Investing someone else’s money can be a complex endeavor that requires careful consideration of legal, ethical, and financial factors. Whether you are a financial advisor managing client portfolios or a friend helping another individual invest, understanding the implications and responsibilities involved is crucial. This article will explore the various aspects of investing other people’s money, including the legal obligations, ethical considerations, and practical steps to take.

| Aspect | Description |

|---|---|

| Legal Obligations | Responsibilities to adhere to regulations and laws governing investments. |

| Ethical Considerations | Importance of acting in the best interest of the investor. |

Understanding Legal Obligations

When investing someone else’s money, it is essential to understand the legal obligations that come with this responsibility. Financial professionals must comply with regulations set forth by governing bodies such as the Financial Industry Regulatory Authority (FINRA) in the United States. These regulations include ensuring that investment recommendations are suitable for the client based on their individual circumstances.

The key legal obligations include:

- Suitability Requirements: Financial advisors must assess a client’s risk tolerance, investment goals, and financial situation before making recommendations. This ensures that the investments align with the client’s needs.

- Disclosure: Advisors are required to disclose any potential conflicts of interest and ensure that clients are fully informed about the risks associated with their investments.

- Record Keeping: Maintaining detailed records of all transactions and communications is crucial for compliance and accountability.

Failure to adhere to these legal obligations can result in severe consequences, including fines, loss of licenses, or legal action from clients.

Ethical Considerations in Investment Management

Investing someone else’s money also involves significant ethical considerations. It is not just about following the law; it is about ensuring that you act in the best interest of your clients or friends. Here are some important ethical principles to keep in mind:

- Fiduciary Duty: As an advisor or manager of someone else’s funds, you have a fiduciary duty to act in their best interests. This means prioritizing their financial well-being over your own potential gains.

- Transparency: Being open about your investment strategies, fees, and potential risks builds trust with your clients. Transparency is vital for maintaining long-term relationships.

- Avoiding Conflicts of Interest: It is essential to identify and mitigate any conflicts of interest that may arise when managing someone else’s money. This includes avoiding situations where personal interests may compromise your ability to act in your client’s best interest.

By adhering to these ethical principles, you can foster trust and credibility with those whose money you are managing.

