A good investment is one that meets specific criteria that align with an investor’s financial goals, risk tolerance, and time horizon. It is essential to understand that what constitutes a good investment can vary significantly from one person to another based on individual circumstances. Generally, a good investment should provide a positive expected return, be manageable in terms of risk, and offer liquidity while aligning with the investor’s overall strategy.

Investments can take many forms, including stocks, bonds, real estate, mutual funds, and exchange-traded funds (ETFs). Each type has its own characteristics and potential benefits. Understanding these options is crucial for making informed decisions.

In this article, we will explore the key characteristics of a good investment and provide insights into various investment types that may be suitable for different investors.

| Investment Type | Description |

|---|---|

| Stocks | Shares representing ownership in a company. |

| Bonds | Loans made to corporations or governments that pay interest over time. |

| Mutual Funds | Pooled investments that buy a diversified portfolio of stocks or bonds. |

| ETFs | Funds traded on stock exchanges that hold a collection of assets. |

Key Characteristics of a Good Investment

A good investment typically exhibits several key characteristics that help evaluate its potential for generating returns while minimizing risks. These include:

- Positive Expected Return: A good investment should offer the potential for positive returns over time. This return should ideally outpace inflation and provide growth on the invested capital.

- Manageable Risk: While all investments carry some level of risk, a good investment involves an acceptable level of risk relative to the potential return. Thorough research and understanding risk factors are crucial in managing this aspect.

- Liquidity: The ability to convert an investment into cash quickly without significant loss is important. Liquidity ensures that you can access funds when needed without compromising the value of your investment.

- Stability and Consistency: Investments that demonstrate stability and consistency in performance over time are considered favorable. This can include consistent dividend payouts or predictable growth patterns.

- Transparency and Information Accessibility: A good investment provides clear information about its fundamentals, operations, financial health, and market trends. Transparency helps investors make informed decisions.

- Alignment with Goals and Strategy: An investment should align with an individual’s or institution’s goals, time horizon, and risk tolerance. For instance, short-term goals may favor more liquid investments, while long-term goals may accommodate higher risk for potential higher returns.

- Tax Efficiency: A good investment minimizes the impact of taxes through tax-deferred growth or by being structured in a way that reduces tax liabilities.

- Quality Management or Governance: Investments in companies benefit from strong leadership and effective management, which often influence performance and growth potential.

- Scalability and Growth Potential: Investments with potential for growth offer the possibility of increasing returns over time due to market demand or innovation.

- Cost-Effectiveness: Minimizing expenses associated with an investment is essential as lower costs can enhance overall returns.

Types of Good Investments

Investors have various options when it comes to choosing good investments. Here are some common types:

- Stocks: Investing in stocks allows individuals to own a piece of a company. Stocks can provide high returns but come with higher volatility. Long-term investors often benefit from holding stocks through market fluctuations.

- Bonds: Bonds are considered safer than stocks but typically offer lower returns. Government bonds are particularly low-risk as they are backed by the government, making them suitable for conservative investors seeking steady income.

- Mutual Funds: These funds pool money from multiple investors to buy diversified portfolios of stocks or bonds. They are ideal for those who prefer professional management and diversification without needing to pick individual stocks.

- ETFs: Similar to mutual funds but traded like stocks on exchanges, ETFs provide diversification across various sectors or asset classes at lower fees than traditional mutual funds.

