When it comes to investing, one of the most pressing questions for individuals and institutions alike is, "What investment brings the highest return?" This query encompasses various asset classes, risk levels, and time horizons. Historically, different investments have yielded varying returns based on market conditions, economic factors, and individual investment strategies. Understanding these dynamics is crucial for making informed decisions that align with one's financial goals.

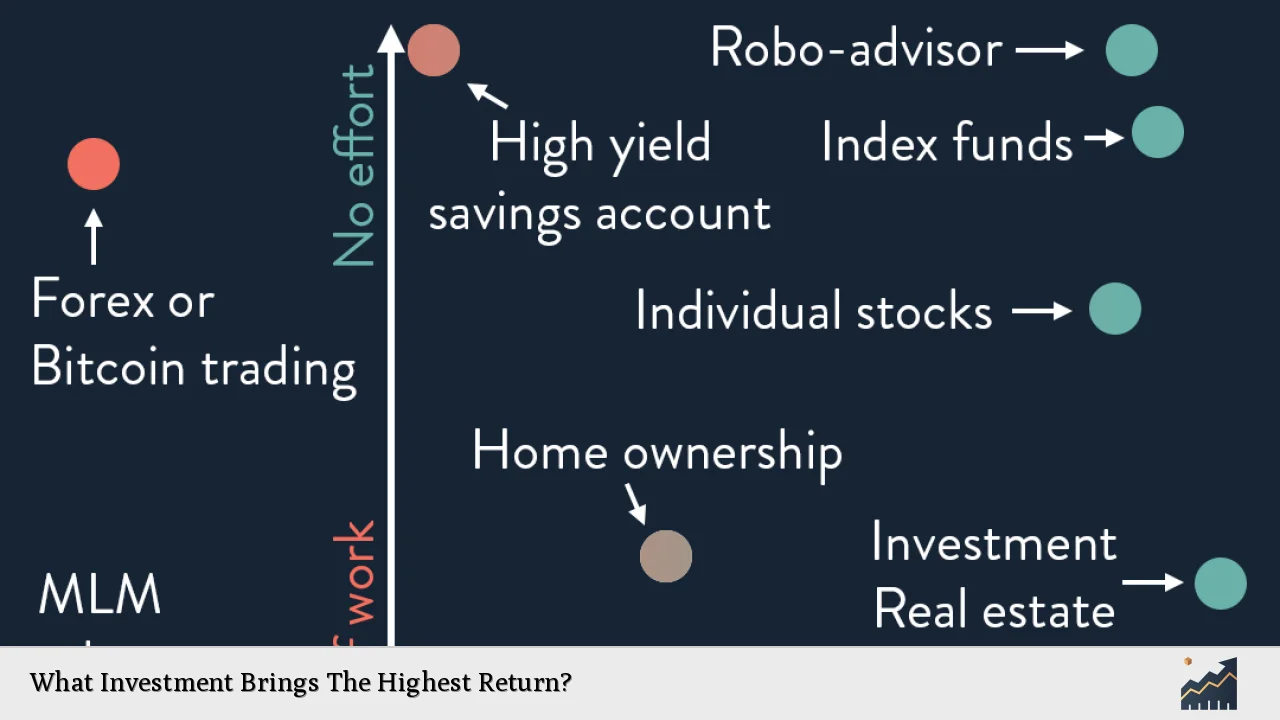

Investments can be broadly categorized into several types: stocks, bonds, real estate, mutual funds, and alternative investments. Each category has its own risk-return profile, and the potential for high returns often comes with increased risk. For example, while stocks have historically provided higher returns than bonds or savings accounts, they are also subject to greater volatility. Therefore, understanding the nuances of each investment type is essential for maximizing returns while managing risk.

The following table summarizes key investment types and their historical average returns:

| Investment Type | Average Annual Return |

|---|---|

| Stocks | 10% - 12% |

| Bonds | 4% - 6% |

| Real Estate | 8% - 10% |

| Mutual Funds | 6% - 8% |

| Alternative Investments | Varies significantly |

Historical Performance of Stocks

Stocks are often regarded as the best investment for achieving high returns over the long term. The U.S. stock market has consistently outperformed other asset classes, delivering an average annual return of approximately 10% to 12% over the past century. This performance is attributed to economic growth, innovation, and the compounding effect of reinvested dividends.

