Choosing the best investment firm can be a daunting task, especially given the vast array of options available. Investors often seek firms that align with their financial goals, risk tolerance, and investment strategies. Factors such as fees, performance history, customer service, and available investment products play a crucial role in this decision-making process. The right investment firm can significantly impact an investor’s financial journey, providing not just a platform for trading but also valuable insights and guidance.

When evaluating investment firms, it’s essential to consider various factors that contribute to their effectiveness and reliability. This includes their reputation in the industry, the range of services they offer, and how well they cater to individual investor needs. Below is a concise overview of what to look for when selecting an investment firm.

| Criteria | Description |

|---|---|

| Fees | Understand the fee structure including management fees, trading commissions, and any hidden charges. |

| Investment Options | Check the variety of investment products available such as stocks, bonds, ETFs, and mutual funds. |

| Customer Service | Evaluate the quality of customer support and resources provided for investors. |

| Performance History | Review historical performance data to gauge the firm’s track record. |

| Technology | Look for user-friendly platforms and tools that facilitate investing. |

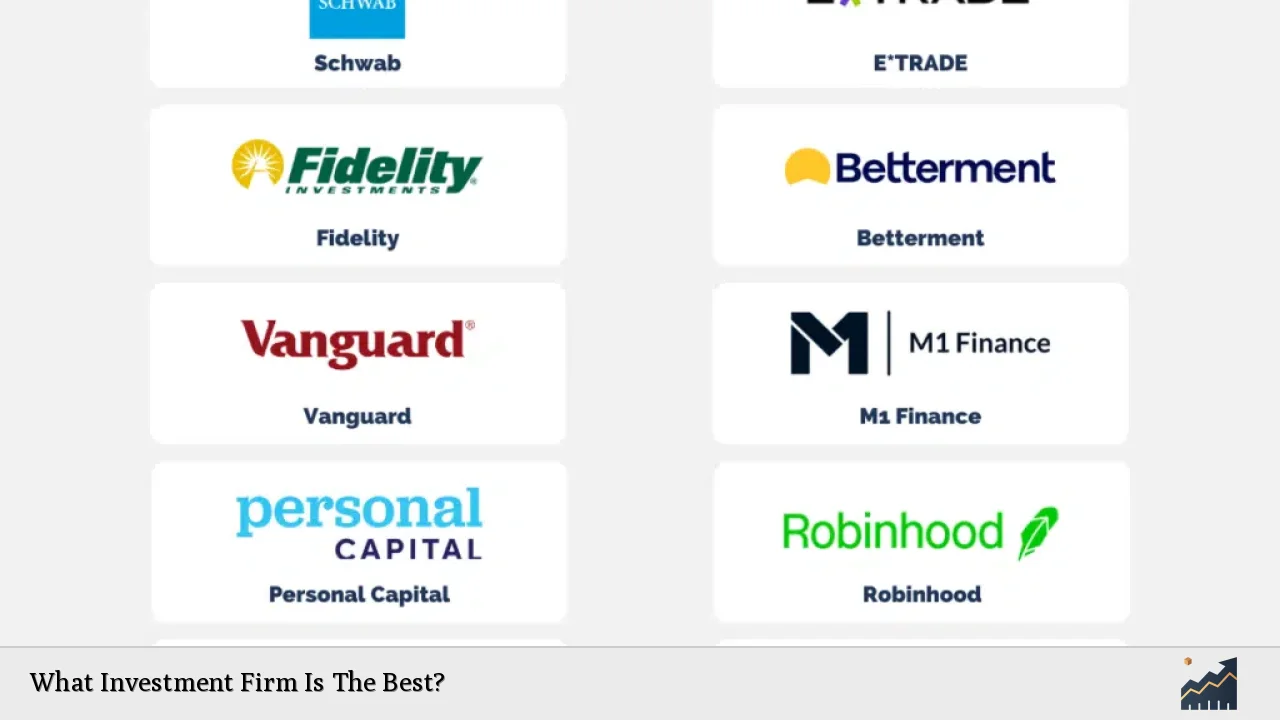

Top Investment Firms

Several firms stand out in the investment landscape due to their unique offerings and proven track records. Below are some of the best investment firms currently recognized for their excellence in various aspects.

