Finding an investment company with the lowest fees is crucial for maximizing returns and minimizing costs. In today’s competitive financial landscape, many companies are vying for your attention by offering low or no fees for trading and account management. This article will explore various investment companies known for their low fees, compare their offerings, and help you make an informed decision.

The primary focus here is on companies that provide commission-free trading for stocks, ETFs, and options. These companies typically target both beginner and experienced investors looking to reduce the cost of investing. Below is a summary table highlighting some key features of popular investment companies.

| Investment Company | Key Features |

|---|---|

| Fidelity | $0 commissions on trades, no account minimums |

| Charles Schwab | $0 commissions on stocks and ETFs, extensive research tools |

| Robinhood | No commissions on trades, user-friendly mobile app |

| SoFi Active Investing | No trading fees, access to financial advisors |

| Interactive Brokers | Low-cost trading, advanced trading tools |

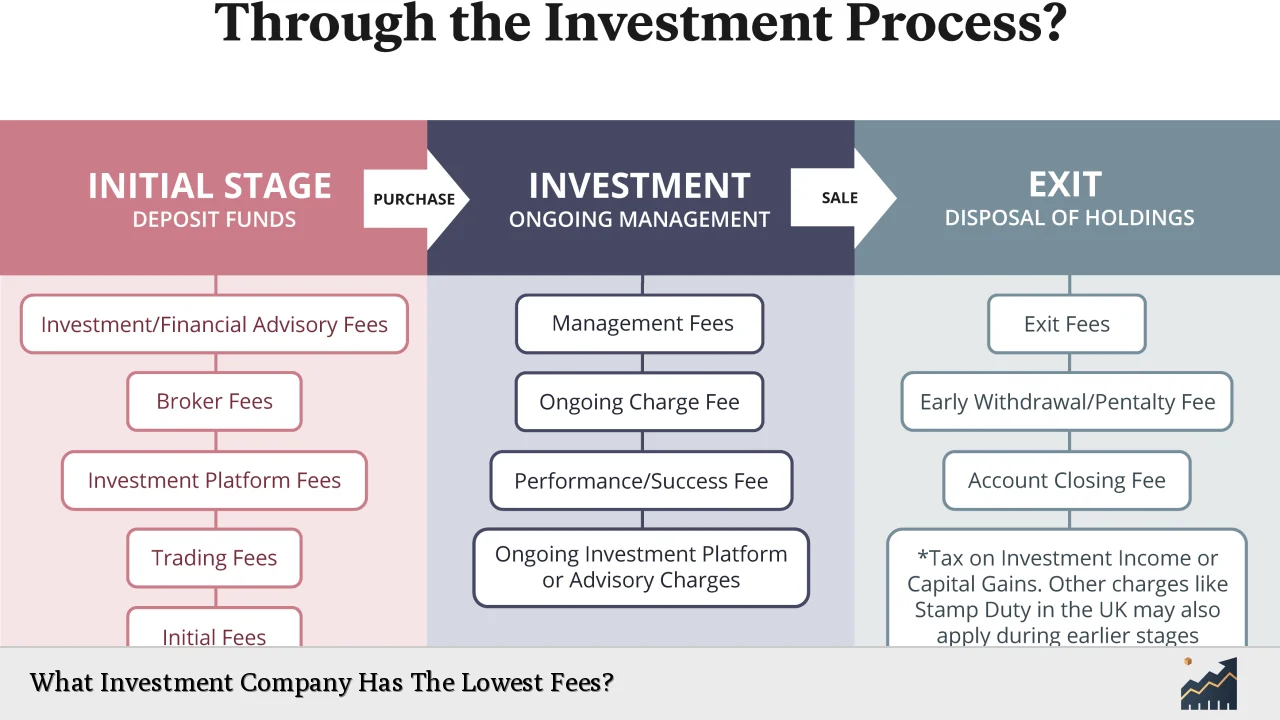

Understanding Investment Fees

Investment fees can significantly impact the growth of your portfolio over time. Important info to consider includes:

- Trading Commissions: These are charges per trade made through a brokerage. Many platforms now offer commission-free trading.

- Account Maintenance Fees: Some brokers charge annual fees to maintain your account. Look for firms that waive these fees.

- Expense Ratios: If you invest in mutual funds or ETFs, the expense ratio represents the annual fee expressed as a percentage of your investment.

