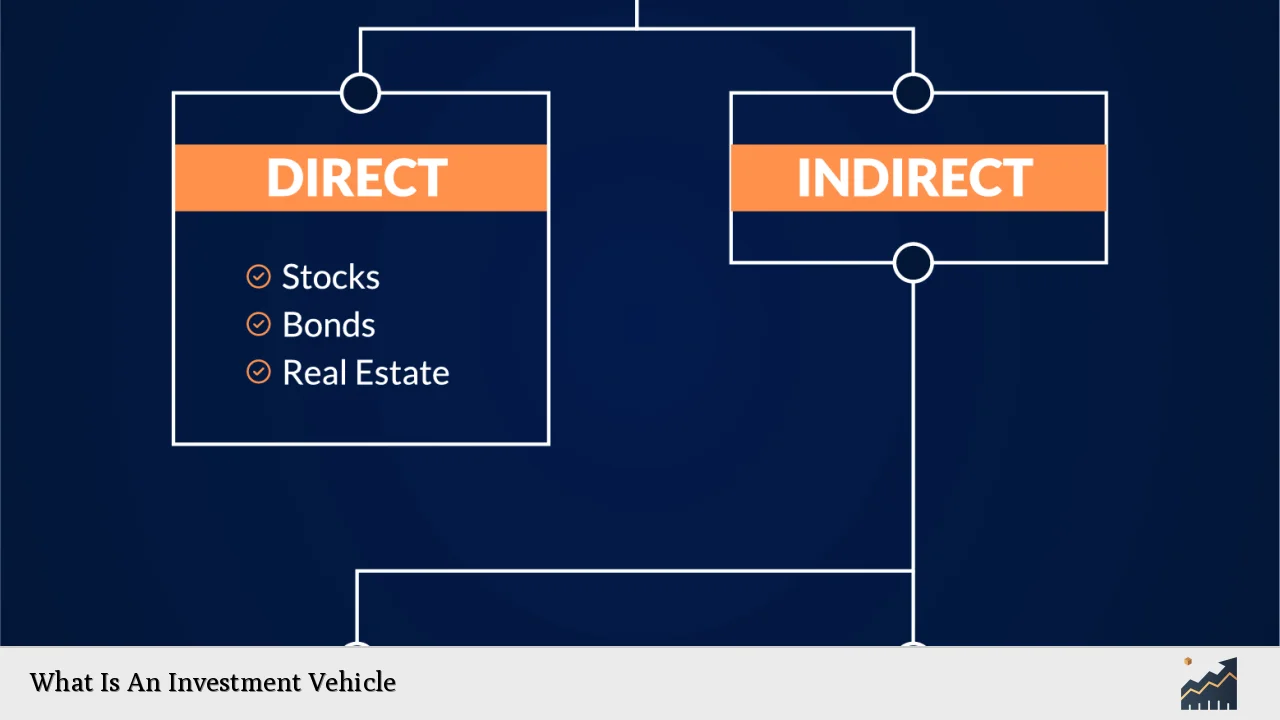

Investment vehicles are essential tools that individuals and institutions use to invest their money with the goal of generating returns. These vehicles encompass a wide range of options, from traditional assets like stocks and bonds to alternative investments such as real estate and cryptocurrencies. Understanding the various types of investment vehicles, their risks, benefits, and market trends is crucial for effective investment strategy formulation.

| Key Concept | Description/Impact |

|---|---|

| Ownership Investments | Investments in physical assets like stocks, real estate, and collectibles that provide potential appreciation and income. |

| Lending Investments | Involves lending money to entities (e.g., bonds, CDs) with the expectation of receiving interest and principal back. |

| Pooled Investment Vehicles | Collective investments where multiple investors pool their resources (e.g., mutual funds, ETFs) to achieve diversification. |

| Cash Equivalents | Short-term investments that are easily convertible to cash with minimal risk (e.g., money market accounts). |

| Alternative Investments | Non-traditional assets such as hedge funds, private equity, and commodities that often have different risk-return profiles. |

Market Analysis and Trends

The investment landscape is continually evolving, influenced by economic conditions, technological advancements, and regulatory changes. Recent trends indicate a growing interest in sustainable investing and alternative assets.

