Investing in the stock market can be a transformative financial decision, allowing individuals to grow their wealth over time. The stock market serves as a platform where shares of publicly traded companies are bought and sold, enabling investors to own a piece of these companies. When you invest in stocks, you essentially purchase ownership in a company, with the hope that its value will increase over time. This process can lead to capital gains when you sell your shares at a higher price than you paid. Additionally, many companies distribute profits to shareholders in the form of dividends, providing another potential source of income.

Understanding how the stock market operates is crucial for anyone considering investment. The market is influenced by various factors, including economic indicators, company performance, and investor sentiment. By investing wisely, individuals can not only achieve financial growth but also build a diversified portfolio that mitigates risk.

| Key Concepts | Description |

|---|---|

| Stocks | Shares representing ownership in a company. |

| Dividends | Payments made by a company to its shareholders from profits. |

| Capital Gains | Profit from selling an asset at a higher price than purchased. |

| Diversification | Investing in different assets to reduce risk. |

Understanding Stock Market Basics

The stock market operates through exchanges where stocks are listed and traded. Major exchanges include the New York Stock Exchange (NYSE) and NASDAQ. Investors can buy and sell shares through brokers who facilitate these transactions. The price of stocks fluctuates based on supply and demand dynamics, influenced by various factors such as company performance, economic conditions, and investor sentiment.

Investing in stocks offers several benefits:

- Potential for High Returns: Historically, stocks have provided higher returns compared to other asset classes like bonds or savings accounts.

- Liquidity: Stocks can typically be bought or sold quickly, allowing investors to access their funds when needed.

- Dividends: Many companies pay dividends, providing investors with regular income in addition to capital gains.

However, investing in stocks also comes with risks:

- Market Volatility: Stock prices can fluctuate significantly in short periods due to market conditions.

- Risk of Loss: There is always the possibility that an investment may decrease in value.

- Emotional Decision-Making: Investors may react emotionally to market changes, leading to poor investment decisions.

Understanding these fundamentals is essential for anyone considering investing in the stock market.

Steps to Start Investing in the Stock Market

Starting your investment journey requires careful planning and execution. Here are the essential steps to begin investing in the stock market:

- Set Clear Investment Goals: Determine what you want to achieve with your investments. Are you saving for retirement, a home, or education?

- Assess Your Financial Situation: Understand how much money you can afford to invest without compromising your financial stability.

- Choose an Investment Strategy: Decide whether you want to be an active investor who picks individual stocks or a passive investor who uses index funds or ETFs.

- Select a Brokerage Account: Open an account with a brokerage firm that fits your investment style. Many online brokers offer user-friendly platforms with low fees.

- Fund Your Account: Transfer money into your brokerage account from your bank account or other sources.

- Research Investments: Analyze potential stocks or funds based on their performance history, financial health, and market conditions.

- Place Your Orders: Decide on the type of order (market or limit) and execute your trades through your brokerage platform.

It's crucial to educate yourself continuously about market trends and investment strategies as you embark on this journey.

Types of Investments Available

When investing in the stock market, there are various types of investments available:

- Individual Stocks: Buying shares of specific companies allows for targeted investment but comes with higher risk due to lack of diversification.

- Exchange-Traded Funds (ETFs): These funds track specific indexes and allow investors to buy a collection of stocks within one trade, providing diversification at lower costs.

- Mutual Funds: Similar to ETFs but usually actively managed by professionals; they pool money from multiple investors to purchase a diversified portfolio of stocks.

- Dividend Stocks: Investing in companies that regularly pay dividends can provide income while also offering potential capital appreciation.

Understanding these options can help investors align their portfolios with their financial goals and risk tolerance.

Risk Management Strategies

Effective risk management is vital for successful investing. Here are some strategies:

