The 1970s were marked by stagflation, a challenging economic environment characterized by high inflation and stagnant economic growth. During this tumultuous decade, traditional investments like stocks and bonds struggled to provide returns that kept pace with inflation. However, certain asset classes thrived, offering investors substantial returns. Understanding which investments performed best during this period can provide valuable insights for navigating similar economic conditions today.

The standout investment of the 1970s was undoubtedly gold. The price of gold skyrocketed from approximately $35 per ounce at the start of the decade to around $850 per ounce by 1980. This remarkable increase made gold a favored asset for investors seeking to protect their wealth against inflation. Additionally, other commodities also saw significant gains, with the S&P GSCI Index, which tracks commodity performance, returning an impressive 586% over the decade.

| Investment Type | Performance |

|---|---|

| Gold | $35 to $850 per ounce |

| Commodities | 586% return |

In addition to gold and commodities, other investments such as farmland and certain stocks also performed well. Understanding these investment trends provides a clearer picture of the financial landscape of the 1970s and highlights strategies that may be relevant in today’s economy.

The Rise of Gold

Gold emerged as the most successful investment of the 1970s due to its status as a safe haven asset during times of economic uncertainty. As inflation rates soared—peaking at nearly 14.8% in 1980—investors flocked to gold as a means of preserving purchasing power. The shift from a gold-backed currency system to a fiat currency system further fueled demand for gold, leading to its dramatic price increase.

The allure of gold lies in its intrinsic value and limited supply. Unlike fiat currencies, which can be printed at will by governments, gold requires significant resources to mine and produce. This characteristic makes it a reliable hedge against inflation and currency devaluation.

Investors who recognized this trend early on were able to capitalize on the rising prices of gold throughout the decade. The performance of gold not only outpaced traditional investments but also provided a sense of security during a time when many other assets were faltering.

Commodities and Real Assets

Alongside gold, commodities in general proved to be highly lucrative investments during the 1970s. The S&P GSCI Index demonstrated extraordinary performance, reflecting a broader trend where commodity prices surged due to inflationary pressures.

Investments in agricultural commodities such as corn, wheat, and beef yielded substantial returns as food prices rose sharply during this period. For instance, wheat prices quadrupled over the decade, while corn prices nearly tripled. These increases were driven by both domestic demand and global market dynamics.

Real estate also presented mixed results during the 1970s. While residential real estate had uneven performance across different regions, farmland consistently delivered strong returns. The average price of U.S. farmland increased significantly from $137 per acre in 1970 to about $737 per acre by 1980, averaging over 14% annual returns.

Investors who focused on real assets—those that have intrinsic value—were better positioned to weather the economic challenges of the decade compared to those heavily invested in traditional financial instruments.