Practical Steps for Investing Other People’s Money

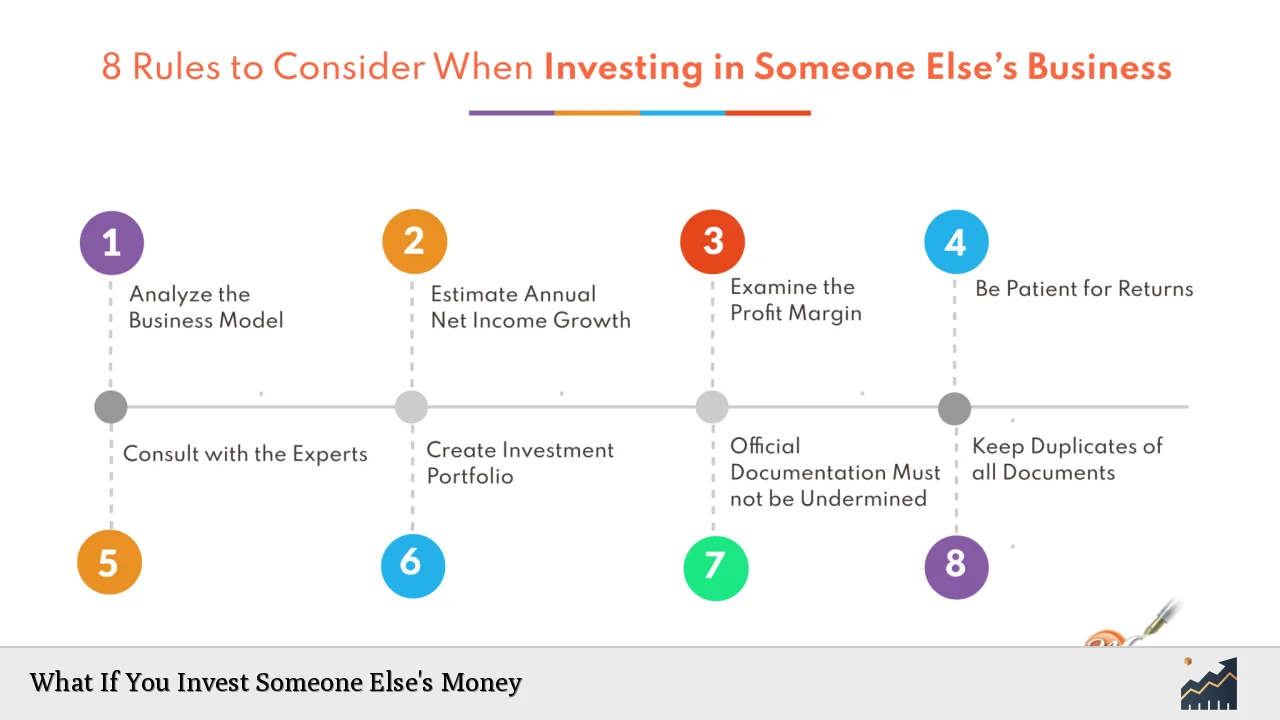

Investing someone else’s money requires a structured approach to ensure that all aspects are handled appropriately. Here are some practical steps to consider:

- Assess the Investor’s Profile: Understand the individual’s financial situation, investment goals, risk tolerance, and preferences. This information will guide your investment decisions.

- Create an Investment Strategy: Based on the investor’s profile, develop a personalized investment strategy that aligns with their goals. This may include asset allocation decisions, selecting specific securities, or diversifying across different asset classes.

- Regular Communication: Keep open lines of communication with the investor. Regular updates on portfolio performance and market conditions help build trust and ensure that any changes needed can be discussed promptly.

- Monitor Investments: Regularly review and monitor investments to ensure they continue to meet the investor’s objectives. Adjustments may be necessary based on market changes or shifts in the investor’s circumstances.

By following these practical steps, you can effectively manage someone else’s investments while minimizing risks and maximizing potential returns.

The Risks Involved

Investing other people’s money comes with inherent risks that must be acknowledged. These risks can affect both the investor’s financial health and your professional reputation. Some key risks include:

- Market Risk: The potential for losses due to fluctuations in market prices can impact investments significantly. It is essential to communicate this risk clearly to investors.

- Liquidity Risk: Some investments may not be easily convertible into cash without a significant loss in value. Understanding an investor’s liquidity needs is critical when making investment choices.

- Reputational Risk: Poor investment performance can lead to damage to your reputation as an advisor or manager. Ensuring transparency and maintaining open communication can help mitigate this risk.

Being aware of these risks allows you to take proactive measures to protect both your investors’ interests and your professional integrity.

Managing Money for Friends or Family

Investing money for friends or family members presents unique challenges due to personal relationships involved. Here are some guidelines for managing money in these situations:

- Set Clear Boundaries: Establish clear boundaries regarding expectations and responsibilities before proceeding with any investment management. This helps prevent misunderstandings later on.

- Document Everything: Keep detailed records of all transactions and communications related to managing their funds. Documentation protects both parties in case of disputes or misunderstandings.

- Consider Referring Them: If you feel uncomfortable managing money for friends or family due to potential conflicts of interest or personal dynamics, consider referring them to a qualified financial advisor instead.

By following these guidelines, you can navigate the complexities of investing for friends or family while minimizing potential pitfalls.

The Importance of Education

Educating yourself about investment strategies and market conditions is vital when investing someone else’s money. Staying informed allows you to make better decisions on behalf of your clients or friends. Here are some educational resources you might consider:

- Investment Courses: Many institutions offer courses on investment strategies, portfolio management, and financial planning that can enhance your knowledge base.

- Financial Literature: Reading books by reputable authors on investing principles can provide valuable insights into effective investment strategies.

- Online Resources: Websites such as Investopedia offer a wealth of information on various topics related to investing and finance.

Continuous education empowers you to make informed decisions while managing other people’s money effectively.

FAQs About Investing Someone Else’s Money

- What legal obligations do I have when investing others’ money?

You must comply with regulations regarding suitability, disclosure, and record keeping. - How can I ensure ethical practices while managing investments?

Act in your client’s best interest by adhering to fiduciary duties and maintaining transparency. - What steps should I take before investing for someone else?

Assess their financial profile, create an investment strategy, and maintain regular communication. - What risks should I be aware of?

Market risk, liquidity risk, and reputational risk are key factors when investing other people’s money. - How should I handle investments for friends or family?

Set clear boundaries, document everything, and consider referring them to a professional if necessary.

In conclusion, investing someone else’s money requires a thorough understanding of legal obligations, ethical considerations, practical steps for management, awareness of risks involved, effective communication strategies with friends or family members involved in investments, continuous education on market trends—each aspect plays a crucial role in ensuring successful outcomes for both investors and managers alike. By following these guidelines diligently while fostering trust through transparency—investors will feel secure knowing their funds are being handled responsibly!