Determining which investment has the best rate of return involves analyzing various asset classes, market conditions, and individual risk tolerances. Investors often seek high returns, but these typically come with increased risks. Therefore, understanding the balance between risk and reward is crucial for making informed investment decisions.

In recent years, certain sectors have demonstrated remarkable growth, particularly technology and renewable energy. However, traditional investments like stocks and bonds continue to play a significant role in many portfolios. As we approach 2025, investors must consider both historical performance and future potential when evaluating investment options.

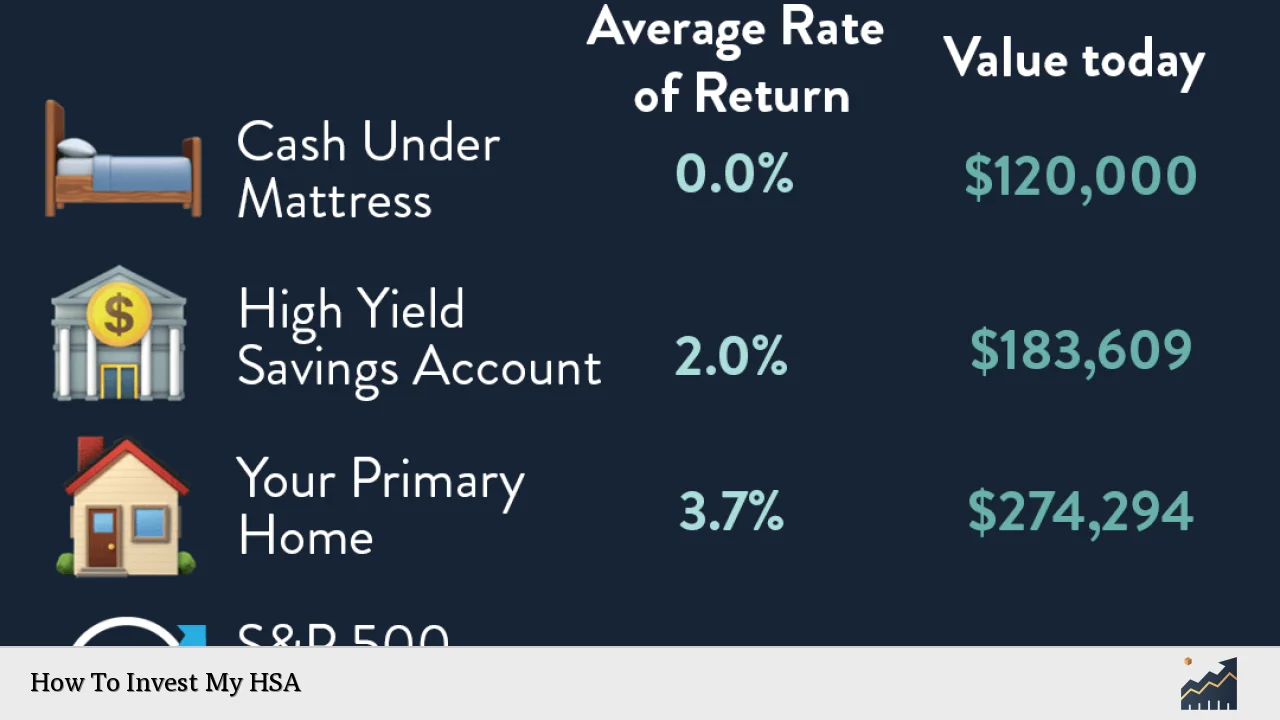

The following table summarizes some common investment types and their typical returns:

| Investment Type | Average Annual Return |

|---|---|

| Stocks | 7-10% |

| Bonds | 3-5% |

| Real Estate | 8-12% |

| Cryptocurrencies | Varies widely (20-100%+) |

| Commodities (e.g., Gold) | 4-6% |

Understanding Different Investment Types

Investments can be categorized into several types, each with its unique characteristics and potential returns.

Stocks

Investing in stocks is one of the most popular ways to achieve high returns. Historically, stocks have provided an average annual return of 7-10% over the long term. The potential for capital appreciation and dividends makes stocks attractive. However, they also come with volatility and risk of loss, especially in the short term.

Bonds

Bonds are generally considered safer than stocks but offer lower returns, typically around 3-5% annually. They are fixed-income securities that provide regular interest payments. While bonds can stabilize a portfolio during market downturns, they may not keep pace with inflation over time.

