Investment credit recapture refers to the process by which the government reclaims a portion of tax credits previously granted to taxpayers when certain conditions are no longer met. This mechanism is primarily associated with the Investment Tax Credit (ITC), which incentivizes businesses to invest in specific types of property, such as energy-efficient equipment or renewable energy installations. When a taxpayer disposes of or ceases to use the property for which the credit was claimed within a designated period, they may be required to “recapture” part or all of the credit, effectively increasing their tax liability.

The recapture rules are designed to ensure that the benefits of tax credits are aligned with the intended use of the property. If an asset is sold, converted to personal use, or otherwise disposed of before the end of its useful life, the taxpayer must report this change and potentially repay some of the tax benefits received. The recapture percentage decreases over time, offering a more lenient approach for assets held longer.

| Key Concept | Description/Impact |

|---|---|

| Investment Tax Credit (ITC) | A federal tax credit that allows businesses to deduct a percentage of investment costs in eligible property from their federal taxes. |

| Recapture Period | The five-year period during which a taxpayer must hold the property before it can be disposed of without triggering recapture. |

| Recapture Percentage | The percentage of the ITC that must be repaid if the property is disposed of within the recapture period; starts at 100% in year one and decreases by 20% each subsequent year. |

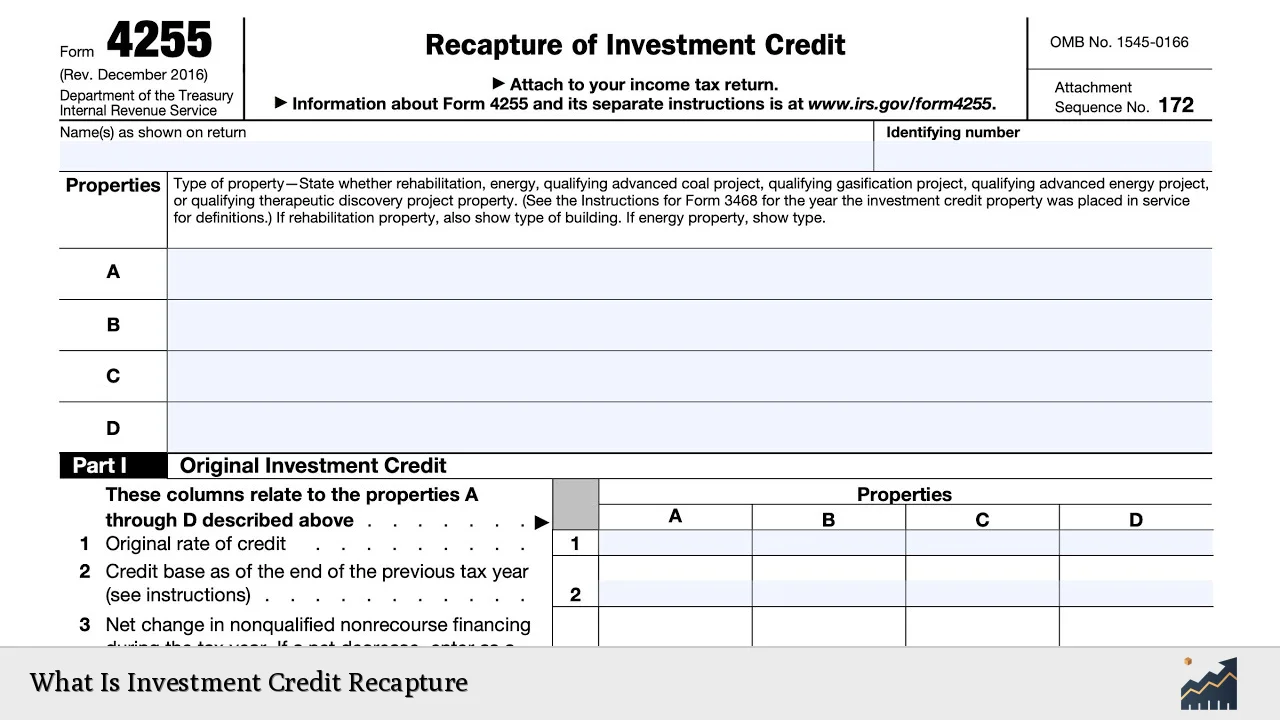

| Form 4255 | The IRS form used to report and calculate the recapture amount owed when an ITC-eligible property is disposed of. |

| Exceptions to Recapture | Certain transactions, such as transfers due to death or divorce, do not trigger recapture obligations. |

Market Analysis and Trends

The landscape for investment credits has evolved significantly, particularly with recent legislative changes aimed at promoting clean energy investments. The Inflation Reduction Act (IRA) has introduced new credits and modified existing ones, enhancing their attractiveness and complexity.

