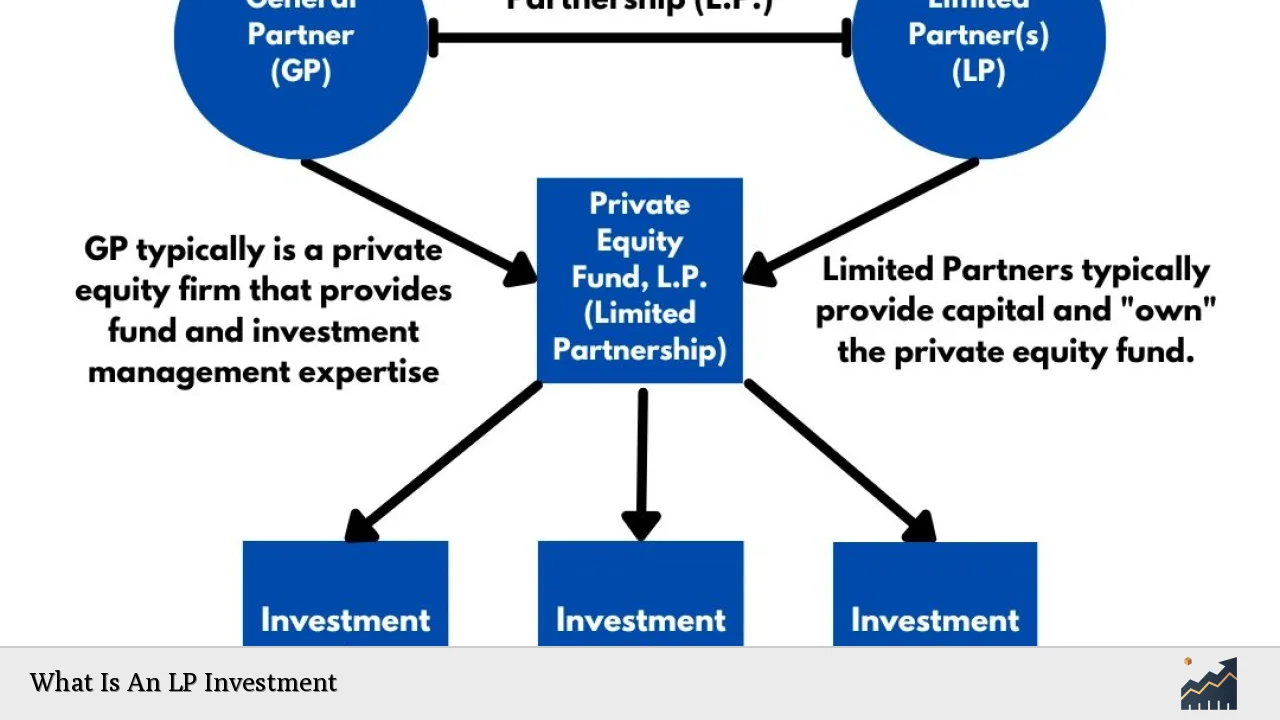

Limited Partnership (LP) investments represent a unique structure in the investment landscape, primarily utilized in private equity and venture capital. This investment model allows individuals or entities to pool resources while limiting their liability to the amount they invest. In a typical LP arrangement, there are two types of partners: general partners (GPs), who manage the investment and assume unlimited liability, and limited partners (LPs), who contribute capital but do not engage in day-to-day management. This structure not only facilitates significant capital mobilization but also provides a safety net for investors, making it an attractive option for many.

LPs play a crucial role in funding various ventures, especially in sectors like real estate, technology, and natural resources. They commit their capital upfront, often for extended periods, anticipating returns that may take years to materialize. This investment model is particularly prevalent in venture capital, where LPs provide the necessary funding for startups and emerging companies.

| Key Concept | Description/Impact |

|---|---|

| Structure of Limited Partnerships | A limited partnership consists of at least one general partner with unlimited liability and one or more limited partners whose liability is restricted to their investment amount. |

| Investment Horizon | LP investments typically have long holding periods, often spanning several years before returns are realized. |

| Risk Management | LPs enjoy limited liability protection, meaning they are only at risk for the amount they invest, shielding their personal assets from business liabilities. |

| Return on Investment | Returns are distributed based on a predetermined waterfall structure, which outlines how profits are allocated among partners. |

| Market Trends | Recent trends indicate a shift towards co-investments and a focus on sectors like technology and energy transition due to economic uncertainties. |

| Regulatory Considerations | LPs must comply with regulations governing private investments, including reporting requirements and adherence to securities laws. |

| Tax Implications | LPs benefit from pass-through taxation, where income is reported on individual tax returns, avoiding double taxation at the entity level. |

Market Analysis and Trends

The landscape of LP investments has evolved significantly in recent years. As of 2023, total LP investments saw a notable decline of approximately 29%, dropping from $56.54 billion in 2022 to $40.30 billion[6]. This downturn can be attributed to unfavorable macroeconomic conditions such as rising interest rates and increased regulatory scrutiny. Despite this contraction, certain sectors have emerged as focal points for LPs:

- Technology: The technology sector continues to attract significant LP interest due to its potential for high returns. Between 2019 and 2024, technology-related deals accounted for the highest volume of LP investments.

