Finding the investment with the highest interest rate is essential for maximizing returns on savings and investments. Various options are available, each with different risk levels and potential returns. This article explores the current landscape of high-interest investments, including high-yield savings accounts, certificates of deposit (CDs), and fixed deposits, among others.

Investors typically seek to balance risk and return, with higher interest rates often accompanied by increased risk. However, in today’s market, there are several low-risk options that offer competitive rates. Understanding these options can help investors make informed decisions that align with their financial goals.

In recent months, interest rates have been on the rise due to economic conditions and Federal Reserve policies. This has created a favorable environment for savers and investors looking for better returns on their money. Below is a summary of some of the top investment options currently available.

| Investment Type | Current Interest Rate |

|---|---|

| High-Yield Savings Account | Up to 6.17% APY |

| Certificates of Deposit (CDs) | Up to 5.00% APY |

| Fixed Deposits (India) | Up to 9.00% |

High-Yield Savings Accounts

High-yield savings accounts (HYSAs) are among the most popular choices for individuals seeking higher interest rates without significant risk. These accounts typically offer rates much higher than traditional savings accounts due to their online nature and lower overhead costs.

Currently, some of the leading high-yield savings accounts offer rates up to 6.17% APY. The Digital Federal Credit Union (DCU) is one such institution providing this competitive rate for balances up to $1,000. Other notable accounts include:

- Pibank Savings: 5.00% APY

- Jenius Savings Account: 4.80% APY

- BrioDirect High-Yield Savings Account: 4.75% APY

These accounts are generally FDIC-insured, meaning your deposits are protected up to $250,000 per institution, adding a layer of security for investors.

HYSAs are ideal for short-term savings goals where liquidity is important since funds can be accessed easily without penalties. However, it is essential to compare various options as fees and minimum balance requirements can vary significantly among banks.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another low-risk investment option that offers fixed interest rates over a specified term, typically ranging from six months to five years. CDs generally provide higher interest rates than standard savings accounts due to the commitment of locking in funds for a set period.

Currently, some CDs are offering rates exceeding 5% APY:

- Many banks provide competitive rates based on the length of the term chosen.

- For example, a 12-month CD may yield around 5.00% APY, while longer terms can offer even higher rates.

The primary advantage of CDs is the guaranteed return on investment; however, they come with a caveat: funds are locked until maturity, and early withdrawals may incur penalties.

Investors should assess their cash flow needs before committing to a CD since accessing funds prematurely can diminish overall returns.

Fixed Deposits in India

For investors in India, fixed deposits (FDs) present an attractive option with some banks offering rates as high as 9% for specific tenures. Small finance banks often lead in competitive interest rates:

- NorthEast Small Finance Bank: 9.00% for tenures ranging from 546 days to 1111 days

- Unity Small Finance Bank: 9.00% for tenures of 1001 days

- Jana Small Finance Bank: 8.25% for tenures between one and three years

Fixed deposits provide security as they are typically insured by the government and offer guaranteed returns over the investment period.

However, investors should consider factors such as tenure length and liquidity needs before investing in FDs since funds cannot be withdrawn easily without penalties.

High-Dividend Stocks

For those willing to take on more risk in exchange for potentially higher returns, high-dividend stocks can be an appealing option. These stocks provide regular dividend payments that can yield between 4% to 10% annually:

- Crown Castle: 6.2%

- Enterprise Products Partners: 6.5%

- LyondellBasell: 7.0%

Investing in dividend-paying stocks not only offers income but also provides an opportunity for capital appreciation over time. However, it is essential to evaluate the stability of the company and its dividend payout history before investing.

