Investing is a crucial aspect of financial planning, and understanding the risk associated with different investment options is vital for making informed decisions. Low-risk investments are particularly appealing for conservative investors who prioritize capital preservation over high returns. These investments typically offer lower volatility and a more predictable income stream, making them suitable for individuals nearing retirement or those with short-term financial goals.

In this article, we will explore various low-risk investment options, their characteristics, and how they can fit into an overall investment strategy. By understanding these options, investors can make better decisions that align with their financial objectives.

| Investment Type | Risk Level |

|---|---|

| Government Bonds | Very Low |

| High-Yield Savings Accounts | Low |

| Certificates of Deposit (CDs) | Low |

| Money Market Funds | Low |

| Dividend-Paying Stocks | Moderate |

Understanding Low-Risk Investments

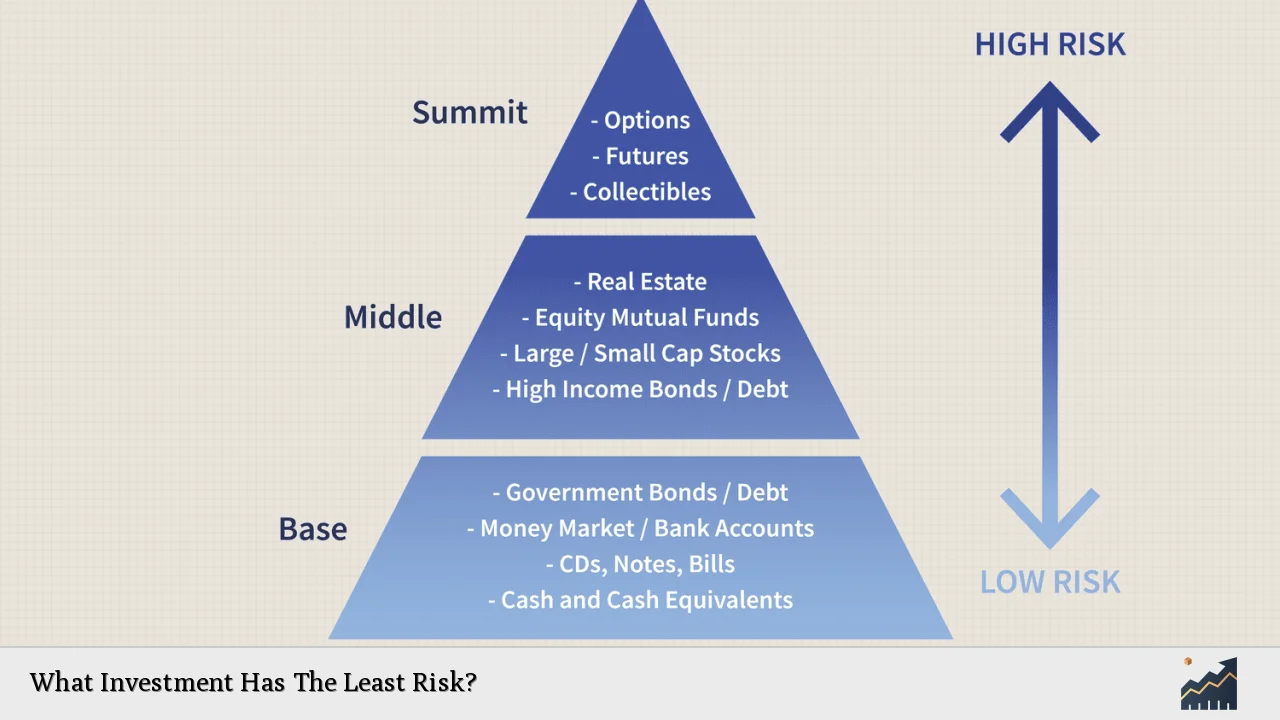

Low-risk investments are characterized by their stability and predictability. They tend to have a lower potential for loss compared to higher-risk investments like stocks or real estate. This stability is essential for investors who seek to protect their capital while still earning a return.

One of the primary benefits of low-risk investments is the steady income they provide. This income can come from interest payments, dividends, or other forms of returns that are generally more reliable than those from riskier assets. Additionally, these investments often experience less volatility, meaning they do not fluctuate dramatically in value, which can be particularly reassuring during economic downturns.

However, it is important to note that while low-risk investments offer safety, they typically provide lower returns compared to higher-risk alternatives. This trade-off means that investors must balance their desire for security with their need for growth in their investment portfolios.

