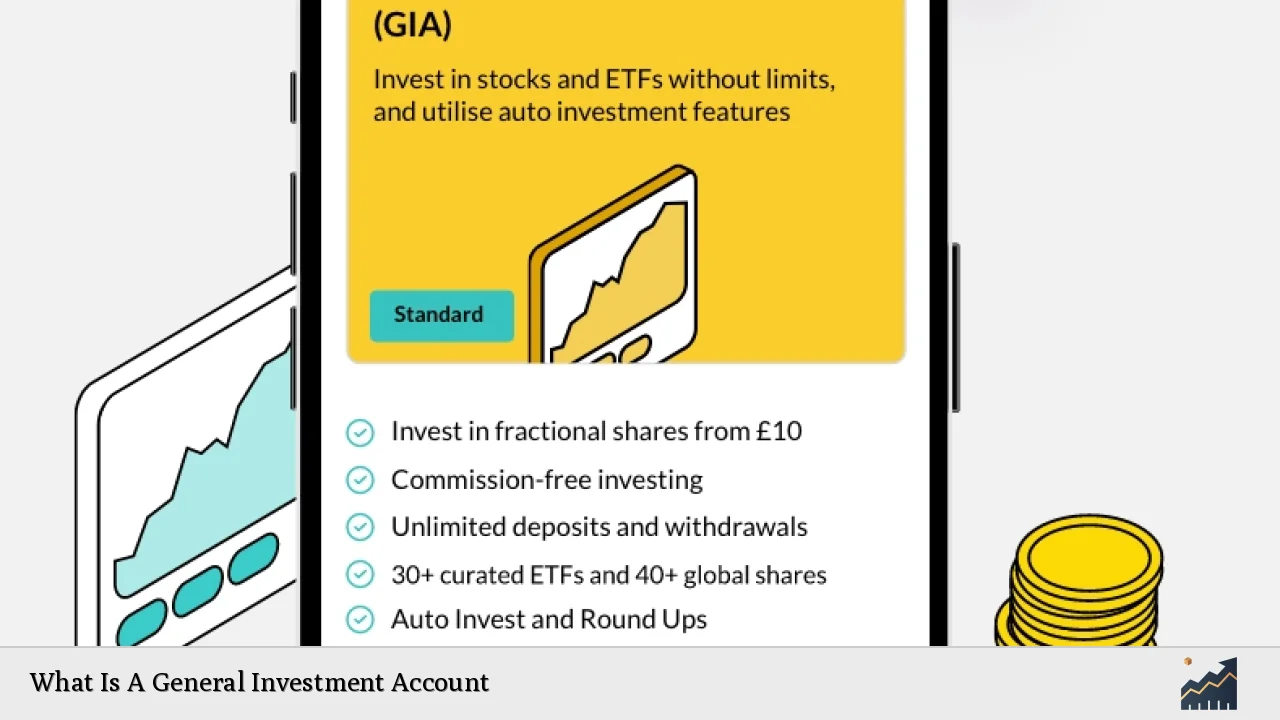

A General Investment Account (GIA) is a flexible investment vehicle that allows individuals to invest in a wide array of assets without the tax advantages associated with other accounts like Individual Savings Accounts (ISAs) or pensions. Unlike these tax-efficient wrappers, a GIA does not limit the amount you can contribute annually, making it an attractive option for investors who have maximized their ISA contributions. This account can hold various types of investments, including stocks, bonds, mutual funds, and real estate investment trusts (REITs), providing investors with the ability to diversify their portfolios.

The primary appeal of a GIA lies in its accessibility and flexibility. Investors can withdraw funds at any time without penalties, making it suitable for both short-term and long-term investment strategies. However, it is essential to understand the tax implications associated with a GIA, as any income generated or capital gains realized may be subject to taxation.

| Key Concept | Description/Impact |

|---|---|

| Tax Treatment | Income and capital gains from a GIA are taxable, unlike ISAs where returns are tax-free. |

| Contribution Limits | No annual contribution limits, allowing for significant investment potential. |

| Investment Options | Wide range of assets including stocks, bonds, ETFs, and mutual funds. |

| Liquidity | Funds can be accessed at any time without penalties, providing flexibility. |

| Capital Gains Tax (CGT) | Gains above the annual exempt amount are subject to CGT. |

| Dividend Tax Allowance | Dividends exceeding the allowance are subject to income tax. |

| Risk Factors | Investments can fluctuate in value; capital is at risk. |

Market Analysis and Trends

The investment landscape is continually evolving, influenced by economic conditions, regulatory changes, and investor behavior. As of late 2024, several trends have emerged that are particularly relevant to General Investment Accounts:

- Increased Demand for Flexibility: Investors are increasingly seeking accounts that offer both flexibility and a broad range of investment options. GIAs cater to this demand by allowing contributions without limits and easy access to funds.

