Deciding whether to invest or buy outright is a crucial financial decision that can significantly impact your financial future. This choice often arises in various contexts, such as purchasing a home versus investing in real estate, buying stocks versus investing in mutual funds, or even deciding between saving for a car and financing it through loans. Each option has its own set of advantages and disadvantages that can affect your long-term financial health.

Investing typically involves putting your money into assets with the expectation of generating a return over time. This could include stocks, bonds, real estate, or mutual funds. On the other hand, buying refers to acquiring an asset outright, which may involve immediate costs but can provide tangible benefits such as ownership and potential appreciation in value.

Understanding the implications of both choices is essential for making informed financial decisions. The following sections will explore the differences between investing and buying outright, the benefits and drawbacks of each approach, and practical considerations for your financial strategy.

| Aspect | Investing |

|---|---|

| Risk Level | Higher risk with potential for higher returns |

| Liquidity | Generally more liquid; can sell investments easily |

| Time Horizon | Long-term focus (5+ years) |

| Ownership | No direct ownership of physical assets |

| Returns | Variable returns based on market performance |

Understanding Investing

Investing is fundamentally about allocating resources, usually money, in order to generate income or profit. It encompasses various asset classes such as stocks, bonds, real estate, and mutual funds. Each investment type has its own risk profile and potential return.

Investing is often characterized by its long-term orientation. Investors typically aim to grow their wealth over time through capital appreciation or income generation. For instance, stock market investments have historically provided higher returns compared to traditional savings accounts. However, this comes with greater volatility and risk of loss.

One of the primary advantages of investing is diversification. By spreading investments across different asset classes or sectors, investors can mitigate risks associated with any single investment. This strategy helps protect against market fluctuations and economic downturns.

Another significant benefit of investing is the potential for compounding returns. Over time, reinvesting earnings can lead to exponential growth of an investment portfolio. This makes starting early crucial for maximizing long-term gains.

However, investing also has its downsides. The risk of loss is inherent in all investments; market conditions can change rapidly due to economic factors, geopolitical events, or company-specific issues. Additionally, investors must be prepared for short-term volatility and should ideally have a long-term perspective to weather market fluctuations.

The Buying Approach

Buying an asset outright involves acquiring it without the intention of selling it immediately for profit. This could include purchasing a home, a vehicle, or even stocks in a company you believe in for personal reasons rather than purely financial ones.

One major advantage of buying is immediate ownership. When you buy an asset like a house or a car, you gain full control over it right away. This can provide significant personal satisfaction and utility beyond just financial considerations. For instance, owning a home allows you to customize it according to your preferences.

Buying also tends to involve lower risk compared to investing in volatile markets. Once you own an asset outright, its value may appreciate over time without the same level of fluctuation seen in investments like stocks or bonds.

