Understanding what investments are insured by the Federal Deposit Insurance Corporation (FDIC) is crucial for anyone looking to safeguard their financial assets. The FDIC was established in 1933 to provide stability and confidence in the U.S. banking system by protecting depositors in case of bank failures. It insures deposits at member banks, ensuring that individuals do not lose their hard-earned money if a bank becomes insolvent.

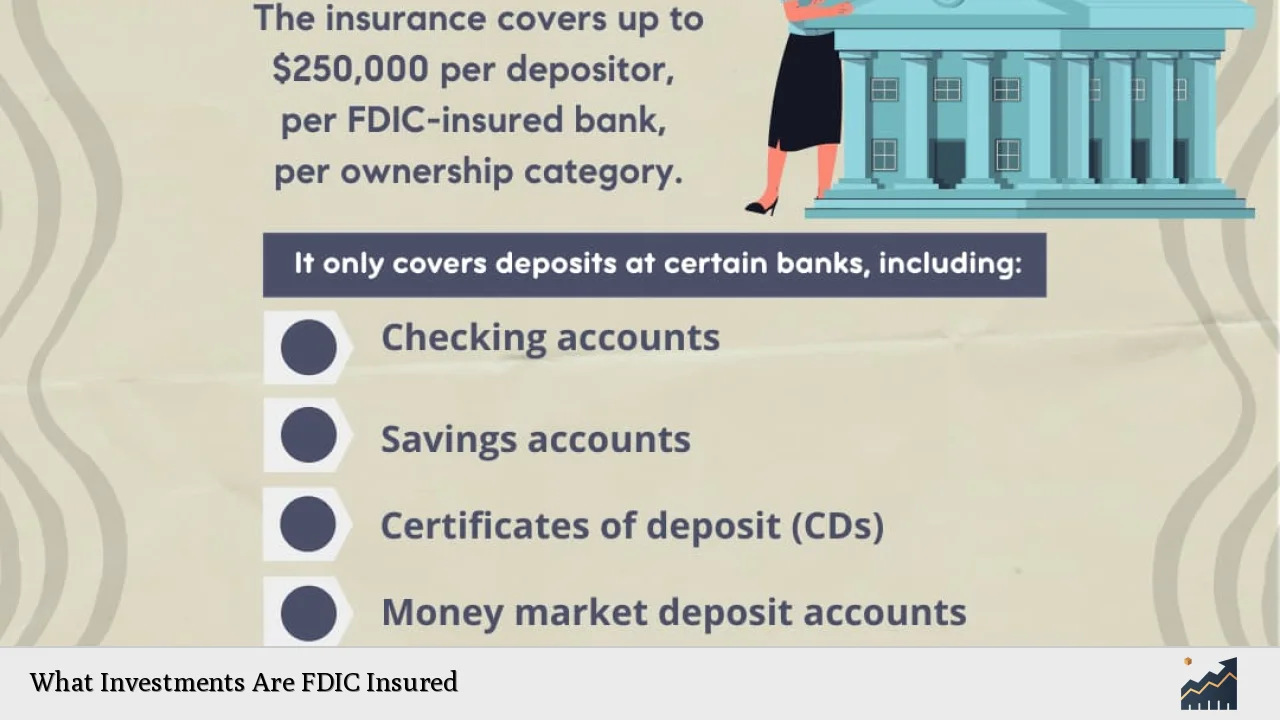

FDIC insurance covers various types of deposit accounts, but it is essential to note that it does not extend to investment products. This distinction is vital for investors who may mistakenly believe that their investment accounts are protected under FDIC insurance. The insurance limit is currently set at $250,000 per depositor, per insured bank, for each account ownership category.

| Type of Account | FDIC Insured? |

|---|---|

| Checking Accounts | Yes |

| Savings Accounts | Yes |

| Money Market Deposit Accounts | Yes |

| Certificates of Deposit (CDs) | Yes |

| Mutual Funds | No |

| Stocks and Bonds | No |

Types of Accounts Covered by FDIC Insurance

FDIC insurance is designed to protect depositors by covering a variety of account types held at member banks. Here are the primary accounts that fall under FDIC coverage:

- Checking Accounts: These accounts allow for easy access to funds through checks or debit cards. They are fully insured up to the limit.

- Savings Accounts: These accounts earn interest on deposits and are also insured by the FDIC, providing peace of mind for savers.

- Money Market Deposit Accounts (MMDAs): Similar to savings accounts, MMDAs may offer higher interest rates and are covered by FDIC insurance.

- Certificates of Deposit (CDs): These time deposits typically offer higher interest rates in exchange for locking up funds for a specified period. CDs are insured as long as they are held at an FDIC-insured bank.

