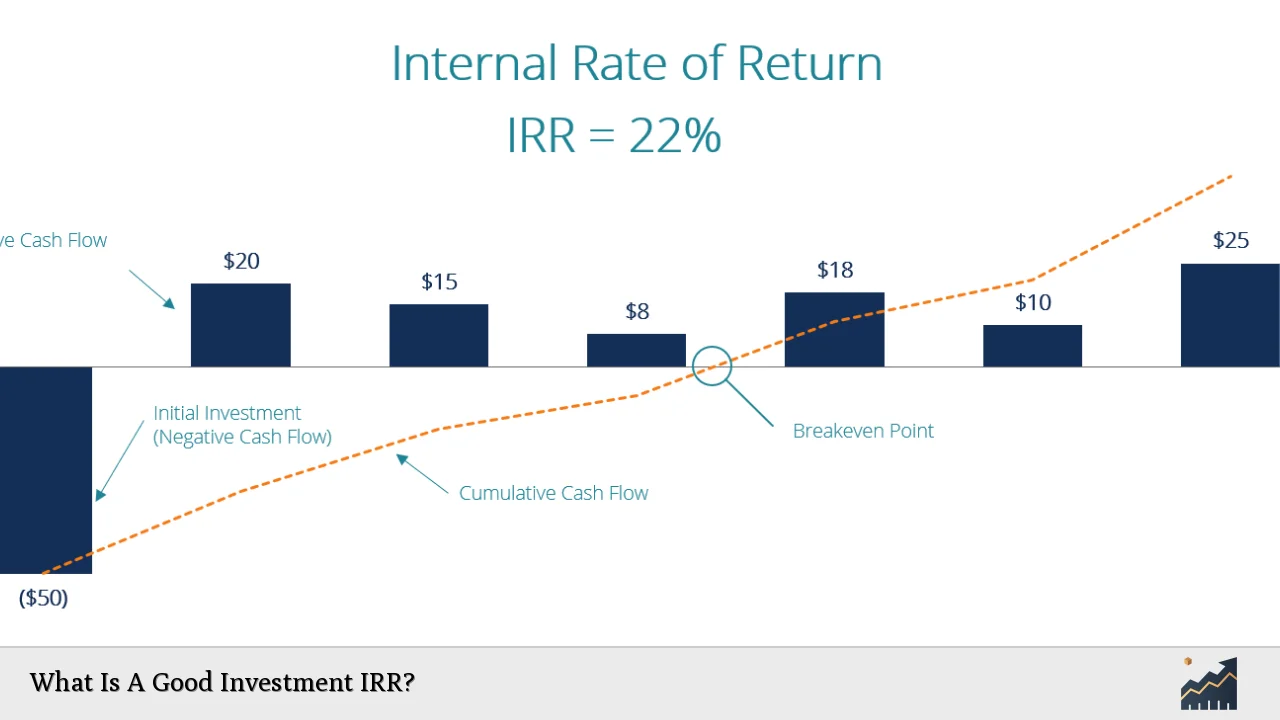

The Internal Rate of Return (IRR) is a critical financial metric used by investors and businesses to evaluate the profitability of potential investments. It represents the annualized effective compounded return rate that makes the net present value (NPV) of all cash flows from an investment equal to zero. Essentially, IRR helps investors assess whether a particular investment will yield a satisfactory return compared to alternative options.

Determining what constitutes a “good” IRR can be complex as it varies based on factors such as the type of investment, risk tolerance, market conditions, and the investor’s financial goals. Generally, a higher IRR indicates a more attractive investment opportunity, but it is essential to consider the context in which the IRR is being evaluated.

Investors often set a hurdle rate, which is the minimum acceptable return on an investment. If the IRR exceeds this hurdle rate, the investment is typically considered viable. Conversely, if the IRR falls below this threshold, the investment may not be worth pursuing.

| Investment Context | Typical Good IRR |

|---|---|

| Low-Risk Investments | 5% – 10% |

| Moderate-Risk Investments | 10% – 15% |

| High-Risk Investments | 20% or higher |

Understanding IRR

The concept of IRR is rooted in the time value of money, which posits that money available today is worth more than the same amount in the future due to its potential earning capacity. When calculating IRR, investors look for the rate at which the present value of future cash inflows equals the initial investment outlay.

IRR serves several purposes:

- It allows for comparison between different investment opportunities.

- It helps determine whether an investment meets an investor’s required rate of return.

