Investing in artificial intelligence (AI) stocks has become increasingly popular as businesses and consumers alike seek to leverage the power of AI technologies. The market has seen significant growth, especially in the past few years, with companies developing innovative solutions that utilize machine learning, data analytics, and automation. This article will explore some of the best AI stocks to consider for investment in 2025, analyzing their potential for growth, market position, and technological advancements.

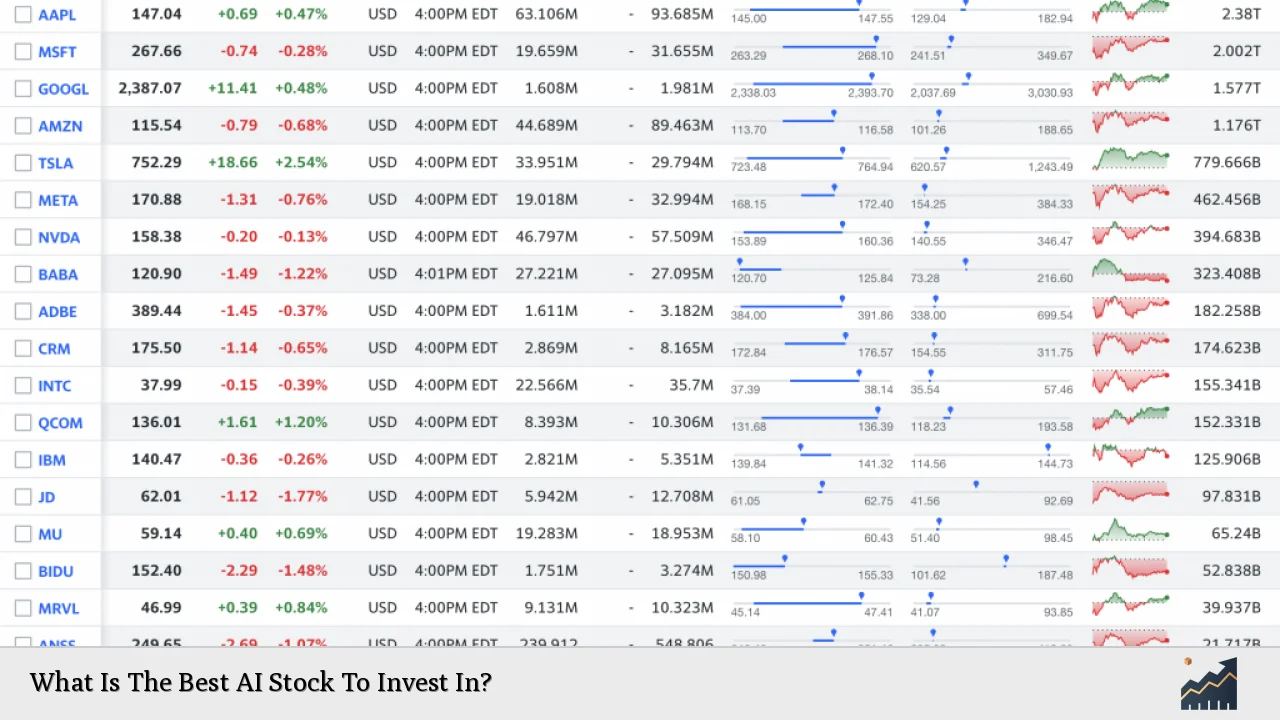

| Company | Stock Symbol |

|---|---|

| Nvidia Corporation | NVDA |

| Taiwan Semiconductor Manufacturing | TSM |

| Micron Technology | MU |

| Upstart Holdings | UPST |

| Lemonade Inc. | LMND |

| Revolve Group | RVLV |

Nvidia Corporation: The AI Leader

Nvidia Corporation is widely recognized as a leader in the AI sector, primarily due to its development of graphics processing units (GPUs) that are essential for training AI models. The company’s GPUs excel at performing complex calculations required for machine learning tasks, making them indispensable for businesses investing in AI technologies.

In recent years, Nvidia’s stock has surged significantly, with analysts predicting continued growth. For instance, revenue is expected to rise by approximately 51% in fiscal year 2026. Nvidia’s innovative products, such as the upcoming Blackwell GPU, promise to enhance performance and efficiency further. This innovation cycle is crucial as it ensures Nvidia remains competitive against rivals like AMD and Intel.

Moreover, Nvidia’s valuation is relatively moderate compared to its growth potential. Currently trading at around 54 times its trailing earnings, this valuation is justified given its robust revenue growth and dominant market position. Analysts forecast that Nvidia could reach a stock price between $200 and $225 by 2025, making it a compelling investment choice for those looking to capitalize on the booming AI sector.

