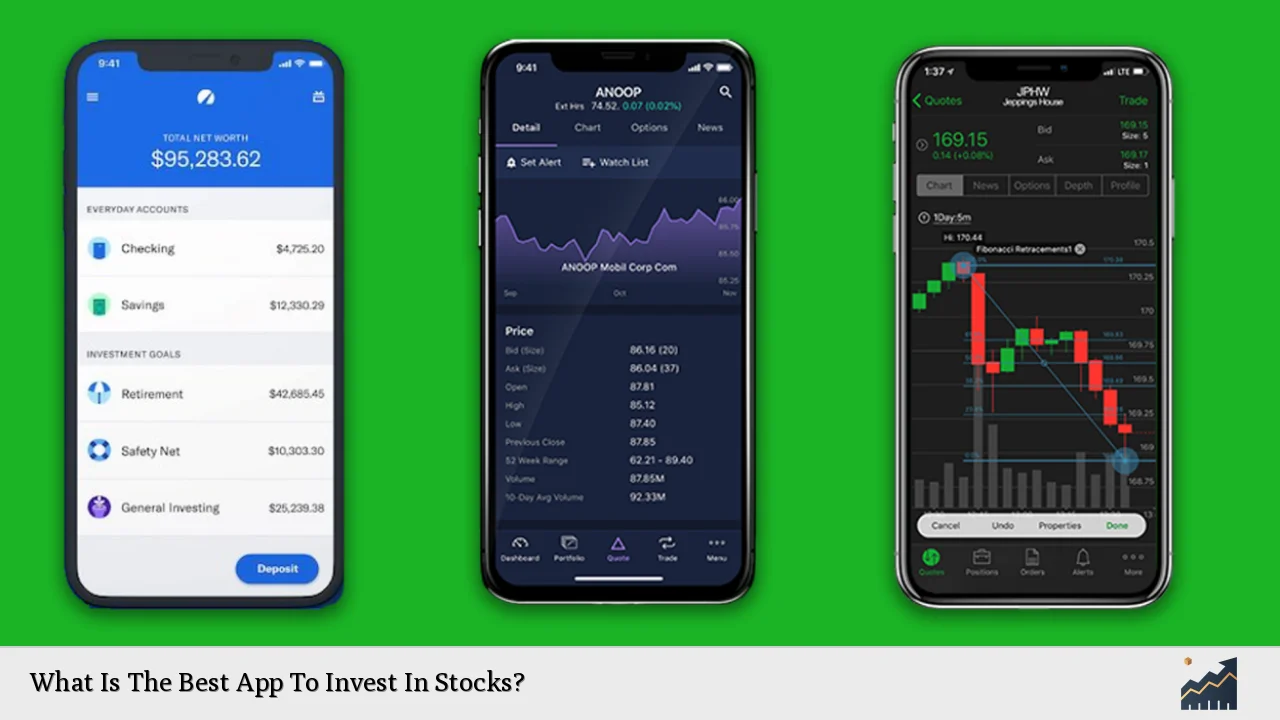

Choosing the best app to invest in stocks can significantly impact your investment journey. With a plethora of options available, selecting the right one depends on various factors such as user experience, fees, available features, and your investment style. Whether you are a beginner looking for an easy-to-use platform or an experienced trader seeking advanced tools, there is an app tailored to your needs.

Investment apps have transformed how people manage their portfolios. They provide access to stock markets at your fingertips, allowing users to trade, analyze market trends, and monitor investments in real time. The best apps often offer commission-free trading, educational resources, and robust customer support.

This article will explore some of the top investment apps for 2025, highlighting their features, pros, and cons to help you make an informed decision.

| App Name | Best For |

|---|---|

| E*TRADE | Overall Best Investment App |

| Fidelity | Full-Service Brokerage |

| SoFi Invest | Beginners |

| Interactive Brokers | Active Traders |

| Webull | Low-Cost Trading |

E*TRADE: Overall Best Investment App

E*TRADE stands out as the overall best investment app for its comprehensive features and user-friendly interface. It offers a wide range of investment options including stocks, ETFs, mutual funds, and options trading. The app is designed for both beginners and experienced traders, providing educational resources that help users understand market dynamics.

E*TRADE’s mobile app includes advanced charting tools and real-time data that allow investors to make informed decisions on the go. Additionally, it offers a robust selection of research reports and analysis tools that cater to various trading strategies.

