Investment is the act of allocating resources, typically money, with the expectation of generating income or profit over time. It involves putting your money to work in various financial instruments or assets with the goal of growing your wealth. Investments can take many forms, from stocks and bonds to real estate and commodities. The primary objective of investing is to achieve financial goals, such as retirement planning, wealth accumulation, or funding major life expenses.

When you invest, you’re essentially buying assets that have the potential to increase in value or provide regular income. This process allows your money to work for you, potentially earning returns that outpace inflation and help you build wealth over the long term. Investments differ from savings in that they typically involve some level of risk, but also offer the possibility of higher returns.

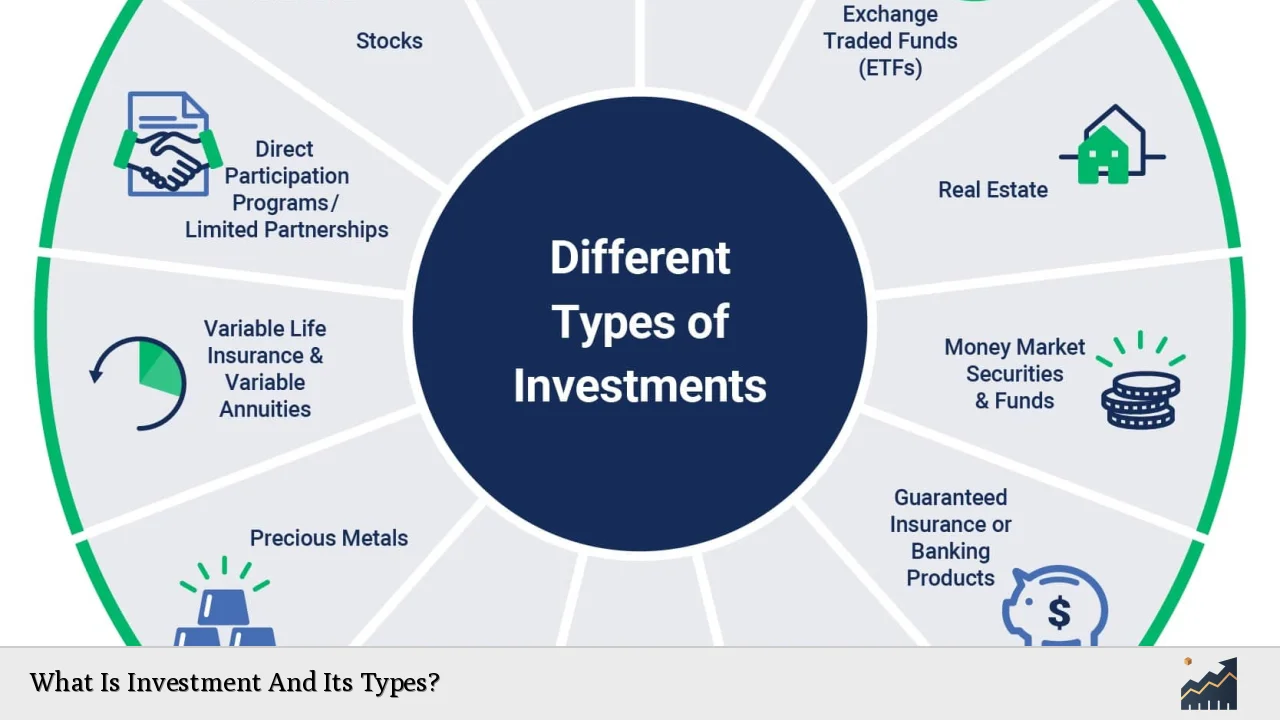

Understanding the various types of investments is crucial for making informed decisions about where to allocate your money. Different investment types carry varying levels of risk and potential reward, and the right mix depends on your financial goals, risk tolerance, and investment timeline.

| Investment Type | Risk Level |

|---|---|

| Stocks | High |

| Bonds | Low to Moderate |

| Real Estate | Moderate to High |

| Mutual Funds | Varies |

Types of Investments

Investments can be broadly categorized into three main asset classes: equity, fixed income, and cash equivalents. Each of these categories includes various investment types, each with its own characteristics, risks, and potential returns. Let’s explore the most common types of investments within these asset classes.

Stocks (Equity)

Stocks, also known as shares or equities, represent ownership in a company. When you buy a stock, you’re purchasing a small piece of that company, making you a shareholder. Stocks are considered one of the riskiest yet potentially most rewarding investment types. They offer the possibility of high returns through capital appreciation (increase in stock price) and dividends (regular payments to shareholders).

Key features of stocks include:

- Potential for high returns: Historically, stocks have outperformed many other investment types over the long term.

- Volatility: Stock prices can fluctuate significantly in the short term.

- Liquidity: Stocks can be easily bought and sold on stock exchanges.