- Energy Transition: With growing concerns over climate change and sustainability, investments in energy transition technologies have surged. LPs are increasingly focusing on sectors that promise long-term viability and compliance with ESG standards[7].

- Private Equity: There has been a marked increase in private equity deal values, with sovereign wealth funds leading the charge towards larger equity deals as they pivot away from traditional venture capital due to geopolitical uncertainties[4].

Implementation Strategies

Investing as an LP involves several strategic considerations:

- Due Diligence: Conduct thorough research on potential GPs. Assess their track record, management team experience, and investment strategy to ensure alignment with your investment goals.

- Diversification: Spread investments across different funds and sectors to mitigate risk. This approach can help balance out potential losses in one area with gains in another.

- Co-Investment Opportunities: Engage in co-investments alongside GPs to reduce fees and maintain greater control over specific investments. This strategy has gained traction as LPs seek more direct involvement without the traditional fund structure’s costs[7].

- Monitoring Performance: Regularly review fund performance reports provided by GPs. Key metrics include Net Asset Value (NAV), Internal Rate of Return (IRR), and cash flow summaries[10].

Risk Considerations

While LP investments offer several advantages, they are not without risks:

- Illiquidity: Capital is often locked up for extended periods (typically 7-10 years), making it challenging for LPs to access their funds during this time.

- Market Volatility: Economic downturns can adversely affect the performance of portfolio companies within the fund.

- Dependence on GPs: The performance of an LP’s investment heavily relies on the capabilities and decisions made by the general partner. Poor management can lead to suboptimal returns or losses.

Regulatory Aspects

Limited partnerships must navigate a complex regulatory environment:

- Securities Regulations: LPs need to comply with securities laws that govern private placements and fundraising activities.

- Reporting Requirements: Regular reporting is essential for maintaining transparency with investors. Many LPs now incorporate ESG criteria into their reporting frameworks due to increasing stakeholder interest[10].

- Tax Compliance: Understanding tax implications is crucial as LPs benefit from pass-through taxation but must also navigate any changes in tax legislation that could impact their returns[8].

Future Outlook

The future of LP investments appears cautiously optimistic despite recent challenges:

- Increased Focus on ESG: As sustainability becomes a priority for many investors, LPs are likely to continue integrating ESG factors into their investment strategies[7].

- Technological Advancements: Innovations in financial technology may streamline operations within limited partnerships, enhancing reporting capabilities and investor engagement.

- Adaptation to Economic Conditions: LPs are expected to remain vigilant about macroeconomic trends and adjust their strategies accordingly, favoring sectors less sensitive to economic fluctuations such as infrastructure and private debt[4].

Frequently Asked Questions About What Is An LP Investment

- What is the primary role of a limited partner?

The primary role of a limited partner is to provide capital for investment while enjoying limited liability protection up to the amount invested. - How do limited partners earn returns?

Limited partners earn returns through profit distributions based on their proportional share of investment when the fund realizes gains from its portfolio companies. - What are the risks associated with being an LP?

The main risks include illiquidity due to long lock-up periods, market volatility affecting portfolio performance, and reliance on general partners’ management capabilities. - Can limited partners influence fund management?

No, limited partners typically do not engage in day-to-day management; doing so could jeopardize their limited liability status. - What is pass-through taxation?

Pass-through taxation allows income generated by the partnership to be reported directly on individual partners’ tax returns, avoiding double taxation at the entity level. - How long do I need to commit my capital as an LP?

The commitment period can vary but typically lasts between 7 to 10 years before significant returns may be realized. - What should I consider before investing as an LP?

Consider factors such as the general partner’s track record, fund strategy alignment with your goals, sector focus, and overall market conditions. - Are there any specific regulatory requirements for LP investments?

Yes, LP investments must comply with securities regulations regarding fundraising activities and maintain transparency through regular reporting.

In conclusion, Limited Partnership investments offer a compelling opportunity for individuals looking to engage in private equity or venture capital while limiting their financial exposure. By understanding the structure, market dynamics, risks involved, and strategic implementation methods associated with being an LP, investors can make informed decisions that align with their financial goals.