Vanguard

Vanguard is widely regarded as a leader in low-cost investing. Known for its low expense ratios, Vanguard offers a diverse range of index funds and ETFs that cater to long-term investors. The firm prioritizes investor interests by keeping costs down, allowing clients to retain more of their returns. Vanguard’s philosophy emphasizes passive investing, which has proven effective over time.

- Strengths: Low fees, extensive range of index funds

- Weaknesses: Limited active management options

Fidelity Investments

Fidelity is another top contender known for its comprehensive suite of services. It provides a wide array of investment options including stocks, bonds, mutual funds, and retirement accounts. Fidelity is praised for its robust research tools and educational resources that help investors make informed decisions. The firm also offers no-commission trading, which is appealing to many investors.

- Strengths: Extensive research resources, no commission fees

- Weaknesses: Some funds have higher fees compared to competitors

Charles Schwab

Charles Schwab is recognized for its all-in-one capabilities that cater to both self-directed investors and those seeking professional advice. The firm offers a user-friendly platform with advanced trading tools. Schwab’s commitment to customer service is evident in its extensive support options.

- Strengths: User-friendly platform, strong customer service

- Weaknesses: Higher advisory fees compared to some competitors

BlackRock

BlackRock is a global leader in asset management known primarily for its exchange-traded funds (ETFs). The firm’s iShares line of ETFs provides investors with diversified exposure across various asset classes at low costs. BlackRock’s expertise in managing large portfolios makes it a preferred choice for institutional investors.

- Strengths: Leading provider of ETFs, global reach

- Weaknesses: Less focus on individual retail investors

JPMorgan Chase

JPMorgan Chase offers a full suite of financial services including wealth management and investment banking. Its investment management division provides tailored solutions for high-net-worth individuals and institutions. The firm’s strong research capabilities and market insights are significant advantages.

- Strengths: Comprehensive financial services, strong research

- Weaknesses: Higher minimum investments required

Factors to Consider When Choosing an Investment Firm

When selecting an investment firm, several factors should guide your decision-making process:

Fees and Expenses

Understanding the fee structure is crucial as it directly impacts your returns. Look for firms that offer transparent pricing with no hidden fees.

Range of Investment Options

Consider what types of investments you want to make. A good firm should provide access to various asset classes including stocks, bonds, ETFs, and mutual funds.

Customer Support

Evaluate the quality of customer service provided by the firm. Access to knowledgeable representatives can make a significant difference in your investing experience.

Performance History

Reviewing historical performance can provide insights into how well the firm has managed investments over time. Look for consistent performance rather than short-term gains.

Technology and Tools

A user-friendly platform with robust tools can enhance your investing experience. Check if the firm offers mobile access and features that facilitate easy trading and portfolio management.

Investment Strategies Offered by Leading Firms

Different firms may emphasize various investment strategies based on their expertise:

Passive Investing

Firms like Vanguard excel in passive investing through index funds that track market performance rather than trying to outperform it.

Active Management

Firms such as Fidelity offer actively managed funds where portfolio managers make decisions based on market research and analysis.

Target-Date Funds

Many firms provide target-date funds designed for retirement planning that automatically adjust asset allocations as the target date approaches.

Robo-Advisors

Some firms have embraced technology by offering robo-advisory services that provide automated portfolio management based on individual risk tolerance.

FAQs About What Investment Firm Is The Best

- What should I look for in an investment firm?

Consider fees, range of investment options, customer support, performance history, and technology. - Are low-fee firms better?

Generally, low-fee firms allow you to keep more of your returns over time. - What is passive investing?

Passive investing involves tracking an index rather than trying to outperform it through active management. - Can I trust online investment platforms?

Yes, but ensure they are regulated and have good reviews from users. - How do I know if an investment firm is reputable?

Research their history, client reviews, regulatory compliance, and performance metrics.

Choosing the best investment firm ultimately depends on your personal financial goals and preferences. By carefully evaluating your options based on the criteria outlined above, you can make an informed decision that aligns with your investment strategy. Whether you prioritize low fees or comprehensive services, there is an ideal firm out there to help you achieve your financial objectives effectively.