Features of E*TRADE:

- Commission-Free Trades: E*TRADE allows users to trade stocks and ETFs without paying commissions.

- User-Friendly Interface: The app is intuitive, making it easy for new investors to navigate.

- Educational Resources: Users have access to articles, videos, and webinars that enhance their investing knowledge.

However, while E*TRADE excels in many areas, it may not be the cheapest option for all types of trades. Users should consider their trading frequency and style before committing.

Fidelity: Best Full-Service Brokerage

Fidelity is renowned as a full-service brokerage that caters to a wide range of investors. It offers zero-commission trading on stocks and ETFs while providing extensive research tools and personalized financial advice. Fidelity’s mobile app is particularly beneficial for those who prefer a more hands-on approach to managing their investments.

One of Fidelity’s standout features is its extensive educational resources aimed at helping investors make informed decisions. The app also integrates seamlessly with other Fidelity services such as retirement accounts and wealth management.

Key Features of Fidelity:

- No Account Minimum: Investors can start with any amount.

- Comprehensive Research Tools: Fidelity provides in-depth analysis and market insights.

- Retirement Planning Resources: The app includes tools specifically designed for retirement savings.

While Fidelity is excellent for long-term investors seeking comprehensive support, its platform may be overwhelming for those who prefer simplicity.

SoFi Invest: Best for Beginners

SoFi Invest is an ideal choice for beginners looking to start investing with minimal barriers. With no commissions on trades and a low minimum investment requirement of just $1, SoFi makes it easy for anyone to enter the stock market.

The app features a straightforward interface that simplifies the investment process. Additionally, SoFi offers automated investing options where users can have their portfolios managed based on their risk tolerance and financial goals.

Advantages of SoFi Invest:

- Easy Setup: Users can create an account quickly and start investing with minimal funds.

- Financial Planning Help: SoFi provides access to certified financial planners at no additional cost.

- Commission-Free Trading: All trades are commission-free, making it cost-effective for beginners.

However, SoFi lacks some advanced trading features that more experienced investors might seek.

Interactive Brokers: Best for Active Traders

For active traders who require sophisticated tools and low-cost trading options, Interactive Brokers is a top choice. The platform offers extensive resources including advanced trading tools and access to international markets.

Interactive Brokers provides a tiered pricing structure that allows frequent traders to benefit from lower commission rates. The app also includes powerful analytics tools that cater to both technical analysis and fundamental research.

Highlights of Interactive Brokers:

- Low-Cost Trading: Competitive commission rates especially beneficial for high-volume traders.

- Advanced Trading Tools: Features like algorithmic trading and customizable dashboards are available.

- Global Market Access: Users can trade in multiple currencies across various international markets.

While Interactive Brokers excels in offering advanced features, its complexity may not be suitable for casual or beginner investors.

Webull: Best Low-Cost Trading App

Webull has gained popularity among active traders due to its zero-commission structure on stock trades and its robust analytical tools. The app is designed with an emphasis on providing real-time market data and customizable watchlists.

Webull also offers advanced charting capabilities that appeal to day traders looking for technical analysis tools. Its community features allow users to engage with other traders through forums and discussions about market strategies.

Benefits of Webull:

- No Commission Fees: Users can trade stocks without incurring commissions.

- Advanced Charting Tools: The app provides detailed charts with technical indicators.

- Community Engagement: Traders can share insights and strategies within the app’s community forums.

However, Webull may not provide as much educational content as other platforms, which could be a drawback for novice investors seeking guidance.

FAQs About What Is The Best App To Invest In Stocks

- What should I look for in an investment app?

Look for features like commission-free trading, user-friendly interface, educational resources, and customer support. - Are investment apps safe to use?

Yes, most reputable investment apps use strong encryption methods to protect user data. - Can I start investing with little money?

Yes, many apps allow you to start investing with as little as $1. - Do I need prior investing experience?

No, many apps are designed specifically for beginners with educational resources available. - What types of investments can I make through these apps?

You can typically invest in stocks, ETFs, mutual funds, options, and sometimes cryptocurrencies.

In conclusion, choosing the best stock investment app depends on your individual needs as an investor. Whether you prioritize low costs, advanced trading tools, or educational resources will guide your decision. By evaluating each option carefully against your investment goals and style, you can find the perfect platform to help you succeed in the stock market.