- Business Accounts: Business checking and savings accounts also qualify for FDIC coverage, ensuring that business owners can protect their funds.

The standard insurance amount is $250,000 per depositor, per insured bank, for each ownership category. This means that if you have multiple accounts at the same bank under different ownership categories, you could potentially have more than $250,000 in insured deposits.

Ownership Categories and Insurance Limits

Understanding how ownership categories affect FDIC insurance limits is essential for maximizing coverage. The FDIC recognizes several types of ownership categories:

- Single Accounts: Accounts owned by one person are insured up to $250,000.

- Joint Accounts: For joint accounts owned by two or more people, each co-owner’s share is insured up to $250,000. Therefore, a joint account with two owners can be insured up to $500,000.

- Certain Retirement Accounts: Individual Retirement Accounts (IRAs) and similar retirement accounts are also covered up to $250,000 per depositor.

- Trust Accounts: Revocable trust accounts may provide additional coverage based on the number of beneficiaries named in the trust.

By spreading deposits across different ownership categories and banks, depositors can ensure that their funds remain fully protected under FDIC insurance limits.

What Investments Are Not Covered by FDIC Insurance

While FDIC insurance provides robust protection for deposit accounts, it does not cover various types of investments. Understanding what is excluded from FDIC coverage is critical for investors:

- Mutual Funds: Investments in mutual funds are not insured because they do not qualify as deposits. Mutual funds carry inherent risks associated with market fluctuations.

- Stocks and Bonds: Investments in individual stocks or bonds purchased through a bank or brokerage firm are also not covered by FDIC insurance.

- Annuities: Annuities are considered insurance products and do not fall under the protection offered by the FDIC.

- Life Insurance Policies: Similar to annuities, life insurance policies are not insured by the FDIC.

- Treasury Securities: While U.S. Treasury bills, notes, and bonds are considered safe investments backed by the government, they do not qualify for FDIC insurance when purchased through a bank.

It is crucial for investors to recognize these limitations when considering where to place their money. Relying solely on FDIC insurance may lead to misunderstandings regarding asset protection.

Importance of Understanding FDIC Insurance

Understanding the scope and limitations of FDIC insurance can significantly impact financial planning and investment strategies. Knowing which assets are protected helps individuals make informed decisions about where to save or invest their money.

The peace of mind offered by knowing that deposits are insured can encourage individuals to keep their savings in secure accounts rather than risking them in volatile investments. Additionally, understanding how to maximize coverage through different ownership categories can help depositors ensure that their funds remain protected even during economic uncertainty.

Moreover, with recent banking failures highlighting the importance of financial stability, having a clear understanding of FDIC insurance becomes even more relevant. It empowers individuals to navigate their financial landscape confidently while safeguarding their assets against potential risks associated with bank failures.

Strategies for Maximizing Your FDIC Coverage

To ensure that all your deposits are fully covered under FDIC insurance limits, consider implementing these strategies:

- Open Multiple Accounts: If you have significant savings exceeding $250,000, consider opening accounts at different banks or utilizing different ownership categories within the same bank.

- Utilize Joint Accounts: If applicable, open joint accounts with family members or partners to increase your total insured amount without exceeding individual limits.

- Explore Retirement Account Options: Make use of retirement accounts like IRAs that offer separate coverage limits under FDIC insurance.

- Monitor Your Deposits: Regularly review your account balances and ensure they remain within the insured limits. Use tools like the Electronic Deposit Insurance Estimator (EDIE) provided by the FDIC for assistance.

By employing these strategies effectively, you can enhance your financial security and ensure that your deposits remain protected against unforeseen banking crises.

FAQs About What Investments Are FDIC Insured

- What types of accounts are covered by FDIC insurance?

FDIC insurance covers checking accounts, savings accounts, money market deposit accounts, and certificates of deposit. - Is my investment in mutual funds protected by the FDIC?

No, mutual funds are not covered by FDIC insurance as they do not qualify as deposits. - What is the maximum amount covered by the FDIC?

The maximum amount covered is $250,000 per depositor per insured bank for each ownership category. - Are stocks insured by the FDIC?

No, investments in stocks and bonds are not insured by the FDIC. - How can I maximize my FDIC coverage?

You can maximize your coverage by spreading deposits across multiple banks and utilizing different ownership categories.

Understanding what investments are covered by FDIC insurance is essential for anyone looking to protect their financial assets effectively. By being aware of both what is included and excluded from coverage, individuals can make informed decisions about where to place their money while ensuring they remain within safe limits during uncertain economic times.