Investing is a crucial aspect of personal finance that involves allocating resources, usually money, in order to generate income or profit. The quest for the highest returns on investments is a common goal among investors. Various asset classes offer different levels of risk and potential return, and understanding these can help investors make informed decisions. In this article, we will explore the types of investments that historically yield the highest returns, the associated risks, and strategies for maximizing investment returns.

| Investment Type | Potential Returns |

|---|---|

| Stocks | 10% – 12% annually |

| Real Estate | 8% – 12% annually |

| Bonds | 3% – 7% annually |

| Cryptocurrencies | Varies widely, potential for high returns |

| Mutual Funds | 6% – 10% annually |

Understanding Investment Types

Investments can be broadly categorized into various types, each with its unique characteristics and risk profiles.

- Stocks: Historically, the stock market has provided the highest average returns compared to other investment types. Over the long term, stocks have returned approximately 10% to 12% annually. This return comes from capital appreciation and dividends. However, investing in stocks involves significant volatility and risk.

- Real Estate: Real estate investments can yield returns in the range of 8% to 12% annually, depending on market conditions and property management. Real estate can provide both rental income and appreciation in property value. While generally less volatile than stocks, it requires substantial capital and is subject to market fluctuations.

- Bonds: Bonds are typically considered safer investments compared to stocks. They generally offer lower returns, ranging from 3% to 7% annually. Government bonds are less risky but yield lower returns than corporate bonds, which carry more risk but offer higher potential returns.

- Cryptocurrencies: Cryptocurrencies are known for their extreme volatility and potential for high returns. While some investors have seen extraordinary gains, others have faced significant losses. The potential returns vary widely and are influenced by market trends and investor sentiment.

- Mutual Funds: These funds pool money from multiple investors to purchase a diversified portfolio of stocks or bonds. They typically offer returns between 6% and 10% annually, depending on the fund’s focus and management strategy.