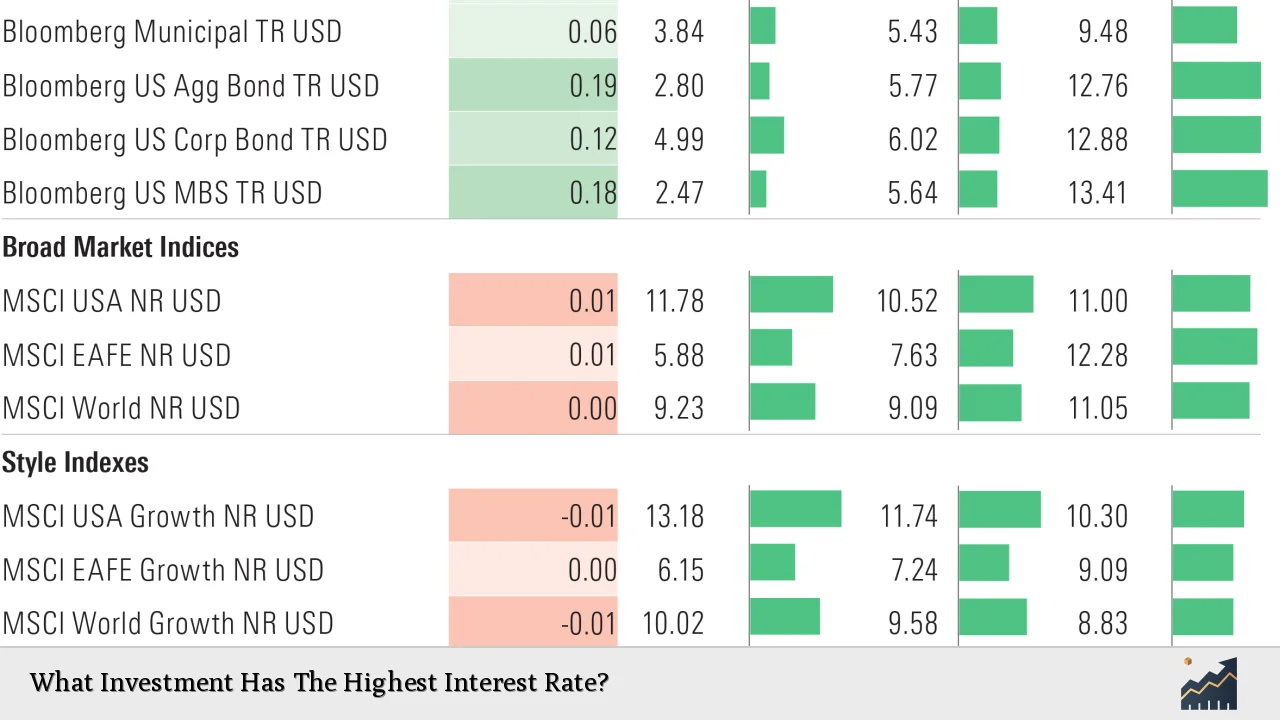

High-Yield Bond Funds

High-yield bond funds focus on lower-quality bonds that offer higher yields compared to investment-grade bonds. These funds can yield around 6% or more, making them attractive for income-seeking investors:

- AB High Income I: 7.32%

- American Beacon SiM High Yield Opps I: 6.76%

While these investments can provide substantial returns, they come with increased risks associated with credit quality and market volatility.

Cryptocurrency Savings Accounts

In recent years, cryptocurrency savings accounts have emerged as a new way to earn interest on digital assets. Some platforms offer yields up to 14.5%, particularly on stablecoins:

- Crypto.com Earn: Up to 14.5%

- Nexo: Up to 12%

While these accounts can offer significantly higher returns than traditional savings vehicles, they also carry risks associated with cryptocurrency volatility and regulatory uncertainties.

Conclusion

When searching for investments with the highest interest rates, it is crucial to consider both potential returns and associated risks carefully. Each investment type—whether high-yield savings accounts, CDs, fixed deposits, high-dividend stocks, or cryptocurrency savings—offers unique benefits suited to different financial goals and risk tolerances.

Investors should conduct thorough research and possibly consult financial advisors when making decisions about where to allocate their funds effectively.

FAQs About What Investment Has The Highest Interest Rate

- What is a high-yield savings account?

A high-yield savings account offers significantly higher interest rates than traditional savings accounts. - Are CDs safe investments?

Yes, CDs are considered safe investments as they are typically FDIC-insured. - What are fixed deposits?

Fixed deposits are investments where money is locked in for a specific period at a fixed interest rate. - Can I lose money in high-dividend stocks?

Yes, while they provide regular income, stock prices can fluctuate leading to potential losses. - What risks do cryptocurrency savings accounts carry?

Cryptocurrency savings accounts carry risks related to market volatility and regulatory changes.