- Growth in Transferable Tax Credits: The market for transferable tax credits has seen substantial growth. In 2024, estimates indicate that between $21 billion and $24 billion in tax credits will be transferred, a significant increase from previous years. This surge is driven by large corporate taxpayers entering the market, seeking to optimize their tax liabilities through strategic credit transactions.

- Pricing Trends: The average pricing for Investment Tax Credits (ITCs) has remained robust, with prices averaging around 92.5 cents on the dollar in early 2024. This reflects increased demand and competition among buyers, particularly for credits associated with renewable energy projects.

- Types of Projects: The majority of transactions involve wind and solar projects, with advanced manufacturing credits also gaining traction. As regulatory frameworks evolve, new categories such as nuclear production tax credits may emerge, further diversifying investment opportunities.

Implementation Strategies

To effectively navigate investment credit recapture, businesses should adopt several key strategies:

- Thorough Asset Management: Maintain detailed records of all assets eligible for ITCs and monitor their usage closely. Ensure that any changes in asset status are documented promptly to avoid unexpected recapture events.

- Tax Planning: Engage in proactive tax planning that considers potential recapture events. This includes evaluating the timing of asset disposals and understanding how changes in business operations may impact eligibility for credits.

- Consultation with Professionals: Work with tax professionals who specialize in investment credits and recapture rules. Their expertise can help identify risks and optimize strategies for claiming and retaining credits.

Risk Considerations

Investors should be aware of several risks associated with investment credit recapture:

- Market Volatility: Changes in market conditions can affect asset values and usage, potentially leading to unplanned dispositions that trigger recapture.

- Regulatory Changes: New legislation or modifications to existing laws can alter eligibility criteria for ITCs or change recapture rules, impacting financial projections.

- Operational Risks: Changes in business operations or asset utilization can inadvertently lead to recapture events. For example, if a company downsizes or shifts focus away from certain properties, it may trigger recapture obligations.

Regulatory Aspects

Understanding the regulatory framework governing investment credit recapture is crucial for compliance:

- IRS Guidelines: The Internal Revenue Service outlines specific regulations regarding ITCs and their recapture under Section 50 of the Internal Revenue Code. Taxpayers must adhere strictly to these guidelines to avoid penalties.

- State Regulations: In addition to federal regulations, some states have their own rules regarding investment credits and recapture. Businesses should consult state-specific guidelines to ensure compliance.

- Reporting Requirements: Filing Form 4255 is mandatory when a recapture event occurs. This form details the amount of credit being recaptured and adjusts taxable income accordingly.

Future Outlook

The future landscape for investment credit recapture appears dynamic:

- Increased Investment in Clean Energy: As global emphasis on sustainability grows, investments in clean energy technologies are expected to rise. This trend will likely lead to more claims for ITCs but also increase awareness around potential recapture risks.

- Legislative Developments: Ongoing discussions about tax reform may introduce new incentives or alter existing ones. Stakeholders should stay informed about legislative changes that could impact investment strategies.

- Technological Advancements: Innovations in tracking and managing eligible assets could streamline compliance processes related to ITCs and reduce risks associated with unintentional recaptures.

Frequently Asked Questions About Investment Credit Recapture

- What triggers investment credit recapture?

Recapture is triggered when an asset for which an Investment Tax Credit was claimed is disposed of or ceases to qualify as eligible property within five years. - How is the recapture percentage calculated?

The percentage starts at 100% if disposed of within one year after being placed in service and decreases by 20% each subsequent year until reaching zero after five years. - What form do I need to file for recapturing ITC?

You must file IRS Form 4255 to report any required recaptures due to asset disposition. - Are there exceptions where recapture does not apply?

Yes, transfers due to death or divorce are generally exempt from triggering recapture obligations. - Can I mitigate risks associated with investment credit recapture?

Yes, through thorough asset management, proactive tax planning, and consulting with tax professionals. - How does market demand affect ITC pricing?

Increased competition among buyers leads to higher pricing for transferable tax credits as demand rises. - What role does legislation play in shaping investment credits?

Legislative changes can introduce new incentives or modify existing ones, directly impacting how businesses approach investments eligible for tax credits. - How can businesses prepare for potential regulatory changes?

Businesses should stay informed about legislative developments and engage with tax advisors who can provide guidance on compliance strategies.

Investment credit recapture remains a crucial aspect of managing tax liabilities associated with business investments. By understanding its mechanics and implications, investors can make informed decisions that align with both financial goals and regulatory requirements.