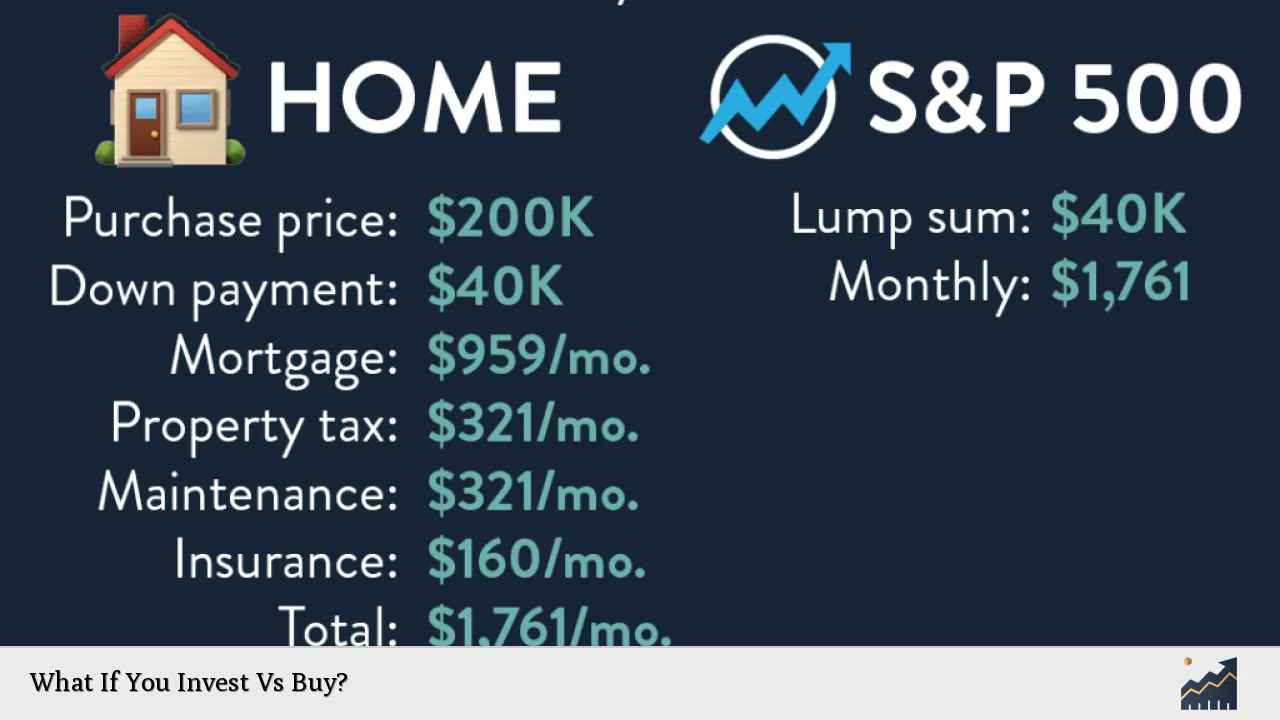

However, buying comes with its own set of challenges. The initial costs can be substantial; purchasing real estate often requires a significant down payment along with closing costs. Additionally, owning physical assets can incur ongoing expenses such as maintenance and taxes that may not be present with other forms of investment.

Liquidity is another concern when buying outright. Selling assets like real estate can take time and may not yield immediate cash flow if you need funds quickly. Therefore, while buying provides security and control over an asset, it may not always be the most flexible option financially.

Comparative Analysis: Investing vs Buying

When weighing whether to invest or buy outright, several factors come into play that can influence your decision:

| Factor | Investing |

|---|---|

| Initial Cost | Varies; often lower than buying outright |

| Potential Returns | Higher potential returns over time |

| Risk Level | Higher risk due to market volatility |

| Ownership Control | No direct control over underlying assets |

| Liquidity | Easier to convert into cash quickly |

In contrast:

| Factor | Buying Outright |

|---|---|

| Initial Cost | Typically higher upfront cost |

| Potential Returns | Moderate returns; dependent on asset appreciation |

| Risk Level | Lower risk; less volatility involved |

| Ownership Control | Total control over the asset purchased |

| Liquidity | Takes longer to sell; less liquid than investments |

Practical Considerations

When deciding between investing and buying outright, consider your financial goals, risk tolerance, and time horizon:

- Assess your financial goals: Are you looking for long-term growth or immediate utility from an asset? Understanding your objectives will guide your decision-making process.

- Evaluate your risk tolerance: If you are uncomfortable with market fluctuations and potential losses, buying may be more suitable than investing in volatile assets like stocks.

- Consider your time horizon: If you plan on needing access to funds soon (within five years), buying might be preferable due to the liquidity concerns associated with investing.

- Analyze current market conditions: Economic factors can influence whether it’s a good time to invest or buy outright. For example, during a housing market downturn, purchasing property may offer better value than investing in stocks that are also experiencing volatility.

- Factor in personal circumstances: Your current financial situation plays a critical role in determining which option is best for you. Ensure you have adequate savings before committing significant resources to either approach.

FAQs About What If You Invest Vs Buy?

- What are the main differences between investing and buying?

The main difference lies in ownership; investing typically involves purchasing shares without direct ownership of physical assets while buying means acquiring assets outright. - Is investing riskier than buying?

Yes, investing generally carries higher risks due to market volatility compared to the lower risks associated with owning physical assets. - Can I lose money by investing?

Yes, there is always a risk of loss when investing as market conditions fluctuate. - What are the benefits of buying assets outright?

The benefits include immediate ownership and lower risk since you are not subject to market volatility. - How do I decide which option is best for me?

Your decision should be based on your financial goals, risk tolerance, time horizon, and current market conditions.

In conclusion, whether you choose to invest or buy outright depends on various factors including your financial goals and personal circumstances. Both strategies have their merits and drawbacks; understanding these will empower you to make informed decisions that align with your long-term financial objectives.