Taiwan Semiconductor Manufacturing: The Chipmaker’s Advantage

Another strong contender in the AI stock market is Taiwan Semiconductor Manufacturing Company (TSMC). As a key supplier of microchips used in Nvidia’s GPUs and other AI hardware, TSMC stands to benefit greatly from the increasing demand for AI-related chips.

Analysts project that TSMC’s revenue from AI hardware will grow at a compound annual growth rate of 50% over the next five years. This growth is driven by the rising need for advanced chips capable of supporting complex AI applications across various industries. TSMC’s management forecasts that AI revenue will triple in 2024, indicating a strong upward trajectory.

The company’s stock is also considered relatively inexpensive compared to other major tech stocks, offering investors an attractive entry point. With analysts predicting a 25% increase in revenue for 2025 and continued demand for its next-generation chips, TSMC represents a solid investment opportunity within the AI space.

Micron Technology: Memory Solutions for AI

Micron Technology specializes in producing DRAM memory and NAND flash storage, both critical components for AI applications. As the demand for memory solutions grows alongside advancements in AI technology, Micron is well-positioned to capitalize on this trend.

Analysts forecast that Micron’s revenue will grow by 52% in fiscal year 2025 due to increased demand for memory products used in data centers and AI applications. The company’s strategic focus on high-bandwidth memory (HBM) is expected to enhance its market share significantly.

Despite recent challenges affecting the broader semiconductor market, Micron’s strong fundamentals and anticipated recovery make it an attractive option for investors looking to invest in AI-related stocks. With a projected revenue increase and ongoing innovations in memory technology, Micron could yield substantial returns over the coming years.

Upstart Holdings: A Risky Yet Promising Investment

Upstart Holdings operates an AI-driven credit assessment platform that aims to improve loan approval rates while minimizing risk for lenders. Although Upstart experienced significant fluctuations in its stock price due to economic conditions affecting loan applications, it has shown signs of recovery.

The company is introducing new products and expanding its credit partner network as it prepares for a potential rebound in consumer interest rates. Market sentiment around Upstart remains mixed; however, analysts predict that if the company can stabilize its operations and return to profitability by 2025, it could see substantial stock appreciation.

Investors should approach Upstart with caution due to its volatility and mixed analyst ratings but may find it appealing if they have a higher risk tolerance and are looking for potential high-reward opportunities.

Lemonade Inc.: Innovating Insurance with AI

Lemonade Inc. utilizes AI and machine learning technologies to disrupt traditional insurance models by offering competitive pricing and enhanced customer experiences. While Lemonade has faced challenges with elevated loss ratios impacting profitability, it is beginning to recover from these setbacks.

The company’s innovative approach allows it to streamline processes and improve customer interactions significantly. As it continues to refine its business model and reduce losses, Lemonade could emerge as a strong player in the insurance sector.

Investors interested in technology-driven companies within traditional industries may find Lemonade an intriguing option as it leverages AI to create value and improve operational efficiencies.

Revolve Group: Fashion Meets Technology

Revolve Group operates an online retail platform that integrates AI-enhanced technology into its operations. The company has successfully navigated recent economic challenges by focusing on customer engagement through social media and personalized shopping experiences.

With significant improvements in revenue growth—reporting a 10% year-over-year increase—Revolve demonstrates resilience amid changing consumer spending patterns. If it can maintain this momentum while continuing to innovate its offerings through technology, Revolve Group may present an attractive investment opportunity within the fashion retail space.

FAQs About Best AI Stocks To Invest In

- What are the top AI stocks to consider for investment?

Nvidia Corporation (NVDA), Taiwan Semiconductor Manufacturing (TSM), Micron Technology (MU), Upstart Holdings (UPST), Lemonade Inc. (LMND), and Revolve Group (RVLV) are among the top contenders. - Why is Nvidia considered a strong investment?

Nvidia leads the GPU market essential for AI applications with significant projected revenue growth. - How does Taiwan Semiconductor benefit from AI?

Taiwan Semiconductor manufactures chips used in various AI hardware, positioning itself well amid rising demand. - Is investing in Upstart Holdings risky?

Yes, Upstart has shown volatility; however, it may offer high-reward potential if it stabilizes. - What makes Micron Technology appealing?

Micron specializes in memory solutions crucial for AI applications with strong projected revenue growth.

Investing in AI stocks presents both opportunities and risks as the sector continues to evolve rapidly. By carefully evaluating companies like Nvidia, TSMC, Micron Technology, Upstart Holdings, Lemonade Inc., and Revolve Group based on their market positions and technological advancements, investors can make informed decisions that align with their financial goals.