Tax-free investments are a strategic way to grow your wealth without the burden of taxation on your returns. These investments allow individuals to save and invest money while avoiding taxes on interest, dividends, and capital gains. Understanding the various options available can help you make informed decisions that align with your financial goals.

Tax-free investment vehicles are designed to encourage savings and investment by providing tax incentives. Different countries have different regulations and options for tax-free investments. In general, these investments can include municipal bonds, certain types of mutual funds, tax-advantaged accounts, and specific insurance products.

The following table summarizes some common types of tax-free investments:

| Investment Type | Description |

|---|---|

| Municipal Bonds | Debt securities issued by local governments, exempt from federal taxes. |

| Health Savings Accounts (HSAs) | Accounts for medical expenses that grow tax-free if used for qualified expenses. |

| Roth IRAs | Retirement accounts where contributions are made post-tax, but withdrawals are tax-free. |

| Tax-Exempt Mutual Funds | Funds that primarily invest in municipal bonds, offering tax-free returns. |

| Indexed Universal Life Insurance | Life insurance policies that accumulate cash value tax-free. |

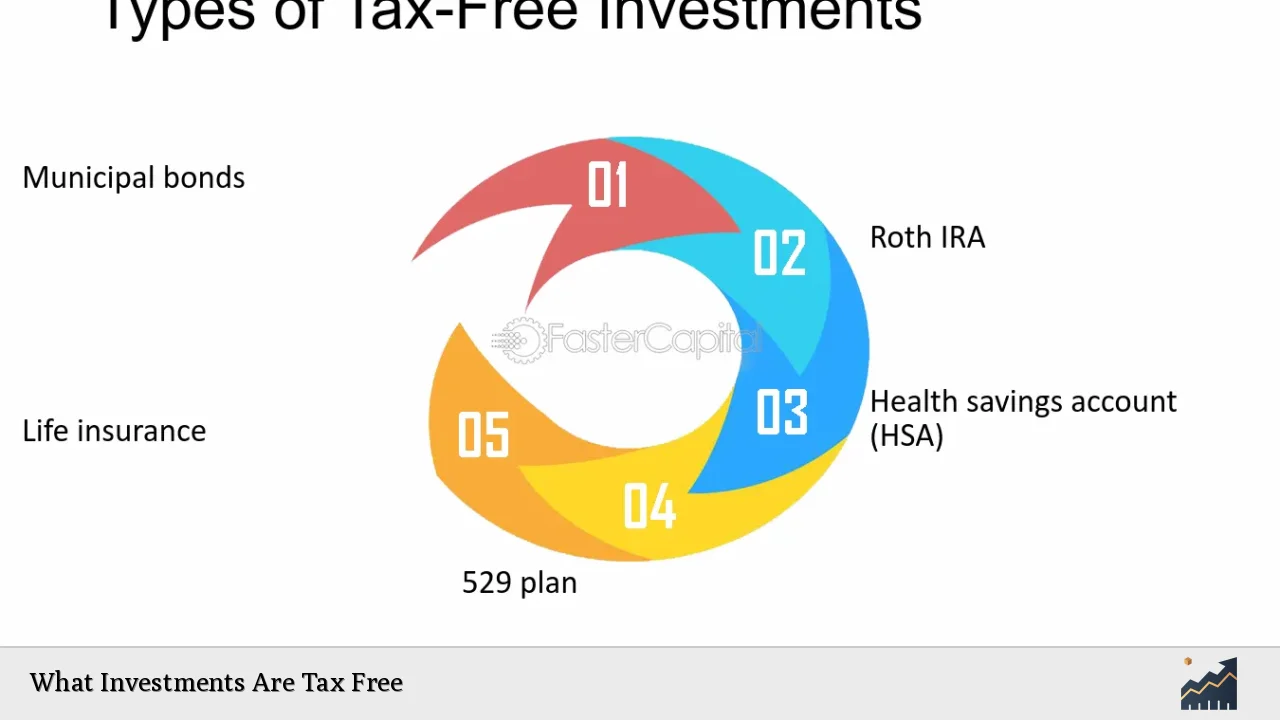

Types of Tax-Free Investments

There are several categories of tax-free investments available to investors. Understanding these options is crucial in selecting the right investment strategy.

- Municipal Bonds: These are issued by state or local governments and are typically exempt from federal taxes. They can also be exempt from state taxes if you reside in the state where the bond is issued. Municipal bonds are considered low-risk investments and provide interest income that is not subject to federal income tax.