- It provides insight into the risk associated with an investment; generally, higher IRRs are associated with higher risks.

However, it’s crucial to remember that while IRR is a valuable tool, it should not be used in isolation. Investors should also consider other metrics such as NPV and cash-on-cash returns to gain a comprehensive understanding of an investment’s potential.

Factors Influencing a Good IRR

Several factors can influence what is considered a good IRR for an investment:

- Investment Type: Different asset classes have varying average IRRs. For instance, private equity investments typically target higher IRRs compared to real estate investments.

- Market Conditions: Economic factors such as interest rates and market trends can impact expected returns. In a robust economy, higher returns are often anticipated.

- Risk Profile: The risk associated with an investment plays a significant role in determining acceptable IRRs. Higher-risk investments usually demand higher returns to compensate for increased uncertainty.

- Investment Horizon: The duration for which capital is tied up can also affect expected returns. Longer-term investments may require higher IRRs to justify their risk and illiquidity.

Understanding these factors can help investors set realistic expectations regarding what constitutes a good IRR for their specific situation.

Average IRRs Across Different Asset Classes

The average IRR varies widely across different asset classes and types of investments. Here’s a brief overview:

| Asset Class | Average IRR |

|---|---|

| Private Equity | 13% – 20% |

| Real Estate | 10% – 15% |

| Venture Capital | 20% – 30% |

| Hedge Funds | 6% – 10% |

Private equity investments tend to have higher average IRRs due to their inherent risks and longer holding periods. In contrast, hedge funds might offer lower but more stable returns.

Setting Your Hurdle Rate

When evaluating investments using IRR, it’s essential for investors to establish a hurdle rate—the minimum return they require before committing capital. This rate varies based on individual circumstances but generally aligns with:

- The cost of capital

- Risk tolerance

- Opportunity cost of investing elsewhere

For instance, if an investor has set their hurdle rate at 10%, they will only consider investments with an IRR above this threshold as viable options.

Common Mistakes in Evaluating IRR

Investors often make mistakes when interpreting or calculating IRR:

- Ignoring Cash Flow Patterns: Investments with unconventional cash flow patterns (e.g., multiple inflows and outflows) can lead to misleading IRRs.

- Assuming Constant Reinvestment Rates: Many calculations assume that future cash flows are reinvested at the same rate as the calculated IRR, which may not be realistic.

- Overlooking Other Metrics: Relying solely on IRR without considering NPV or other financial metrics can lead to poor investment decisions.

Being aware of these pitfalls can help investors make more informed decisions regarding their investments.

Real Estate Considerations for Good IRR

In real estate investing, determining what constitutes a good IRR can depend on various factors:

- Location: Properties in prime locations may yield lower but more stable returns compared to those in developing areas with higher potential upside but greater risk.

- Property Type: Different types of real estate (commercial vs. residential) have varying risk profiles and expected returns.

- Investment Strategy: Strategies such as value-add or ground-up development typically target higher IRRs due to increased risks involved.

A good benchmark for real estate investments generally falls between 10% and 20%, depending on these considerations.

Evaluating Startups and Venture Capital

In venture capital investing, targeting high IRRs is crucial due to the high risks associated with early-stage companies. Typically:

- Seed-stage investments aim for an IRR of at least 30%.

- Later-stage investments may target around 20%, reflecting lower associated risks compared to seed-stage ventures.

Investors should carefully analyze each opportunity’s potential against these benchmarks while considering market conditions and individual risk tolerance.

Conclusion

In summary, determining what constitutes a good investment IRR involves understanding various factors such as asset class, market conditions, risk profile, and individual investor goals. While higher IRRs are generally preferred, they must be contextualized within each unique investment scenario. Investors should use IRR alongside other metrics like NPV and hurdle rates to make informed decisions about where to allocate their capital effectively.

FAQs About Good Investment IRR

- What is considered a good IRR?

A good IRR typically ranges from 5% for low-risk investments to over 20% for high-risk ventures. - How do I calculate my required rate of return?

Your required rate of return should reflect your cost of capital and personal risk tolerance. - Can I rely solely on IRR for investment decisions?

No, it’s essential to consider other metrics like NPV and cash-on-cash returns. - What factors influence my expected IRR?

The type of investment, market conditions, risk profile, and investment horizon all play crucial roles. - How does location affect real estate IRR?

Prime locations typically yield lower but more stable returns compared to developing areas with higher potential risks.