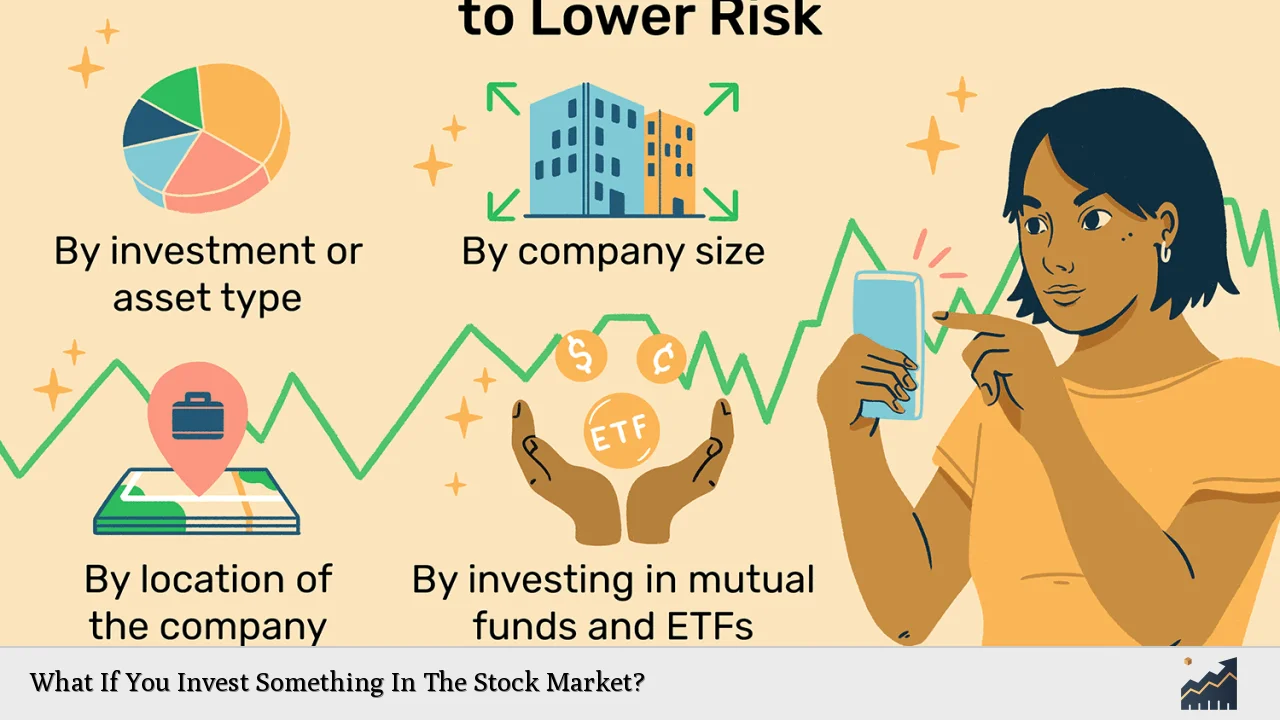

- Diversification: Spread investments across various sectors and asset classes to reduce exposure to any single investment's poor performance.

- Regular Portfolio Review: Periodically assess your portfolio's performance and make adjustments based on changing market conditions or personal goals.

- Set Stop-Loss Orders: These orders automatically sell your shares when they reach a certain price, limiting potential losses on declining investments.

- Educate Yourself Continuously: Stay informed about market trends and economic indicators that could impact your investments.

Implementing these strategies can help mitigate risks associated with stock market investing while maximizing potential returns.

The Importance of Research

Conducting thorough research before making investment decisions is essential. Investors should analyze:

- Company Fundamentals: Review financial statements, earnings reports, and management discussions to assess a company's health and growth potential.

- Market Trends: Understand broader economic trends that could affect specific industries or sectors where you plan to invest.

- Analyst Ratings: Look at expert analyses and ratings from reputable sources for insights into potential investments' future performance.

Research helps investors make informed decisions rather than relying on speculation or emotions, ultimately leading to better investment outcomes.

FAQs About Investing In The Stock Market

- What is the best way to start investing?

The best way is to set clear goals, choose an appropriate brokerage account, and begin with diversified investments like ETFs or mutual funds. - How much money do I need to start investing?

You can start investing with as little as $5 using micro-investing apps; however, traditional brokerages may have higher minimums. - What are dividends?

Dividends are payments made by companies to shareholders from their profits, providing income alongside potential capital gains. - Is investing in stocks risky?

Yes, investing in stocks carries risks including market volatility and potential loss of capital; however, strategies like diversification can help manage these risks. - How often should I review my investments?

You should review your investments at least quarterly or annually to ensure they align with your financial goals and adjust as necessary.

Investing in the stock market presents both opportunities for growth and risks that require careful consideration. By understanding the fundamentals of stock trading, taking measured steps towards investment goals, implementing effective risk management strategies, conducting thorough research, and continuously educating oneself about market dynamics, individuals can navigate the complexities of the stock market successfully. This approach not only enhances the likelihood of achieving financial objectives but also fosters confidence in one's investment decisions over time.