- Tax-Exempt Mutual Funds: These funds invest primarily in municipal bonds or other tax-exempt securities. The income generated from these funds is generally exempt from federal taxes, making them an attractive option for investors seeking tax-efficient income.

- Health Savings Accounts (HSAs): HSAs offer a triple tax advantage. Contributions to HSAs are made pre-tax or can be deducted from taxable income. The funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs an effective tool for both saving for healthcare costs and investing.

- Roth IRAs: A Roth IRA allows individuals to contribute after-tax dollars, meaning that qualified withdrawals during retirement are completely tax-free. This can be particularly beneficial for younger investors who expect to be in a higher tax bracket in retirement.

- Indexed Universal Life Insurance (IUL): This type of life insurance not only provides a death benefit but also accumulates cash value over time. The cash value grows on a tax-deferred basis, and policyholders can take loans against this value without incurring taxes as long as the policy remains in force.

Tax-Free Investment Accounts

In addition to specific investment types, there are accounts designed to facilitate tax-free investing. These accounts often come with contribution limits and specific rules regarding withdrawals.

- Tax-Free Savings Accounts (TFSAs): Available in countries like Canada, TFSAs allow individuals to save or invest without paying taxes on earnings. Contributions are made with after-tax dollars, but all growth and withdrawals are tax-free.

- Individual Retirement Accounts (IRAs): In the U.S., IRAs come in two main forms: traditional and Roth. Traditional IRAs allow for pre-tax contributions with taxes due upon withdrawal, while Roth IRAs allow for after-tax contributions with tax-free withdrawals.

- Stocks and Shares ISAs: In the UK, an Individual Savings Account (ISA) allows individuals to save or invest without paying taxes on interest or capital gains. There is an annual contribution limit, and funds can be withdrawn at any time without penalty.

Benefits of Tax-Free Investments

Investing in tax-free options offers several advantages that can enhance your overall financial strategy.

- Enhanced Growth Potential: By avoiding taxes on returns, your investments can compound more effectively over time. This leads to potentially greater wealth accumulation compared to taxable accounts.

- Diversification of Income Sources: Tax-free investments can provide a steady income stream without increasing your taxable income, which is particularly beneficial for those in higher tax brackets.

- Flexibility in Withdrawals: Many tax-free accounts allow for flexible withdrawals without penalties or taxes, making them suitable for both short-term needs and long-term goals.

- Encouragement of Saving: Tax incentives associated with these investments encourage individuals to save more effectively for retirement or significant life events such as education or healthcare costs.

Considerations When Investing Tax-Free

While tax-free investments offer numerous benefits, there are important considerations to keep in mind before diving into these options.

- Contribution Limits: Many tax-free investment vehicles have annual contribution limits that restrict how much you can invest each year. It’s essential to understand these limits to maximize your benefits.

- Withdrawal Rules: Some accounts impose restrictions on when and how much you can withdraw without penalties or taxes. Familiarize yourself with these rules to avoid unexpected costs.

- Investment Choices: The types of investments available within a specific account may vary significantly. Ensure that the investment options align with your risk tolerance and financial goals.

- State-Specific Regulations: If you’re considering municipal bonds or other state-specific investments, be aware that regulations may vary by state. Consult with a financial advisor familiar with local laws.

FAQs About Tax-Free Investments

- What is a municipal bond?

A municipal bond is a debt security issued by local governments that is typically exempt from federal income taxes. - How does a Health Savings Account work?

An HSA allows you to contribute pre-tax money that grows tax-deferred and can be withdrawn tax-free for qualified medical expenses. - Can I withdraw from my Roth IRA anytime?

You can withdraw contributions from your Roth IRA at any time without penalty; however, earnings may incur taxes if not qualified. - What is the contribution limit for TFSAs?

The contribution limit for TFSAs varies by country; in Canada, it was $6,500 for 2023. - Are there penalties for withdrawing from an HSA?

If you withdraw funds from an HSA for non-medical expenses before age 65, you will incur taxes plus a 20% penalty.

Tax-free investments represent an effective strategy for building wealth while minimizing taxation on returns. By understanding the various types of available investments and their benefits, investors can make informed decisions that align with their financial objectives. Whether through municipal bonds, tax-exempt mutual funds, or specialized accounts like HSAs and Roth IRAs, there are numerous ways to optimize your investment strategy while enjoying the advantages of tax efficiency.