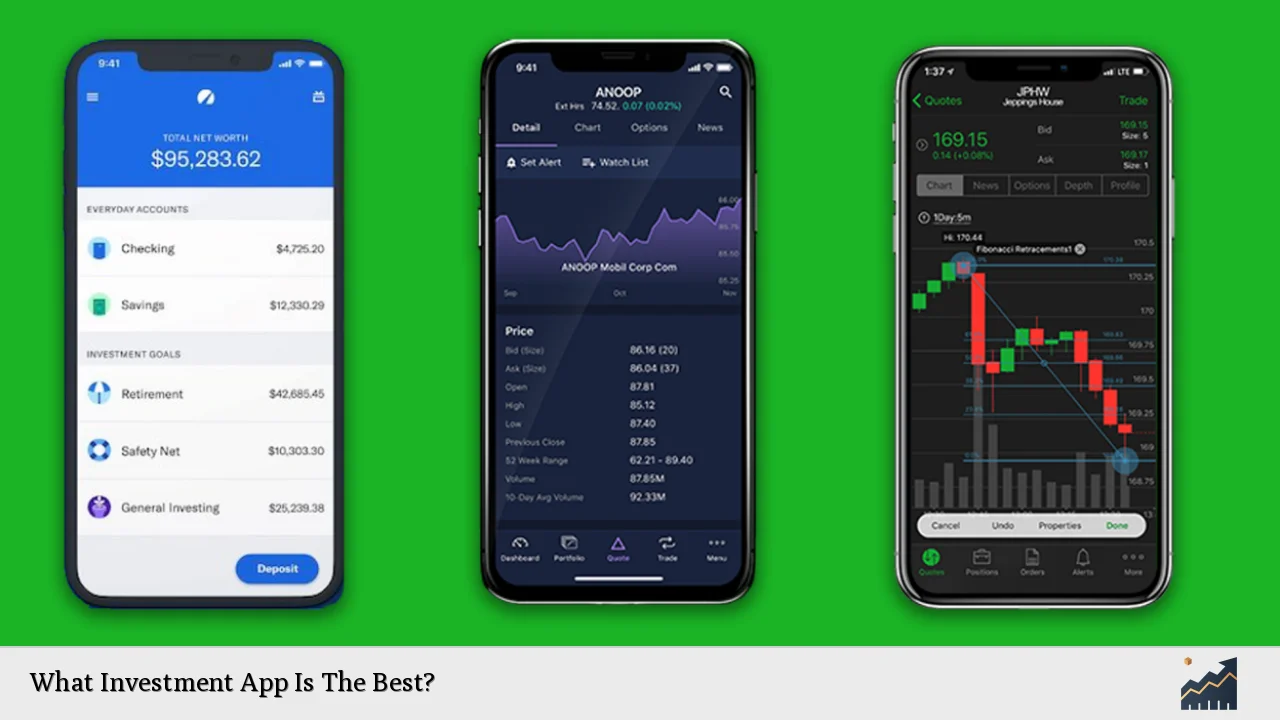

Choosing the right investment app can significantly impact your financial journey, whether you are a beginner or an experienced investor. Investment apps have revolutionized how people manage their finances, making investing accessible to a broader audience. With numerous options available, it is essential to consider various factors such as fees, features, usability, and the types of investments offered. This article will explore the best investment apps currently available, highlighting their unique features and benefits.

| Investment App | Key Features |

|---|---|

| IG | Wide market range, low fees, robust security |

| eToro | Social trading, user-friendly interface |

| Interactive Brokers | Global access, low-cost trading |

Factors to Consider When Choosing an Investment App

When selecting an investment app, several factors should be considered to ensure it meets your needs. Understanding these aspects will help you make an informed decision.

- Fees and Commissions: It’s crucial to evaluate the fee structure of each app. Look for transparency in fees, as high costs can eat into your returns over time. Many apps offer commission-free trades but may charge for other services.

- Investment Options: Different apps provide varying types of investments. Some focus on stocks and ETFs, while others may include cryptocurrencies or bonds. Choose an app that aligns with your investment strategy.

- User Interface: A user-friendly interface is essential for both beginners and experienced investors. The app should be intuitive and easy to navigate, allowing users to execute trades quickly without confusion.

- Educational Resources: For new investors, educational resources can be invaluable. Look for apps that offer tutorials, articles, and market analysis to help you understand investing better.

