Invest 95L refers to a designated area of investigation in the Atlantic Ocean that has the potential to develop into a tropical cyclone. The term “Invest” is used by meteorologists to categorize disturbances that are being monitored for possible development into named storms. These systems are often tagged with a number (in this case, 95) and are tracked by agencies such as the National Hurricane Center (NHC). The monitoring process involves analyzing atmospheric conditions, sea surface temperatures, and other meteorological data to assess the likelihood of development.

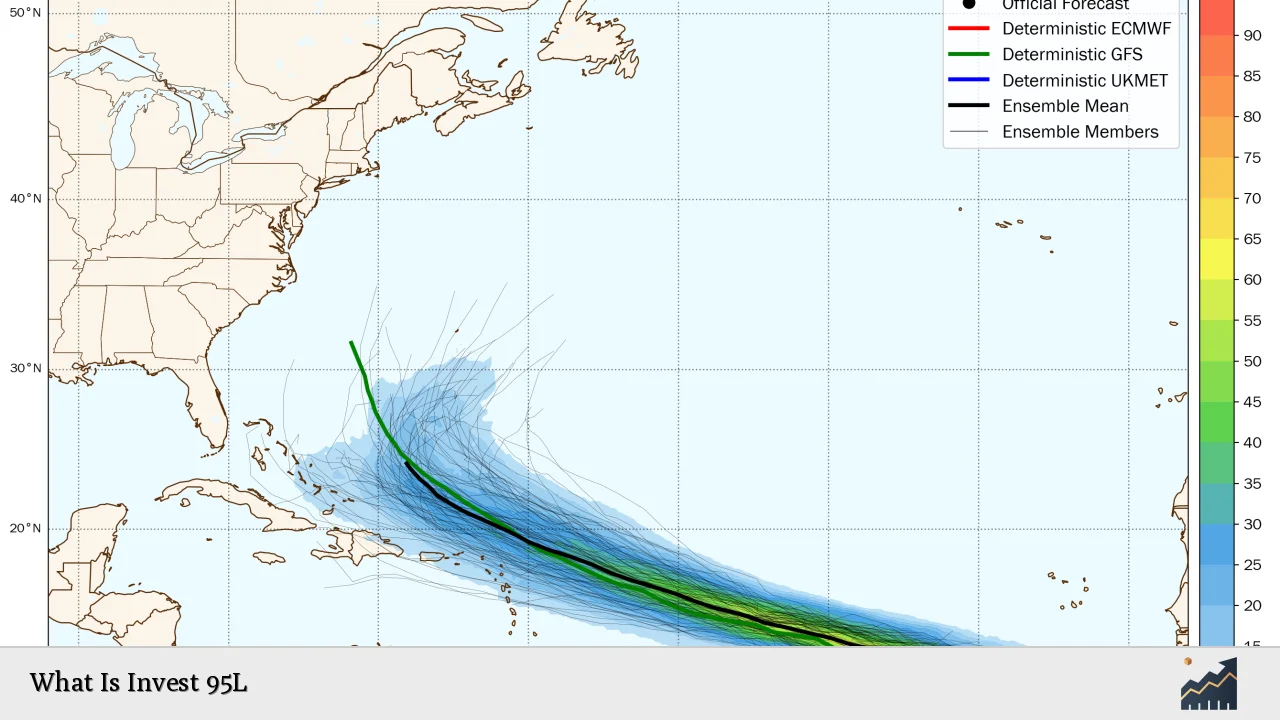

Invest 95L has garnered attention due to its potential impact on weather patterns, particularly in Central America and the Caribbean. As it progresses through its lifecycle, meteorologists utilize various models to predict its path and intensity, which can significantly affect coastal regions.

| Key Concept | Description/Impact |

|---|---|

| Formation Potential | Invest 95L has a chance of developing into a tropical depression or storm, depending on environmental conditions such as wind shear and sea surface temperatures. |

| Tracking and Monitoring | Agencies like the NHC use satellite imagery and computer models to track Invest 95L’s movement and predict its future development. |

| Impact on Regions | Heavy rainfall and potential flooding can occur in areas like Central America and the Caribbean as Invest 95L approaches land. |

| Forecast Models | Forecasts often vary between models, leading to different predictions regarding the storm’s path and intensity. |

| Tropical vs. Subtropical Storms | If developed, Invest 95L could be classified as either a tropical or subtropical storm based on its characteristics at formation. |

Market Analysis and Trends

The analysis of Invest 95L is not just limited to meteorological aspects; it also intersects with economic considerations, particularly in sectors like agriculture, insurance, and tourism. The impacts of tropical systems can lead to significant economic consequences, including:

- Agricultural Disruption: Heavy rains from storms like Invest 95L can lead to flooding, affecting crop yields in Central America where agriculture is a key economic driver.

