Climate change is increasingly recognized as a significant factor influencing financial markets, particularly the stock market. As global temperatures rise and extreme weather events become more frequent, investors are becoming more aware of the associated risks and opportunities. This article explores how climate change impacts stock prices, investment strategies, and market trends, providing a comprehensive analysis for individual investors and finance professionals.

| Key Concept | Description/Impact |

|---|---|

| Physical Risks | Direct impacts from climate change events such as hurricanes, floods, and wildfires can damage infrastructure and disrupt business operations, leading to significant financial losses for affected companies. |

| Transition Risks | As economies shift towards sustainable practices, companies that fail to adapt may face declining revenues and increased costs, while those investing in green technologies could see enhanced profitability. |

| Regulatory Risks | New regulations aimed at reducing greenhouse gas emissions can impose additional costs on businesses, particularly in carbon-intensive sectors like oil and gas. |

| Market Sentiment | Investor sentiment is increasingly influenced by climate-related disclosures and sustainability practices, affecting stock valuations and capital flows. |

| Long-term Investment Trends | The shift towards renewable energy and sustainable practices is expected to drive long-term investment opportunities, with clean energy investments projected to exceed $2 trillion in 2024. |

Market Analysis and Trends

The impact of climate change on the stock market can be analyzed through various dimensions:

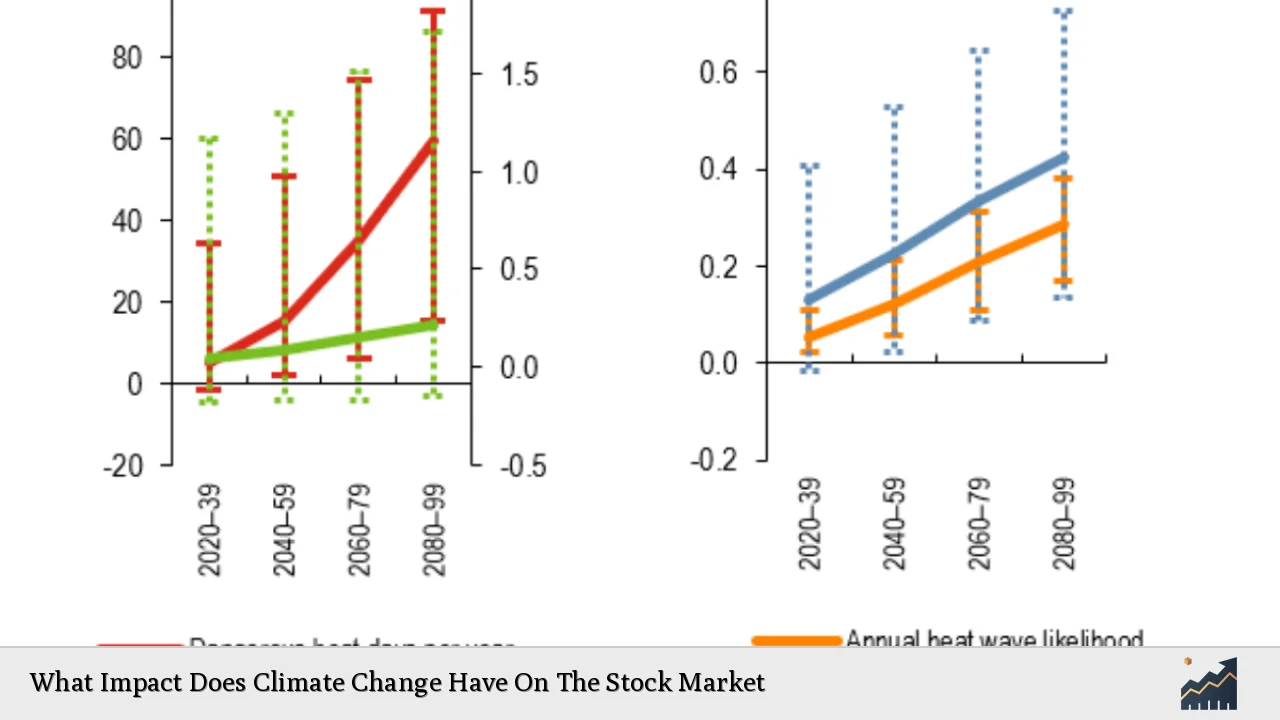

- Physical Risks: Climate-related disasters such as hurricanes and wildfires have direct financial implications. A study analyzing the NASDAQ 100 index found that extreme weather events negatively affected stock returns across various sectors. Companies exposed to physical risks often experience immediate declines in stock prices due to operational disruptions and increased repair costs.