- Sustainable Investing: There is a significant shift towards Environmental, Social, and Governance (ESG) criteria among investors. Funds focusing on sustainable practices have seen inflows increase by over 30% in the past year.

- Rise of Alternative Investments: Assets like cryptocurrencies and real estate crowdfunding platforms have gained popularity, particularly among younger investors seeking high returns.

- Technological Advancements: The rise of robo-advisors has democratized access to investment vehicles, allowing more individuals to invest with lower fees and minimums.

- Market Volatility: Recent economic uncertainties have led to increased volatility in traditional markets, prompting investors to seek safer or alternative investments.

Implementation Strategies

To effectively utilize investment vehicles, investors should consider several strategies:

- Diversification: By holding a mix of asset classes (stocks, bonds, real estate), investors can reduce risk while aiming for stable returns.

- Asset Allocation: Adjusting the percentage of different asset classes in a portfolio based on market conditions and personal financial goals can enhance performance.

- Regular Rebalancing: Periodically adjusting the portfolio to maintain desired asset allocation helps manage risk and capitalize on market movements.

- Utilizing Tax-Advantaged Accounts: Investing through accounts like IRAs or 401(k)s can provide tax benefits that enhance overall returns.

Risk Considerations

Investing inherently involves risks that vary across different vehicles:

- Market Risk: The potential for loss due to fluctuations in market prices affects all investment types but is particularly pronounced in stocks and ETFs.

- Credit Risk: For lending investments like bonds or CDs, there is a risk that the issuer may default on payments.

- Liquidity Risk: Some investments (e.g., real estate) may be difficult to sell quickly without incurring losses.

- Regulatory Risk: Changes in laws or regulations can impact investment vehicles significantly; for example, new tax laws may affect returns from certain investments.

Regulatory Aspects

Investment vehicles are subject to various regulations depending on their type and jurisdiction:

- Securities Regulation: In many countries, securities must be registered with regulatory bodies (like the SEC in the U.S.) to protect investors from fraud.

- Tax Compliance: Different investment vehicles have distinct tax implications. For instance, capital gains from stocks are taxed differently than interest income from bonds.

- Consumer Protection Laws: These laws ensure that investors receive adequate information about the risks associated with different investment products.

Future Outlook

Looking ahead, several trends are likely to shape the future of investment vehicles:

- Increased Focus on ESG Investing: As awareness grows regarding climate change and social issues, more funds will incorporate ESG criteria into their investment strategies.

- Technological Integration: Innovations such as blockchain technology may revolutionize how investments are managed and traded.

- Global Market Expansion: Emerging markets are expected to attract more foreign investment as they develop economically.

- Regulatory Evolution: Ongoing changes in regulations will require investors to stay informed about compliance issues related to their chosen investment vehicles.

Frequently Asked Questions About Investment Vehicles

- What are the main types of investment vehicles?

Investment vehicles include ownership investments (like stocks), lending investments (like bonds), pooled investments (like mutual funds), cash equivalents (like money market accounts), and alternative investments (like cryptocurrencies). - How do I choose the right investment vehicle?

Your choice should depend on your financial goals, risk tolerance, time horizon, and market conditions. Diversifying across different types can help manage risk. - What is the difference between public and private investment vehicles?

Public investment vehicles are available for general purchase (like ETFs), while private ones are restricted to accredited investors (like hedge funds). - Are alternative investments worth considering?

Alternative investments can offer diversification benefits and potentially higher returns but come with unique risks and complexities. - How does liquidity affect my investments?

Liquidity refers to how easily an asset can be converted into cash. Higher liquidity generally means lower risk; illiquid assets may require longer holding periods. - What role does regulation play in investing?

Regulation protects investors by ensuring transparency and fairness in the market. It governs how investment products are offered and managed. - Can I invest in multiple types of vehicles simultaneously?

Yes! Many investors diversify their portfolios by investing across various asset classes to balance risk and return. - What should I consider when investing for retirement?

You should focus on long-term growth potential while considering your risk tolerance. Utilizing tax-advantaged accounts can also enhance your retirement savings.

In conclusion, understanding investment vehicles is crucial for anyone looking to build wealth through investing. By exploring various options—each with its unique characteristics—investors can tailor their strategies to align with financial goals while managing risks effectively.