Investing wisely can lead to substantial financial growth, but understanding the tax implications of your investments is crucial. Certain investments allow you to avoid or minimize taxes, making them attractive options for many investors. These non-taxable investments can help you retain more of your earnings, especially if you are in a higher tax bracket. This article will explore various types of non-taxable investments, how they work, and their benefits.

| Type of Investment | Description |

|---|---|

| Municipal Bonds | Debt securities issued by local governments, exempt from federal taxes. |

| Tax-Exempt Mutual Funds | Funds that invest primarily in municipal bonds and are exempt from federal taxes. |

| Roth IRA | A retirement account with tax-free withdrawals in retirement. |

| 529 Plans | Education savings plans with tax-free growth and withdrawals for qualified expenses. |

Types of Non-Taxable Investments

There are several types of investments that can be classified as non-taxable or tax-advantaged. Each has its unique features and benefits, making them suitable for different financial goals.

Municipal Bonds

Municipal bonds are debt securities issued by state and local governments to fund public projects. The interest earned on these bonds is typically exempt from federal income tax and may also be exempt from state and local taxes, depending on where you reside. This makes municipal bonds particularly appealing for investors in higher tax brackets who want to maximize their after-tax returns.

Investing in municipal bonds can provide a steady income stream without the burden of taxation on the interest earned. However, it’s essential to consider the credit quality of the issuing municipality, as lower-rated bonds may carry higher risks.

Tax-Exempt Mutual Funds

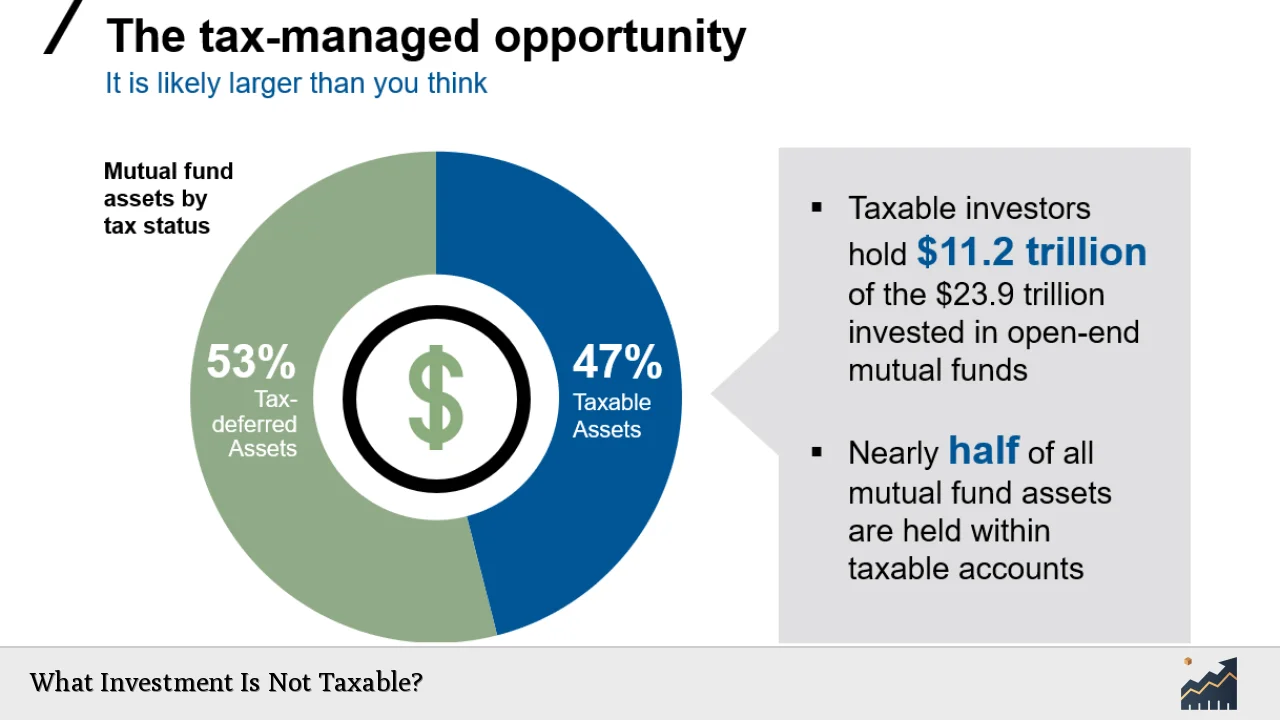

Tax-exempt mutual funds primarily invest in municipal bonds and other tax-exempt securities. These funds offer diversification and professional management while ensuring that the income generated is not subject to federal taxes. Investors benefit from the potential for capital appreciation along with tax-free income.