- Customer Support: Reliable customer support is vital for resolving issues or answering questions. Check if the app provides multiple support channels like chat, email, or phone.

Top Investment Apps for 2025

Several investment apps stand out in 2025 based on their features and user reviews. Here are some of the best options available:

IG

IG is widely regarded as one of the best investment apps due to its extensive market offerings and user-friendly platform. It provides access to over 18,000 markets, including stocks, ETFs, commodities, and cryptocurrencies.

- Key Features:

- Low trading fees

- Robust security measures

- Excellent customer support

IG is ideal for both beginners and experienced investors looking for a comprehensive trading experience.

eToro

eToro has gained popularity for its social trading features that allow users to follow and copy the trades of successful investors. This makes it a great choice for beginners who want to learn from others.

- Key Features:

- Commission-free trades

- User-friendly interface

- Diverse asset selection including cryptocurrencies

eToro’s social aspect fosters a community environment where users can share insights and strategies.

Interactive Brokers

Interactive Brokers is known for its low-cost trading options and extensive research tools. It caters primarily to experienced traders but also offers features suitable for beginners.

- Key Features:

- Global market access

- Advanced trading tools

- Low-cost commissions

This app is perfect for those who require detailed analytics and a wide range of investment options.

Acorns

Acorns is designed for new investors who may not have large sums to invest initially. It allows users to start investing with as little as $5, making it accessible for everyone.

- Key Features:

- Automated investing

- Round-up feature that invests spare change

- Educational resources tailored for beginners

Acorns simplifies the investment process by automating contributions based on everyday spending habits.

Betterment

Betterment is a robo-advisor that focuses on automated investing strategies tailored to individual goals. It is particularly beneficial for those who prefer a hands-off approach.

- Key Features:

- Personalized portfolio management

- Automatic rebalancing

- Tax-loss harvesting options

Betterment helps users build a diversified portfolio without requiring extensive knowledge of the stock market.

Comparing Investment Apps

To help you choose the right investment app, here’s a comparison of some popular options based on key features:

| App Name | Minimum Deposit |

|---|---|

| IG | £250 |

| eToro | $50 |

| Interactive Brokers | $0 (for most accounts) |

| Acorns | $5 |

| Betterment | $0 |

Investment Strategies Using Apps

Using investment apps effectively requires understanding various strategies that align with your financial goals. Here are some common strategies:

- Long-Term Investing: This strategy involves buying and holding investments over an extended period. Apps like Betterment and Acorns are excellent choices for long-term investors due to their automated features.

- Active Trading: For those looking to make frequent trades based on market fluctuations, platforms like Interactive Brokers provide advanced tools necessary for day trading or swing trading.

- Social Trading: eToro’s unique social trading feature allows users to mimic successful traders’ strategies, making it suitable for those new to investing who want guidance from experienced peers.

- Diversification: Spreading investments across various asset classes can reduce risk. Most apps allow users to create diversified portfolios easily through ETFs or mutual funds.

Security Features in Investment Apps

Security is paramount when choosing an investment app. Here are some essential security features you should look for:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring users to verify their identity through a second method besides their password.

- Encryption Protocols: Ensure the app uses strong encryption methods to protect your personal information and financial data from unauthorized access.

- Regulatory Compliance: Choose apps that are regulated by reputable authorities like the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. This ensures they adhere to strict standards regarding customer protection.

FAQs About Investment Apps

FAQs About What Investment App Is The Best?

- What should I look for in an investment app?

Consider fees, investment options, user interface, educational resources, and customer support. - Are investment apps safe?

Most reputable investment apps use strong security measures like encryption and two-factor authentication. - Can I start investing with little money?

Yes, many apps like Acorns allow you to start investing with as little as $5. - What types of investments can I make?

You can invest in stocks, ETFs, cryptocurrencies, bonds, and more depending on the app. - Do investment apps offer educational resources?

Many apps provide tutorials, articles, and market analysis to help users learn about investing.

In conclusion, selecting the best investment app depends on your individual needs and preferences. Whether you are looking for low fees, diverse investment options, or educational resources, there are plenty of choices available in today’s market. By considering the factors outlined above and exploring top-rated apps like IG, eToro, Interactive Brokers, Acorns, and Betterment, you can find an app that aligns with your financial goals and helps you navigate your investing journey successfully.