: Inflation can erode purchasing power; thus, fixed-rate bonds may lose value in real terms during periods of rising inflation.

Understanding these risks is essential for making informed investment decisions in the bond market.

FAQs About Best Bond ETFs

- What are bond ETFs?

Bond ETFs are investment funds that hold a diversified portfolio of bonds and trade on stock exchanges like stocks. - How do I choose a bond ETF?

Consider factors like expense ratios, yield, duration, credit quality, and liquidity when choosing a bond ETF. - Are bond ETFs safe investments?

Bond ETFs are generally safer than stocks but carry risks such as interest rate risk and credit risk. - What is the average yield for bond ETFs?

The average yield varies by fund type; core bond ETFs typically yield around 3-4%, while high-yield options may exceed this. - Can I lose money investing in bond ETFs?

Yes, particularly if interest rates rise or if you invest in lower-quality bonds that default.

Investing in bond ETFs can be an effective way to diversify your portfolio and manage risk while seeking income generation or capital preservation strategies tailored to your financial goals in 2025 and beyond.