- Insurance Claims: Increased storm activity raises concerns for insurance companies regarding payouts for damages caused by flooding or wind damage.

- Tourism Impact: Areas reliant on tourism may see reduced visitor numbers during storm seasons due to safety concerns.

Recent trends indicate an increase in tropical activity linked to climate change, which has implications for investment strategies in sectors vulnerable to weather disruptions.

Implementation Strategies

For investors looking to navigate the risks associated with tropical disturbances like Invest 95L, several strategies can be employed:

- Diversification: Spread investments across different sectors (e.g., agriculture, insurance) to mitigate risks associated with weather events.

- Weather Derivatives: Consider investing in weather derivatives or catastrophe bonds that provide financial protection against adverse weather conditions.

- Monitoring Tools: Utilize advanced weather tracking tools and models to stay informed about potential developments related to Invest 95L.

- Emergency Preparedness: Companies should have contingency plans in place for operational disruptions due to storms.

Risk Considerations

Investing during periods of heightened tropical activity carries inherent risks:

- Natural Disasters: The unpredictability of storms can lead to sudden market shifts affecting stock prices in vulnerable sectors.

- Supply Chain Disruptions: Flooding or damage from storms can disrupt supply chains, impacting businesses reliant on timely deliveries.

- Regulatory Changes: Increased storm activity may prompt changes in regulations regarding construction standards and environmental protections.

Investors should remain vigilant about these risks and consider them when making investment decisions during hurricane season.

Regulatory Aspects

Regulatory bodies play a crucial role in managing the impacts of tropical systems:

- National Hurricane Center (NHC): Provides forecasts and warnings related to tropical disturbances like Invest 95L.

- Federal Emergency Management Agency (FEMA): Coordinates disaster response efforts and provides assistance post-storm.

- Insurance Regulations: Insurers must comply with state regulations regarding coverage for storm-related damages, influencing their financial stability.

Understanding these regulatory frameworks is essential for investors involved in sectors impacted by tropical weather.

Future Outlook

The outlook for Invest 95L will depend on various factors including:

- Environmental Conditions: Changes in sea surface temperatures and atmospheric pressure systems will influence whether Invest 95L develops further.

- Seasonal Trends: Historical data shows that late summer months typically see increased tropical activity; thus, monitoring trends is crucial.

- Climate Change Implications: As climate patterns shift, the frequency and intensity of storms may increase, affecting long-term investment strategies.

Investors should continuously assess these factors as they relate to their portfolios and prepare for potential impacts from future disturbances like Invest 95L.

Frequently Asked Questions About Invest 95L

- What does “Invest” mean in meteorology?

The term “Invest” refers to an area being monitored for potential development into a tropical cyclone. - How does Invest 95L impact local economies?

It can lead to flooding that disrupts agriculture, increases insurance claims, and affects tourism. - What are the chances of Invest 95L developing into a named storm?

The chances vary based on environmental conditions; forecasts often indicate probabilities between 30% and 70% during monitoring. - How do meteorologists track Invest systems?

Meteorologists use satellite imagery, computer models, and historical data to track and predict the behavior of these systems. - What should businesses do during hurricane season?

Businesses should have contingency plans, diversify their supply chains, and monitor weather forecasts closely. - Are there financial instruments related to hurricane risks?

Yes, investors can consider weather derivatives or catastrophe bonds that provide financial protection against adverse weather events. - What role does FEMA play during storms?

FEMA coordinates disaster response efforts and provides assistance after storms make landfall. - How does climate change affect storm activity?

Climate change is linked to increased frequency and intensity of storms due to warmer ocean temperatures.

This comprehensive overview of Invest 95L highlights its significance not only as a meteorological phenomenon but also as an important consideration for investors across various sectors. Understanding the interplay between weather patterns and economic implications is essential for making informed investment decisions.