While 401(k) plans are popular retirement savings vehicles, they may not always be the best option for everyone. Several alternative investments can potentially offer better returns, more flexibility, or additional tax advantages. It’s important to understand that the “best” investment depends on your individual financial situation, goals, and risk tolerance.

Let’s explore some investments that could potentially outperform a traditional 401(k) plan:

| Investment Type | Key Advantage |

|---|---|

| Roth IRA | Tax-free withdrawals in retirement |

| Real Estate | Potential for passive income and appreciation |

| Self-Directed IRA | Access to alternative investments |

| Health Savings Account (HSA) | Triple tax advantage |

Roth IRA: Tax-Free Growth and Withdrawals

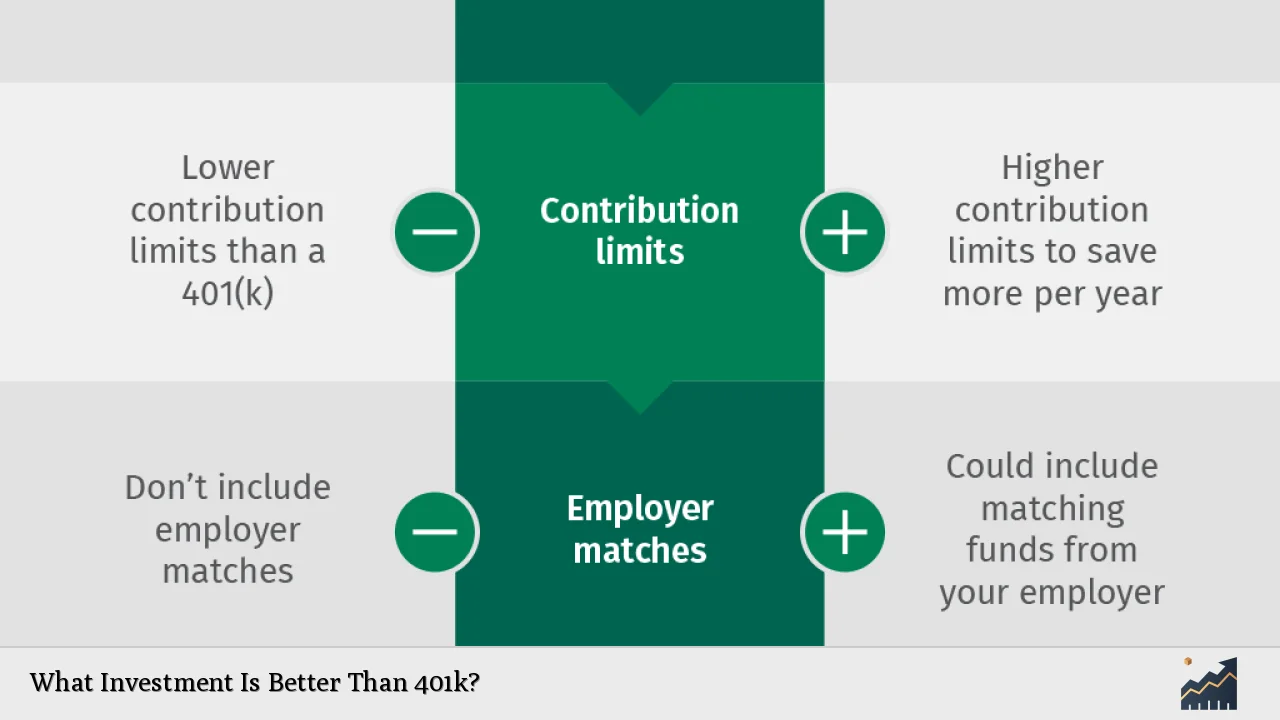

A Roth IRA can be an excellent alternative or complement to a 401(k) plan. Unlike traditional 401(k)s, Roth IRAs are funded with after-tax dollars, but offer tax-free growth and tax-free withdrawals in retirement. This can be particularly advantageous if you expect to be in a higher tax bracket during retirement.

Key benefits of a Roth IRA include:

- Tax-free withdrawals in retirement

- No required minimum distributions (RMDs)

- Flexibility to withdraw contributions penalty-free

- Wide range of investment options

However, Roth IRAs have income limits for eligibility and lower contribution limits compared to 401(k)s. In 2024, the contribution limit for Roth IRAs is $7,000 per year, with an additional $1,000 catch-up contribution allowed for those 50 and older.