- Shift Towards Passive Investing: The rise of low-cost Exchange-Traded Funds (ETFs) has led many investors to favor passive investment strategies over traditional mutual funds. This shift is reflected in the growing assets under management (AUM) in ETFs, which now account for approximately 25% of open-ended fund AUM globally.

- Tax Awareness: With increasing awareness about tax implications on investment returns, more investors are considering GIAs as a temporary holding place for investments until they can be moved into tax-efficient accounts like ISAs.

- Technological Integration: The use of technology in managing investments has grown significantly. Many platforms now offer automated services that help investors manage their GIAs effectively while providing insights into market trends and performance analytics.

Market statistics indicate that as of December 2024, total money market fund assets reached $6.77 trillion, highlighting robust investor interest in liquid assets that can complement longer-term investments held within GIAs.

Implementation Strategies

When considering a General Investment Account, investors should adopt strategic approaches tailored to their financial goals:

- Diversification: Utilize the GIA to invest across various asset classes such as equities, fixed income securities, and alternative investments. This strategy helps mitigate risk while seeking optimal returns.

- Regular Contributions: Establish a routine of making regular contributions to the GIA. This approach not only builds wealth over time but also takes advantage of dollar-cost averaging.

- Tax Planning: Monitor your taxable gains and income closely. Utilize the annual capital gains tax exemption effectively by planning when to sell investments within the GIA.

- Transitioning Investments: Consider using the GIA as a holding account for investments until you reach your ISA contribution limit each tax year. This strategy allows you to maintain investment growth while waiting for the opportunity to transfer funds into a more tax-efficient wrapper.

Risk Considerations

Investing through a General Investment Account comes with inherent risks:

- Market Volatility: The value of investments can fluctuate significantly based on market conditions. Investors should be prepared for potential losses and have strategies in place to manage volatility.

- Tax Liabilities: Unlike ISAs where returns are sheltered from tax, GIAs expose investors to capital gains tax and income tax on dividends exceeding the allowance. Understanding these implications is crucial for effective financial planning.

- Investment Selection Risk: Choosing the wrong investments can lead to suboptimal returns. Investors should conduct thorough research or consult financial advisors before making investment decisions within their GIAs.

Regulatory Aspects

General Investment Accounts operate under specific regulatory frameworks that govern taxation and investment practices:

- Tax Regulations: In many jurisdictions, including the UK, any capital gains realized above the annual exemption limit are subject to capital gains tax. Additionally, dividends received above the dividend allowance will incur income tax liabilities.

- Investment Restrictions: While GIAs offer broad investment options, certain restrictions may apply based on the provider's policies or local regulations. It is essential for investors to familiarize themselves with these rules before opening an account.

- Consumer Protection Laws: Regulatory bodies oversee financial institutions offering GIAs to ensure compliance with consumer protection laws. Investors should choose reputable providers who adhere to these regulations.

Future Outlook

The outlook for General Investment Accounts remains positive as they adapt to changing investor needs:

- Growth in Digital Platforms: The rise of fintech companies is likely to enhance access to GIAs through user-friendly digital platforms that provide comprehensive investment tools and resources.

- Increased Focus on ESG Investing: Environmental, Social, and Governance (ESG) factors are becoming increasingly important for investors. GIAs will likely evolve to include more sustainable investment options as demand grows.

- Continued Market Volatility: As global markets face uncertainties such as inflationary pressures and geopolitical tensions, investors may turn to GIAs for flexible investment solutions that allow them to respond quickly to changing conditions.

Overall, General Investment Accounts will continue to play a vital role in individual investing strategies as they provide both flexibility and access to diverse investment opportunities.

Frequently Asked Questions About General Investment Accounts

- What types of investments can I hold in a GIA?

You can hold various assets including stocks, bonds, mutual funds, ETFs, and REITs. - Are there limits on how much I can invest in a GIA?

No annual contribution limits exist for GIAs; you can invest as much as you want. - How are capital gains taxed in a GIA?

Capital gains exceeding the annual exemption limit are subject to capital gains tax. - Can I withdraw money from my GIA at any time?

Yes, you can withdraw funds without penalties whenever needed. - What happens if my investments lose value?

The value of your investments may fluctuate; you could lose some or all of your invested capital. - Is it advisable to use a GIA if I have not maxed out my ISA?

If you have not maxed out your ISA allowance but still wish to invest more than your limit allows, consider using a GIA temporarily until you can transfer funds into an ISA. - Do I need professional advice before opening a GIA?

While not mandatory, seeking professional advice can help tailor your investment strategy based on your financial goals. - How do I report taxes on my GIA earnings?

You will need to report any taxable income or capital gains from your GIA when filing your annual tax return.

This comprehensive overview provides individual investors with essential insights into General Investment Accounts—highlighting their features, benefits, risks, and strategic considerations necessary for effective investing.