Investing in stocks can be done through direct purchases of individual shares or indirectly through mutual funds and exchange-traded funds (ETFs). While individual stocks can provide substantial gains, they also carry higher risks due to market volatility. Therefore, diversification—investing in a variety of stocks across different sectors—can help mitigate risks while still allowing for significant upside potential.

Moreover, investors should consider their investment horizon when investing in stocks. Historically, longer holding periods have reduced the impact of short-term volatility and have led to more stable returns.

Real Estate as a High-Return Investment

Real estate is another asset class that has demonstrated strong historical returns. On average, real estate investments yield around 8% to 10% annually. This return comes from both rental income and property appreciation over time. Real estate can serve as a hedge against inflation, as property values often rise with increasing costs.

Investing in real estate can take various forms, including direct ownership of rental properties, real estate investment trusts (REITs), or real estate crowdfunding platforms. Each option presents different levels of involvement and risk. Direct ownership requires active management but offers greater control and potential tax benefits. In contrast, REITs provide a more passive investment approach while still allowing exposure to real estate markets.

However, it is essential to recognize that real estate investments are not without risks. Market fluctuations, property management challenges, and liquidity constraints can impact overall returns. Therefore, thorough research and strategic planning are crucial when venturing into real estate investing.

Bonds: A Safer Investment Option

Bonds are generally considered safer investments compared to stocks and real estate but offer lower returns. The average annual return on bonds ranges from 4% to 6% depending on the type of bond (government vs. corporate) and prevailing interest rates. Bonds provide fixed income through interest payments and are less volatile than stocks.

For conservative investors seeking stability and income generation, bonds can be an attractive option. They play a crucial role in diversifying an investment portfolio by balancing out higher-risk assets like stocks. However, it’s important to note that inflation can erode the purchasing power of bond returns over time.

Investors should assess their risk tolerance and financial goals when considering bonds as part of their investment strategy. While they may not yield the highest returns compared to stocks or real estate, they offer security and predictability in uncertain market conditions.

Mutual Funds: Diversification Made Easy

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They typically yield average annual returns between 6% to 8%, depending on their underlying assets and management fees.

Investing in mutual funds allows individuals to access professional management and diversification without needing extensive knowledge about individual securities. This makes mutual funds suitable for novice investors or those looking to simplify their investment process.

However, investors should be aware of management fees that can eat into overall returns. Additionally, mutual funds may not always outperform their benchmarks due to market fluctuations or poor fund management decisions.

Alternative Investments: High Risk and High Reward

Alternative investments encompass a wide range of assets outside traditional categories like stocks and bonds. These include commodities (like gold), private equity, hedge funds, collectibles (art or antiques), and cryptocurrencies.

Returns on alternative investments can vary significantly based on market conditions and investor expertise. Some alternatives have shown exceptional gains; for instance, cryptocurrencies have experienced meteoric rises in value but also exhibit extreme volatility.

Investing in alternatives often requires specialized knowledge or access to specific markets. As such, they may not be suitable for all investors but can complement a well-rounded portfolio seeking higher returns.

Factors Influencing Investment Returns

Several factors influence the potential returns on investments:

- Market Conditions: Economic growth or recession impacts asset prices.

- Interest Rates: Higher interest rates typically lead to lower bond prices but can enhance savings account yields.

- Inflation: Inflation erodes purchasing power; investments that outpace inflation yield real growth.

- Investment Horizon: Longer time frames generally reduce volatility risks.

- Diversification: Spreading investments across various asset classes mitigates risks associated with individual securities.

Understanding these factors helps investors make informed decisions about where to allocate their capital for optimal returns while managing associated risks effectively.

FAQs About What Investment Brings The Highest Return?

- What is the best long-term investment?

Historically, stocks have provided the best long-term investment returns averaging around 10% annually. - Are bonds a good investment?

Bonds are safer than stocks but offer lower returns averaging between 4% to 6% annually. - How does real estate compare to stocks?

Real estate typically yields around 8% to 10%, while stocks average about 10% to 12%, making both viable options depending on investor goals. - What are alternative investments?

Alternative investments include assets like commodities, cryptocurrencies, private equity, and collectibles that often yield variable returns. - How important is diversification?

Diversification is crucial as it helps reduce risk by spreading investments across various asset classes.

In conclusion, determining which investment brings the highest return depends on various factors including risk tolerance, time horizon, market conditions, and personal financial goals. Stocks have historically provided the highest average returns over time; however, other assets like real estate also offer substantial potential gains with different risk profiles. Understanding each asset class's characteristics allows investors to tailor their strategies effectively for optimal financial outcomes.