Choosing the right investment type for your 401(k) plan is crucial for building a secure financial future. A 401(k) is a retirement savings plan that allows employees to invest a portion of their paycheck before taxes are deducted. This tax-advantaged account can significantly enhance your savings over time, but selecting the appropriate investments can be daunting. Factors such as age, risk tolerance, and financial goals play a vital role in determining the best investment options for each individual.

In a typical 401(k) plan, participants can choose from various investment options, including stocks, bonds, mutual funds, target-date funds, and more. Each option carries different levels of risk and potential returns. Understanding these options is essential to making informed decisions that align with your retirement objectives.

| Investment Type | Description |

|---|---|

| Stocks | Equities that offer high growth potential but come with higher volatility. |

| Bonds | Debt securities that provide steady income with lower risk than stocks. |

| Mutual Funds | Pooled investments managed by professionals, offering diversification. |

| Target-Date Funds | Funds that automatically adjust their asset allocation based on retirement date. |

Understanding Investment Options in 401(k) Plans

When evaluating what investment type is best for your 401(k), it’s essential to understand the various options available.

Stocks are often favored for their potential for high returns. They can be volatile in the short term but may yield substantial growth over the long term. Younger investors typically allocate more to stocks since they have time to recover from market fluctuations.

Bonds, on the other hand, are generally considered safer investments. They provide fixed interest payments and are less volatile than stocks. As individuals approach retirement age, they may shift their portfolios towards bonds to preserve capital and generate income.

Mutual funds combine both stocks and bonds, allowing for diversification within a single investment. These funds are managed by professionals who make decisions on behalf of investors, which can be beneficial for those who prefer a hands-off approach.

Target-date funds are designed to automatically adjust their asset allocation as the target retirement date approaches. They start with a higher allocation to stocks and gradually shift towards bonds and other conservative investments. This option is particularly appealing for those who want a simple, one-stop solution for their retirement savings.

Factors Influencing Your Investment Choices

Several factors should influence your choice of investments within your 401(k) plan:

- Age: Younger investors typically have a longer time horizon and can afford to take more risks with their investments. As you age, it may be wise to gradually reduce exposure to high-risk assets.

- Risk Tolerance: Understanding your comfort level with market fluctuations is crucial. If you prefer stability over potential high returns, consider more conservative options like bonds or stable value funds.

- Financial Goals: Define what you want to achieve with your retirement savings. If you’re aiming for significant growth, you might lean towards stock-heavy portfolios. Conversely, if you prioritize capital preservation or income generation, focus on bonds or dividend-paying stocks.

- Investment Fees: Be mindful of the fees associated with different investment options. High fees can erode your returns over time, so look for low-cost index funds or ETFs when possible.

Diversification: A Key Strategy

Diversification is a critical strategy in managing investment risk within your 401(k). By spreading your investments across various asset classes—such as stocks, bonds, and cash equivalents—you can mitigate potential losses from any single investment type.

- Asset Allocation: Determine an appropriate mix of asset classes based on your risk tolerance and investment horizon. Younger investors might allocate a larger percentage to equities while older investors may prefer fixed-income securities.

- Geographic Diversification: Consider investing in both domestic and international markets. This approach can reduce reliance on the U.S. economy and expose you to growth opportunities in emerging markets.

- Sector Diversification: Investing across different sectors—like technology, healthcare, and consumer goods—can further reduce risk by ensuring that not all investments are affected by sector-specific downturns.

The Role of Professional Guidance

For those unsure about how to navigate their 401(k) investment options, seeking professional guidance can be beneficial. Financial advisors can provide personalized advice based on individual circumstances and help create a tailored investment strategy.

Many 401(k) plans also offer access to financial education resources or workshops that can enhance understanding of investment choices. Utilizing these resources can empower participants to make informed decisions about their retirement savings.

