Investors are constantly seeking opportunities to maximize their returns and grow their wealth. When it comes to identifying the investment with the highest annual return, it’s important to understand that returns can vary significantly based on market conditions, economic factors, and individual investment choices. However, by analyzing historical data and current market trends, we can identify some investments that have consistently delivered strong performance over time.

Before diving into specific investments, it’s crucial to note that higher returns often come with increased risk. Investors should always consider their risk tolerance, investment goals, and time horizon when making investment decisions. Additionally, past performance does not guarantee future results, and diversification remains a key strategy for managing risk in any investment portfolio.

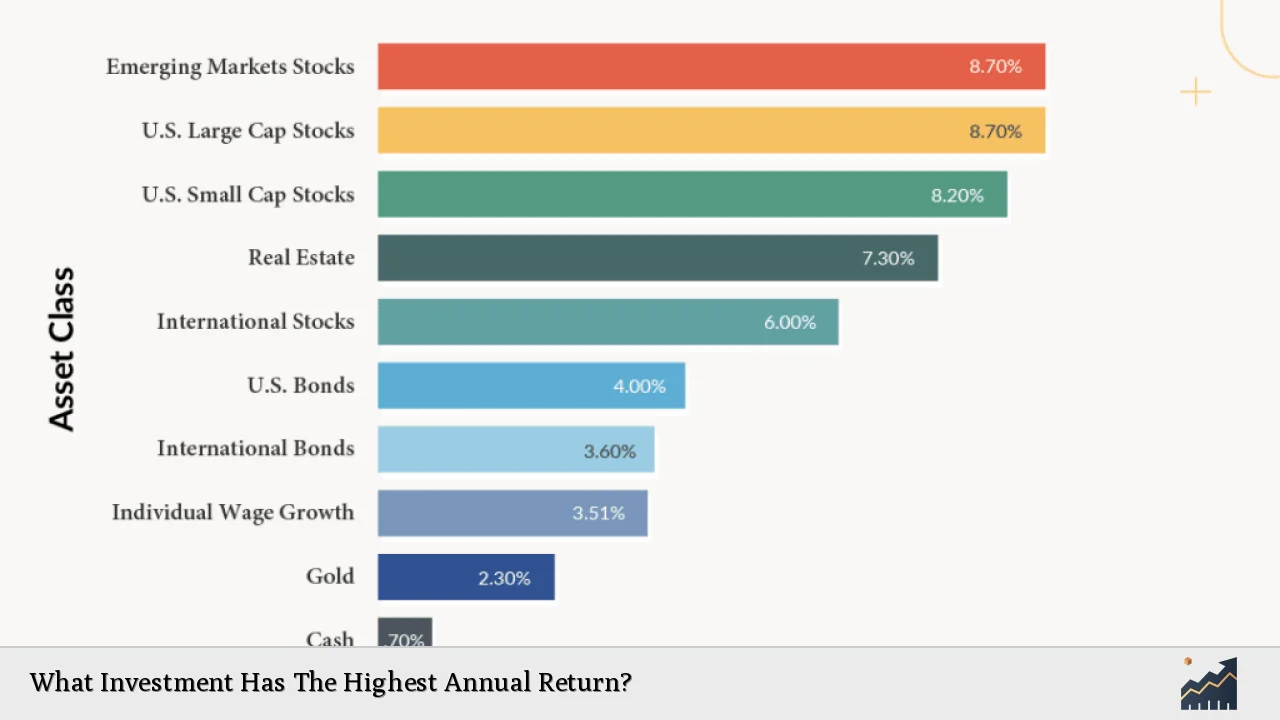

Let’s examine some of the top-performing investments and their historical returns:

| Investment Type | Average Annual Return |

|---|---|

| S&P 500 Index | 10.5% (since 1957) |

| Nasdaq-100 Index | 15-20% (over the past decade) |

| Real Estate Investment Trusts (REITs) | 10-12% (long-term average) |

| Cryptocurrencies | Highly volatile, potentially over 100% |

Stock Market Investments

The stock market has historically been one of the most reliable sources of high returns for long-term investors. Within the stock market, certain sectors and investment vehicles have shown particularly strong performance.