Real Estate

Investing in real estate can yield substantial returns, often ranging from 8-12% annually. Real estate investments can provide rental income and capital appreciation. However, they require significant capital upfront and come with risks such as market fluctuations and property management challenges.

Cryptocurrencies

Cryptocurrencies have emerged as a high-risk, high-reward investment option. Returns can vary dramatically, with some investors experiencing gains of 20-100% or more in a short period. However, the volatility of cryptocurrencies also means that investors can incur significant losses.

Commodities

Investing in commodities, such as gold or oil, typically yields average annual returns of 4-6%. Commodities can serve as a hedge against inflation and economic uncertainty but are subject to price fluctuations based on supply and demand dynamics.

Factors Influencing Investment Returns

Several factors influence the rate of return on investments:

Economic Conditions

The overall economic environment plays a crucial role in determining investment performance. Factors such as interest rates, inflation rates, and economic growth impact asset prices and investor sentiment.

Market Trends

Market trends can significantly affect certain sectors more than others. For example, technology stocks have seen substantial growth due to advancements in artificial intelligence and digital transformation.

Risk Tolerance

An investor’s risk tolerance is essential when selecting investments. Higher potential returns often come with increased risks; thus, understanding personal risk capacity is vital for long-term success.

Diversification

Diversifying an investment portfolio across various asset classes can mitigate risks while enhancing potential returns. A well-balanced portfolio may include a mix of stocks, bonds, real estate, and alternative investments to achieve optimal growth.

Best Investments for 2025

As we approach 2025, several investment opportunities show promise based on current market conditions:

Technology Stocks

Technology companies continue to lead the market with innovations in artificial intelligence and cloud computing. Investing in tech stocks may yield high returns due to ongoing advancements and consumer demand.

Renewable Energy

With a global shift towards sustainability, investments in renewable energy sources are expected to grow significantly. Companies involved in solar, wind, and other renewable technologies are poised for strong performance as governments push for greener initiatives.

Emerging Markets

Investing in emerging markets can provide higher growth potential compared to developed economies. Countries like India and Brazil offer opportunities due to their expanding middle class and increasing consumer spending.

Real Estate Investment Trusts (REITs)

REITs allow investors to participate in real estate markets without directly owning property. They typically offer attractive dividends and can provide exposure to various real estate sectors.

Risks Associated with High-Return Investments

While seeking high-return investments is appealing, it’s essential to consider the associated risks:

Market Volatility

High-return investments like stocks and cryptocurrencies can experience significant price swings within short periods. This volatility can lead to substantial losses if not managed properly.

Economic Downturns

Economic recessions can negatively impact all asset classes but particularly affect stocks and real estate values. Investors should be prepared for downturns that may affect their portfolios.

Regulatory Changes

Changes in regulations can impact certain sectors significantly. For example, stricter environmental regulations could affect fossil fuel companies while benefiting renewable energy firms.

Strategies for Maximizing Investment Returns

To maximize investment returns while managing risks effectively:

Develop a Clear Investment Plan

Establishing a clear investment strategy based on individual financial goals is crucial. This plan should outline target returns, acceptable risks, time horizons, and asset allocation strategies.

Regularly Review Your Portfolio

Monitoring your investments regularly allows you to make informed decisions based on market conditions or personal financial changes. Adjustments may be necessary to stay aligned with your goals.

Reinvest Dividends

Reinvesting dividends rather than cashing them out can enhance overall returns through compound growth over time.

FAQs About What Investment Has The Best Rate Of Return

- What is the average return on stocks?

The average annual return on stocks is typically between 7-10%. - Are cryptocurrencies a safe investment?

No, cryptocurrencies are highly volatile and considered high-risk investments. - What are REITs?

REITs are Real Estate Investment Trusts that allow investors to invest in real estate without owning physical properties. - How does diversification help my portfolio?

Diversification reduces risk by spreading investments across various asset classes. - What factors affect investment returns?

Economic conditions, market trends, risk tolerance, and diversification all influence investment returns.

In conclusion, identifying the best investment for maximum returns requires careful consideration of various factors including risk tolerance, market conditions, and personal financial goals. By understanding different asset classes and implementing sound investment strategies, investors can position themselves for success as they navigate the evolving financial landscape into 2025.