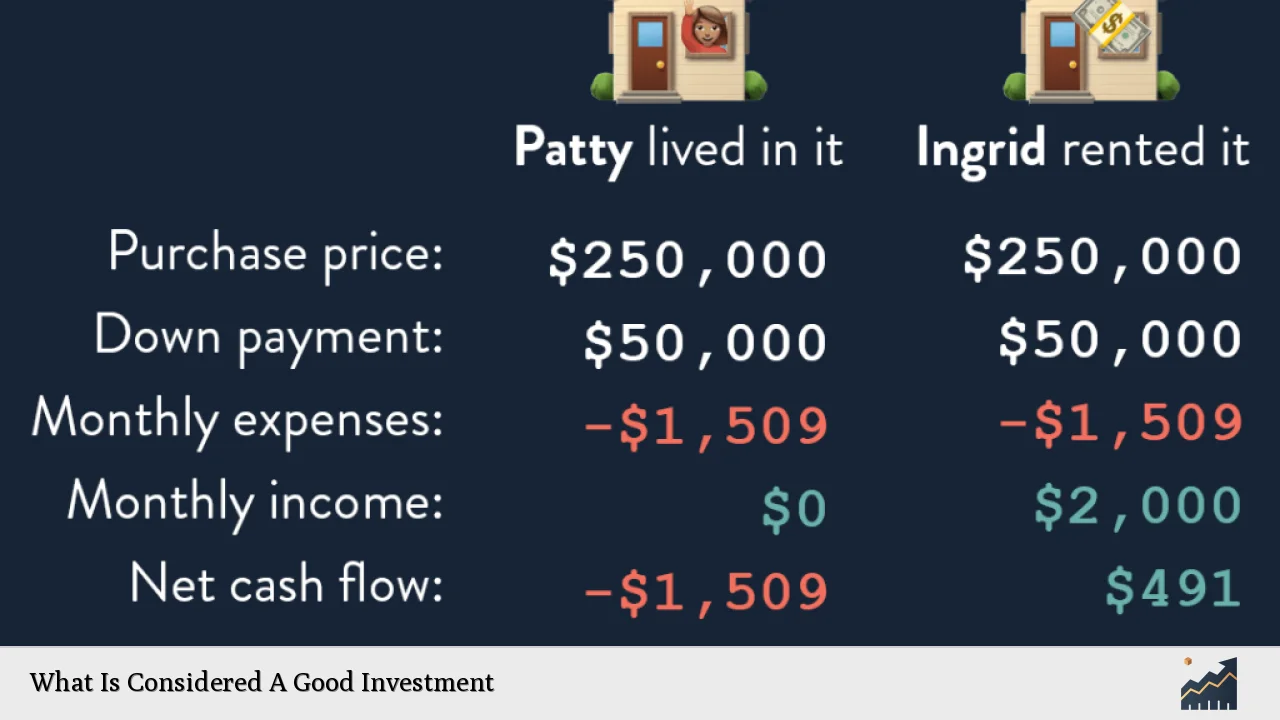

- Real Estate: Investing in rental properties can generate consistent cash flow and appreciate over time. However, it requires active management and understanding of the real estate market.

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts while providing easy access to funds. They are suitable for risk-averse investors looking to save money safely.

Strategies for Successful Investing

To maximize the potential of investments, employing effective strategies is essential. Here are some popular strategies:

- Buy and Hold: This strategy involves purchasing investments and holding them for an extended period, allowing them to grow over time through compounding.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount regularly regardless of market conditions. This approach helps mitigate the impact of volatility by averaging out purchase prices over time.

- Index Fund Investing: By investing in index funds, investors can achieve broad market exposure without needing to analyze individual stocks. This strategy is often recommended for beginners due to its simplicity and lower risk profile.

- Dividend Investing: Focusing on dividend-paying stocks allows investors to receive regular income while also benefiting from potential stock price appreciation.

Evaluating Investment Performance

To determine whether an investment is performing well, several metrics can be used:

- Return on Investment (ROI): This metric measures the gain or loss generated relative to the amount invested. A positive ROI indicates a profitable investment.

- Volatility: Understanding how much an investment’s price fluctuates helps assess its risk level. Higher volatility may indicate greater risk but also the potential for higher returns.

- Sharpe Ratio: This ratio measures risk-adjusted return by comparing the excess return of an investment relative to its volatility. A higher Sharpe ratio indicates better risk-adjusted performance.

FAQs About What Is Considered A Good Investment

- What makes an investment “good”?

A good investment typically offers positive expected returns while managing risks effectively. - How do I choose between stocks and bonds?

Your choice should depend on your risk tolerance; stocks offer higher returns but come with more volatility compared to bonds. - What is liquidity in investments?

Liquidity refers to how quickly you can convert an asset into cash without significantly affecting its value. - Are mutual funds better than ETFs?

It depends on your preferences; ETFs generally have lower fees and trade like stocks, while mutual funds are actively managed. - How important is diversification?

Diversification helps reduce risk by spreading investments across different assets or sectors.

In conclusion, determining what constitutes a good investment requires careful consideration of various factors including expected returns, risks involved, liquidity needs, and alignment with personal financial goals. By understanding these elements and employing sound investing strategies, individuals can make informed decisions that enhance their chances of achieving financial success over time.