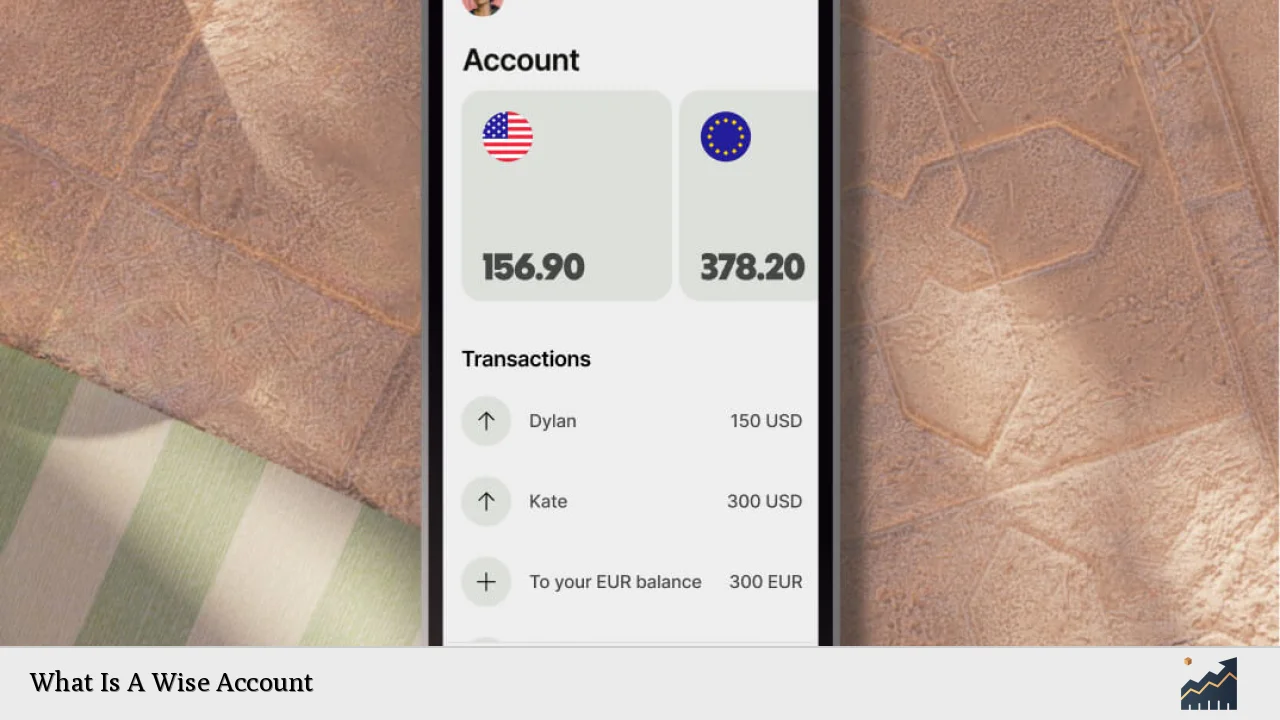

Wise, formerly known as TransferWise, is a financial technology company that revolutionizes how individuals and businesses manage their money across borders. The Wise Account is a multi-currency account designed to facilitate international transactions with minimal fees and real exchange rates. This account allows users to hold, convert, and transfer money in over 40 currencies, making it an attractive option for travelers, freelancers, and businesses dealing with global clients.

The Wise Account stands out in the fintech landscape due to its user-friendly interface, competitive pricing structure, and commitment to transparency. Unlike traditional banks, Wise does not charge monthly fees for account maintenance and offers low-cost currency conversions. This model has gained significant traction, leading to a remarkable increase in active users and transaction volumes.

| Key Concept | Description/Impact |

|---|---|

| Multi-Currency Holding | Allows users to hold balances in over 40 currencies, facilitating easier management of international funds. |

| Real Exchange Rates | Currency conversions are made at the mid-market rate, ensuring users get the best value for their money. |

| Low Fees | Transparent fee structure with no hidden charges; sending money between Wise accounts in the same currency is free. |

| Global Reach | Ability to send money to over 160 countries, making it ideal for international transactions. |

| Integration with Accounting Software | Supports integration with popular accounting tools like Xero and QuickBooks, streamlining business finances. |

| Interest Earning Potential | Users can earn interest on their balances in certain currencies, enhancing the account’s value proposition. |

| User-Friendly App | The Wise app provides an intuitive interface for managing multiple currencies and transactions seamlessly. |

| No Minimum Deposit Requirement | Accessible for all users without the burden of minimum balance requirements. |

Market Analysis and Trends

The global fintech landscape has seen exponential growth over the past decade, with Wise emerging as a leader in the international money transfer sector. In fiscal year 2024, Wise reported a revenue of £1.05 billion, reflecting a 24% increase from the previous year. The company has successfully expanded its customer base to 12.8 million active users, marking a 29% growth year-on-year.