Risk vs. Return

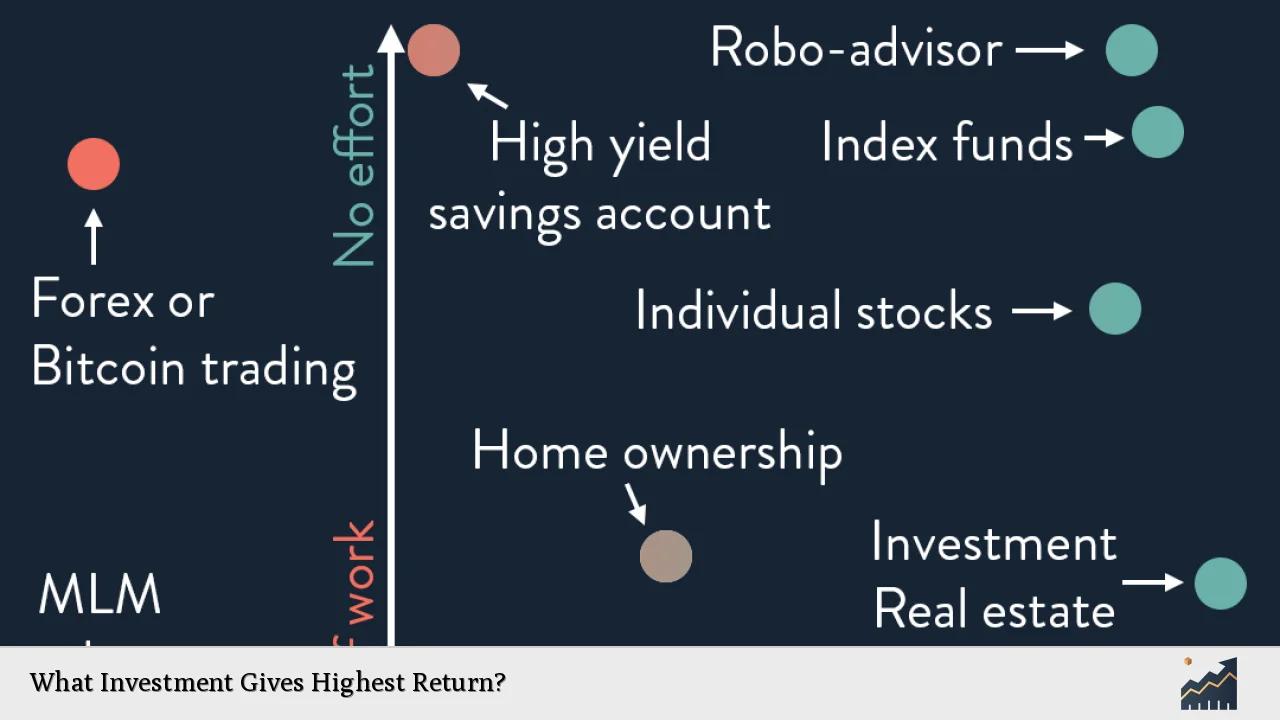

One of the fundamental principles of investing is the relationship between risk and return. Generally, investments that offer higher potential returns also come with higher risks.

- High-Risk Investments: Stocks and cryptocurrencies fall into this category. While they can provide substantial returns, they are also susceptible to market fluctuations that can lead to significant losses.

- Moderate-Risk Investments: Real estate and certain mutual funds represent moderate-risk options. They may not provide as high a return as stocks but tend to be less volatile.

- Low-Risk Investments: Bonds and savings accounts are considered low-risk investments. They typically yield lower returns but offer more stability.

Understanding your risk tolerance is essential when choosing investments. An investor with a high-risk tolerance may prefer stocks or cryptocurrencies, while someone with a low-risk tolerance might lean toward bonds or savings accounts.

Strategies for Maximizing Returns

Investing wisely involves not just choosing the right asset classes but also employing effective strategies to maximize returns.

- Diversification: Spreading investments across various asset classes can reduce risk while maintaining potential for high returns. A diversified portfolio may include stocks, bonds, real estate, and alternative investments like cryptocurrencies.

- Long-Term Investing: Adopting a long-term perspective can help investors ride out market volatility. Historically, markets recover over time, so holding onto investments rather than selling during downturns can lead to better outcomes.

- Reinvesting Dividends: For stock investors, reinvesting dividends can significantly enhance overall returns over time through the power of compounding.

- Regular Review and Rebalancing: Periodically assessing your investment portfolio ensures alignment with financial goals and risk tolerance. Rebalancing may involve selling overperforming assets and buying underperforming ones to maintain desired asset allocation.

Popular High-Return Investment Options

Several investment vehicles are known for their potential high returns:

Stocks

Investing in individual stocks can lead to substantial gains if chosen wisely. Many successful investors focus on growth stocks—companies expected to grow at an above-average rate compared to their industry peers.

Real Estate Investment Trusts (REITs)

REITs allow investors to gain exposure to real estate without directly owning properties. They often pay attractive dividends while providing capital appreciation potential.

Index Funds

Index funds track specific market indices like the S&P 500. They offer diversification at a low cost and have historically returned around 10% annually, making them an excellent choice for passive investors.

Peer-to-Peer Lending

This relatively new investment avenue allows individuals to lend money directly to borrowers through online platforms. Returns can be higher than traditional savings accounts or bonds but come with increased risk of default.

Cryptocurrencies

While highly speculative, cryptocurrencies like Bitcoin have shown remarkable growth over short periods. Investors should approach this market with caution due to its volatility.

Investing in Emerging Markets

Emerging markets present opportunities for high returns due to rapid economic growth compared to developed markets. However, they also carry higher risks related to political instability, currency fluctuations, and less regulatory oversight.

Investors considering emerging markets should conduct thorough research or work with financial advisors who understand these environments well.

Conclusion

The pursuit of high-return investments requires careful consideration of various factors including risk tolerance, investment horizon, and market conditions. Stocks remain one of the best options for long-term growth; however, diversification across different asset classes can help mitigate risks while enhancing overall portfolio performance.

Investors should continuously educate themselves about market trends and investment strategies while remaining adaptable in their approaches as conditions change over time.

FAQs About What Investment Gives Highest Return

- What is the best investment for high returns?

The stock market has historically provided the highest average annual returns. - Are cryptocurrencies a good investment?

Cryptocurrencies can yield high returns but come with significant risks due to their volatility. - What are REITs?

Real Estate Investment Trusts (REITs) allow investors to invest in real estate without owning physical properties. - How do I diversify my investments?

Diversification involves spreading your investments across different asset classes like stocks, bonds, and real estate. - What is an index fund?

An index fund is a type of mutual fund that aims to replicate the performance of a specific market index.