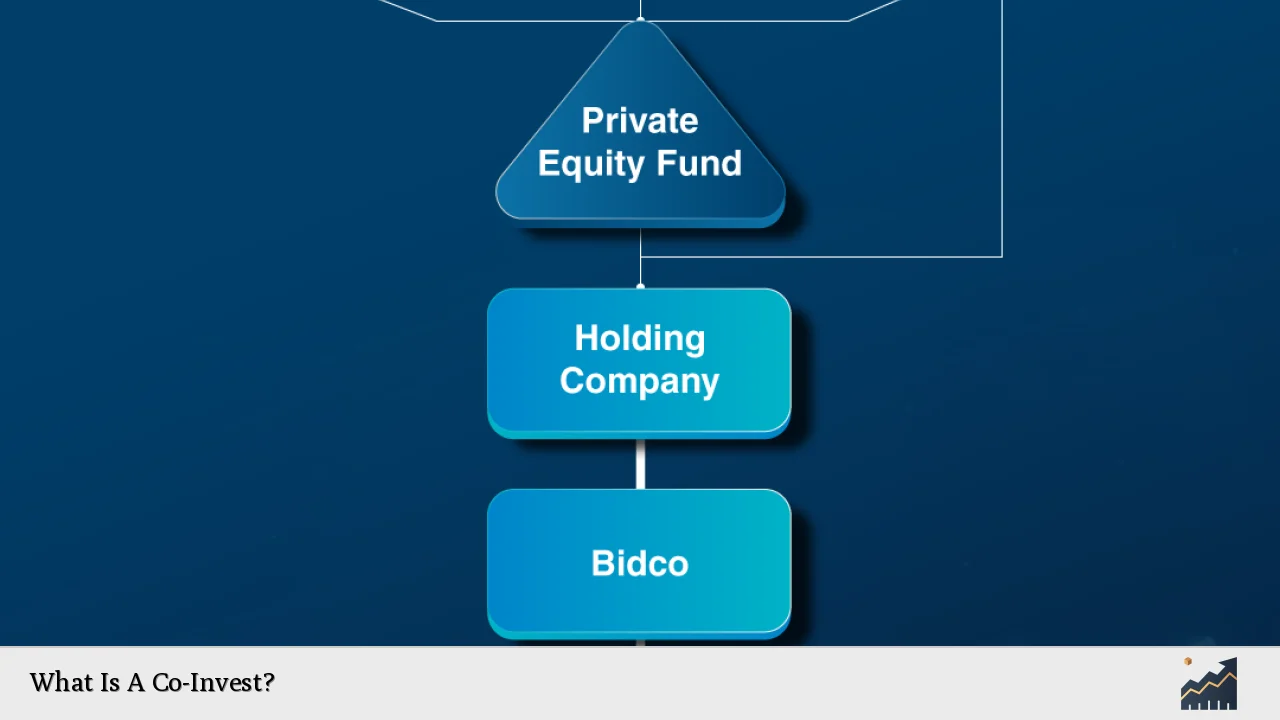

Co-investment, particularly in the context of private equity and venture capital, refers to a minority investment made by an investor directly into a company alongside a financial sponsor or private equity firm. This strategy allows investors to participate in potentially lucrative investment opportunities without incurring the high fees typically associated with managed funds. Co-investments have gained traction among institutional investors and high-net-worth individuals seeking greater control, reduced costs, and enhanced returns.

| Key Concept | Description/Impact |

|---|---|

| Definition | A co-investment is a direct investment made by an investor into a company alongside a financial sponsor, typically involving minority stakes. |

| Investor Types | Co-investors are usually institutional investors like pension funds, insurance companies, and family offices, as well as high-net-worth individuals. |

| Fee Structure | Co-investments often come with reduced or no management fees and carried interest, making them more cost-effective compared to traditional fund investments. |

| Risk Sharing | Co-investments allow both the co-investor and the lead firm to share the risks associated with the investment, potentially leading to better risk-adjusted returns. |

| Market Access | This investment strategy provides access to opportunities that may not be available to typical retail investors, such as mid-market companies or specific growth ventures. |

| Control and Transparency | Investors have more control over their investments and greater transparency regarding the specific deals they are backing. |

| Current Trends | The demand for co-investments has surged in recent years, driven by challenging fundraising environments and rising interest rates, which have increased equity financing needs. |

Market Analysis and Trends

The landscape for co-investments has evolved significantly over the past decade. According to Pitchbook data, capital raised for co-investments with private equity managers increased from $4 billion in 2010 to $10.3 billion in 2022. This trend reflects a growing appetite among institutional investors for direct exposure to specific deals rather than relying solely on traditional fund structures.