Stock Market Performance

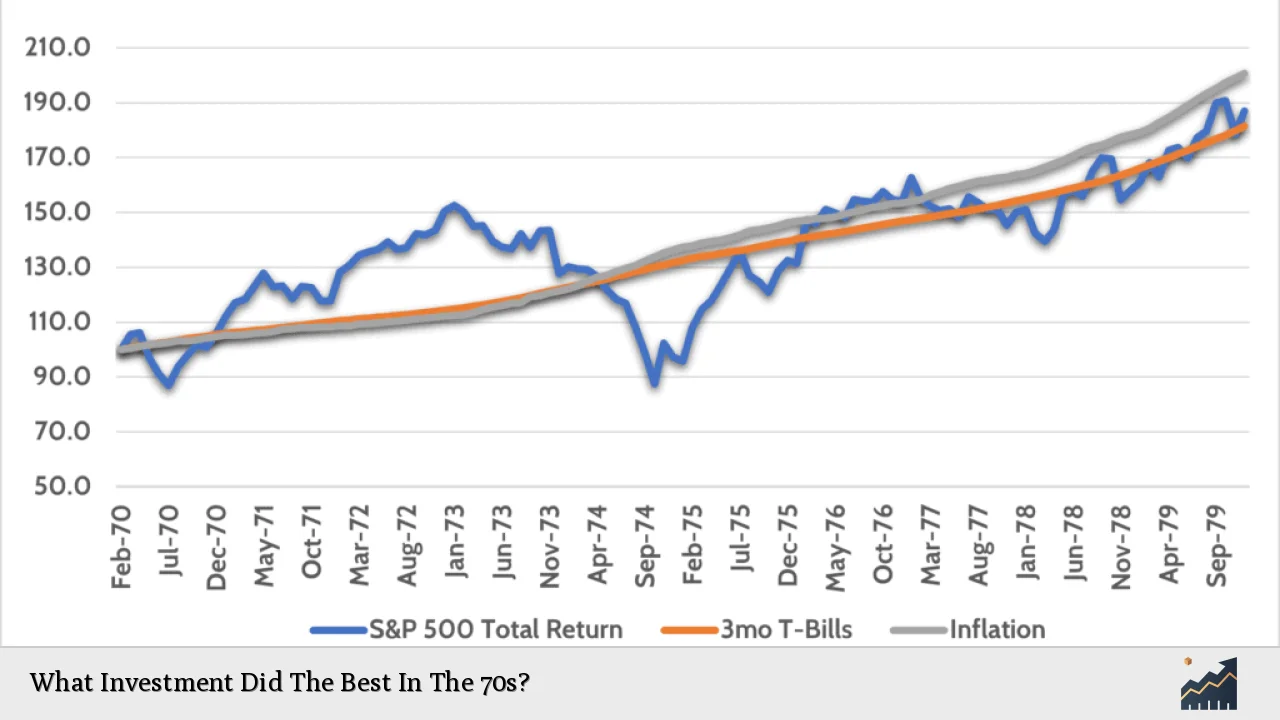

The stock market’s performance during the 1970s was lackluster at best. The Dow Jones Industrial Average opened at 809 points in January 1970 and closed at just 839 points at the end of the decade—an almost negligible gain when adjusted for inflation.

Many investors experienced significant losses as stock prices failed to keep up with rising costs. Traditional growth stocks particularly underperformed compared to value stocks, which offered more stable returns during this volatile period.

Value investing became increasingly popular as investors sought companies with solid fundamentals that could withstand economic downturns. Stocks in sectors such as consumer staples and healthcare provided better resilience against inflationary pressures compared to more cyclical industries.

Farmland Investment

Investing in farmland emerged as one of the most profitable strategies during the 1970s, reflecting a broader trend toward real assets that could provide tangible returns amidst rising inflation rates. Farmland values increased significantly due to both rising commodity prices and growing demand for agricultural products.

Investors who leveraged their purchases—using financing options—often saw even higher returns due to increased land values combined with income generated from crops. This strategy allowed for an average annualized return exceeding 24%, showcasing farmland’s potential as a robust investment during economically challenging times.

However, it is essential to note that not all regions experienced equal success in real estate investment; California’s booming population led to skyrocketing home values, while areas with rent control saw depressed property prices.

Defensive Stocks

In an environment where traditional growth stocks struggled, defensive stocks became increasingly attractive for investors seeking stability. Companies in sectors such as utilities, consumer goods, and healthcare demonstrated resilience against economic downturns due to their consistent demand regardless of economic conditions.

Investors gravitated toward stocks that provided steady dividends and reliable earnings during periods of high inflation and economic uncertainty. This strategy helped mitigate losses associated with broader market volatility while providing some level of income through dividends.

Among notable performers were companies like Altria and General Dynamics, which offered substantial returns compared to many other stocks that faltered throughout the decade.

Lessons Learned from the 1970s

The investment landscape of the 1970s offers several critical lessons for today’s investors:

- Diversification into Real Assets: Investing in tangible assets like gold, commodities, and real estate can provide protection against inflation.

- Focus on Value Stocks: During periods of economic uncertainty, defensive sectors tend to outperform growth-oriented investments.

- Leverage Real Estate Investments: Utilizing financing options can enhance returns on real estate investments when property values are rising.

- Stay Informed on Economic Indicators: Understanding macroeconomic trends can help investors make informed decisions about asset allocation during volatile periods.

These lessons remain relevant today as economies face similar challenges such as high inflation and geopolitical tensions impacting markets globally.

FAQs About Investments in the 1970s

- What was the best investment in the 1970s?

The best investment was gold, which rose from $35 an ounce at the start of the decade to $850 by its end. - How did commodities perform in the 1970s?

Commodities saw significant gains, with an overall return of approximately 586% according to the S&P GSCI Index. - Were stocks a good investment during this period?

No, stock market performance was poor; many investors experienced losses due to high inflation. - What role did farmland play in investments?

Farmland provided strong returns averaging over 14% annually due to rising agricultural commodity prices. - How did defensive stocks perform?

Defensive stocks outperformed growth stocks during this time due to their stability amid economic uncertainty.

In summary, while traditional investments faced significant challenges during the 1970s due to stagflation and high inflation rates, certain asset classes like gold and commodities thrived. Investors who adapted their strategies by focusing on real assets and defensive sectors were able to navigate this difficult period successfully.