- Transition Risks: The transition to a low-carbon economy presents both risks and opportunities. Companies that proactively invest in sustainable practices tend to outperform their peers. For instance, firms with strong environmental policies have shown resilience against market volatility. Conversely, companies heavily reliant on fossil fuels face declining investor interest as regulatory pressures mount.

- Market Sentiment: Investor attitudes towards climate change are shifting. An increasing number of investors are incorporating environmental, social, and governance (ESG) criteria into their investment decisions. This trend has led to a growing preference for stocks of companies demonstrating sustainability leadership.

- Long-term Investment Trends: According to the International Energy Agency (IEA), global investments in clean energy technologies are projected to surpass $2 trillion in 2024. This shift represents a significant reallocation of capital towards sustainable initiatives, which will likely influence stock market dynamics over the coming years.

Implementation Strategies

Investors can adopt several strategies to navigate the impact of climate change on their portfolios:

- Diversification: Investors should diversify their portfolios across sectors less sensitive to climate risks. Sectors such as technology and healthcare may offer more stability compared to traditional energy sectors.

- Sustainable Investing: Focusing on ESG-compliant companies can enhance portfolio resilience. Research indicates that firms with robust sustainability practices often achieve better financial performance over time.

- Climate Risk Assessment: Investors should assess the climate risk exposure of their holdings. Tools like scenario analysis can help gauge potential impacts from regulatory changes or physical climate events.

- Engagement with Companies: Active engagement with companies regarding their climate strategies can influence corporate behavior. Shareholders can advocate for better disclosure practices related to climate risks.

Risk Considerations

Investing in a changing climate landscape involves several risks:

- Market Volatility: Climate-related news can lead to sudden shifts in stock prices. Investors should be prepared for increased volatility associated with extreme weather events or regulatory announcements.

- Reputational Risk: Companies failing to address climate change may face reputational damage, affecting investor confidence and stock performance.

- Regulatory Changes: New policies aimed at combating climate change can impose costs on businesses. Investors must stay informed about legislative developments that could impact their investments.

- Physical Asset Damage: Companies with significant physical assets in vulnerable locations may face higher insurance costs or asset write-downs due to climate impacts.

Regulatory Aspects

Regulatory frameworks surrounding climate change are evolving rapidly:

- Disclosure Requirements: Regulatory bodies are increasingly mandating disclosures related to climate risks. For example, the SEC has proposed rules requiring public companies to disclose material risks associated with climate change.

- Carbon Pricing: Many jurisdictions are implementing carbon pricing mechanisms that directly affect companies’ bottom lines. These policies incentivize reductions in greenhouse gas emissions but may also increase operational costs for high-emission industries.

- Investment Standards: Financial institutions are adopting stricter investment standards related to sustainability. This trend is leading to greater scrutiny of companies’ environmental practices during investment evaluations.

Future Outlook

Looking ahead, the relationship between climate change and the stock market is expected to deepen:

- Increased Capital Allocation: As awareness of climate risks grows, capital will increasingly flow into sustainable investments. This trend is likely to accelerate as institutional investors prioritize ESG factors in their portfolios.

- Technological Innovations: Advances in clean technology will create new investment opportunities while disrupting traditional sectors. Companies that innovate in renewable energy or sustainable practices are poised for growth.

- Global Cooperation: International agreements aimed at reducing emissions will shape market dynamics. The commitment of countries to meet net-zero targets will influence investment patterns globally.

- Market Resilience: Over time, markets may become more resilient as investors integrate climate risk assessments into their decision-making processes.

Frequently Asked Questions About What Impact Does Climate Change Have On The Stock Market

- How does climate change directly affect stock prices?

Climate change leads to physical risks that can disrupt business operations, resulting in immediate declines in stock prices for affected companies. - What are transition risks?

Transition risks arise from the shift towards a low-carbon economy; companies failing to adapt may face declining revenues while those investing in sustainability could see growth. - How important is ESG investing?

ESG investing is becoming crucial as investors increasingly favor companies with strong sustainability practices, often leading to better financial performance. - What role do regulations play?

Regulations concerning emissions and sustainability impact operational costs for businesses, influencing investor sentiment and stock valuations. - Are there specific sectors more affected by climate change?

Sectors like oil & gas, agriculture, and utilities are particularly vulnerable due to their reliance on natural resources and exposure to regulatory changes. - What strategies can investors use?

Diversification across sectors less sensitive to climate risks and focusing on sustainable investments can help mitigate potential losses. - What is the future outlook for investments affected by climate change?

The future will likely see increased capital allocation towards sustainable investments as awareness of climate-related risks continues to grow. - How can investors assess climate risk?

Investors can use tools like scenario analysis and engage with companies regarding their sustainability practices to assess potential climate risks.

This comprehensive analysis highlights the multifaceted impact of climate change on the stock market, emphasizing the need for informed investment strategies amidst evolving market dynamics.