When selecting a tax-exempt mutual fund, it’s crucial to evaluate the fund’s expense ratio and historical performance. While these funds may not provide the highest returns compared to taxable funds, their tax advantages can significantly enhance overall investment performance over time.

Roth IRA

A Roth IRA is a retirement account that allows individuals to contribute after-tax income. The significant advantage of a Roth IRA is that qualified withdrawals during retirement are entirely tax-free. This includes both contributions and any investment gains.

To benefit from a Roth IRA, individuals must adhere to specific income limits and contribution limits set by the IRS. This account is particularly beneficial for younger investors who expect their income—and consequently their tax rate—to rise over time.

529 Plans

529 plans are specialized accounts designed for education savings. Contributions to these plans grow tax-free, and withdrawals used for qualified education expenses (such as tuition, room, board, and books) are also tax-free at the federal level. Some states even offer tax deductions or credits for contributions made to a 529 plan.

These plans not only provide significant tax benefits but also encourage saving for education expenses early on. However, it’s important to understand the specific rules governing withdrawals to avoid penalties on non-qualified distributions.

Other Tax-Advantaged Options

In addition to the primary non-taxable investment options mentioned above, there are other strategies and accounts that can help minimize your overall tax burden.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) allow individuals with high-deductible health plans (HDHPs) to save money for medical expenses on a tax-advantaged basis. Contributions made to HSAs are tax-deductible, and any interest or investment gains grow tax-free. Withdrawals for qualified medical expenses are also exempt from taxes.

This triple-tax advantage makes HSAs an excellent option for those looking to save for healthcare costs while enjoying significant tax benefits.

Tax-Exempt Money Market Funds

Tax-exempt money market funds invest primarily in municipal securities and provide investors with a safe place to park cash while earning interest that is exempt from federal taxes. These funds typically offer lower returns than other investment options but come with lower risk and high liquidity.

For investors in high tax brackets seeking stability without incurring additional taxes on interest income, these funds can be an attractive choice.

Series I Bonds

Series I bonds are U.S. government savings bonds designed to protect against inflation. The interest earned on these bonds is exempt from state and local taxes, although it is subject to federal income tax when redeemed. If used for qualified educational expenses, the interest may also be exempt from federal taxes.

These bonds offer a low-risk investment option with inflation protection while providing some tax advantages.

Key Considerations When Choosing Non-Taxable Investments

When deciding which non-taxable investments suit your financial goals, consider the following factors:

- Investment Horizon: Determine how long you plan to hold your investments before needing access to your funds.

- Risk Tolerance: Assess your comfort level with risk versus potential returns associated with different types of investments.

- Tax Situation: Understand your current and projected future tax situation to choose investments that align with your financial strategy.

- Liquidity Needs: Evaluate how easily you may need to access your funds without incurring penalties or losing out on potential growth.

By carefully considering these factors, you can make informed decisions about which non-taxable investments will best support your financial objectives.

FAQs About Non-Taxable Investments

- What are non-taxable investments?

Non-taxable investments are financial products that allow you to earn income or capital gains without incurring federal or state taxes. - How do municipal bonds work?

Municipal bonds generate interest income that is typically exempt from federal taxes and possibly state/local taxes depending on residency. - What is a Roth IRA?

A Roth IRA allows individuals to contribute after-tax money and withdraw earnings tax-free during retirement. - Can I use 529 plans for any education expenses?

Yes, 529 plans can be used for qualified education expenses such as tuition, books, and room/board without incurring taxes. - Are there penalties for withdrawing from HSAs?

If withdrawn for non-qualified expenses before age 65, HSAs incur penalties; otherwise, they provide significant tax advantages.

Understanding non-taxable investments is essential for optimizing your portfolio while minimizing your overall tax liability. By leveraging these investment options effectively, you can enhance your financial growth while keeping more of your earnings intact.