Types of Low-Risk Investments

There are several types of low-risk investments available to investors. Each type has its own unique features and benefits:

- Government Bonds: Often considered one of the safest investment options, government bonds are backed by the full faith and credit of the issuing government. They provide fixed interest payments over a specified term and return the principal at maturity.

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts while maintaining FDIC insurance protection up to $250,000. They are ideal for short-term savings goals due to their liquidity.

- Certificates of Deposit (CDs): CDs require investors to lock in their funds for a predetermined period in exchange for a fixed interest rate. They are also FDIC insured, making them a safe option for conservative investors.

- Money Market Funds: These funds invest in short-term debt instruments and aim to provide higher yields than standard savings accounts while maintaining liquidity and stability.

- Dividend-Paying Stocks: While slightly riskier than other options on this list, dividend-paying stocks can provide a steady income stream through regular dividend payments. They are generally less volatile than non-dividend stocks.

Characteristics of Low-Risk Investments

Low-risk investments share several common characteristics that make them appealing to conservative investors:

- Stability: These investments typically experience less price fluctuation compared to higher-risk assets, providing peace of mind during market volatility.

- Predictable Returns: Investors can expect a consistent income stream from low-risk investments, which helps in budgeting and financial planning.

- Capital Preservation: The primary goal of low-risk investing is to protect the principal amount invested while still generating some level of return.

- Liquidity: Many low-risk investments allow for easy access to funds without significant penalties or loss of principal.

Advantages and Disadvantages

Like all investment strategies, low-risk investments come with both advantages and disadvantages:

Advantages

- Reduced Risk: The most significant advantage is the lower likelihood of losing money compared to riskier investments.

- Steady Income: Many low-risk options provide regular income through interest or dividends, which can be particularly beneficial for retirees or those needing consistent cash flow.

- Peace of Mind: Knowing that your capital is relatively safe allows investors to maintain confidence during economic uncertainty.

Disadvantages

- Lower Returns: The trade-off for safety is typically lower returns; these investments may not keep pace with inflation over time.

- Opportunity Cost: By investing conservatively, there may be missed opportunities for higher returns available through riskier assets.

How to Choose the Right Low-Risk Investment

Choosing the right low-risk investment depends on various factors including your financial goals, risk tolerance, and investment horizon:

- Financial Goals: If you have short-term goals (e.g., saving for a house), high-yield savings accounts or CDs may be appropriate. For long-term goals (e.g., retirement), consider government bonds or dividend-paying stocks.

- Risk Tolerance: Assess your comfort level with risk. If you prefer minimal fluctuations in your portfolio value, focus on government bonds or money market funds.

- Investment Horizon: Longer investment horizons may allow you to take on slightly more risk without jeopardizing your capital preservation goals.

Diversification in Low-Risk Investing

Diversification is essential even within low-risk investing. By spreading your investments across various asset classes—such as government bonds, CDs, and money market funds—you can reduce overall portfolio risk while still achieving stable returns.

A well-diversified portfolio can help mitigate risks associated with any single investment type while providing opportunities for growth through different market conditions. For example:

| Asset Class | Percentage Allocation |

|---|---|

| Government Bonds | 40% |

| High-Yield Savings Accounts | 20% |

| Certificates of Deposit (CDs) | 20% |

| Money Market Funds | 10% |

| Dividend-Paying Stocks | 10% |

This allocation provides a balanced approach that prioritizes safety while allowing some exposure to equities for potential growth.

FAQs About What Investment Has The Least Risk

- What are the safest types of investments?

The safest types include government bonds, high-yield savings accounts, and certificates of deposit. - How much return can I expect from low-risk investments?

Returns vary but are generally lower than those from higher-risk investments; expect modest interest rates or dividends. - Are low-risk investments suitable for everyone?

No, they are best suited for conservative investors or those nearing retirement who prioritize capital preservation. - Can I lose money in low-risk investments?

While unlikely, it is still possible to lose money due to inflation or changes in interest rates affecting returns. - How should I allocate my portfolio among low-risk options?

A diversified approach is recommended; consider your financial goals and risk tolerance when deciding on allocations.

In summary, understanding what constitutes low-risk investments allows individuals to create a balanced portfolio that meets their financial needs while minimizing exposure to potential losses. By carefully selecting among government bonds, high-yield savings accounts, CDs, money market funds, and dividend-paying stocks—and diversifying within these categories—investors can achieve both security and steady growth over time.