Key Market Trends

- Increased Demand for Cross-Border Transactions: With globalization on the rise, individuals and businesses are increasingly engaging in cross-border transactions. Wise’s offerings cater directly to this demand by providing low-cost solutions for sending and receiving money internationally.

- Shift Towards Digital Banking: The trend towards digital banking solutions continues to grow as consumers seek more convenient ways to manage their finances. Wise’s user-friendly app and online platform align well with this trend.

- Focus on Transparency: Consumers are becoming more aware of hidden fees associated with traditional banking services. Wise’s commitment to transparency in pricing has resonated well with users seeking clarity in their financial transactions.

- Emergence of Multi-Currency Accounts: The ability to hold multiple currencies within one account is becoming increasingly important for frequent travelers and international businesses. Wise’s multi-currency feature addresses this need effectively.

Implementation Strategies

To maximize the benefits of a Wise Account, users should consider the following strategies:

- Utilize Multi-Currency Features: Take advantage of the ability to hold various currencies. This is particularly useful for freelancers working with international clients who pay in different currencies.

- Leverage Integration Options: Businesses should connect their Wise Account with accounting software like Xero or QuickBooks to streamline financial management and reporting.

- Monitor Currency Trends: Users can save on conversion fees by monitoring currency exchange trends and converting funds at favorable rates when necessary.

- Regularly Review Fees: Although Wise offers competitive pricing, it’s beneficial for users to periodically review the fee structure to ensure they are maximizing savings on transactions.

Risk Considerations

While Wise provides numerous advantages, there are inherent risks associated with using digital financial services:

- Currency Fluctuations: Holding funds in foreign currencies exposes users to exchange rate volatility. It’s essential to monitor currency trends actively.

- Regulatory Risks: As a non-bank financial institution, Wise operates under various regulations depending on the country. Changes in regulatory frameworks could impact service availability or fees.

- Security Concerns: Although Wise employs robust security measures such as two-step authentication, users must remain vigilant against phishing attacks and other cyber threats that could compromise their accounts.

Regulatory Aspects

Wise operates under strict regulatory frameworks across different jurisdictions. It holds licenses from various financial authorities globally:

- Financial Conduct Authority (FCA) in the UK

- Australian Transaction Reports and Analysis Centre (AUSTRAC) in Australia

- Financial Crimes Enforcement Network (FinCEN) in the US

These licenses ensure that Wise adheres to anti-money laundering (AML) regulations and provides a secure environment for its users. Compliance with these regulations is crucial for maintaining user trust and operational integrity.

Future Outlook

The future looks promising for Wise as it continues to innovate and expand its services:

- Expansion into New Markets: As Wise seeks to penetrate emerging markets where digital banking adoption is growing, it will likely introduce localized features tailored to specific regions.

- Enhanced Product Offerings: Continuous improvements in technology may lead to new features within the Wise Account, such as advanced analytics tools for better financial management.

- Partnerships with Financial Institutions: Collaborations with banks could enhance service offerings and broaden customer access while maintaining compliance with regulatory standards.

Frequently Asked Questions About A Wise Account

- What is a Wise Account?

A Wise Account is a multi-currency account that allows you to hold, convert, and transfer money in over 40 currencies at real exchange rates. - Are there any fees associated with a Wise Account?

While there are no monthly fees or minimum balance requirements, there may be transaction fees depending on currency conversions. - Can I earn interest on my balances?

Yes, you can earn interest on certain currency balances held within your Wise Account. - Is my money safe with Wise?

Wise employs strong security measures and holds licenses from various regulatory bodies ensuring compliance and protection of user funds. - How long does it take to send money internationally using a Wise Account?

The transfer speed can vary; many transfers are completed within minutes while others may take up to several days depending on the destination country. - Can I integrate my Wise Account with accounting software?

Yes, you can integrate your Wise Account with popular accounting tools like Xero and QuickBooks for easier financial management. - Is there customer support available if I have issues?

Yes, Wise offers customer support through various channels including email and an extensive help center. - Can I use my Wise Account for business purposes?

Absolutely! The Wise Business Account offers additional features tailored specifically for businesses engaged in international transactions.

In conclusion, the Wise Account represents a significant advancement in how individuals and businesses manage their finances globally. Its focus on low-cost transactions, transparency, and user-friendly technology positions it as a leader in the fintech industry. With ongoing growth trends and an expanding user base, Wise is well-equipped to meet the evolving needs of its customers while navigating potential risks associated with digital finance.