Common Investment Types in 401(k) Plans

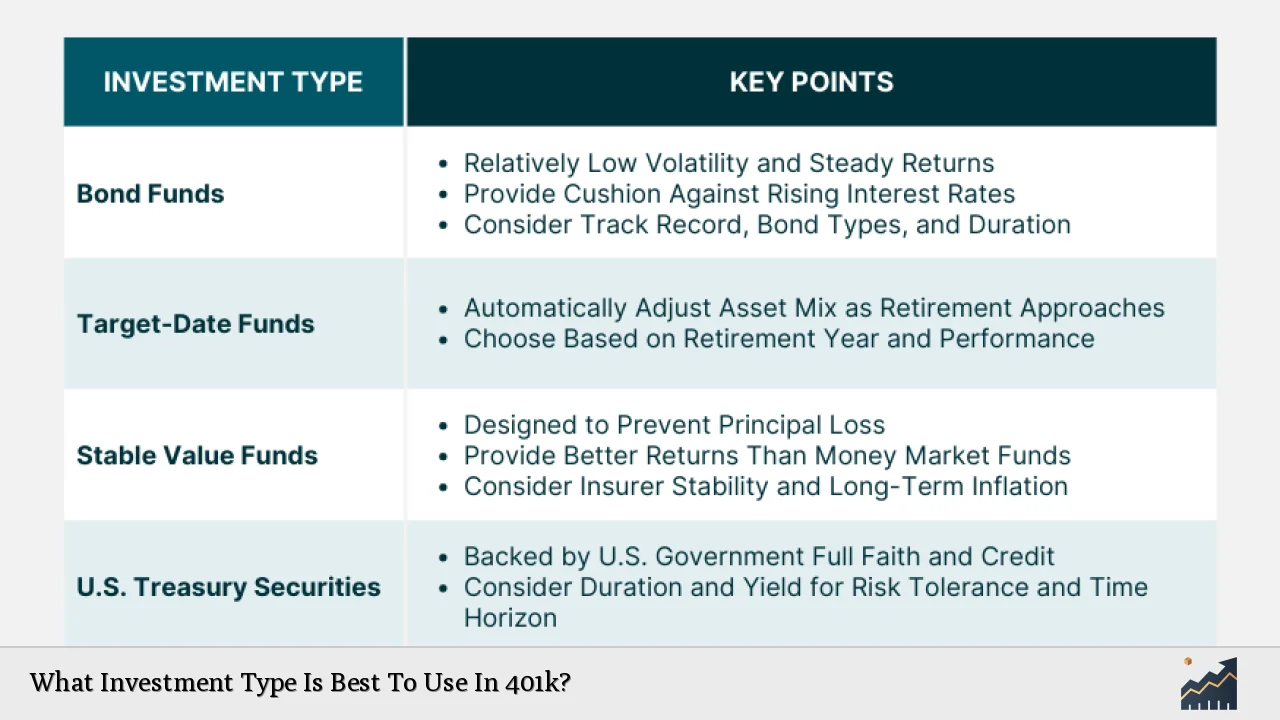

Understanding the common types of investments available in most 401(k) plans will help you make informed decisions:

- Mutual Funds: These are pooled investments that allow investors to buy into a diversified portfolio managed by professionals. They come in various types—equity funds focus on stocks while bond funds invest in fixed-income securities.

- Index Funds: A subset of mutual funds that aim to replicate the performance of specific market indices (like the S&P 500). They typically have lower fees compared to actively managed funds due to their passive management style.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like stocks on exchanges. ETFs offer flexibility and often come with lower expense ratios than traditional mutual funds.

- Company Stock: Some 401(k) plans allow participants to invest directly in their employer’s stock. While this may seem appealing due to familiarity with the company, it also poses risks related to lack of diversification.

Balancing Growth and Stability

As you build your 401(k) portfolio, it’s essential to strike a balance between growth-oriented investments and those that provide stability:

- Growth Investments: Focused on capital appreciation through equities or growth mutual funds. These are suitable for younger investors who can withstand market volatility.

- Stable Investments: Include bonds or stable value funds that offer lower returns but provide security against market downturns. These become increasingly important as you near retirement age.

Regularly reviewing your portfolio will help ensure it remains aligned with your goals as circumstances change over time.

FAQs About What Investment Type Is Best To Use In 401k

- What is the best investment type for young investors?

Younger investors should consider allocating more towards stocks or equity mutual funds due to their higher growth potential. - How often should I review my 401(k) investments?

It’s advisable to review your portfolio at least annually or whenever there are significant changes in your financial situation. - Are target-date funds a good choice?

Yes, target-date funds are convenient as they automatically adjust asset allocation based on your retirement date. - What is the safest investment option in a 401(k)?

The safest options include money market funds or U.S. government bonds; however, they typically offer lower returns. - How do fees impact my 401(k) investments?

High fees can significantly reduce your overall returns over time; thus, opting for low-cost index funds is often recommended.

In conclusion, selecting the best investment type for your 401(k) requires careful consideration of various factors including age, risk tolerance, financial goals, and available options within your plan. By diversifying your portfolio and regularly reviewing it against changing circumstances, you can optimize your retirement savings strategy effectively.