- Dividends: Some stocks pay regular dividends, providing a source of income.

Bonds (Fixed Income)

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you buy a bond, you’re essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are generally considered lower risk than stocks but offer lower potential returns.

Key features of bonds include:

- Regular income: Bonds provide predictable interest payments, usually semi-annually.

- Lower risk: Bonds are generally less volatile than stocks.

- Variety: Different types of bonds are available, including government, corporate, and municipal bonds.

- Maturity dates: Bonds have a set maturity date when the principal is repaid.

Mutual Funds

Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. Professional fund managers make investment decisions on behalf of investors. Mutual funds offer diversification and professional management, making them popular among both novice and experienced investors.

Key features of mutual funds include:

- Diversification: Funds invest in multiple securities, spreading risk.

- Professional management: Experienced managers make investment decisions.

- Accessibility: Mutual funds allow investors to access a variety of markets and asset classes.

- Liquidity: Most mutual funds can be bought and sold daily.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They typically track a specific index, sector, commodity, or other asset. ETFs offer the diversification benefits of mutual funds with the trading flexibility of stocks.

Key features of ETFs include:

- Lower costs: Many ETFs have lower expense ratios than mutual funds.

- Intraday trading: ETFs can be bought and sold throughout the trading day.

- Transparency: ETF holdings are typically disclosed daily.

- Tax efficiency: ETFs often generate fewer capital gains than mutual funds.

Real Estate

Real estate investments involve purchasing property for rental income or capital appreciation. This can include residential properties, commercial buildings, or real estate investment trusts (REITs).

Key features of real estate investments include:

- Tangible asset: Real estate provides a physical asset you can see and touch.

- Potential for passive income: Rental properties can generate regular cash flow.

- Tax benefits: Real estate investments may offer tax deductions and depreciation benefits.

- Leverage: Investors can use mortgages to purchase properties with a fraction of the total cost.

Certificates of Deposit (CDs)

CDs are savings certificates issued by banks with a fixed maturity date and interest rate. They typically offer higher interest rates than regular savings accounts in exchange for leaving your money untouched for a specific period.

Key features of CDs include:

- Low risk: CDs are insured by the FDIC up to $250,000 per depositor.

- Fixed returns: Interest rates are guaranteed for the term of the CD.

- Various terms: CDs are available with terms ranging from a few months to several years.

- Penalties for early withdrawal: Accessing funds before maturity usually incurs a penalty.

Money Market Accounts

Money market accounts are a type of savings account that typically offers higher interest rates than traditional savings accounts. They often come with check-writing privileges and debit card access.

Key features of money market accounts include:

- Higher interest rates: Generally offer better rates than regular savings accounts.

- Liquidity: Funds can be accessed easily, often with check-writing capabilities.

- Low risk: These accounts are typically FDIC-insured.

- Minimum balance requirements: Often require higher minimum balances than regular savings accounts.

Commodities

Commodities are physical goods such as gold, silver, oil, or agricultural products. Investors can buy commodities directly or invest in commodity-focused funds or futures contracts.

Key features of commodity investments include:

- Inflation hedge: Commodities often increase in value during inflationary periods.

- Portfolio diversification: Commodities often have low correlations with stocks and bonds.

- High volatility: Commodity prices can be highly volatile.

- Complexity: Direct commodity investing can be complex and may require specialized knowledge.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Bitcoin is the most well-known, but there are thousands of different cryptocurrencies.

Key features of cryptocurrency investments include:

- High volatility: Cryptocurrency prices can be extremely volatile.

- Decentralization: Most cryptocurrencies operate independently of central banks.

- 24/7 trading: Cryptocurrency markets operate around the clock.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving.

Options and Derivatives

Options and other derivatives are financial contracts whose value is derived from the performance of an underlying asset, index, or entity. These can include options contracts, futures, and swaps.

Key features of options and derivatives include:

- Leverage: These instruments can provide significant leverage, amplifying potential gains and losses.

- Complexity: Understanding and trading derivatives often requires advanced knowledge.

- Risk management: Can be used to hedge against potential losses in other investments.

- Speculation: Often used for speculative trading strategies.

FAQs About What Is Investment And Its Types

- What is the best type of investment for beginners?

For beginners, low-risk options like index funds or ETFs are often recommended due to their diversification and lower costs. - How much money do I need to start investing?

You can start investing with as little as $100 through many online brokers or investment apps. - What’s the difference between saving and investing?

Saving is setting money aside with minimal risk, while investing involves putting money into assets with the potential for higher returns and higher risk. - How do I choose the right investments for my goals?

Consider your financial goals, risk tolerance, and investment timeline when choosing investments. Diversification across different types is often recommended. - Are cryptocurrencies a good investment?

Cryptocurrencies can be highly volatile and risky. They may be suitable for some investors, but should typically make up only a small portion of a diversified portfolio.