- Inactivity Fees: Some brokers charge fees if your account remains inactive for a certain period.

Understanding these fees will help you choose an investment company that aligns with your financial goals.

Top Investment Companies with Low Fees

Fidelity Investments

Fidelity is widely recognized for its commitment to low-cost investing. It offers $0 commissions on online trades for U.S. stocks and ETFs. Additionally, there are no minimum balances required to open an account, making it accessible to all investors. Fidelity also provides a range of investment options including mutual funds, bonds, and retirement accounts without hidden fees.

Fidelity’s proprietary funds have zero expense ratios, which can be a significant advantage for long-term investors. They also offer robust research tools and educational resources that can help investors make informed decisions.

Charles Schwab

Charles Schwab is another leading broker known for its low-cost structure. It offers commission-free trading on stocks, ETFs, and options with no account minimums. Schwab provides multiple trading platforms catering to different types of investors—from beginners to advanced traders.

In addition to low fees, Schwab offers extensive research tools and educational resources. Their commitment to customer service is also notable, with support available through various channels.

Robinhood

Robinhood revolutionized the investing landscape by introducing commission-free trades via a user-friendly mobile app. It has no account minimums and allows users to trade stocks, ETFs, options, and even cryptocurrencies without incurring any commissions.

However, while Robinhood is excellent for casual investors seeking ease of use, it may lack some advanced features found in other platforms. Additionally, it has faced scrutiny regarding its business practices and customer service.

SoFi Active Investing

SoFi Active Investing stands out by offering no trading fees on stocks and ETFs while also providing access to certified financial planners at no extra cost. This feature can be particularly beneficial for new investors looking for guidance as they navigate their investment journey.

SoFi has no minimum balance requirement to open an account and allows users to buy fractional shares, making it easier for those with limited capital to invest in high-value stocks.

Interactive Brokers

Interactive Brokers is renowned for its low-cost structure tailored towards active traders. It offers commission-free trading on U.S. stocks and ETFs while providing advanced trading tools and research capabilities.

Though it caters primarily to experienced traders, its tiered pricing model allows users to choose between various fee structures based on their trading volume. This flexibility can lead to substantial savings for frequent traders.

Comparing Fee Structures

When comparing investment companies based on their fee structures, it’s essential to look at various aspects like commissions, account maintenance fees, and additional costs associated with specific services. Below is a comparison table highlighting key features of the aforementioned companies:

| Company | Commissions |

|---|---|

| Fidelity | $0 per trade (stocks & ETFs) |

| Charles Schwab | $0 per trade (stocks & ETFs) |

| Robinhood | $0 per trade (stocks & ETFs) |

| SoFi Active Investing | $0 per trade (stocks & ETFs) |

| Interactive Brokers | $0 per trade (U.S. stocks & ETFs) |

Additional Considerations

While low fees are crucial when selecting an investment company, other factors should also influence your decision:

- Investment Options: Ensure that the broker offers a variety of investment products that align with your goals.

- User Experience: A user-friendly platform can enhance your investing experience significantly.

- Research Tools: Access to quality research tools can help you make more informed decisions.

- Customer Support: Reliable customer support is vital in addressing any issues or questions you may have.

Choosing an investment company involves balancing low costs with other essential features that contribute to a positive investing experience.

FAQs About Investment Companies with Low Fees

- What are the benefits of using a low-fee investment company?

Low-fee investment companies help maximize returns by reducing costs associated with trading and account maintenance. - Are there any hidden fees I should be aware of?

Always review the fee schedule of any investment company as some may charge inactivity fees or higher rates for certain transactions. - Can I invest in mutual funds through low-fee brokers?

Yes, many low-fee brokers offer access to mutual funds with competitive expense ratios. - Is customer support important when choosing an investment company?

Yes, reliable customer support can assist you in resolving issues promptly and enhance your overall experience. - How do I know if an investment company is right for me?

Consider factors such as fee structure, available investment options, user experience, and customer service when making your choice.

In conclusion, selecting an investment company with the lowest fees requires careful consideration of various factors beyond just cost. Fidelity Investments, Charles Schwab, Robinhood, SoFi Active Investing, and Interactive Brokers all present excellent options depending on individual needs and preferences. Always ensure that the chosen platform aligns with your financial goals while providing the necessary tools and support for successful investing.