S&P 500 Index Funds

The S&P 500 index, which tracks the performance of 500 large U.S. companies, has delivered an average annual return of about 10.5% since its inception in 1957. This consistent performance makes S&P 500 index funds a popular choice for many investors seeking stable, long-term growth.

Investing in S&P 500 index funds offers several advantages:

- Broad market exposure

- Lower fees compared to actively managed funds

- Automatic diversification across various sectors

However, it’s important to note that the S&P 500’s performance can vary significantly from year to year. For example, in 2023, the S&P 500 delivered an impressive 26.3% return, while in 2022, it experienced a -18.1% decline.

Nasdaq-100 Index Funds

For investors willing to take on more risk in pursuit of higher returns, Nasdaq-100 index funds have shown strong performance, particularly in recent years. The Nasdaq-100 index focuses on 100 of the largest non-financial companies listed on the Nasdaq stock exchange, with a heavy concentration in technology stocks.

Over the past decade, Nasdaq-100 index funds have often outperformed the broader market, with annual returns sometimes exceeding 20%. This exceptional performance is largely attributed to the strong growth of tech giants like Apple, Amazon, and Microsoft.

Key considerations for Nasdaq-100 investments:

- Higher potential returns compared to broader market indexes

- Increased volatility due to tech sector concentration

- Potential for significant drawdowns during market corrections

Real Estate Investments

Real estate has long been considered a solid investment option, offering the potential for both steady income and capital appreciation. Within the real estate sector, Real Estate Investment Trusts (REITs) have emerged as a popular choice for investors seeking high returns.

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-generating real estate properties. They offer investors the opportunity to participate in real estate markets without the need for direct property ownership. Historically, REITs have provided attractive returns, with long-term average annual returns ranging from 10% to 12%.

Advantages of investing in REITs:

- High dividend yields, often exceeding 5%

- Potential for capital appreciation

- Diversification across various real estate sectors

It’s worth noting that REIT performance can be influenced by factors such as interest rates, property market conditions, and overall economic health. During periods of economic uncertainty or rising interest rates, REIT returns may be negatively impacted.

Alternative Investments

For investors willing to venture into more speculative territory, alternative investments can offer the potential for exceptionally high returns, albeit with significantly increased risk.

Cryptocurrencies

Cryptocurrencies, particularly Bitcoin and Ethereum, have garnered significant attention in recent years due to their potential for astronomical returns. While extremely volatile, cryptocurrencies have seen periods of explosive growth, with annual returns sometimes exceeding 100% or even 1,000% in some cases.

Key considerations for cryptocurrency investments:

- Extreme price volatility

- Regulatory uncertainties

- Potential for complete loss of investment

It’s crucial to approach cryptocurrency investments with caution and only allocate a small portion of one’s portfolio to this high-risk asset class.

Balancing Risk and Return

While the allure of high returns is strong, it’s essential to remember that chasing the highest possible returns can expose investors to significant risks. A balanced approach that combines different investment types can help optimize returns while managing risk.

Strategies for balancing risk and return:

- Diversify across asset classes (stocks, bonds, real estate, etc.)

- Rebalance portfolio regularly to maintain desired asset allocation

- Consider your investment time horizon and adjust risk accordingly

Remember, the investment with the highest annual return can change from year to year, and past performance does not guarantee future results. It’s crucial to conduct thorough research, consult with financial professionals, and carefully consider your individual financial goals and risk tolerance before making investment decisions.

FAQs About What Investment Has The Highest Annual Return

- Is there a single investment that consistently provides the highest annual return?

No, returns vary yearly and depend on market conditions and economic factors. - How do stock market returns compare to other investments?

Historically, stocks have outperformed many other asset classes over long periods. - Are high-return investments always the riskiest?

Generally, higher potential returns come with increased risk, but not always. - Should I invest all my money in the highest-returning asset?

No, diversification is crucial for managing risk and optimizing overall portfolio performance. - How often should I review my investment returns?

Regular portfolio reviews are recommended, typically annually or semi-annually.