In 2023, global private equity capital deployment was down approximately 46% from its peak in 2021. This decline has prompted general partners (GPs) to offer more co-investment opportunities as they seek fresh capital sources. The current economic climate—with elevated interest rates—has also made co-investments more attractive. In 2023, U.S. buyouts were financed with about 54% equity on average, up from a historical average of 45%. This shift underscores the increasing importance of equity financing in deal structures.

Key Market Drivers

- Increased Demand: Nearly two-thirds of institutional investors plan to invest directly alongside their GPs within the next year.

- Cost Efficiency: Co-investments typically avoid management fees and carried interest, leading to higher net returns for investors.

- Flexibility: Investors can select specific deals that align with their risk tolerance and investment goals.

- Enhanced Deal Flow: As GPs face tougher fundraising conditions, they are incentivized to expand their co-investment offerings.

Implementation Strategies

Investors looking to engage in co-investing should consider several strategies:

- Building Relationships: Establishing strong relationships with private equity firms is crucial for accessing co-investment opportunities. Networking within industry circles can facilitate introductions and create partnerships.

- Due Diligence: Conduct thorough due diligence on potential investments. Understanding the financial health of target companies and the market landscape is essential for making informed decisions.

- Diversification: While co-investments allow for targeted investments, maintaining a diversified portfolio across different sectors and stages of business can help mitigate risks.

- Monitoring Performance: Regularly review the performance of co-investments against benchmarks and market conditions to ensure alignment with investment objectives.

- Legal Considerations: Ensure that all legal agreements are clear regarding rights, responsibilities, and exit strategies related to co-investments.

Risk Considerations

While co-investments offer several advantages, they also come with inherent risks:

- Lack of Control: Co-investors typically hold minority stakes and may have limited influence over company decisions compared to majority stakeholders.

- Market Volatility: Economic downturns can adversely affect the performance of underlying investments, impacting returns for co-investors.

- Dependency on Lead Investors: The success of a co-investment heavily relies on the expertise and decision-making of the lead financial sponsor or private equity firm.

- Illiquidity: Investments in private companies can be illiquid, making it challenging to exit positions quickly if needed.

Regulatory Aspects

Co-investments are subject to various regulatory considerations that investors must navigate:

- Securities Regulations: Depending on jurisdiction, securities regulations may apply when offering or soliciting investments from potential co-investors.

- Disclosure Requirements: Transparency regarding fees, risks, and investment strategies is critical in maintaining compliance with regulatory standards.

- Tax Implications: Understanding the tax treatment of co-investments is essential for effective financial planning and maximizing returns.

Future Outlook

The future of co-investing appears robust as market dynamics continue to evolve:

- Increased Opportunities: As economic conditions fluctuate, GPs may increasingly turn to co-investments as a means of raising capital without compromising fund performance.

- Growing Interest from Family Offices: Family offices are increasingly adopting co-investment strategies as they seek direct exposure to promising ventures while minimizing fee burdens associated with traditional fund investments.

- Technological Advancements: Digital platforms facilitating private market transactions could enhance access to co-investment opportunities for a broader range of investors.

Overall, as market conditions remain volatile and fundraising becomes more challenging for many private equity firms, co-investing will likely remain an attractive option for savvy investors seeking higher returns with reduced fees.

Frequently Asked Questions About Co-Investments

- What is a co-investment?

A co-investment is a minority investment made by an investor directly into a company alongside a financial sponsor or private equity firm. - Who can participate in co-investments?

Typically, institutional investors such as pension funds and insurance companies participate in co-investments; however, high-net-worth individuals may also have access through specific channels. - What are the benefits of co-investing?

Benefits include reduced fees compared to traditional funds, greater control over specific investments, potential for higher returns, and access to exclusive deals. - What risks are associated with co-investing?

Risks include lack of control over decision-making processes, exposure to market volatility, dependency on lead sponsors’ performance, and potential illiquidity. - How do I find co-investment opportunities?

Building relationships with private equity firms and participating in industry networks can help identify available opportunities. - Are there any regulatory considerations?

Yes, securities regulations apply depending on jurisdiction; compliance with disclosure requirements is also essential. - What is the future outlook for co-investing?

The future looks promising as economic conditions evolve; increased interest from family offices and technological advancements will likely enhance access to these opportunities. - How do fees compare between traditional funds and co-investments?

Co-investments typically involve lower or no management fees or carried interest compared to traditional fund investments.

This comprehensive analysis provides insights into what co-investing entails while addressing current trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks within this evolving investment landscape.