Real Estate: Tangible Assets and Passive Income

Investing in real estate can potentially offer better returns than a 401(k), especially when considering the benefits of leverage and potential tax advantages. Real estate investments can provide:

- Steady cash flow through rental income

- Potential for property appreciation

- Tax deductions for mortgage interest and property expenses

- Ability to use leverage to increase returns

Real estate investing can take various forms, including:

- Rental properties

- Real Estate Investment Trusts (REITs)

- Real estate crowdfunding platforms

- House flipping

While real estate can offer significant returns, it also comes with risks and requires more active management than a 401(k). It’s important to consider factors such as market conditions, property maintenance, and potential vacancies when investing in real estate.

Self-Directed IRA: Access to Alternative Investments

A Self-Directed IRA (SDIRA) allows you to invest in a wider range of assets than traditional IRAs or 401(k)s. With an SDIRA, you can potentially achieve higher returns by investing in:

- Private equity

- Precious metals

- Cryptocurrencies

- Real estate

- Startups and private businesses

SDIRAs offer the same tax advantages as traditional IRAs, but with greater investment flexibility. However, they also come with increased responsibility and potential risks. It’s crucial to understand the rules and regulations surrounding SDIRAs, as prohibited transactions can result in significant penalties.

Key Considerations for SDIRAs:

- Higher fees compared to traditional IRAs

- More complex administration and reporting requirements

- Potential for fraud or risky investments

- Prohibited transactions can disqualify the entire IRA

Health Savings Account (HSA): Triple Tax Advantage

While not typically considered a retirement account, a Health Savings Account (HSA) can be an excellent investment vehicle that offers unique tax advantages. HSAs provide a triple tax benefit:

- Contributions are tax-deductible

- Growth is tax-free

- Withdrawals for qualified medical expenses are tax-free

After age 65, you can withdraw funds from an HSA for non-medical expenses without penalty, paying only income tax, similar to a traditional IRA. This makes HSAs a powerful tool for both healthcare savings and retirement planning.

To be eligible for an HSA, you must be enrolled in a high-deductible health plan (HDHP). The contribution limits for 2024 are $4,150 for individuals and $8,300 for families, with an additional $1,000 catch-up contribution allowed for those 55 and older.

Taxable Brokerage Account: Flexibility and Control

While not offering the same tax advantages as retirement accounts, a taxable brokerage account can provide greater flexibility and control over your investments. Benefits include:

- No contribution limits

- No withdrawal penalties or restrictions

- Access to a wide range of investment options

- Potential for lower long-term capital gains tax rates

With a taxable account, you can invest in individual stocks, bonds, mutual funds, ETFs, and other securities. This flexibility allows you to tailor your investment strategy to your specific goals and risk tolerance.

However, it’s important to consider the tax implications of a taxable account. You’ll owe taxes on dividends, interest, and capital gains in the year they’re earned or realized. Strategic tax planning, such as tax-loss harvesting, can help minimize your tax liability.

Small Business Ownership: High Risk, High Reward

For those with an entrepreneurial spirit, starting or investing in a small business can potentially offer higher returns than a 401(k). Small business ownership provides:

- Unlimited earning potential

- Control over your financial destiny

- Potential tax advantages

- Opportunity to build equity and sell the business

However, small business ownership also comes with significant risks and requires a substantial time commitment. It’s important to carefully consider your skills, resources, and risk tolerance before pursuing this option.

Conclusion: Diversification is Key

While these investments may offer potential advantages over a 401(k), it’s important to remember that diversification is crucial for a well-rounded retirement strategy. Rather than choosing a single investment type, consider combining multiple options to balance risk and potential returns.

Always consult with a financial advisor to determine the best investment strategy for your individual circumstances. They can help you create a personalized plan that takes into account your risk tolerance, time horizon, and financial goals.

FAQs About What Investment Is Better Than 401k

- Can I invest in both a 401(k) and a Roth IRA?

Yes, you can contribute to both a 401(k) and a Roth IRA, subject to income and contribution limits. - Are there penalties for withdrawing from a 401(k) early?

Yes, withdrawals before age 59½ typically incur a 10% penalty plus income tax, with some exceptions. - How much should I contribute to my retirement accounts?

Aim to save at least 15% of your income for retirement, including any employer match. - What are the advantages of a Solo 401(k) for self-employed individuals?

Solo 401(k)s offer higher contribution limits and the ability to make both employee and employer contributions. - Should I prioritize paying off debt or investing for retirement?

Generally, prioritize high-interest debt, then balance between debt repayment and retirement savings based on interest rates and employer match.